Takeaways

Executive Summary

Africa's fintech ecosystem stands at a transformative inflection point, with stablecoins emerging as critical infrastructure for addressing longstanding financial challenges. The continent's fintech industry is projected to cross $65 billion by 2030 at a compound annual growth rate of 32%, while stablecoins now account for 43% of all crypto transactions in Sub-Saharan Africa.

This report examines the current state of Africa's fintech landscape, the meteoric rise of stablecoin adoption, regulatory developments, and the path forward for sustainable digital financial infrastructure.

Global Money Movement Report 2025

The African Fintech Landscape: Current State and Trajectory

Africa’s fintech ecosystem is heavily shaped by mobile-first adoption. Lending platforms, InsurTech, RegTech, ecommerce, and other financial products making up the rest.

Africa's fintech sector experienced significant turbulence in 2024, with total funding dropping 45% year-over-year to $857 million, down from $1.6 billion in 2023. However, this decline masks a strong recovery in the second half of 2024, where funding nearly tripled from $226 million in H1 to $630 million in H2. Despite short-term volatility, the sector's long-term prospects remain robust, with market revenues expected to grow fivefold from $10 billion in 2023 to $47 billion by 2028.

The "Big Four" fintech hubs (Nigeria, South Africa, Kenya, and Egypt) continue to dominate, accounting for 76% of total funding. Nigeria alone captured 35% of total tech investment in 2024, with fintech contributing 18.9% to the country's GDP, a figure projected to reach 22% by 2025. Notably, 76% of Nigerian fintech startups are already profitable, and 57% report annual revenues exceeding $5 million.

Embedded finance, AI, data-driven lending, stablecoins, blockchain integration, and B2B and infrastructure fintechs will drive the next leg of fintech innovation in the continent.

African Fintech Faces Unique Challenges

The African fintech industry is still struggling to find profitability and has to make do with limited payment rails. Firms need to cope with political and economic instability, FX volatility, and limited access to global payment networks.

Fragmented Infrastructure: An IMF report reveals that only 12% of intra-African transactions are fully processed on the continent while the rest are routed through the US and Europe. Benedict Oramah, President of the Africa Export Import Bank, notes, "It is easier for a bank in an African country to finance trade with a European counterpart than with its neighbors."

Currency Volatility: Nigeria's naira has declined by over 75% in five years, while Zimbabwe's dollar lost over 75% of its value between 2020 and early 2024.

High Remittance Costs: Sub-Saharan Africa experiences the world's highest remittance fees, averaging 7.9% for a $200 transfer (nearly double global averages).

Stablecoins Emerging as Alternative, Always-on Rails

Stablecoins move onchain and require no correspondent banking relationships. They offer instantaneous, 24/7 settlements at very low fees. And with Transak, they can be easily embedded as APIs in any consumer-facing fintech application.

Also Read: How Stablecoins Are Powering The next Generation of Crypto Payment Platforms

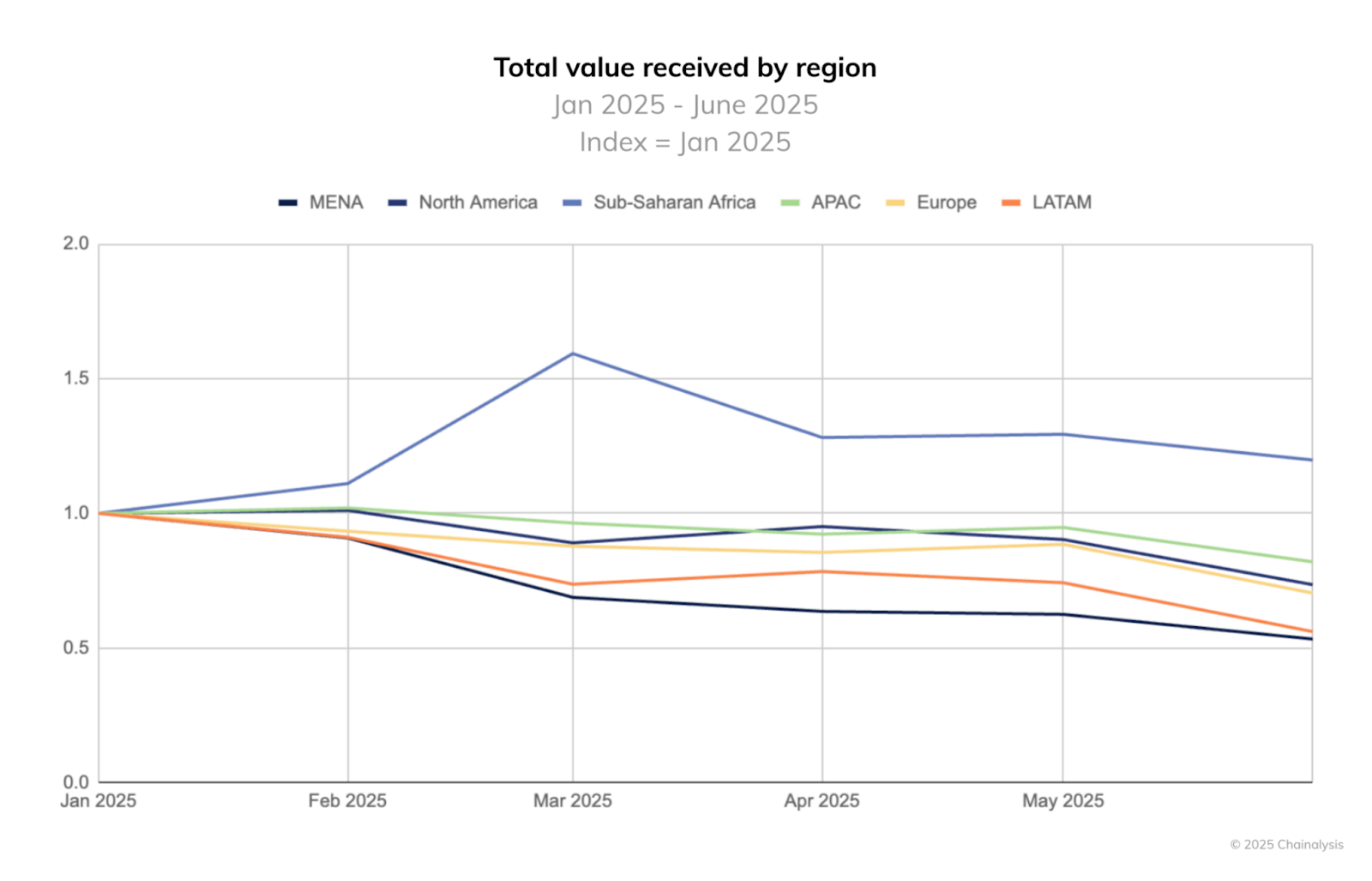

Using stablecoins means fintechs gain newfound liquidity previously tied up for days in banking rails. It also enables cross-border trade growth, better customer reception, and less domestic FX friction. Sub-Saharan Africa moved over $200 billion in on-chain value between mid-2024 and mid-2025, with stablecoins representing 43% of that activity.

Stablecoin Adoption Across Africa

Geographical Breakdown

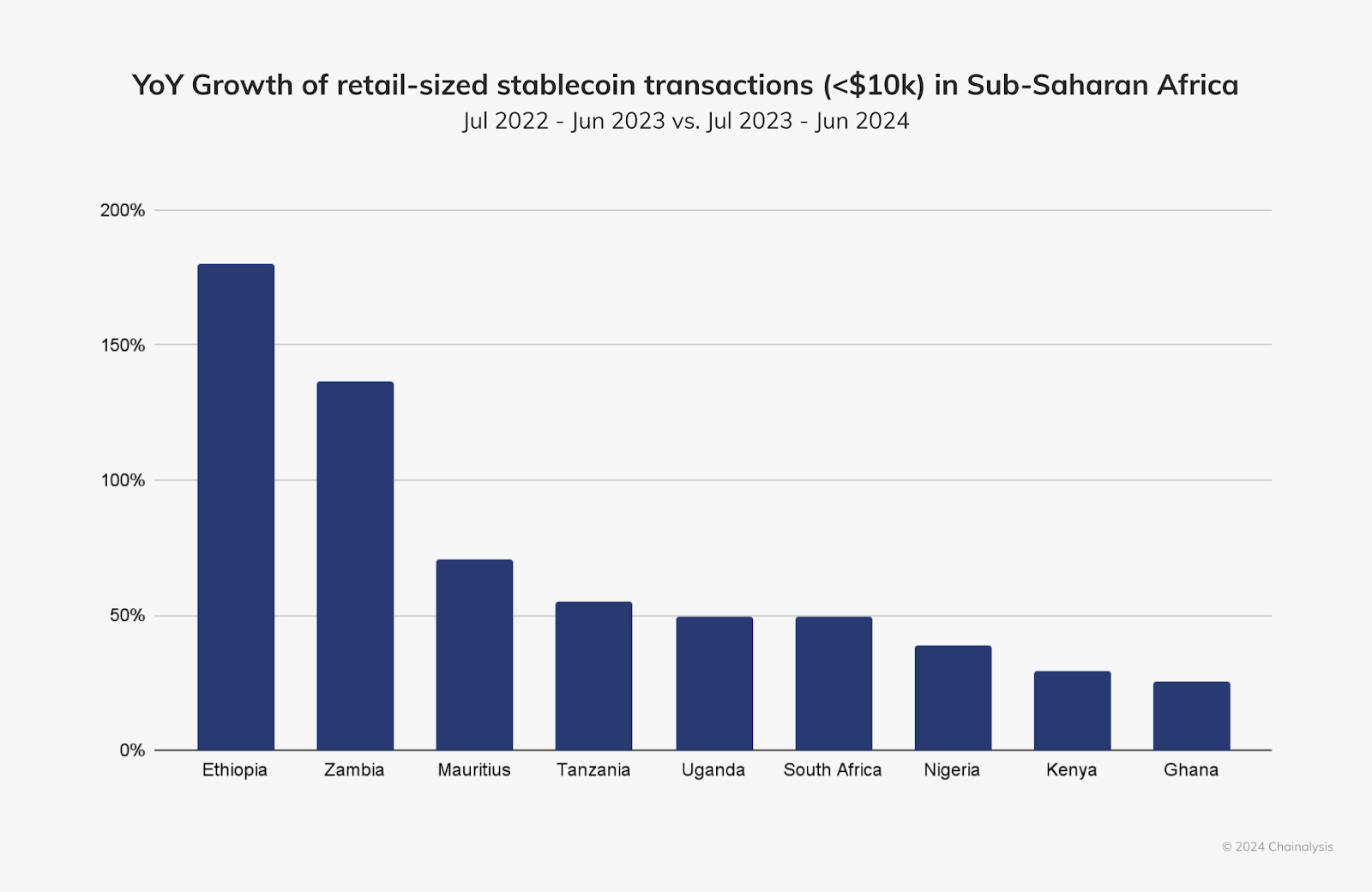

Nigeria accounts for 40% of stablecoin inflows, followed by South Africa, Kenya, Uganda, and Ethiopia. Nigeria saw maximum retail activity with 85% of its transfers being less than $1 million in value, processing nearly $22 billion in transactions between July 2023 and June 2024. The country ranks second globally in overall crypto adoption, with approximately 25.9 million users.

Ethiopia saw 180% YoY growth in retail-sized stablecoin transfers after its local currency devalued by 30%, becoming the fastest-growing retail market in Africa in 2025.

Kenya ranks 5th globally for transactional use of stablecoins, building on its established mobile money infrastructure led by M-Pesa's 34 million users.

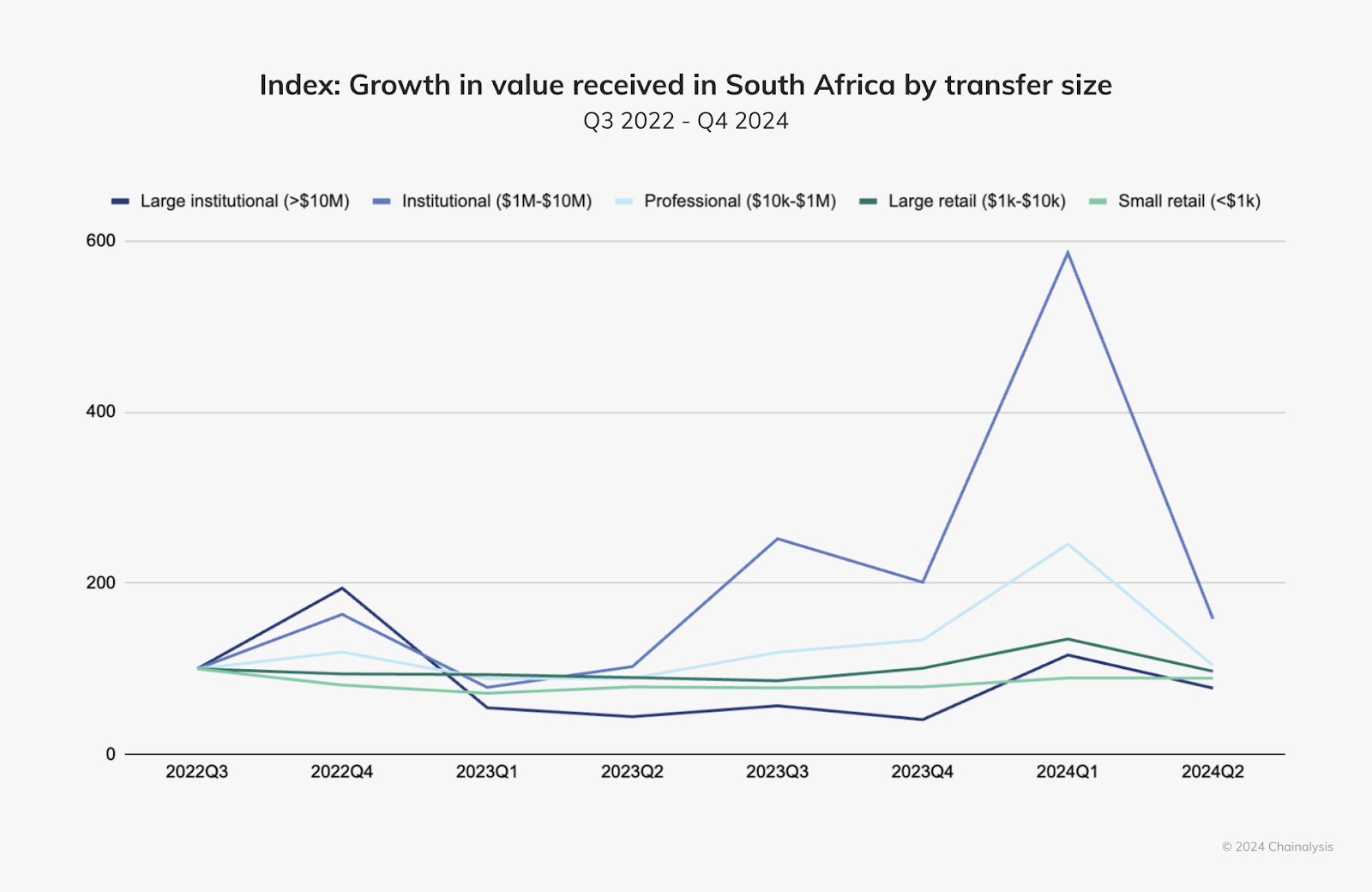

South Africa contributes the largest share through institutional and professional-sized transactions, leveraging its position as Africa's largest economy.

Primary Use Cases

Remittances and International Payments: Africans are using stablecoins to save up to 85% on costs. Africa received approximately $54 billion in remittances in 2023.

Inflation Hedging: Stablecoins provide protection against local currency volatility and inflation. March 2025 saw on-chain volume reach $25 billion when CEX activity surged in Nigeria, prompted by currency devaluation.

Treasury Management and Payroll: Companies are running payroll on stablecoin rails and using them for liquidity management.

DeFi Access and Trading: Nigeria saw over $30 billion in value received by DeFi services, positioning Sub-Saharan Africa as the global leader in DeFi adoption.

B2B Payments: Corporate stablecoin transfers grew by 25% in 2024 as businesses use them for supplier payments and cross-border trade.

Also Read: 10 Incredible Stablecoin Use Cases Beyond Trading in 2026

Rising Institutional Interest

Banks and institutions are warming up to stablecoins as a tool for managing liquidity and reducing exposure to local currency volatility. For banks and fintechs, stablecoins mean financial sovereignty where payments don't need to be routed through the US or Europe.

South Africa contributes the largest share through institutional and professional-sized transactions. Multi-million dollar transfers are being made between Africa, Asia, and the Middle East for energy and merchant payments.

Stablecoins for B2B Payments

B2B payments in Africa are costly and complex. Fees can go up to 6-10%, settlement can take days, and most payments are routed outside Africa. B2B enterprises and fintechs are looking at stablecoins as a hedge against currency risks and for cross-border payments to suppliers abroad.

Also Read: Why Fintechs Are Turning To Stablecoins: Key Benefits And Challenges

Stablecoin infrastructure, on/off-ramps, liquidity engines, FX orchestration, KYC/AML layers, and developer APIs can accelerate adoption further. Corporate stablecoin transfers grew by 25% in 2024.

Stablecoin infrastructure including on/off-ramps, liquidity engines, FX orchestration, KYC/AML layers, and developer APIs can accelerate adoption further.

Also Read: How Transak Abstracts the Messy Middle of Stablecoin Payments

Regulatory Progress Across the Continent

While regulations aren't at par with frameworks like MiCA in the EU or the GENIUS Act in the US, the African continent is making steady progress.

South Africa has established the continent's most comprehensive regulatory framework under the Financial Advisory and Intermediary Services Act. As of December 2024, 248 licenses had been approved by the Financial Sector Conduct Authority.

Nigeria made a significant pivot in April 2025 with the Investment and Securities Act, formally recognizing digital assets as securities. After lifting the crypto ban in 2023, Nigeria introduced its Accelerated Regulation Incubation Program (ARIP), which has approved major exchanges including Quidax and Busha.

Kenya passed the Virtual Asset Service Providers Act in October 2025, assigning licensing authority to the Central Bank of Kenya. The country also abolished a controversial 3% digital asset tax in July 2025, replacing it with a 10% consumption tax on VASP fees.

Ghana is legalized crypto trading as per the recently-passed Virtual Asset Service Providers (VASP) Bill. The country also created Virtual Assets Regulatory Office (VARO) to oversee VASPs.

However, for many African nations, stablecoins and crypto still operate in a grey zone, creating both opportunities and risks.

Also Read: Breaking Down Compliance Challenges in Stablecoin Transactions

Which Stablecoin Dominates

USDT dominates across Africa, mostly because it is the most accessible stablecoin across chains, is highly liquid, and has lower KYC requirements. The average African user prioritizes accessibility over transparency.

However, increasing regulatory clarity is pushing the case for regulated stablecoins like USDC and RLUSD in the region. A few homegrown stablecoins like Nigeria's cNGN and AfriqCoin are also gaining traction.

Challenges and Path Forward

Technical Barriers

Africa remains a patchwork of fragmented financial infrastructure and uneven stablecoin adoption. There's a need to localize payment rails via smoother on- and off-ramps and embedded APIs for the informal user to embrace stablecoins.

Building compliant rails, FX networks, and liquidity hubs remains capital-intensive and operationally complex. Converting between stablecoins and local fiat currencies remains cumbersome in many jurisdictions.

Regulatory and Economic Risks

Tax Revenue Concerns: Over 30% of income in developing countries comes from the underground economy. Unregulated stablecoin use could narrow tax bases and undermine fiscal development goals.

U.S. Treasury Dependence: Most stablecoins are backed by U.S. Treasury bills and dollar reserves, creating dependence on American monetary policy.

Regulatory Fragmentation: The lack of harmonized regional standards complicates cross-border operations and creates compliance burdens.

User Education

Many potential users lack understanding of how stablecoins work, their risks, and proper security practices. Robust frameworks for dispute resolution, consumer protection, and recourse mechanisms remain underdeveloped.

Conclusion

Africa needs to strengthen its backend for fintech adoption to accelerate. At the macro level, better regulatory clarity and institutional adoption are needed. B2B use cases require speed, cost efficiency, trust, and transparency in payments.

Once compliant infrastructure is in place, fintechs can pivot quickly and vouch for long-term value capture. The region leads globally in retail stablecoin activity, with over 8% of all transfers under $10,000, which is evidence that this technology solves everyday financial problems for ordinary people.

Stablecoin orchestration platforms are providing seamless routes to connect TradFi and DeFi safely, helping partners achieve the vision of accessible, affordable financial services for all Africans.