Takeaways

Remember when “paying with crypto” meant copying a wallet address, triple-checking every character, and praying you didn’t just burn your funds forever? Today, crypto payments barely feel like crypto anymore. You can top up a game wallet with Apple Pay, cash out to your bank in seconds, or make an in-app purchase that settles on-chain without you ever seeing a wallet address.

That’s not magic. It’s evolution.

Behind the scenes, a massive shift has been happening: from clunky wallets and QR codes to fully embedded payment rails that blend crypto into everyday finance. Think APIs, SDKs, and compliance-ready infrastructure replacing the chaos of manual transfers.

This is the story of how crypto and stablecoin payments are becoming seamless infrastructure, why it matters for developers and businesses, and what the next phase of embedded finance could look like.

Enter Embedded Finance

Embedded finance in the 2010s and 2020s turned platforms into financial front ends. Companies like Shopify and Uber embedded payments, lending, and insurance inside their apps, using fintech APIs like that of Stripe.

That stack unlocked convenience and scale, but it came with constraints:

- Settlement delays of 1–3 days for merchants

- Cross-border transfers stuck in SWIFT queues

- Costly FX spreads and intermediary fees

- Compliance silos across markets

Embedded finance made banking invisible, but it couldn’t make money borderless or programmable. The industry solved distribution, not rails.

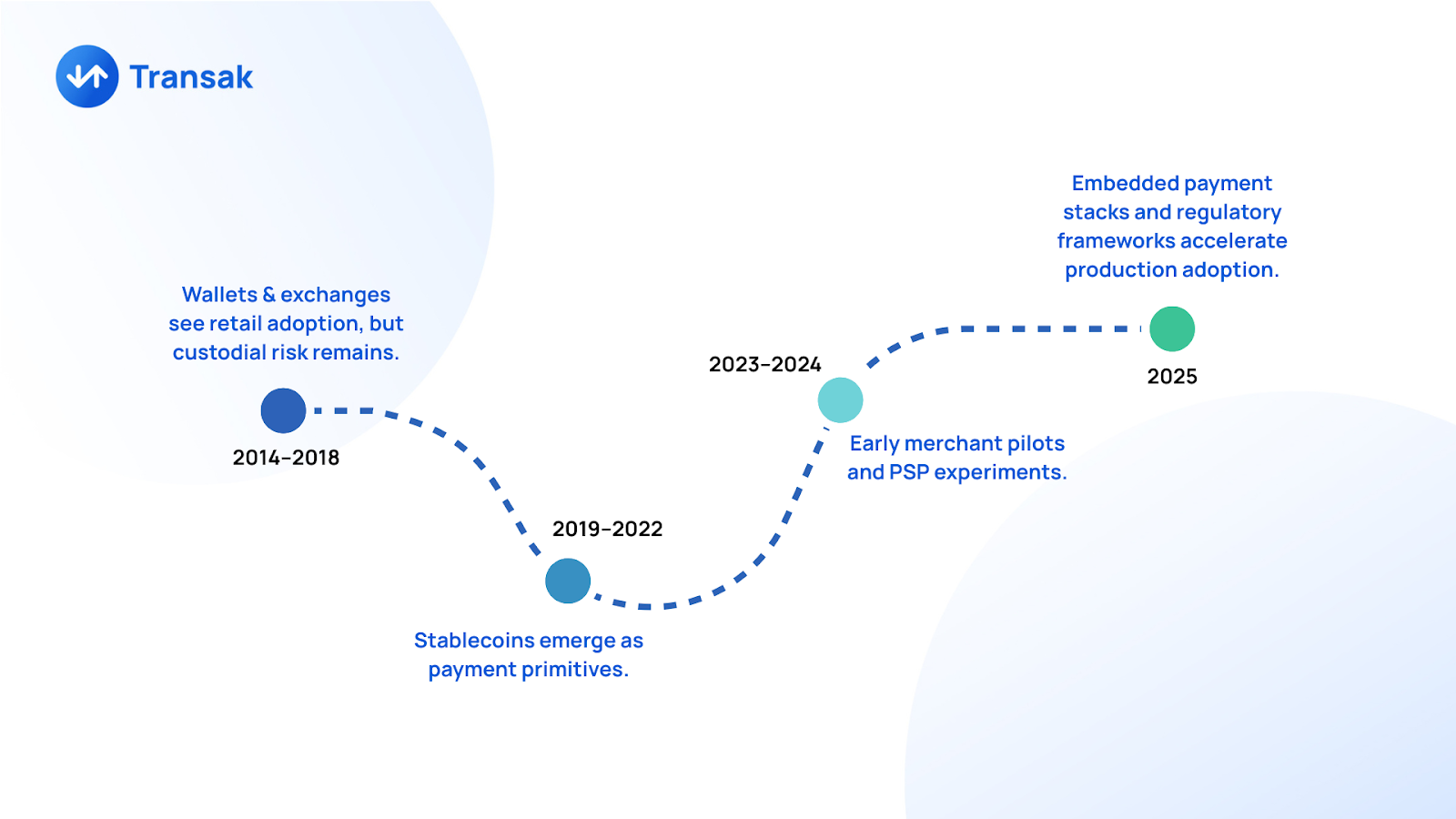

Where is Payment Headed with Crypto?

Early on, crypto payments meant two things: a wallet you control and an exchange that converts fiat to crypto and back. That model served the speculators and early adopters.

Over time, two shifts changed the calculus:

- Stablecoins matured as a payment primitive

- Businesses wanted payments to be invisible and integrated

Simply put, people didn’t want to leave the app to pay.

That pushed fintech product teams to ask for developer-friendly rails with compliance baked in. So, today, fintechs, neobanks, and other TradFi institutions are adopting stablecoin rails reinforced with compliant infrastructure providers like Transak.

The On-Ramp Revolution

With Web3 wallets, you could transfer value globally without banks. But they lacked usability and compliance. Then came fiat-to-crypto on-ramps. Suddenly, you didn’t need to go through an exchange or a tech tutorial to get crypto, instead, you could just buy it. With your debit card. Inside the app you were already using.

Transak turned crypto access into an API call. Behind the scenes, the on-ramp handles KYC, compliance, payment processing, and liquidity so that users see only a “Buy Now” button. For the first time, Web2 users could enter Web3 without even realizing it.

The Embedded Crypto Infrastructure Era

As Transak’s onboarding capabilities matured, the next leap forward was about giving users less to think about. With friendly APIs, SDKs, and white-label offerings, developers could embed crypto payment capabilities directly into apps, games, and exchanges.

You no longer need to hold a wallet or understand private keys. You just pay, play, or transact, while the service provider (Transak) handles the heavy lifting (compliance, liquidity, and settlement) in the background.

For businesses, embedded crypto payments have significant implications on operations. Below are a few benefits they unlock:

- Instant global settlement: Payments move as fast as data without intermediaries or multi-day holds

- Capital efficiency: Stablecoins reduce prefunding requirements for cross-border transactions

- Localized accessibility: Users in emerging markets can use local payment methods to access global crypto networks

- Programmability: Developers can automate payouts, subscriptions, or royalties directly on-chain

The real breakthrough is invisibility. For users, it doesn’t even feel like they’re meddling with crypto. It’s just “seamless payments” for them. And that’s exactly what drives adoption.

Use Cases: When Crypto Feels Invisible

The real proof of evolution lies in how crypto payments now blend in. You’re no longer “using crypto,” you’re just transacting. The blockchain runs undetected beneath the surface while the user experience stays simple and familiar.

1. Gaming & Digital Economies

In-game purchases once relied on clunky top-ups or card payments with high platform fees. Now, embedded crypto rails let players buy assets, upgrade characters, or trade items using stablecoins, all from within the game.

Transak makes it possible for players to pay with Apple Pay or Google Pay, while the settlement happens on-chain. For users, it’s just a click; for developers, it’s a globally scalable payment layer.

2. Cross-Border Payroll and Creator Payouts

Startups and DAOs with distributed teams used to juggle PayPal limits and bank delays. Today, they use stablecoin rails to send global payouts within seconds.

Employees or creators receive funds in their local currency through off-ramps, skipping intermediaries entirely. What used to take five days and 5% in fees now takes a few seconds and a fraction of that cost.

3. NFT Marketplaces & Digital Commerce

When NFTs exploded, users had to navigate wallet extensions and bridge networks just to buy art. Embedded payments flipped that experience.

Marketplaces can now offer credit card or Apple Pay checkout flows that convert to on-chain purchases seamlessly. The buyer doesn’t even need to know what blockchain the NFT lives on because ‘it just works’.

Conclusion

Embedded infrastructure made crypto payments ‘invisible’. The next evolution is making them ‘intelligent’. We’re entering an era where AI agents can hold wallets, execute transactions, rebalance treasuries, and settle payments without human intervention.

At the same time, innovations like chain abstraction will make blockchain boundaries irrelevant. Users won’t need to know whether they’re on Ethereum, Solana, or Base. The system will route value wherever it’s fastest and cheapest.

Together, these shifts point to what many now call PayFi, a programmable, intelligent financial layer that merges AI, crypto, and traditional money rails into one cohesive ecosystem.