Visa, Mastercard, and AmEx all move dollars. Yet merchants, banks, and consumers choose between them for reasons that have nothing to do with the currency itself.

For a user, the fees, compliance, global reach, and settlement speed decide which network fits them best.

The same goes for stablecoins. Most stablecoins promise to carry one U.S. dollar across the trenches, yet their underlying policies and operating models couldn’t be more different.

Understand it like this:

Say four people hold one dollar each in a digital wallet. The wallet shows “1 USD” for all, but the route that dollar takes in each transaction can be very different.

One person might convert via PayPal rails (PYUSD), another through exchange liquidity (USDT), a third across cross-chain corridors (USDC), and a fourth through institutional rails (RLUSD).

USDC, USDT, PYUSD, and RLUSD all move the same digital dollar. But they differ in the following:

- Governance

- Redemption mechanics

- Arbitrage behavior

- Regulatory strategy

- Ecosystem positioning

These differences matter if you’re building financial infrastructure or selecting settlement rails.

Why Stablecoins Differ

Each issuer builds around a unique philosophy of money, i.e., who it serves, how it earns trust, and how it plans to scale.

Here’s what sets the four leaders apart.

USDC: The Regulated Multichain Standard

- Issuer: Circle

- Circulation (2025): ~$61B

- Networks: Ethereum, Solana, Base, Arbitrum, and 24 more

USDC has become the “fintech favorite.” Its design prioritizes transparency, compliance, and deep integration with regulated financial partners.

Circle holds reserves in the Circle Reserve Fund (USDXX), an SEC-registered 2a-7 money market fund made up of short-term Treasuries, repo, and cash. It publishes weekly reserve data and monthly Deloitte attestations.

With plans for a U.S. trust bank charter, its recent IPO and launch of Circle Payments Network, Circle is positioning USDC as the institutional backbone for tokenized finance and real-world settlements.

Circle also enforces full OFAC compliance and blacklisting, giving it the highest regulatory alignment under the U.S. GENIUS Act (2025) and EU MiCA frameworks.

USDT: The Liquidity Powerhouse

- Issuer: Tether Holdings Ltd.

- Circulation (2025): ~$115B

- Networks: Ethereum, TRON, Solana, and soon Bitcoin Lightning

USDT dominates global liquidity. It’s the base pair for most crypto trades, settlement markets, and remittance flows. Its strength lies in ubiquity (not regulation).

Tether’s reserves are 85% U.S. Treasuries, with attestations from BDO Italia, but not full Big Four audits. The firm reported $98.5B in Treasury holdings and $7B in excess reserves, making it one of the world’s largest non-sovereign holders of U.S. debt.

Despite transparency debates, USDT remains crypto’s default “dollar rail.” However, as enforcement tightens, Tether is launching USAT, a new compliant variant for U.S. markets.

PYUSD: The Consumer Bridge

- Issuer: PayPal (via Paxos Trust Company)

- Circulation (2025): ~$2.5B

- Networks: Ethereum, Arbitrum

PYUSD is PayPal’s way of pulling everyday users into Web3 without them even realizing it.

Backed 1:1 by cash and short-term Treasuries, PYUSD is regulated by the NYDFS, with monthly KPMG attestations and bankruptcy-remote trust protections. Its integration across PayPal, Venmo, Coinbase, and Crypto.com makes it one of the most accessible on-chain dollars for consumers and merchants.

In 2025, PYUSD’s supply surged 113% in a month, settling nearly $2B daily on-chain and proving that stablecoins are no longer just for traders, but for mainstream payments.

RLUSD: The Institutional Rail

- Issuer: Ripple Labs

- Circulation (2025): ~$0.7B

- Networks: XRPL, EVM networks, DBS, Securitize

RLUSD is Ripple’s answer to institutional demand for regulated tokenized settlement. It’s built for banks, funds, and tokenization platforms, with custody handled by BNY Mellon and audits by Deloitte.

In less than a year, RLUSD partnered with Franklin Templeton, DBS, SBI Holdings, Archax, and BlackRock’s BUIDL fund, becoming one of the few stablecoins usable for compliant RWA off-ramping.

Ripple’s post-SEC-settlement reputation and its pursuit of a U.S. banking license further strengthen RLUSD’s positioning as a bridge between tokenized assets and real-world finance.

How Do Stablecoin Issuers Manage Reserves?

If you hold a stablecoin, your biggest question is simple. Is there real cash or cash-equivalents backing it, and who checks the numbers? Here is how the four coins handle that.

USDC

Circle keeps USDC reserves in the Circle Reserve Fund, ticker USDXX. This is a registered 2a-7 money market fund that holds short-dated U.S. Treasuries, repurchase agreements, and cash. Circle publishes weekly breakdowns of reserves and mint or burn flows, and a Big Four firm provides monthly third-party assurance that reserves exceed coins in circulation.

In its Q2 2025 results, Circle reported total revenue and reserve income of about 658 million dollars, up roughly 53 percent year over year, with USDC circulation near 61.3 billion dollars at quarter end. Circle also completed its public listing on the NYSE under the ticker CRCL in June 2025.

Also Read: How Stablecoins Fit Into The Modern Treasury Stack

USDT

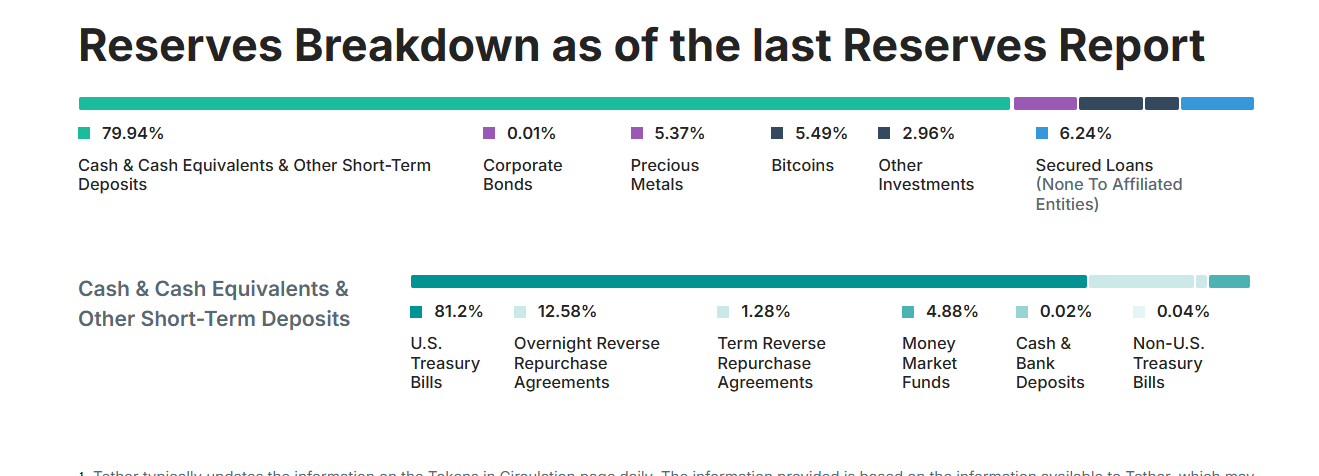

Tether publishes quarterly reserve reports that are attested by BDO. As of Q1 2025, research and Tether’s own disclosures indicate direct holdings of about 98.5 billion dollars in U.S. Treasury bills, making Tether a significant non-sovereign participant in that market, with reported excess reserves over liabilities.

Source: Tether

An academic paper in May 2025 analyzed this footprint and found that Tether’s share of the T-bill market is associated with slightly lower short-term yields, while noting risks if that share were to fall.

PYUSD

PYUSD is issued by Paxos Trust Company under New York Department of Financial Services oversight. Reserves consist of cash and short-term U.S. government securities, and Paxos posts monthly reserve information and monthly independent attestations.

In 2025 the attestation provider for Paxos dollar-backed stablecoins transitioned to KPMG. It has over $500 million in reserve assets, as per its latest transparency report.

RLUSD

RLUSD was built with an institutional audience in mind. Ripple selected BNY Mellon as the primary custodian for RLUSD reserves, and Deloitte issued an attestation confirming reserves of about 773.6 million dollars in late September 2025.

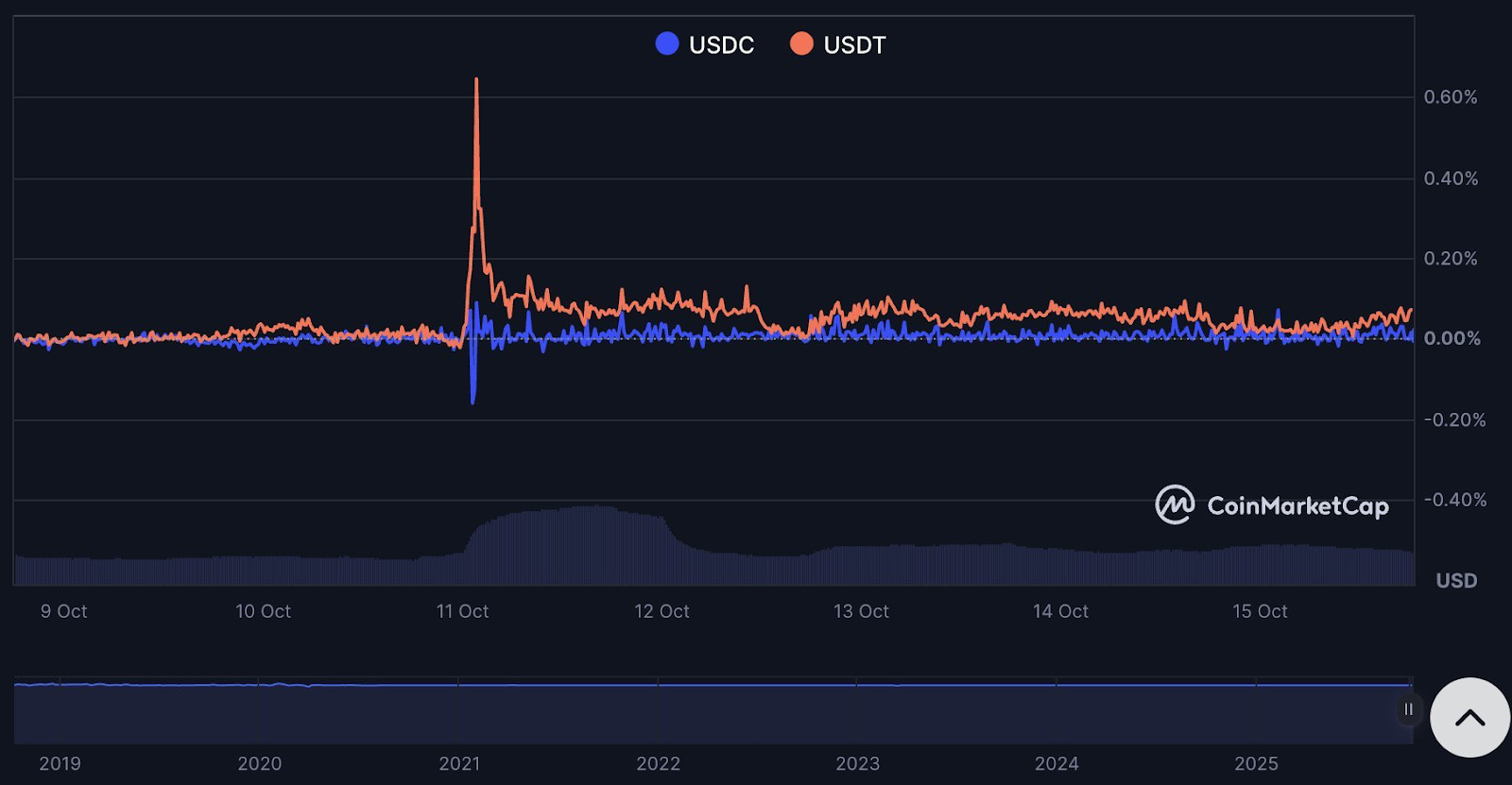

How Stablecoins Keep (or Lose) Their Peg

For most people, a stablecoin’s price looks… well, stable. But behind that one-dollar price tag are different market behaviors shaped by how each issuer handles redemptions and liquidity.

USDC: Built for Redemption Parity

USDC sometimes trades a fraction of a cent below USDT on major exchanges. That small gap comes from how easily institutions can redeem USDC for cash.

As one engineer on X explained, users can convert USDC to USD at par on Coinbase. That creates natural “sell pressure” above $1, keeping USDC very close to its peg but rarely above it.

Circle’s direct 1:1 redemptions for verified (KYC’d) institutions ensure confidence and liquidity, even if it limits arbitrage opportunities for retail users.

Recently, Circle has been experimenting with compliance-focused features like reversible USDC transactions (similar to card chargebacks), an idea that sparked debate between traditional finance advocates and Web3 purists.

To strengthen its infrastructure, Circle acquired StableFi.com and expanded its partnership with Safe (formerly Gnosis Safe). Safe now secures over $2.5 billion in USDC and processes more than $1 trillion in transactions, with monthly transfers rising from $1.5 billion in early 2024 to $4.1 billion by September 2025.

USDT: The Market’s Liquidity Engine

Tether’s USDT remains the largest and most-traded stablecoin, with circulation above $115 billion as of October 2025.

Redemptions directly with Tether require KYC and large minimum amounts (around $100,000), creating high barriers for everyday users. That’s why USDT sometimes trades slightly above $1, as retail arbitrage is less accessible.

Despite the premium, demand stays strong because most perpetual futures and crypto-to-crypto pairs settle in USDT.

To enhance cross-chain movement, Tether launched USDT on Solana via LayerZero and expanded its gold-backed token (XAUT). It also announced plans to bring USDT to the Bitcoin Lightning Network, signaling a push toward faster payments and broader utility.

PYUSD: The Retail On-Ramp

PayPal’s PYUSD became one of the fastest-growing stablecoins of 2025, with supply jumping 113% in a single month to $2.54 billion. It now processes nearly $2 billion in daily on-chain transactions, thanks to integrations with PayPal, Venmo, Coinbase, and Crypto.com.

Its expansion to Arbitrum made PYUSD faster and cheaper to use across PayPal’s 20-million-plus merchant network, showing how traditional fintechs are now competing in the stablecoin race.

RLUSD: The Institutional Contender

Ripple launched RLUSD in late 2024 on the XRP Ledger (XRPL) as a fully regulated institutional stablecoin.

In less than a year, RLUSD has become one of the most strategically placed assets in traditional finance, forming partnerships with Franklin Templeton, DBS Bank, SBI Holdings, Securitize, Archax, and BlackRock’s BUIDL fund.

By September 2025, RLUSD’s supply hit $729 million (a tenfold growth year-to-date) and analysts expect it to cross $1 billion by Q4. RLUSD also stands out as one of the few stablecoins approved for compliant off-ramping of tokenized real-world assets (RWAs).

Also Read: What Makes A Stablecoin Enterprise-Grade?

How Do These Stablecoins Manage Compliance?

Before laws like the GENIUS Act in the U.S. or MiCA in the EU took effect, it had already become clear that transparency and regulation were the real currencies of trust.

Stablecoin issuers that built around compliance gained access to global markets, while those that leaned on secrecy started hitting roadblocks. Let’s look at how each of the four leading stablecoins approaches regulation.

USDC: Compliance First, Always

Among all major stablecoins, USDC is the most tightly regulated. Circle operates under U.S. state money-transmitter and trust licenses, maintaining fiat reserves through regulated banking partners.

USDC is designed to meet the requirements of the GENIUS Act (2025), the U.S. law that officially recognizes “payment stablecoins.” The stablecoin is also compliant with Markets in Crypto Assets (MiCA) regulation in the EU.

Circle takes an active role in compliance:

- It blacklists sanctioned addresses and wallets linked to illicit activity (such as those tied to Tornado Cash)

- It provides full transparency through its monthly reports

- It’s supported on most regulated exchanges and banking platforms

That level of oversight means USDC sometimes trades off anonymity for credibility, but it’s also what keeps it welcome across jurisdictions.

USDT: Still the Liquidity King, But Under Scrutiny

USDT continues to dominate the global crypto market, with the deepest liquidity and widest adoption. Yet, it operates in what many regulators call a “gray zone.”

Tether has no direct oversight in the U.S. and is not yet compliant with MiCA in Europe. Following enforcement pressure, the company announced plans to launch USAT, a new stablecoin built for compliance in U.S. markets.

Over time, Tether has shown signs of evolving:

- It now cooperates selectively with law enforcement

- Aligns with FATF travel rule standards

- Has frozen hundreds of illicit addresses since 2023

However, much of this enforcement remains reactive rather than proactive, which keeps regulators watchful even as USDT’s dominance continues.

PYUSD: The Most Licensed Stablecoin Yet

PYUSD serves everyday users. Issued by Paxos Trust Company, a regulated New York trust under NYDFS, PYUSD is one of the most clearly supervised stablecoins in existence.

Key facts:

- 100% backed by cash and short-term Treasuries

- Monthly audits and attestations

- Automatic KYC and OFAC screening built into every transaction

- Approved by NYDFS alongside Gemini’s GUSD

PYUSD is already available through PayPal and Venmo, and is integrated with Coinbase and Crypto.com for broader circulation.

It isn’t yet approved for use in the EU until MiCA licensing completes, but Paxos is expected to seek authorization in 2026.

RLUSD: Regulation at the Banking Level

RLUSD, issued by Ripple Labs, represents the institutional side of the stablecoin spectrum. It’s designed for banks, funds, and tokenized-asset platforms, following FATF, MiCA, and Basel III-aligned AML/KYC standards.

Key compliance highlights:

- Full OFAC compliance and enterprise-grade monitoring

- Custody and reporting handled through regulated financial partners

- API integrations with Chainalysis and TRM for transaction oversight

RLUSD is already approved for use on DBS Digital Exchange (Singapore) and SBI Japan, and is expanding into the U.K. (Archax) and Africa (Chipper Cash).

Ripple’s 2024 settlement with the U.S. SEC over XRP cleared a major hurdle, paving the way for RLUSD’s smooth regulatory rollout.

Also Read: What is RLUSD and How Does It Work?

Comparative Overview of USDC, USDT, PYUSD, and RLUSD

|

Stablecoin |

Issuer |

Oct. 2025 Circulation |

Core Focus |

Reserve & Reporting Model |

Regulatory Oversight |

Notable Networks |

|

USDC |

Circle |

~$60–75B |

Regulated fintech & settlements |

100% cash + Treasuries; monthly Deloitte attestations |

GENIUS Act & trust charter pending |

Ethereum, Solana, Base, Arbitrum |

|

USDT |

Tether Holdings Ltd. |

~$115B |

Global trading liquidity |

~85% Treasuries; quarterly attestations |

Offshore (BVI); exploring U.S. variant |

Ethereum, TRON, Solana, Bitcoin (Lightning) |

|

PYUSD |

PayPal / Paxos |

~$2.5B |

Consumer payments & merchant rails |

Cash + Treasuries; NYDFS audits |

Fully regulated under NYDFS |

Ethereum, Arbitrum |

|

RLUSD |

Ripple Labs |

~$0.7B |

Institutional settlements & tokenization |

Cash + Treasuries; regulated issuance |

Banking license pursuit; OCC supervision targeted |

XRPL, EVM networks, DBS, Securitize |

Transak’s Role in the Multi-Stablecoin Future

Transak connects fiat and crypto across all major stablecoins across on-ramps, off-ramps, NFT checkout, and institutional payout infrastructure.

By supporting USDC, USDT, PYUSD, and RLUSD, Transak ensures that:

- Users can buy or cash out using their local payment methods

- Apps can onboard global customers without compliance complexity

- Enterprises can settle across fiat and on-chain rails seamlessly

As payments, tokenization, and regulation converge, the real question is who makes them interoperable. That’s where Transak is already leading.

Final Thoughts

Each of the four major USD-backed stablecoins now expresses a different philosophy of finance.

- USDC prioritizes compliance, reversibility, and partnerships with institutional custodians

- USDT doubles down on scale and liquidity dominance

- PYUSD anchors consumer trust within regulated fintech frameworks

- RLUSD bridges the tokenized-asset economy with real banking infrastructure

For developers, businesses, and financial platforms, the future isn’t about choosing one. It’s about interoperability.

As regulation, payments, and tokenization converge, the next era of stablecoins won’t be decided by their peg, but by their purpose fit, and Transak ensures you’re connected to every major path the digital dollar can take.

Also Read: Why Smart Companies Are Building Their Own Stablecoin Rails