KYC RELIANCE

Your KYC = Transak KYC

Enable your users to effortlessly purchase crypto with Transak, leveraging their existing KYC — no repeated KYC required.

Here’s how it works

Three steps to get started in seconds

Say goodbye 👋 to onboarding hurdles

KYC Reliance allows users to do a seamless checkout with Transak without the need for KYC again.

Your users have to go through end-to-end KYC verification once and we can re-use it anytime.

Improve user conversion by 50-60% by enabling your users to directly place an order.

Without any of the KYC steps, it’s as simple as a few clicks!

Simple Integration <> Better Experience

One KYC across Web3

User registers on your platform

As part of your sign-up process, user does KYC on your platform.

KYC Reliance via API endpoints

Using the Identities Endpoint:

1. Send user’s verified KYC data to Transak.

2. We instantly create and verify the customer’s record.

3. For Sumsub users, pass the KYC token through this endpoint.

Instant orders on Transak

Users are now auto-verified for Standard KYC on Transak, allowing orders up to $20,000 with no repeated KYC checks—boosting your conversion rates!

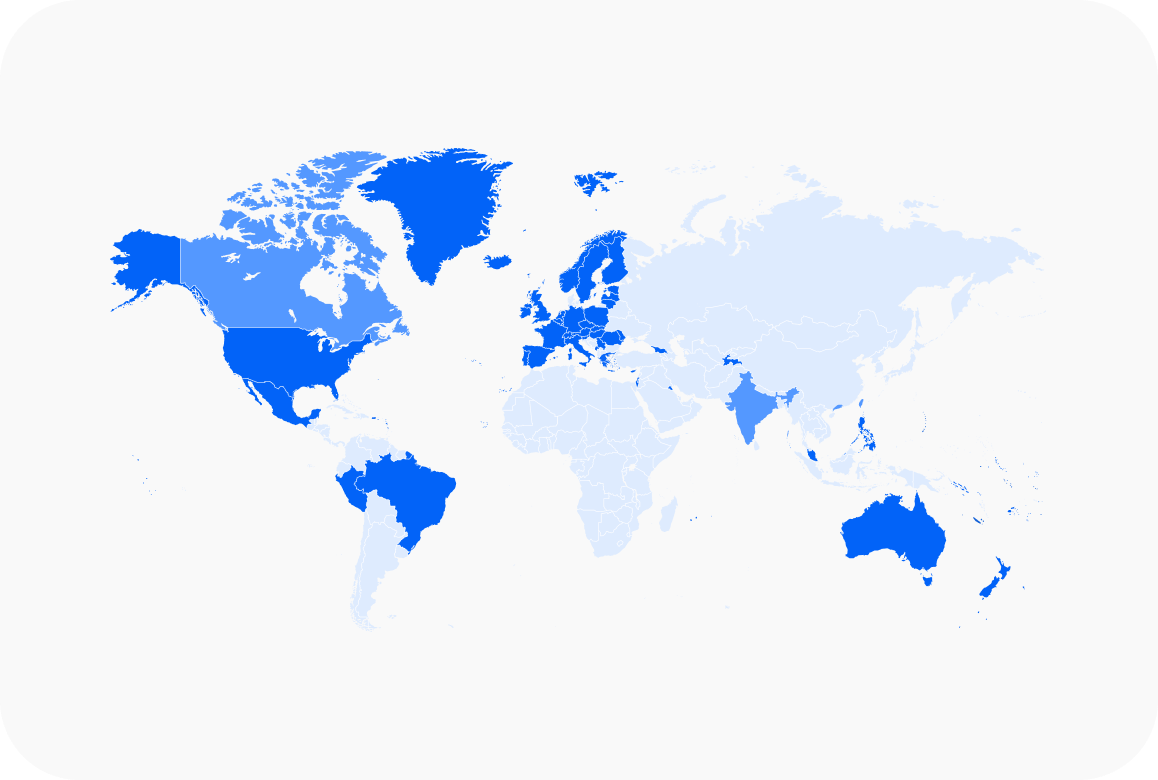

Enables you to go global

Unlock global markets. Grow in developed markets. Penetrate emerging markets. All with a single integration.

Frequently asked questions

As of today we only have KYC Reliance via sumsub. But, as a part of larger roadmap, we will be able to receive KYC token via every identity verification setup.

Whatever the use-case, we’ve got your covered!

Fast track your GTM strategy execution with Transak

Transak is trusted by 450+ web3 brands