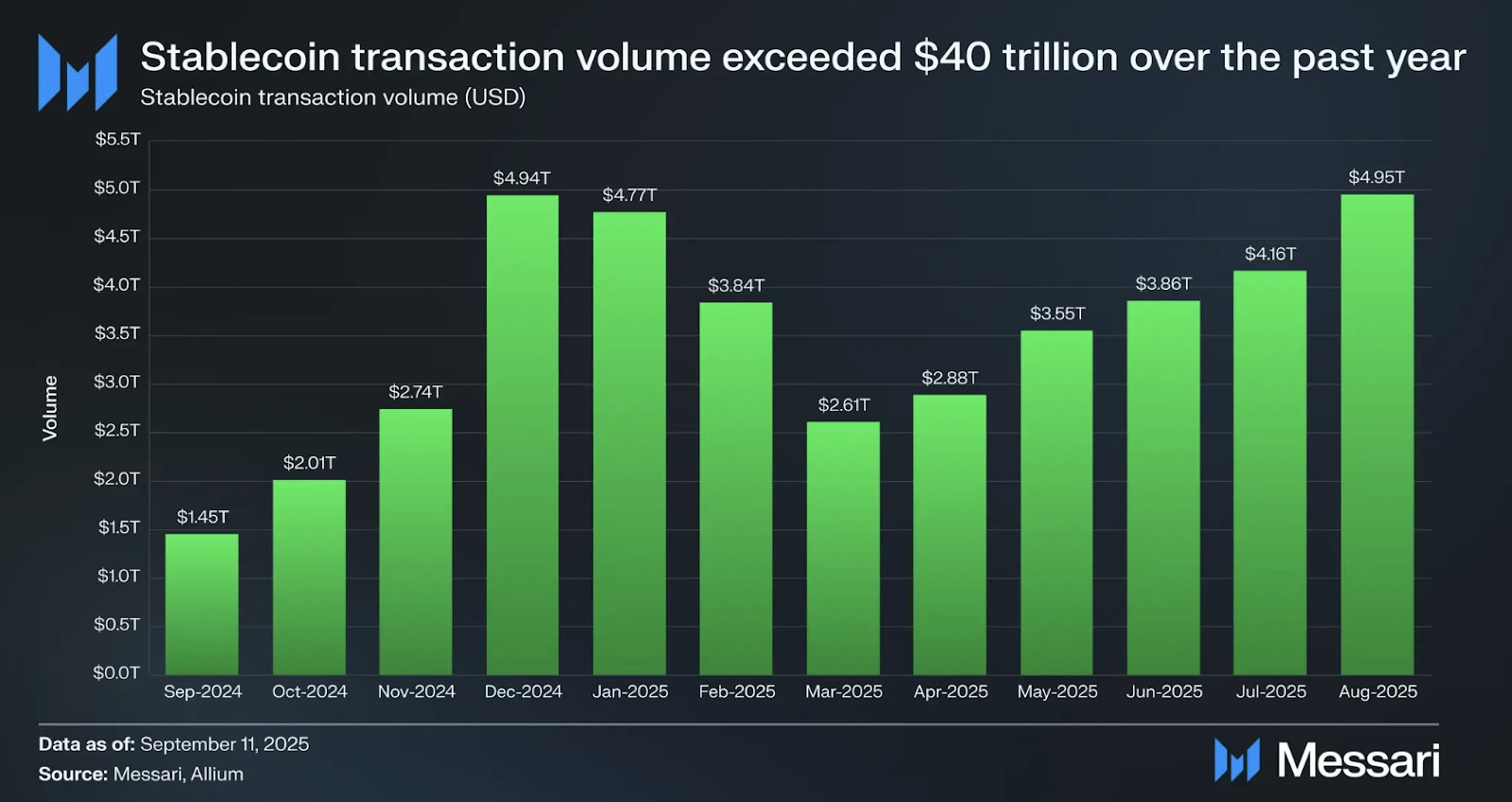

Stablecoins are already settling more transactions than Visa and Mastercard combined). At the time of writing (September2025), their market cap is already teasing $300 billion - that’s nearly 10% of circulating U.S. Dollar.

For CFOs, treasurers, and financial institutions, these numbers are clear signals that stablecoins are the next mainstream financial rails.

Today, stablecoins are even cementing themselves as regulated settlement instruments, with the U.S. GENIUS Act of 2025 and Europe’s MiCA framework providing clarity, and major players like Bank of America, Visa, Mastercard, Stripe, and Société Générale actively integrating stablecoins into their operations.

What was once an experiment is now a regulated tool for reducing costs, increasing efficiency, and staying competitive in a global market.

Here are 7 reasons why stablecoins are best positioned to be ‘the currency’ of regulated businesses.

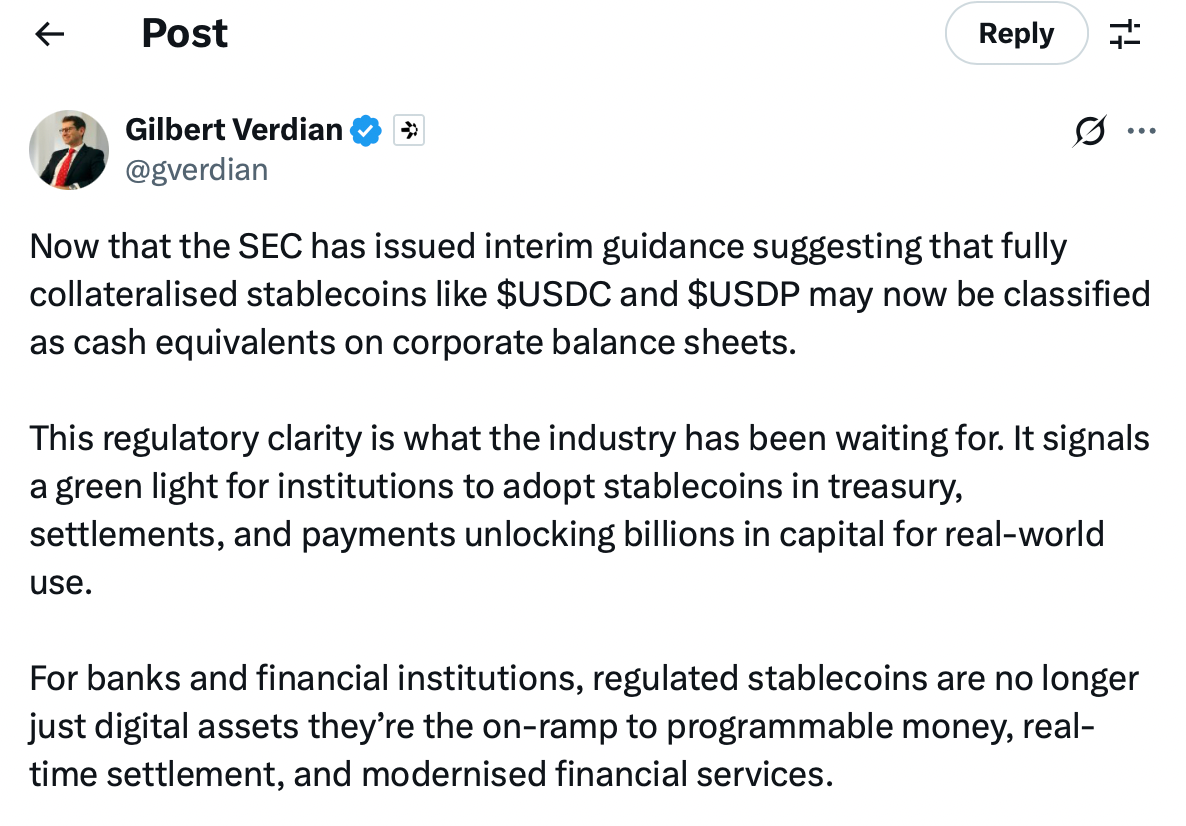

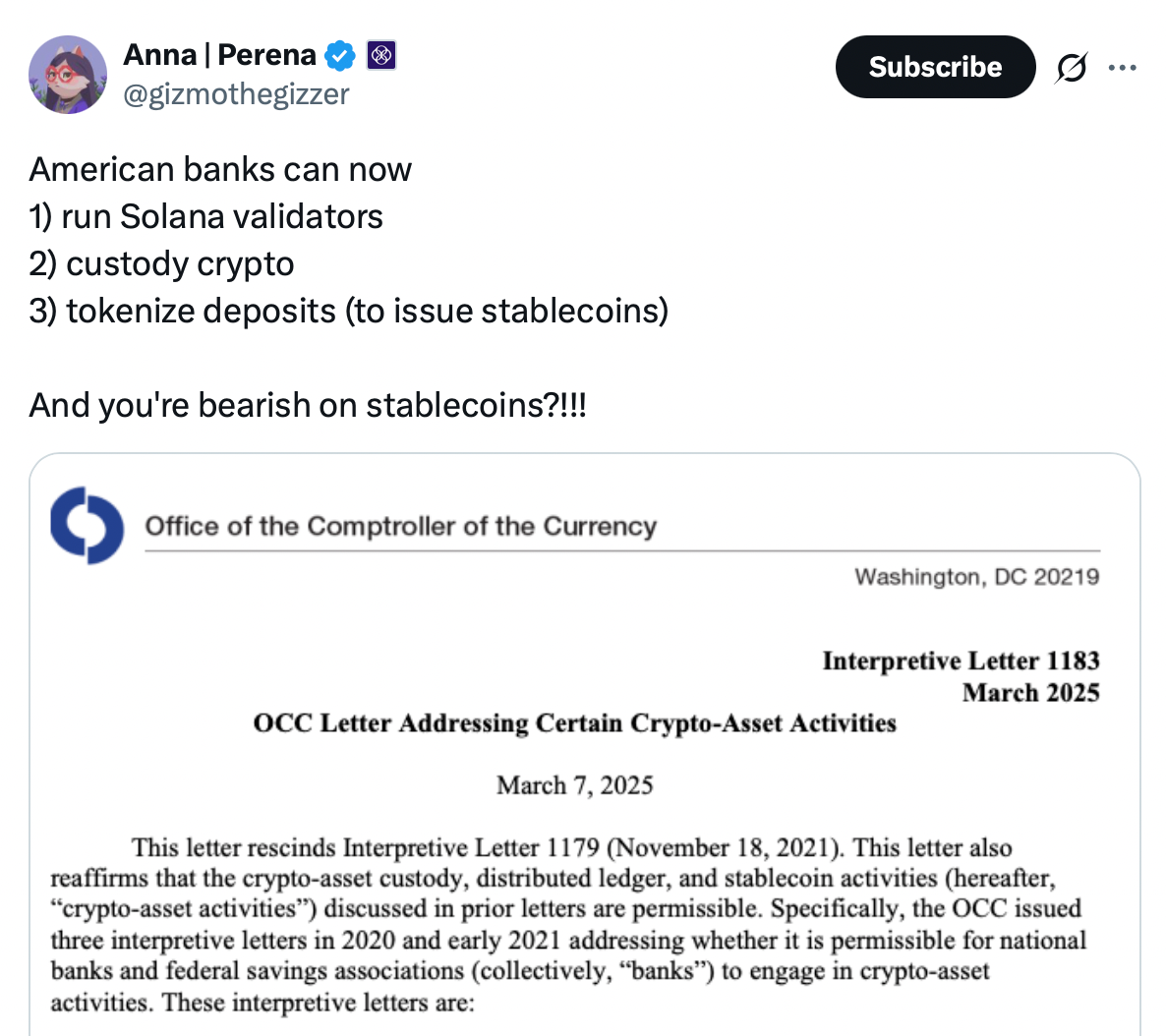

1. Regulatory Clarity Helped Stablecoins Move From Gray Zone to Green Light

For years, businesses hesitated to adopt stablecoins due to legal uncertainty. That changed in 2025 with many legislations greenlighting regulated stablecoins:

- GENIUS Act (U.S., July 2025): Requires full cash/T-bill reserves, audits, AML/KYC, and OCC-approved issuers.

- MiCA (EU, June 2023): Introduces a bloc-wide licensing regime, ensuring disclosure, liquidity, and consumer safeguards.

- Asia & Middle East: Singapore and UAE fast-tracking licenses to attract global stablecoin hubs.

The regulatory clarity does more than reduce risk. It levels the playing field. For example, soon after Circle secured an EMI license in France under MiCA, PayPal issued PYUSD under U.S. guardrails, while Ant Group applied for stablecoin licenses in Hong Kong, Singapore, and Luxembourg.

2. Stablecoins Are Being Used As a Release Valve

The Association for Financial Markets in Europe (AFME) estimates €225B in capital and €250B in liquidity remain trapped by national restrictions that block cross-border consolidation.

- Stablecoins present a release valve. By operating as programmable cash, they bypass legacy bottlenecks, allowing liquidity to move seamlessly across jurisdictions without prefunding.

- Banks like Société Générale are piloting euro- and dollar-pegged stablecoins to accelerate internal treasury flows, while fintechs like Revolut explore U.S. bank acquisitions to combine digital rails with stablecoin liquidity management.

Stablecoins are being used not just as a payment tool but as a regulatory arbitrage instrument to sidestep inefficiencies while staying compliant.

3. Stablecoins For Speedier Settlements

It’s easy to say stablecoins are “faster.” But for corporations, settlement finality is the real prize.

Method |

Time to Settle |

Risk Profile |

|

SWIFT/Wire |

1–3 business days |

Counterparty, FX, prefunding |

|

ACH |

Same-day to 2 days |

Operational hours only |

|

Stablecoins (USDC) |

Seconds |

On-chain, 24/7 finality |

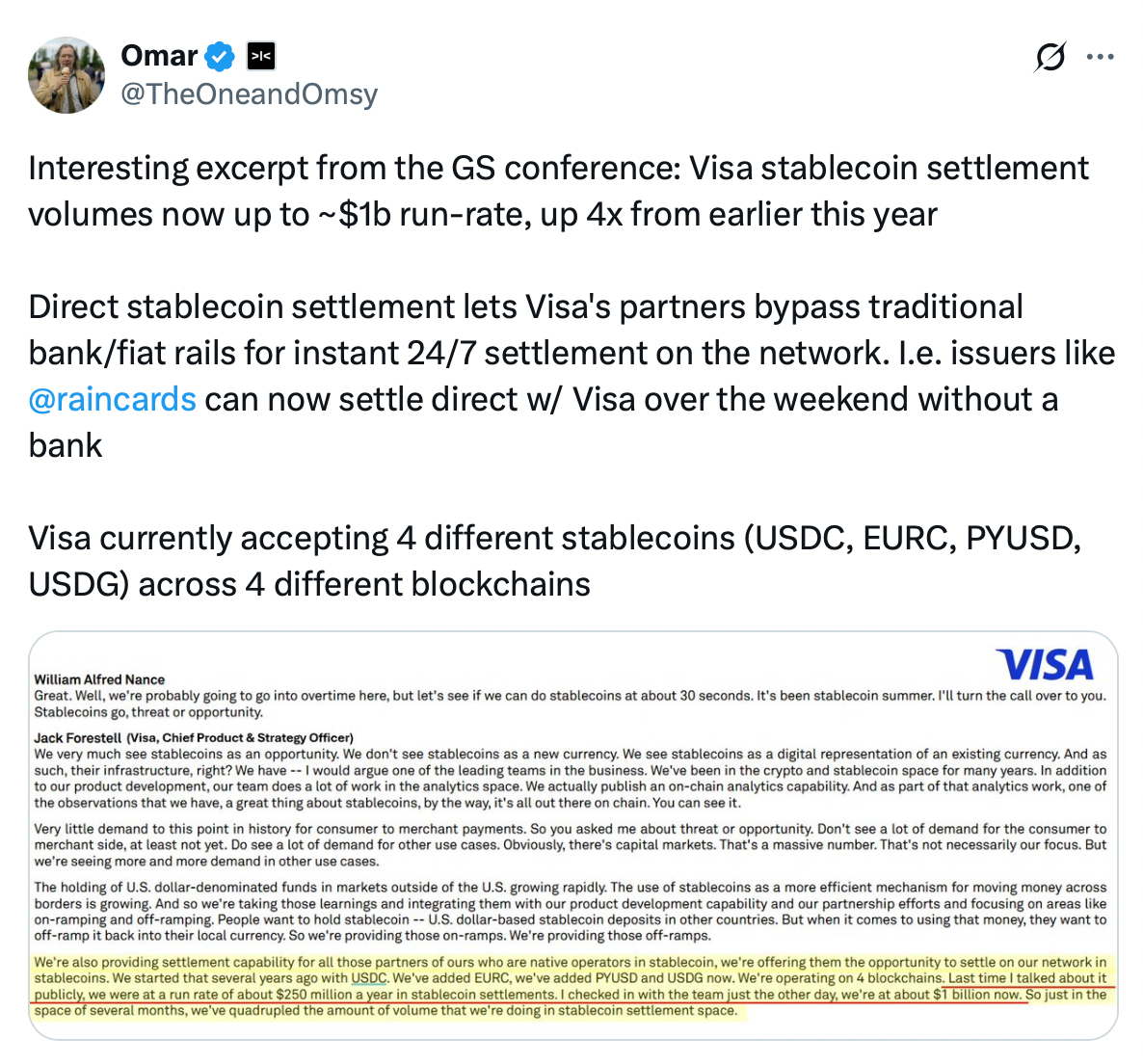

For companies like Visa and Corpay, stablecoin rails are becoming a powerful way to remove settlement lag. Visa’s 2023 pilot enabled merchants to settle through USDC instead of waiting on traditional networks. Corpay’s deal with Circle now means its businesses can access USDC-based payments that settle 24/7, eliminating delays of hours or days.

Remittance fintechs like Félix, too, leverage stablecoins to streamline cross-border flows, cut FX friction, and speed up payouts. What used to be a back-office bottleneck is fast becoming a strategic advantage.

4. Businesses Are Preferring Stablecoins For Cost Compression

Traditional cross-border transfers average 6.6% in fees, with U.S.–Mexico wires costing nearly $10 per $200 sent. Stablecoin transfers typically cost under 0.1%, sometimes less than a dollar, regardless of size.

At scale, these differences move markets:

- NGOs save millions on remittance channels.

- Payroll providers like Rise enable dollar-based salaries in emerging markets.

- Nubank offers 4% yield on USDC, pulling deposits from local banks.

The erosion of fee-based margins pressures legacy rails. Just as low-cost trading apps squeezed brokerages, stablecoin settlements threaten the “fee layers” of banking infrastructure.

5. Stablecoins as Programmable Money

Stablecoins transform settlement from a static process into a programmable layer:

- Deposit Tokens: Bank-issued stablecoins used for wholesale payments and real-world asset tokenization.

- Corporate Stablecoins: Amazon and Walmart exploring issuance for loyalty + supply chain settlement.

- Payment Integrations: Stripe, SAP, and PayPal are embedding stablecoins in merchant checkout flows.

Programmability also enables innovations like automated FX routing, yield-bearing treasuries on-chain, and B2B smart contracts tied to delivery milestones. In effect, wallets stop being storage tools and become financial engines.

6. Global Power Plays Backed By Stablecoins

Stablecoins are a geopolitical shift.

- The ECB warns dollar-backed stablecoins could weaken euro sovereignty.

- India and China voice concern over losing monetary control.

- Some regulators accelerate CBDCs or local-currency stablecoins to hedge risks.

Yet attempts to limit dollar stablecoins often look like stopgaps. Analysts argue that stablecoins are forcing governments and central banks to modernize payment systems rather than wall them off.

Meanwhile, U.S. adoption strengthens dollar dominance. Issuers’ $200B+ Treasury holdings effectively tie stablecoin growth to U.S. government financing, creating a feedback loop between digital adoption and sovereign debt markets.

7. Stablecoin Adoption Signals from Banks and Fintechs

The roster of adopters grows daily:

- JPMorgan expanded into German retail banking while piloting stablecoin rails via Onyx.

- Standard Chartered is partnering on a Hong Kong dollar stablecoin.

- Bank of America, Visa, Mastercard, and Fiserv are exploring proprietary issuance.

- Revolut and Starling are pursuing U.S. licenses and acquisitions to scale stablecoin integration.

No longer a crypto-native territory, stablecoins are mainstream financial products embedded into regulated institutions.

Risks That Can’t Be Ignored

A few risks remain. These risks won’t stall adoption, but they demand oversight and standards.

- Deposit Flight: U.S. Treasury estimates up to $6.6T in bank deposits could shift into stablecoins, raising funding costs for lenders.

- Transparency: Tether was fined $41M by CFTC (2021) for opaque reserves.

- Market Stability: Run risks during crises, as seen in TerraUSD collapse.

- Accounting & Tax: CFOs still lack clarity on balance sheet treatment.

Stablecoin Settlements Are Moving From ‘Disruptive’ to ‘Integrated’

Stablecoins have crossed the chasm. With trillions settled annually, and full regulatory frameworks in the U.S. and EU, they’ve moved from crypto’s periphery to the center of institutional finance.

For regulated businesses, the shift is about more than faster or cheaper payments. It’s about unlocking trapped liquidity across borders, turning settlement into a competitive weapon, owning programmable money rails, and staying globally relevant in a fragmented financial system.

The risks are real, but the momentum is undeniable. Stablecoins are no longer optional. For banks, fintechs, and corporates, they’re the new standard of settlement in a digital-first economy.

How Transak Helps Businesses Embrace Stablecoins

Adopting stablecoins is no longer a question of if but how fast. For most businesses, the challenge is not in understanding the benefits, but in building the infrastructure to use them safely, compliantly, and at scale. This is where Transak steps in.

Transak is the enterprise-grade gateway to stablecoin rails. As a regulated Money Services Business (MSB) under FinCEN and an ISO/IEC 27001 and SOC II certified provider, Transak removes the technical and compliance roadblocks that have historically slowed adoption. Through a single integration, businesses can:

- Onboard users directly into stablecoins from all over the world using local payment methods.

- Off-ramp stablecoins to fiat using Visa Direct and local bank rails.

- Embed stablecoin payments in their products with Transak’s APIs, SDKs, and smart contract modules.

- Access a growing roster of stablecoins including USDC, USDT, PYUSD, XAUT, and regulated Euro stablecoins.

By abstracting away the licensing, KYC/AML, and settlement complexity, Transak lets companies focus on building products while it handles the heavy lifting of stablecoin infrastructure.

For businesses ready to move beyond legacy rails, Transak is the bridge between traditional finance and the stablecoin economy.