Takeaways

Most neobanks already nailed the front end. The app is clean, onboarding is fast, and users are growing. Where things still hurt is underneath. Payments are expensive, cross-border flows are messy, and too much capital sits idle just to keep money moving.

Stablecoin rails fix these problems in very practical ways.

How Neobanks Make Money

Unlike most businesses, neobanks don’t have just one or two sources to bring in all of their revenue. Instead, they rely on multiple small (and predictable) revenue sources that keep the business afloat and profitable. Think foreign exchange fees and personal loans.

Neobanks often tread on thin ice. Their primary offer to customers tends to be ‘brilliant and hassle-free user experience’. However, such UX is very hard to achieve with rigid legacy systems of TradFi. And when something breaks, neobanks often absorb losses so as to not lose out on customers. Eventually, this firefighting becomes the norm and dilutes profits.

Stablecoin rails replace parts of the traditional payment stack with blockchain-based settlement, without changing how the product feels to users.

The key distinction is separation of experience and infrastructure. The frontend remains fintech. The backend becomes programmable, faster, and cheaper to operate.

So, how does that translate to significantly high profitability for neobanks? Two words: unit economics.

The Unit Economics Shift: Where Profits Improve

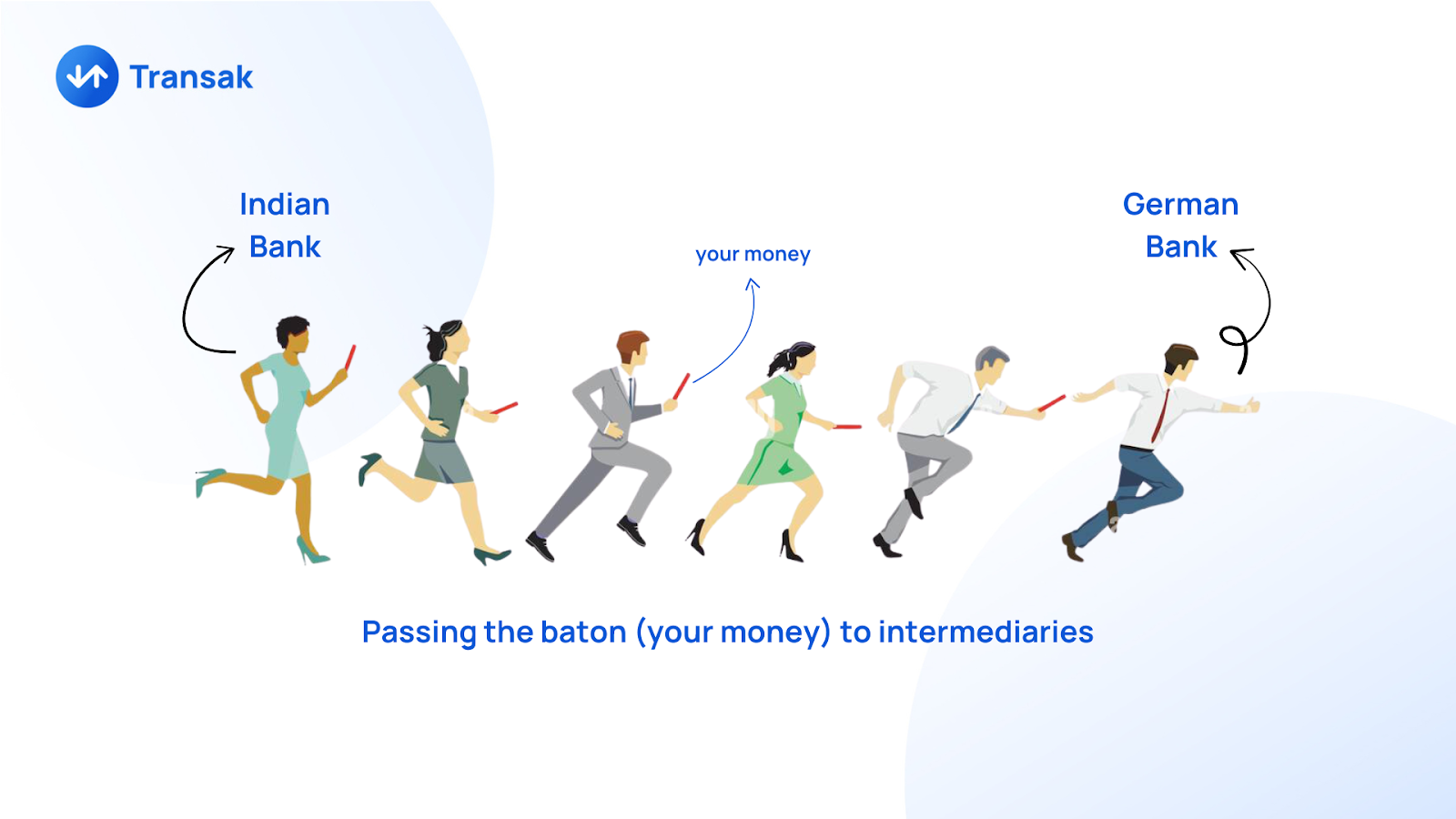

Stablecoin cut costs and improved efficiency right at the settlement layer rather than the product layer. This was never possible until stablecoins because settlements relied on intermediaries and correspondent networks taking a piece of the pie that neobanks had no control over.

1. Payments get cheaper for all

With stablecoins transaction fees drop because fewer intermediaries are involved and neobanks settle value directly on a blockchain. At scale, this materially lowers the cost per transaction.

Cross-border payments are where users complain the most and where neobanks often struggle to stay profitable. Stablecoins eliminate multiple FX conversions and banking hops and transfer value just once to be converted locally.

This makes a massive impact as transaction sizes and volumes increase because unlike intermediaries that often siphon a percentage of the transaction, stablecoin rails have a flat fee. For instance, neobanks would pay one cent whether they settle one dollar or a million dollars.

2. Less money stuck doing nothing

Settlement speed improves from days to minutes. Faster finality means neobanks can reuse liquidity instead of locking capital in prefunded accounts across regions. This improves capital efficiency and reduces the working capital required to support growth.

3. Faster payouts unlock better business

Speed leads to products that users will pay for. Think freelancers who want same-day payouts, creators who want instant access to earnings, and marketplaces that need to settle sellers quickly.

Stablecoin rails make these flows economically viable without adding heavy operational cost. Neobanks can charge for speed and reliability without burning margin.

Faster settlement also reduces failed transactions, simplifies reconciliation, and lowers dispute resolution overhead. Treasury and finance teams gain clearer visibility into flows and balances.

4. Programmability creates paid features

Legacy rails are rigid. Stablecoins are not.

Once payments become programmable, neobanks can offer:

- Conditional payouts

- Automated escrow-like flows

- Milestone-based B2B payments

- Treasury automation for businesses

These are premium features. They justify higher pricing, subscriptions, or transaction fees, and they are difficult to build cleanly on traditional rails.

Also Read: Why On-Ramping RLUSD, USDG, and New Stablecoins Matters

Making This Practical With the Right Infrastructure

All of this sounds good on paper, but building it alone is unrealistic for most neobanks. Licensing, compliance, liquidity, routing, and local payment access are hard problems.

This is where Transak comes in.

Instead of building a crypto stack, a neobank plugs into a payments layer that already handles the complexity.

How Transak Helps Neobanks

Regulation and Compliance Handling

Regulatory compliance and risk management remain central to any viable implementation for neobanks.

KYC, AML, transaction monitoring, and jurisdiction-specific rules are handled at the infrastructure level, i.e., by Transak. Neobanks do not need to reinvent compliance to use stablecoin rails.

Best Rates

With a global pool of liquidity providers and optimized routing, we provide Neobanks nearly 1:1 asset conversion rates for stablecoins. This allows neobanks more flexibility to choose how much of the savings they should pass on to the users to gain moat in the target market.

Native On-Ramps and Off-Ramps

Stablecoins only help if users can move in and out easily. Transak supports local payment methods, offers global coverage, and enables seamless fiat to stablecoin conversion through one integration.

Modular building blocks

With Transak, neobanks can start small. For example:

- use stablecoins only for cross-border settlement

- later add payouts or treasury flows

- expand region by region

No big rebuild required.

Real-World Cases of Neobanks Using Stablecoins for Profitability

Revolut

Revolut, a major neobank with over 65 million users, now offers in-app stablecoin conversion at a true 1:1 rate between fiat and major stablecoins like USDC and USDT with no spreads or hidden costs above certain volumes. This reduces FX and conversion fees for users and makes cross-border transfers cheaper and faster while maintaining a familiar interface.

In December of 2024, the popular neobank integrated Polygon, enabling users to move stablecoins across borders at low cost. By November 2025, over $690 million in stablecoin volume had been processed through this integration, showing real usage at scale. This volume translates into lower settlement costs for the bank and greater user engagement in cross-border flows.

Rizon

Stablecoin-centric neobanks like Rizon are building banking products where dollar-pegged stablecoins are the native balance and settlement layer. Users can send, spend, and receive USDC/USDT in over 100 countries with cards and wallets, replacing expensive wires and FX fees with blockchain settlement.

Conclusion

Neobanks haven’t really struggled with demand. They’ve historically struggled with margins. Thin margins always meant operating at scale but the competitive landscape and rigid rails don’t go hand-in-hand for neobanks.

Stablecoin rails address this at the root by modernizing settlement itself, and Transak turns stablecoins into a reliable profit lever for neobanks.

Transak powers neobanks with the moat they’re looking for in a competitive landscape. Integrate today.