Takeaways

- Cross-border payments still depend on an outdated correspondent banking network filled with intermediaries.

- The correspondent banking system was built for a trust-based era, not the always-on digital economy.

- Each intermediary in the payment chain adds compliance checks, conversion fees, and settlement delays.

- Smaller banks and emerging markets face higher costs due to limited access to global correspondent relationships.

- Stablecoins enable instant, transparent, and 24/7 global value transfer without middlemen.

- Web3 payment providers, like Transak, are becoming the new digital correspondents for global finance.

Money can be digital. The Internet can move digital value across continents in milliseconds at less than a penny. Yet, a single cross border transaction can take days or cost over $30.

What went wrong and where?

Every cross-border transaction passes through a web of financial institutions called “correspondents,” which are a part of a decades-old network called “the correspondent banking system” built long before the internet.

So, in reality, your money doesn’t actually move directly from one country to another. It hops through multiple banks and financial institutions, each taking time and fees to pass the baton.

The result of this inefficient system is a lock up of over 4 trillion dollars globally (which otherwise could circulate in the economy).

In this article, we’ll decode how the correspondent banking system really works, why it struggles to keep up, and how Web3 rails can help.

What Is the Correspondent Banking System?

The correspondent banking system is the global money network that lets one bank (the correspondent) talk to another (respondent), especially when they don’t have a direct relationship.

A relay race is a wonderful visualization of this system.

When you send funds from your bank in India to someone in Germany, your local bank might not have a branch there. So, it routes the transaction through one or more correspondent banks that do. These intermediate financial institutions “pass the baton” across borders until the money reaches its destination.

Here’s a simplified version of what happens:

- Originating Bank: This is where your transaction starts. It sends a payment instruction to move funds abroad.

- Correspondent Bank(s): These are middlemen holding accounts for other banks (called nostro and vostro accounts) in different currencies. They handle the conversion, routing, and settlement.

- Beneficiary Bank: This is the recipient’s bank, which finally credits the account once the chain completes.

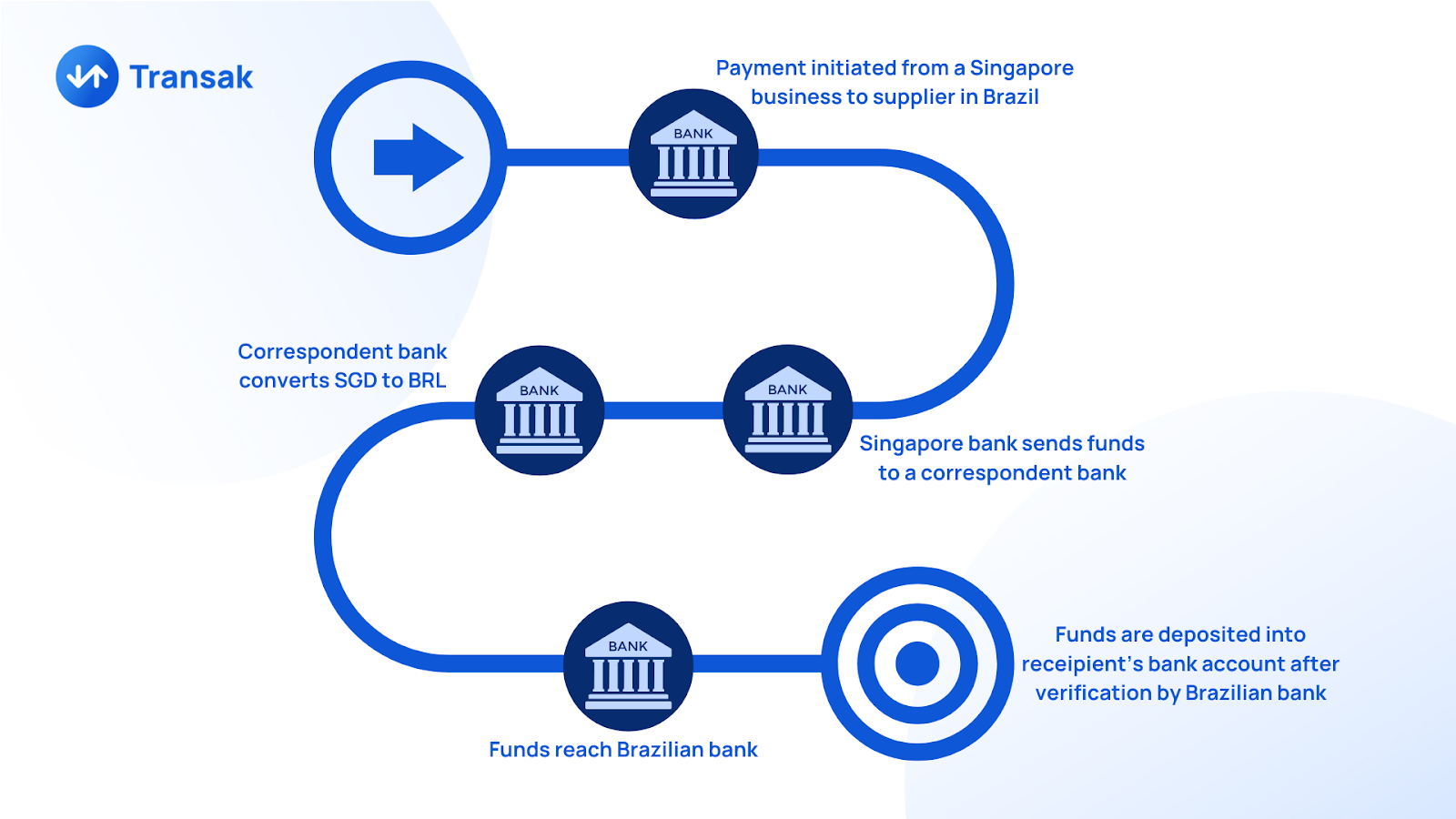

For example, a company in Singapore paying a supplier in Brazil might go through two or three correspondent banks (one in New York for USD liquidity and another in London for FX conversion) before the funds reach the Brazilian bank.

Each hop adds time, cost, and complexity. Every bank in the chain must verify the transaction, perform compliance checks, and update its internal ledger before passing it on.

This system has worked for decades because it’s based on trust and access. Not every bank can operate everywhere, so they rely on trusted partners who can. But it’s also a closed, institution-heavy network designed for a slower era of finance.

Why It Exists: Trust and Access

To understand why correspondent banking exists, we have to go back to a time when the world’s financial system was stitched together through trust, not technology.

After World War II, global trade exploded. But most banks could only operate within their own borders. A small regional bank in Thailand couldn’t just “send” dollars to a partner in the U.S. because it didn’t have a branch or license there.

So, it turned to a correspondent bank (typically a large international institution with access to multiple currencies and markets) to handle that transaction on its behalf.

These correspondent banks held nostro accounts (an account a domestic bank keeps in a foreign currency with another bank) and vostro accounts (an account a foreign bank holds in local currency). These accounts acted as the connecting tissue of cross-border payments, allowing money to “move” across ledgers even if it never physically left a balance sheet.

For decades, this system worked beautifully. and became the foundation of global finance supported by networks like SWIFT, which standardized how payment instructions were communicated between banks. Everyone had confidence their money would arrive (albeit the delays).

Therein lies the problem. This structure was built for a world where banks closed at 5pm, communication happened by telex (a device almost like a hybrid of a fax machine and a typewriter), and international transfers were the exception, not the norm.

Today, the world operates 24/7, but correspondent banking still runs on the old schedule. The trust-based model that once made global payments possible has now become a bottleneck.

How It Works (and Why It’s So Complicated)

When you send money within your country, it usually moves directly between two banks over a central payment network like UPI, ACH, or SEPA. But when you send money abroad, there’s no single global network connecting every bank.

Here’s what a typical cross-border payment looks like behind the scenes:

- You initiate a transfer from your local bank to a recipient overseas

- Your bank doesn’t have a direct relationship with the recipient’s bank, so it sends a SWIFT message to its correspondent bank (one that holds an account in the required foreign currency)

- The correspondent bank either settles the payment directly or passes it through another intermediary if needed

- Each intermediary verifies the transaction, performs anti-money-laundering (AML) and sanctions checks, and updates its own ledger

- The recipient’s bank finally receives the funds and credits the end user

This process might sound simple, but in practice it’s slow and costly because:

- Each intermediary operates on its own system.

- There’s no shared ledger.

- SWIFT only sends messages, not money. So the actual movement happens later, once balances are reconciled.

- Time zones and cut-off windows mean a transaction started on Friday in Asia might not settle until Tuesday in the U.S.

- Fees accumulate at every hop, with each bank charging for processing, FX conversion, and compliance checks.

- Visibility is limited. Users and even sending banks often can’t track where the payment currently sits in the chain.

To ensure smooth operations, banks keep large sums locked in foreign accounts as pre-funded liquidity, ready to settle future transactions. This is like keeping cash parked at every toll booth just in case you need to pass through. It’s safe, but highly inefficient.

Enter Stablecoins and Web3 Payment Rails

Stablecoins are digital tokens backed by real-world assets, usually fiat currencies like the U.S. dollar or euro. Each token represents one unit of currency held in reserve by a regulated issuer such as Circle (USDC), Paxos (USDG), or Ripple (RLUSD).

As stablecoins maintain a stable value, they can act as digital cash for global payments by combining the stability of fiat with the speed of crypto rails.

Also Read: Why VCs Are Betting on Stablecoin Infrastructure in 2025

What does that mean for cross-border payments?

- Direct value transfer: SWIFT can only send messages about payments. Stablecoins transfer real value instantly and programmatically.

- Transparent: Every currency unit (say, a dollar) can be tracked at any instance in the chain. This wasn’t possible with the opaque structure of the old system.

- Always-on: Stablecoins run on blockchains. That means, the financial pipes are available at any hour (unlike banks that close at 5pm and on public holidays).

- Built-in security: Blockchains are more secure than any manual banking chain. So, value transfer via stablecoins does not require repeated manual checks and verifications.

Also Read: 7 Reasons Stablecoins Are Becoming the Currency of Regulated Businesses

Web3 Payment Infrastructure in Action

A growing number of traditional financial players are already experimenting with this model:

- Visa uses USDC on blockchains like Solana and Ethereum to settle merchant payouts in real time.

- Fireblocks and Transak provide fiat-to-stablecoin bridges for banks, fintechs, and wallets, allowing them to send and receive stablecoins seamlessly.

- Securitize and Ondo Finance are enabling investors to redeem tokenized U.S. Treasuries into stablecoins like RLUSD or USDC. This frees capital that would otherwise be locked in traditional banking cycles.

Also Read: Why Smart Companies Are Building Their Own Stablecoin Rails

The Rise of “Web3 Correspondents”

Today, infrastructure providers, like Transak, are stepping into the role of correspondents. But with a twist. Web3 payments providers move money itself, not just the message (like SWIFT).

Instead of sending manual instructions over SWIFT, companies today use API-based payment networks to initiate, verify, and settle transactions in real time.

Platforms like Transak, and Circle Payments Network serve as digital correspondents, connecting fiat banking systems to on-chain stablecoin liquidity.

And in this new architecture, regulated stablecoins such as USDC, RLUSD, USDG, and EURC act as the bridge currency between institutions.

FAQs

1. What is the correspondent banking system?

The correspondent banking system is a network of financial institutions that collaborate to process cross-border payments. When two banks don’t have a direct relationship, they use one or more correspondent banks to route and settle funds internationally.

2. What are correspondent banks?

Correspondent banks are domestic and foreign banks that provide services on behalf of other banks, especially across borders. They hold accounts (nostro/vostro) and facilitate transactions, currency conversions, and settlements between other domestic and foreign banks that don’t have a direct relationship.

3. Why does it take so long to send money across borders?

Cross-border payments pass through multiple domestic and foreign banks, each performing compliance checks, currency conversions, and reconciliations. These steps can take two to five days, especially when financial transactions move across different time zones and currencies.

4. What role does SWIFT play in correspondent banking?

SWIFT doesn’t move money, it moves messages about money. Banks use SWIFT messages to instruct and confirm payments, but actual fund settlement happens later through correspondent banks.

5. How do stablecoins solve correspondent banking inefficiencies?

Stablecoins transfer real value instantly on blockchain networks, removing the need for multiple intermediaries. They allow 24/7 settlement, lower fees, and transparent tracking, effectively modernizing how cross-border value moves.

6. What are “Web3 correspondents”?

Web3 correspondents are digital infrastructure providers like Transak, Circle, or Fireblocks that connect traditional banking systems to blockchain networks. They act as modern equivalents of correspondent banks, but settle value in real time using stablecoins.

7. Will stablecoins replace correspondent banks?

Not entirely. Instead, they’ll coexist in a hybrid model where stablecoins handle settlement and speed, while banks maintain regulatory oversight, compliance, and customer trust.