Takeaways

Every time a fintech startup tries to integrate stablecoin payments, they hit the same wall, i.e., compliance.

Which license do we need? Can we operate globally? Who verifies our reserves?

For all the talk about “frictionless payments,” the reality is that compliance is still the bottleneck between innovation and adoption. And it’s not going away.

But as new frameworks like the GENIUS Act and MiCA emerge, the path forward is finally clearer. For the first time, compliance isn’t just a checkbox for companies to “get it over with,” it’s the infrastructure that makes stablecoins bankable.

Chaos to Credibility

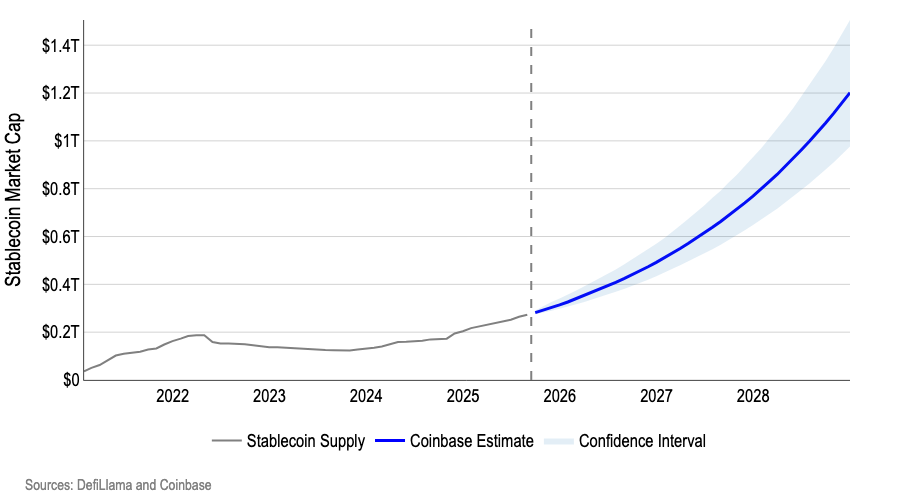

In just a few years, stablecoins started powering billions in daily transactions. Since 2021, global stablecoin supply has grown at an average rate of nearly 65% per year, a trajectory that reminds us of the early days of mobile payments.

Source: Coinbase

Yet, the Financial Action Task Force (FATF) found that stablecoins accounted for the majority of on-chain illicit activity in 2024, overtaking Bitcoin as the preferred rail for criminals laundering funds.

As volumes soar, so have the stakes. Regulators are asking whether these digital dollars are resilient enough to handle fraud, tax evasion, and consumer risk.

Every test that stablecoins have faced, from reserve controversies to high profile collapses (cue Terra-Luna crash), has pushed regulators and issuers to build stronger guardrails. The result is a landscape where compliance is the foundation for stablecoins to earn mainstream trust.

Also Read: Stablecoin Remittances: The Next Frontier In Fintech

Enforcement Actions That Triggered Regulation

Before comprehensive rules were written, enforcement filled the gaps. Here is a chronology of landmark cases that shaped today’s regulatory approach.

|

Year |

Stablecoin |

Regulator |

Issue |

Outcome |

Impact on Regulation |

|

2021 |

Tether (USDT) & Bitfinex |

New York Attorney General |

Misrepresentation of reserves |

$18.5M settlement Barred from operating in New York |

Set precedent for reserve transparency requirements |

|

2022 |

Terraform Labs (TerraUSD – UST) |

SEC, U.S. prosecutors |

Collapse of algorithmic stablecoin; alleged fraud |

~$40B market loss; SEC charges; Do Kwon indicted, pled guilty in 2025 |

Prompted global calls for 1:1 reserves and redemption rights |

|

2023 |

Tether (USDT) |

U.S. DOJ, law enforcement |

Funds tied to illicit activity (terrorism, trafficking) |

$225M USDT frozen (trafficking); $0.87M frozen (terrorism) |

Demonstrated centralized issuers can enforce sanctions in real time |

|

2023 |

Circle (USDC) |

U.S. Treasury (OFAC) |

Tornado Cash sanctions |

Immediate blacklisting of sanctioned wallets |

Reinforced obligation to integrate sanctions screening |

|

2025 |

Paxos (BUSD issuance) |

New York DFS |

Weak AML/KYC program |

$26.5M fine + $22M remediation = $48.5M total |

Influenced GENIUS Act AML/sanctions compliance mandates |

These events weren’t isolated scandals. They became the blueprint regulators used to design stronger, clearer frameworks.

Current Regulatory Landscape

Stablecoins operate in one of the fastest evolving regulatory environments in finance. Several frameworks are already live or in force. A quick snapshot of what each one entails:

GENIUS Act in the United States (2025)

The GENIUS Act establishes a federal license for issuers, mandates 1:1 reserves in cash or Treasuries, requires full AML/sanctions compliance, and bans misleading claims about insurance. Issuers are now treated as financial institutions under the Bank Secrecy Act.

Also Read: What Is The GENIUS Act? A CEO’s Guide To The US Stablecoin Legislation

MiCA in the European Union (2024–25)

MiCA defines stablecoins as e-money tokens or asset-referenced tokens. Issuers must be authorized, maintain 100% segregated reserves, guarantee redemption at par, and publish transparent whitepapers.

Asia-Pacific

- Hong Kong (2025 law) has one of the strictest crypto regimes globally. It asks for mandatory licensing plus KYC for every holder.

- Singapore (MAS framework) covers single-currency stablecoins pegged to SGD or G10 currencies. It also requires reserves in high-quality liquid assets and redemption guarantees.

- Japan restricts issuance to licensed banks and trusts under the Payment Services Act.

Global Standards

FATF enforces the Travel Rule for cross-border transfers, OECD’s Crypto-Asset Reporting Framework (CARF) mandates international tax reporting, and the BIS continues to call for bank-level resilience.

Taken together, these rules shift stablecoins from experimental instruments to recognized, regulated financial products.

Compliance Challenges Stablecoins Still Face

Even with regulations on the books, day-to-day compliance presents challenges that issuers, exchanges, and businesses must manage.

1. AML and KYC at Bank-Grade Precision

Stablecoins move at internet speed, but regulators expect bank-level monitoring.

Centralized issuers (USDC, USDT) perform KYC at issuance and redemption. However, decentralized stablecoins (DAI, FRAX) lack direct user visibility, thus shifting AML responsibility to on-ramps, wallets, and exchanges.

The FATF even demands real-time transaction screening, suspicious activity reporting, and risk-based due diligence, mirroring requirements for global banks.

Basically, regulators expect the same level of transaction screening, suspicious activity reporting, and customer due diligence that traditional financial institutions follow.

Paxos’s $48.5M fine and remediation was a result of KYC/AML non-compliance.

2. Sanctions Enforcement and DeFi Grey Zones

Stablecoins are subject to sanctions just like SWIFT payments. USDC and USDT issuers routinely blacklist wallets tied to OFAC or UN sanctions, demonstrating that compliance can exist on-chain.

However, DeFi protocols complicate this:

- Liquidity pools make asset tracing harder.

- Bridges allow cross-chain transfers that bypass compliance filters.

The GENIUS Act and MAS frameworks both require issuer-controlled sanctions enforcement, yet DeFi integration remains a grey zone regulators are now targeting.

3. Taxation and Reporting

From the IRS to India’s TDS, taxation frameworks treat stablecoins like property, not currency. Every redemption or transfer can trigger capital gains, making record-keeping mandatory.

- U.S.: IRS requires cost basis tracking for all digital asset transactions.

- EU: DAC8 enforces stablecoin transaction reporting across member states.

- Global: OECD’s CARF replicates FATCA for cross-border stablecoin flows.

- India: Applies 30% tax + 1% TDS even on stablecoins.

For business leaders, this complicates things because although stablecoins are designed to behave like cash equivalents, regulators require them to be treated operationally and for reporting purposes as digital assets.

4. Consumer Protection and Transaparency

The collapse of TerraUSD redefined consumer risk. Since then, all major regimes require audited reserves, par-value redemption, and independent attestation:

- GENIUS Act: Bans misleading claims like “FDIC insured” and mandates third-party audits.

- MiCA: Requires segregated reserves and whitepaper disclosures.

- MAS: Mandates cash/Treasury-backed reserves and guaranteed redemption rights.

Tether’s $18.5M settlement in 2021 for misrepresenting its reserves reinforced the point that regulators act swiftly when consumer trust is at stake.

Issuers like Tether and Circle now publish attestation reports monthly, but the next evolution will be real-time, on-chain proof of reserves that combine blockchain transparency with regulated assurance.

5. Licensing and Registration

Stablecoin issuers today face a patchwork of overlapping licenses:

- U.S.: Federal GENIUS license and state-level Money Transmitter laws.

- EU: E-money institution license under MiCA.

In Asia, regimes vary. Hong Kong has created a licensing system specific to stablecoin issuers, Singapore regulates them under the Payment Services Act, and Japan limits issuance to licensed banks and trusts.

For decentralized stablecoins like DAI, which lack a corporate issuer, direct licensing isn’t possible. Regulators instead focus on exchanges, custodians, and wallet providers that integrate or distribute these tokens, effectively pulling compliance into the points of access.

For businesses adopting stablecoin payments, partnering with licensed issuers and regulated on/off-ramps like Transak ensures lower legal exposure and higher user confidence.

Also Read: Why Smart Companies Are Building Their Own Stablecoin Rails

Cross-Chain Compliance and the Interoperability Question

As stablecoins expand across multiple blockchains, interoperability introduces new risk. Bridges and L2 networks often bypass issuer-controlled compliance layers, creating gaps in Travel Rule enforcement.

Also Read: Why Stablecoin Fragmentation Is a Problem (and What Can Fix It)

The FATF’s 2025 targeted update urges VASPs and stablecoin issuers to extend AML controls across chains, ensuring wallet screening and reporting even in multi-chain environments.

In practice, this means that cross-chain monitoring, proof-of-origin verification, and travel rule compatibility will define the next wave of compliance innovation.

Compliance Is Also A Competitive Edge

The global stablecoin race is about who moves safest. Businesses that integrate stablecoins through compliant infrastructure gain:

- Access to more regulated markets

- Faster onboarding and fewer blocked transactions

- Institutional trust from banks and payment partners

At Transak, compliance is built into every flow. We make stablecoin integration seamless, secure, and regulation-ready from day one.

Compliance isn’t the cost of legitimacy. It’s the foundation of scale.

Conclusion

Stablecoins have been tested by speculators and criminals alike. And those tests have made the ecosystem stronger. The rules now in place are the bridges to mainstream adoption.

Compliance frameworks give businesses confidence and clarity while protecting consumers. These new laws ensure stablecoins can integrate seamlessly with banks, payments networks, and global trade.

With Transak, you can integrate stablecoin payments into your business while meeting KYC, AML, tax reporting, and consumer protection standards from day one.