Takeaways

The 2008 financial crisis exposed how fragile and opaque modern payment rails really are. Banks always decided what transactions are legitimate and who could participate, almost on a whim, and the society at large had no option but to place their trust in these gatekeepers.

So, Satoshi Nakamoto came up with a system in 2008 that would remove the need to trust a bank or any institution. That was the blockchain.

With blockchains, payments come with built-in security and immutability (can’t be changed), i.e., there’s no dependency on any financial institution to ensure fair play. Today, blockchain-based payments are on track to become the norm for many businesses including PayPal and YouTube.

In this guide, we walk through blockchain payments step by step, explaining how transactions are created, validated, and settled onchain, and why this model works differently from traditional payment systems.

Why Blockchain Payments Exist

Payments are not broken in an obvious way. For most people, money already moves with a tap, a swipe, or a click. Cards work. Bank transfers work. Apps feel instant. Yet under the surface, the infrastructure moving that money is slow, fragmented, and expensive to operate at global scale.

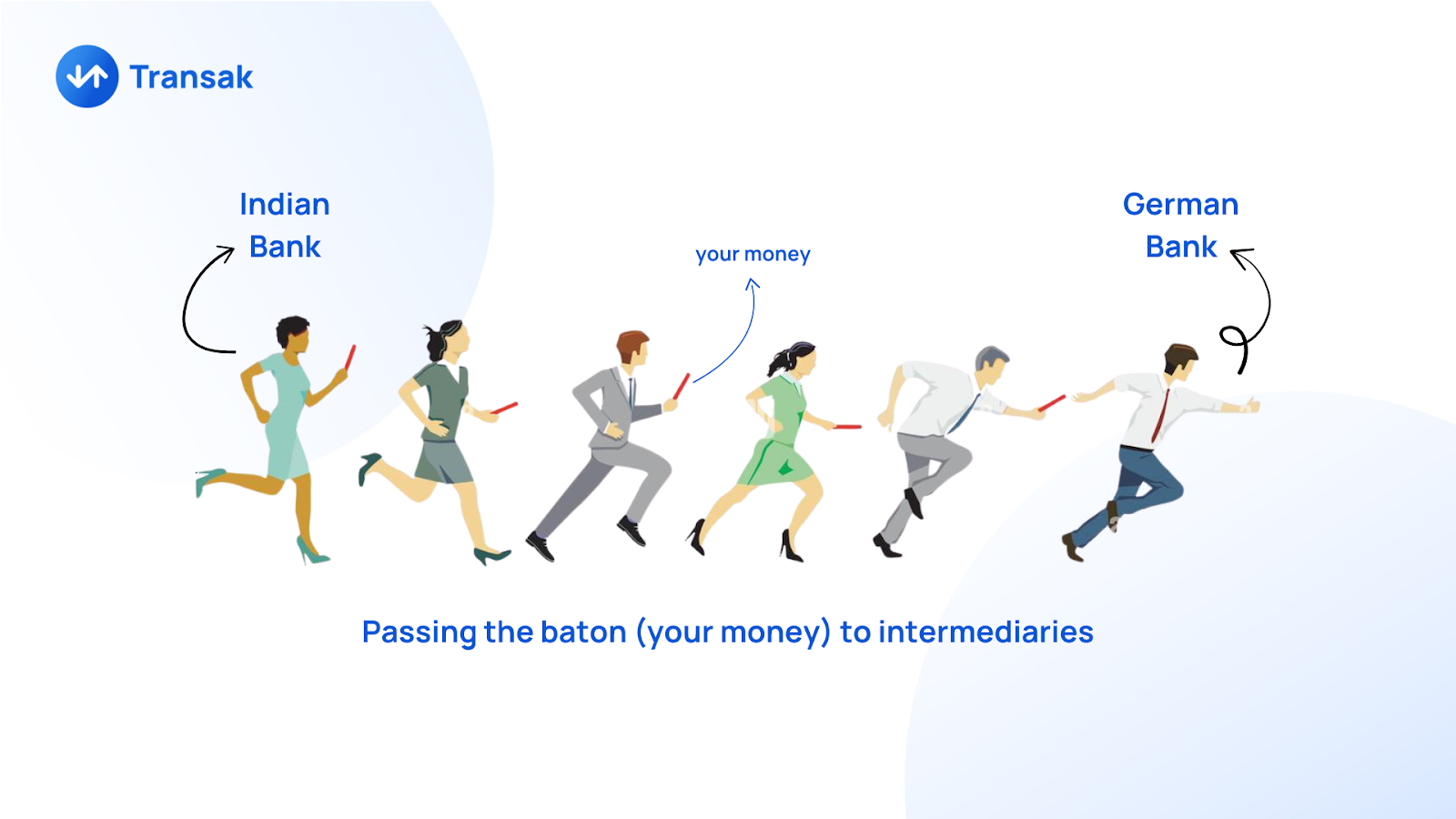

Most traditional payment systems are built on layers of intermediaries. A cross-border transaction, for example, passes through multiple correspondent banks, each one adding cost, delay, and complexity.

The Hidden Costs of Legacy Payment Rails

Traditional payment rails were designed for a world where money moved within national borders and business hours mattered. That design creates several structural issues today:

- Slow settlement that ties up capital

- Costly and unpredictable cross border transfers

- Pre-funded accounts that trap liquidity

- Limited programmability that makes automation and real time settlement difficult

These problems are not always visible to end users, but they scale rapidly for platforms, marketplaces, and global businesses. The cost of which is eventually borne by the user.

What Blockchain Changes At A System Level

Blockchains replace trusted intermediaries with a shared ledger of transactions that settle directly between parties.

This enables the following:

- Direct and final settlement

- Always-on operation

- Global payments using the same rails

- Programmable logic within transactions

Rather than replacing existing systems, blockchains introduce a new settlement layer that behaves more like the internet than traditional finance.

When Blockchain Payments Actually Make Sense

Blockchain payments are not a universal upgrade. They are most effective in specific scenarios:

- Cross-border payments where speed and cost matter

- Platforms that need instant or near-instant settlement

- Businesses operating in multiple currencies and regions

- Apps that benefit from programmable or automated payments

For purely domestic payments with strong local infrastructure, traditional rails may still be simpler. The value of blockchain payments emerges when global scale, liquidity efficiency, and automation become important.

How Blockchain Payments Work

Blockchain payments follow a simple flow at a high level (although the infrastructure underneath is technical).

Here is how they work, step by step.

1. A transaction is created

A payment starts when a sender signs a transaction with their private key. The transaction specifies who is being paid, how much value is being sent, and any conditions or data attached to it.

This signature proves ownership of funds without revealing identity.

2. The transaction is broadcast to the network

The signed transaction is shared with the blockchain network. The blockchain nodes independently check that it follows the rules, such as sufficient balance and valid signatures.

At this stage, the transaction is pending, not yet settled.

3. Transactions are grouped into a block

Validators or miners collect valid transactions and propose them as a new block. Different blockchains use different mechanisms, such as Proof of Work or Proof of Stake, to decide who can add the next block.

4. The network reaches consensus

Other nodes verify the proposed block. Once the network agrees, the block is added to the chain and linked to previous blocks.

This step makes the transaction extremely difficult to reverse.

5. Settlement happens on-chain

When the block is confirmed, the payment is settled. Ownership of funds updates on the ledger, and both parties can independently verify the result.

There is no separate clearing or reconciliation phase.

6. Finality increases over time

As more blocks are added on top, reversing the transaction becomes economically or technically infeasible. On some networks, finality is explicit and near instant. On others, it strengthens with confirmations.

What a “Blockchain Payment” Actually Means

First, here’s what “blockchain payment” is NOT:

- trading

- speculation

- “using crypto”

A blockchain payment is simply the transfer of value that settles on a blockchain.

That value might be a stablecoin, a tokenized representation of fiat, or a native network asset. The key distinction is not the asset itself, but where and how settlement happens.

Push Payments, Not Pull Payments

An important distinction between blockchain payments and traditional card payments is that the former is “push-based” and not “pull-based”. That means, the sender explicitly authorizes and sends funds to a recipient.

In a pull model, a merchant requests funds and the network pulls them from the payer’s account, often with delayed settlement and chargeback risk.

Push payments reduce certain types of fraud and eliminate chargebacks, but they also place more responsibility on the sender to verify details before sending.

Building Blocks of Blockchain Payments

Every blockchain payment system is built from a small set of core components.

Wallets: How Value is Controlled

A wallet is not a place where money is stored. It is a tool that controls access to funds on a blockchain.

Wallets manage cryptographic keys that authorize transactions. Whoever controls the keys controls the funds.

Wallets are generally one of two types; i) custodial wallets, and ii) non-custodial wallets. For payment platforms, the choice often depends on the target audience and regulatory requirements.

Also Read: Custodial vs. Non-Custodial Wallets

Nowadays, most applications are leaning towards using smart accounts. Smart accounts are a unique type of wallet that allow better, tech-abstracted UX and enable features like multi-signature approvals, spending limits, and recovery mechanisms.

Assets: What Is Being Transferred

The asset defines the economic behavior of the payment.

- Native tokens are used to pay network fees and can be transferred like any other asset.

- Stablecoins represent a fixed value, usually pegged to fiat currencies, and are the preferred asset for most payment use cases.

- Tokenized fiat and deposits represent claims on real-world money held by regulated institutions.

For payments, predictability matters more than novelty. Assets that minimize volatility and maximize liquidity are typically favored.

Networks: Where Settlement Happens

The blockchain network determines how fast, how cheap, and how reliable payments are.

- Layer 1 blockchains provide base-layer security and decentralization.

- Layer 2 networks execute transactions off the main chain and settle them back to Layer 1..

Network choice affects user experience, cost structure, and operational complexity.

Also Read: L1 vs L2 Networks Explained

Smart Contracts: Payment Logic

Smart contracts turn simple value transfers into programmable payments. They can enforce conditions like:

- Releasing funds only after an event occurs

- Splitting payments between multiple parties

- Automating refunds or time-based transfers

In payment systems, smart contracts act as the rules engine. They define how funds move, when they move, and under what conditions.

Not every blockchain payment requires a smart contract, but most advanced payment flows rely on them in some form.

How Blockchain Payments Happen in the Real World

Most real-world blockchain payment systems rely on one of three asset types. Each plays a different role in how payments are issued, accepted, and settled.

1. Cryptocurrencies

Native cryptocurrencies like Bitcoin or Ether can be used directly for payments, though they are not optimized for everyday commerce.

They offer:

- Native on-chain settlement without intermediaries

- Global accessibility

- Censorship resistance

However, price volatility makes it difficult for merchants to price goods or manage cash flows. As a result, cryptocurrencies are more commonly used for niche use cases, high-value transfers, or environments where neutrality and permissionless access matter more than price stability.

In retail settings, merchants that accept cryptocurrencies often convert them immediately into stable assets to avoid exposure.

2. Stablecoins

Stablecoins are the dominant asset in real-world blockchain payments.

They are pegged to fiat currencies, most commonly the US dollar, and combine predictable value with blockchain settlement. This makes them suitable for retail payments, payouts, remittances, and B2B transactions.

In practice, stablecoins function like digital cash on programmable rails:

- Merchants price goods in familiar fiat units

- Customers pay using on-chain tokens

- Settlement happens in minutes or seconds

- Funds can be reused immediately

Stablecoins are widely used behind the scenes even when users are unaware that a blockchain is involved.

3. Central Bank Digital Currencies (CBDCs)

CBDCs are digital representations of sovereign money issued by central banks.

In jurisdictions where they exist, CBDCs aim to:

- Modernize domestic payment infrastructure

- Improve settlement efficiency

- Maintain monetary control in a digital economy

CBDCs are typically permissioned and integrated into existing financial systems. While their global interoperability is limited today, they may play a growing role in domestic blockchain-based payment networks.

How The Payment System Works IRL

Although the rails are different, the roles in a blockchain payment mirror traditional systems.

- The customer initiates the payment using a wallet.

- The merchant displays prices, generates payment requests, and receives funds on-chain.

- The payment layer handles address generation, transaction monitoring, compliance checks, and user experience.

- The settlement layer is the blockchain itself. It records the transaction, enforces finality, and acts as the source of truth for balances and ownership.

- Off-chain connectors like Transak link blockchain payments to the real economy.

What Makes Blockchain Payments Different from Traditional Payments

The key difference is not who pays or who gets paid. It is how value moves between them.

Blockchain payments unify messaging, clearing, and settlement into a single process. Assets move directly, finality is enforced cryptographically, and payment logic is programmable by default.

In the real world, this translates to faster access to funds, fewer intermediaries, and new ways to design payment experiences that were not possible on legacy rails.

Where Blockchain Payments Deliver The Most Value

1. Cross-Border Payments and Remittances

Blockchain’s most mature and widely adopted payments use case is moving value internationally faster and cheaper than legacy systems.

As blockchains settle transactions directly on a shared ledger, settlement can happen in seconds or minutes rather than days, bypassing correspondent banks and traditional rails. Stablecoins like USDC and USDT are mostly used.

This benefits both business-to-business (B2B) supplier and vendor payments and person-to-person (P2P) remittances for workers sending money home.

2. Retail and Consumer Payments

Blockchain payments are increasingly accepted at consumer checkouts thanks to stablecoin support and integrations with existing point-of-sale systems.

Ecommerce platforms and digital wallets are integrating blockchain rails so customers can pay with digital assets directly at checkout.

3. Corporate Treasury and Cash Management

Enterprises are using blockchain payments for real-time treasury operations and liquidity management.

Stablecoins allow firms to move capital instantly between divisions or geographies with full traceability.

Distributed ledgers enable more accurate, up-to-date liquidity visibility.

4. Payroll and Gig Economy Payouts

Blockchain enables near-instant global payroll for remote workers and gig platforms. Platforms can pay contractors in stablecoins or other digital assets directly into wallets, avoiding delays and FX risk.

5. Financial Market Settlement

Blockchain payments also extend into capital markets and institutional settlement use cases. Tokenized representations of cash and assets can settle securities trades and interbank transfers more quickly and transparently.

Companies Using Blockchain for Payments

1. Visa

Visa is piloting stablecoin settlement for U.S. banks, enabling transactions to settle using USDC on blockchain networks like Solana. This allows banks to move funds faster with 24/7 availability instead of traditional batch settlements.

2. Stripe

Stripe has extended its payments infrastructure to support accepting and settling USDC stablecoin payments for businesses, treating them much like card transactions. Merchants can accept stablecoins at checkout, and Stripe handles settlement into their Stripe balances, potentially in fiat.

3. Shopify

In 2025 Shopify enabled direct acceptance of USDC stablecoin payments through integrated apps with processors like Coinbase and Stripe, allowing online merchants to offer stablecoin checkout options.

4. GrabPay

GrabPay lets users pay merchants in USDC or USDT, which is then converted to a Singapore dollar-backed stablecoin (XSGD) for merchants. Metro department stores in Singapore began accepting these payments.

5. Revolut

Revolut is evolving toward full-stack blockchain payments, integrating stablecoin services for transfers and potentially payments directly in its app. This transition is part of a broader trend among neobanks leveraging tokenized money rails.

What Are The Challenges of Blockchain Payments?

Blockchain payments solve real problems, but they also introduce new ones. Many of the limitations are not theoretical. They show up in production systems, user experience, compliance workflows, and business operations. The industry is actively working on solutions, and progress is uneven but real.

Below are the major challenges, alongside the approaches being used to address them.

1. User Experience and Onboarding

The challenge:

For non-crypto users, blockchain payments still feel unfamiliar. Concepts like wallets, gas fees, addresses, and confirmations create friction. One mistake can feel irreversible, which discourages everyday use.

What’s being worked on:

- Embedded and invisible wallets inside apps

- Seedless recovery models and social recovery

- Gas abstraction where users never see network fees

- Human-readable identifiers instead of raw addresses

The goal is to make blockchain payments feel no different from using a modern payment app.

2. Volatility and Asset Risk

The challenge:

Native cryptocurrencies fluctuate in value. This makes pricing, accounting, and treasury management difficult for merchants and platforms.

What’s being worked on:

- Widespread use of fiat-backed stablecoins

- Expansion of non-USD stablecoins for regional use

- Clearer reserve standards and disclosures

- Integration of tokenized deposits and regulated digital cash

Stable value assets are now the default settlement layer for most payment use cases.

3. Scalability and Network Congestion

The challenge:

Public blockchains can experience congestion during periods of high demand. Fees may spike and confirmation times may become unpredictable, which is unacceptable for payments.

What’s being worked on:

- Layer 2 networks that offload execution from main chains

- Rollups and batching for high-throughput payments

- Alternative high-performance chains optimized for payments

- Better fee estimation and routing logic

Most payment-focused systems now avoid relying on a single chain.

4. Compliance and Regulation

The challenge:

Payments operate in heavily regulated environments. Requirements around identity, sanctions, and transaction monitoring still apply, even when settlement is on-chain.

What’s being worked on:

- Compliance at the entry and exit points rather than on the ledger

- Travel Rule messaging layers alongside blockchain settlement

- On-chain analytics and monitoring tools

- Jurisdiction-specific licensing and regulatory alignment

The separation of settlement and compliance is becoming a standard architectural pattern.

5. Irreversibility and Error Handling

The challenge:

Blockchain transactions are final. Mistyped addresses or incorrect amounts cannot be reversed by the network.

What’s being worked on:

- Pre-transaction simulations and confirmations

- Address checksums and warnings

- Smart contract escrow and delayed settlement windows

- Application-level refunds and dispute logic

Safety is being moved upstream into the user experience rather than relying on reversibility.

6. Liquidity and Fiat Connectivity

The challenge:

Blockchain payments are only useful if users can move between fiat and on-chain assets easily. Poor on-ramps and off-ramps create friction and fragmentation.

What’s being worked on:

- Global on-ramp and off-ramp coverage with local payment methods

- Just-in-time liquidity instead of prefunded accounts

- Stablecoin liquidity pools across chains

- API-driven fiat-to-on-chain settlement infrastructure

This layer quietly determines whether blockchain payments scale or stall.

7. Fragmentation Across Chains

The challenge:

Different blockchains, assets, and standards create complexity. Users and businesses do not want to choose chains or worry about interoperability.

What’s being worked on:

- Chain abstraction layers that hide network choice

- Cross-chain messaging and liquidity routing

- Unified payment interfaces across multiple blockchains

- Smart routing based on cost, speed, and reliability

The long-term direction is fewer visible chains, not more.

8. Security and Custody Risk

The challenge:

Private key management, smart contract bugs, and infrastructure attacks remain real risks. Payment systems must be resilient under failure.

What’s being worked on:

- Multi-party computation and hardware security modules

- Audited, minimal smart contract designs

- Rate limits and transaction controls

- Monitoring and automated risk detection

Security in payments is about reducing blast radius, not eliminating risk entirely.

9. Business Model and Cost Structure

The challenge:

Lower settlement costs do not automatically translate into sustainable business models. Infrastructure, compliance, and support still cost money.

What’s being worked on:

- Transparent, modular fee structures

- Usage-based pricing instead of fixed rails

- Revenue from value-added services like FX, compliance, and reporting

- Platform-level monetization rather than per-transaction margins

Successful payment systems align incentives across users, merchants, and infrastructure providers.

Use Transak To Enable Blockchain Payments

By now, it should be clear that blockchain payments offer faster settlement, global reach, and programmable money. The hard part is not the blockchain. It is everything around it.

That is where Transak comes in.

Transak sits between traditional money and blockchain settlement.

It lets your users pay using familiar methods like cards or bank transfers, while the value settles on-chain in stablecoins or other supported assets. Transak handles compliance, conversion, and local payment rails so you do not have to.

To your users, it feels like a normal checkout.

Under the hood, it is a blockchain payment.

FAQs on Blockchain and Crypto Payments

1. What are crypto payments?

Crypto payments are digital payments where value is transferred using blockchain networks instead of traditional banking rails. The payment is settled on-chain using assets like cryptocurrencies or stablecoins, with transactions recorded on a public or permissioned ledger. Crypto payments are commonly used for online purchases, cross-border transfers, and platform payouts.

2. Are crypto payments traceable?

Yes. Most crypto payments are traceable because transactions are recorded on a transparent blockchain ledger. While wallet addresses are pseudonymous, transaction history, amounts, and timestamps are publicly visible. Compliance tools and blockchain analytics are widely used to monitor activity and link transactions to real-world entities when required.

3. Are Bitcoin payments safe?

Bitcoin payments are cryptographically secure and resistant to tampering. Once a transaction is confirmed, it cannot be altered. However, safety depends on proper wallet management, secure private key storage, and correct address usage. Bitcoin payments are safe at the protocol level, but user error or poor custody practices can still create risk.

4. Can I pay crypto with a credit card?

Yes. You can use a stablecoin or crypto credit/debit card like the ones listed in this article or use a credit card to buy crypto on Transak to your wallet and then pay with that.

5. Can crypto payments be reversed?

No. Crypto payments cannot be reversed at the protocol level once they are settled on-chain. Transactions are final after confirmation. Refunds or dispute resolution must be handled at the application or merchant level through separate transactions or smart contract logic.

6. How long do crypto payments take?

Crypto payment times vary by network. Some blockchains confirm transactions in seconds, while others may take several minutes. Layer 2 networks and payment-focused chains often offer near-instant confirmations, while final settlement may take slightly longer depending on the network’s design.