Takeaways

Money is changing again. In 2025, the way people get paid is quietly being rewritten by stablecoins.

Freelancers in Manila, designers in Lagos, and developers in Buenos Aires are now receiving salaries, royalties, and bounties directly in digital dollars! Why? Because that’s faster than any bank wire and without middlemen taking a cut.

What began as a crypto-native experiment has evolved into a financial infrastructure movement, backed by regulators, fintech giants, and enterprises. The GENIUS Act in the U.S., Circle’s IPO, and MiCA in Europe have cemented stablecoins as legitimate settlement tools.

And that’s how we entered the “stablecoin summer.”

But the real question around this seasonal change is, “What actually changes for payouts?” The answer - faster, cheaper, and safer global payouts, without breaking the peg or the law. In this read, we’ll learn how

What are stablecoin payouts?

A stablecoin payout is simply a payment made in a stablecoin (like USDC, USDT, or euro-pegged tokens) instead of fiat currency. Because stablecoins are pegged to real-world assets (e.g., USD, EUR, or government securities), they offer price stability along with the benefits of blockchain-based settlement.

Typical use cases include:

- Payroll and contractor payments across borders

- Treasury operations (fund transfers, liquidity deployment)

- Supplier and vendor payments in international trade

- Peer-to-peer disbursements, rewards, and rebates

The appeal lies in near-instant settlement, low costs, and programmability (e.g. smart contracts triggering conditional payments).

Let’s understand it better with a hypothetical example. Say, you run a design marketplace and need to pay $500 to a creator in Manila. Traditionally, you'd pre-fund an account, navigate FX fees, wait days for settlement, and hope the payment messaging doesn’t get lost in the banking maze.

Stablecoin transfers are much more seamless. Your treasury converts USD to USDC, selects Solana for its low fees, and triggers a payroll app that performs a KYC check on the recipient and batches transfers.

Within seconds, the creator receives USDC in their wallet. They can hold it on-chain to hedge currency risk, swipe with a crypto card, or cash out through a local e-money wallet. Your ledger reconciles automatically using the transaction hash.

Key Advantages of Using Stablecoins for Payouts

Benefit |

Why It Matters |

|

Speed & 24/7 settlement |

Payments can clear in minutes (or seconds) unlike ACH/SWIFT. |

|

Lower cost |

Fewer intermediaries means reduced fees. |

|

Currency neutrality |

You can pay someone in India, Nigeria, or the U.S. using the same token. |

|

Programmability |

Smart contracts enable conditional, automatic payments (bonus triggers, escrow, etc.). |

|

Auditability & transparency |

On-chain records provide cryptographic traceability. |

In McKinsey’s “The stable door opens” report, stablecoins are described as transforming payments by enabling global, frictionless settlement in 2025. Meanwhile, Fireblocks reports that 90% of payments firms are already taking action to build stablecoin infrastructure.

The 5 Building Blocks of a Stablecoin Payout System

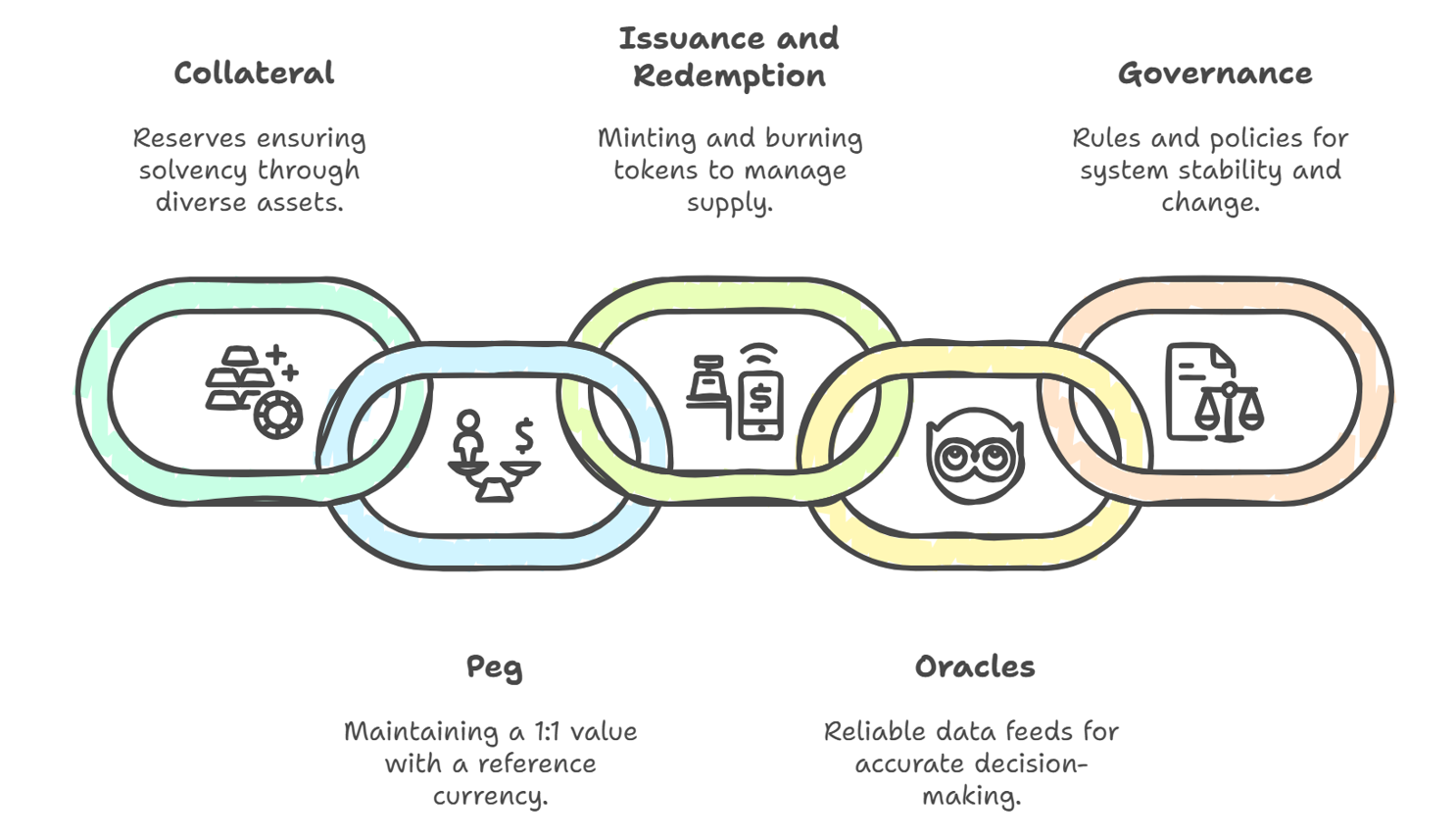

Core building blocks keep a stablecoin payout system functional and trustworthy. They revolve around how value is backed, how the peg is maintained, and how risks are managed in the event of stress events.

These five elements include.

- Collateral: Reserves of fiat, Treasuries, or over-collateralised crypto that guarantee solvency.

- Peg: The 1:1 target with a reference currency, usually the dollar.

- Issuance and redemption: Minting when new funds enter, burning when redemptions occur.

- Oracles: Reliable feeds for asset prices and FX rates that anchor decisions.

- Governance: Rules and policies for changes, plus circuit-breaker logic when conditions break.

Together, these pillars ensure that payouts remain credible, liquid, and aligned with their intended value.

The Mechanics of How Payouts in Stablecoin Flow

Public blockchains settled over $26.1 trillion in stablecoin value in 2024, outpacing many traditional networks. That scale explains why you now treat payout mechanics as core finance plumbing.

Stablecoin payouts might sound complex, but under the hood, they’re just digital versions of a familiar process, i.e., moving money from one wallet to another. The difference lies in how much faster, cheaper, and programmable that movement becomes.

A stablecoin payout typically follows three core stages:

- Funding and conversion

- Disbursement and settlement

- Treasury and accounting

1. Funding and Conversion

Everything starts with funding, i.e., getting stablecoins into your treasury. A company or DAO converts fiat (like USD or EUR) into stablecoins such as USDC, USDT, DAI, or PYUSD.

This can happen in two ways:

- Direct minting from an issuer like Circle or Paxos

- Purchase from an exchange or Transak OTC desk

Once acquired, the sender chooses the most efficient blockchain network, for example, Solana for high throughput, Base or Arbitrum for scalability, or Ethereum for settlement-grade trust.

At this stage, businesses also set wallet policies, like whitelisting recipient addresses, adding spending limits, and automating tags for reconciliation. These on-chain policies act as built-in compliance and risk controls.

2. Disbursement and settlement

Once wallets are funded, payouts can be pushed instantly to recipients.

Whether you’re paying ten creators or ten thousand contractors, the transfers are batched and signed digitally. There are no intermediaries, no SWIFT cutoffs, no or waiting for “banking hours.”

Stablecoin transactions settle within seconds or minutes, depending on the chain. Recipients immediately receive the funds in their wallets, ready to:

- Hold the tokens as digital dollars,

- Spend them via crypto cards or Web3 payment apps, or

- Off-ramp to local fiat using integrated payment partners.

What makes this powerful is that settlement and recordkeeping happen simultaneously. The transaction hash on-chain serves as both a receipt and a ledger entry, eliminating manual reconciliation.

3. Treasury and accounting

After payouts are executed, treasury teams handle liquidity and bookkeeping.

- Liquidity sweeps move idle balances across wallets or jurisdictions in real time, reducing the need for pre-funded Nostro and Vostro accounts (a major inefficiency in traditional finance).

- On-chain proofs provide transparent evidence of funds movement, which can be matched directly to enterprise ERPs or accounting tools.

- Stablecoin balances are often classified as cash equivalents under modern accounting guidance, especially when the coin maintains 1:1 redemption certainty.

This last stage turns what used to be multi-day, multi-intermediary processes into a near-instant financial workflow that is also transparent, auditable, and globally scalable.

4 Ways Stablecoin Payouts Are Changing How Money Moves

Decentralized rails can eliminate entire layers of pre-funding and messaging hops. This dramatically shifts both the cost structure and the speed of settlement for real-world payouts.

1. Instant Settlement, Lower Costs

Traditional payment rails like SWIFT and ACH still rely on intermediaries, clearing windows, and time zones. Average global remittance fees hover around 6%, and settlement can take 2–5 business days.

Stablecoins flip that model.

When companies pay in tokens like USDC or PYUSD, transfers clear within seconds, at a fraction of a cent in network fees.

A designer in Manila or a contractor in Lagos can now receive their payout instantly, instead of waiting for banking hours in another continent. For businesses, this means faster working capital turnover and happier partners.

For instance, Visa and Mastercard now settle merchant transactions in USDC across several chains, eliminating cut-off times and weekend downtime.

2. Unlocking Capital Efficiency

In traditional banking, businesses often park funds in pre-funded Nostro and Vostro accounts to ensure liquidity for cross-border payments. That locks up billions of dollars that could otherwise be earning yield or funding operations.

Stablecoin payouts remove that friction and allow treasury teams can move liquidity on-chain in real time, sweeping idle balances between entities and currencies as needed. This unlocks capital efficiency, improves cash visibility, and drastically reduces float risk.

Some corporates have already reported up to 70% faster treasury rotation cycles after adopting stablecoin-based settlement rails.

3. Compliance Meets Clarity

One of the biggest unlocks for stablecoin adoption in 2025 has been regulatory clarity.

- In the U.S., the GENIUS Act defines how payment stablecoins can be issued, redeemed, and audited.

- In Europe, MiCA has gone live, setting a clear framework for reserve quality, issuance, and custodial standards.

- In the U.K., the FCA’s stablecoin regime will soon allow regulated firms to custody and distribute payment tokens.

This means businesses can finally treat stablecoins as bankable instruments. The more compliant and transparent stablecoins become, the closer they move to being the default for institutional money movement.

4. The On-Chain Economy Is Going Mainstream

The biggest proof that stablecoins are here to stay lies in who’s using them.

- Enterprises: Companies like Shopify and Stripe are exploring stablecoin payouts for global seller settlements.

- Financial networks: Visa, Fireblocks, and Worldpay have added stablecoin settlement rails.

- Creators and freelancers: Platforms like Braintrust, Layer3, and TalentLayer pay contributors directly in USDC.

Public blockchains settled over $27 trillion in stablecoin value in 2024, more than Visa and Mastercard combined. Stablecoins have become the backbone of Web3 cash flow, where payroll, rewards, royalties, and incentives flow frictionlessly.

“Hybridisation” as a Safety Tweak for Stable Payouts

Although stablecoin payouts are faster and cheaper, relying entirely on blockchain rails can expose companies to new types of risks, like network congestion and liquidity crunches.

That’s why many enterprises and fintechs are adopting a hybrid model that blends traditional finance (TradFi) and on-chain systems (DeFi).

By mixing old and new payment channels, businesses can ensure continuity, compliance, and user trust.

1. Anchor with Strong Collateral

Every stablecoin payout system starts with what backs the coin. Hybrid frameworks favor fiat-backed stablecoins (like USDC, PYUSD, or EURC) over purely crypto-collateralized ones when dealing with high-volume or regulated payouts.

These assets are tied to short-term Treasuries and cash reserves, offering liquidity and transparency. By contrast, over-collateralized stablecoins such as DAI or LUSD are better suited for DeFi-native ecosystems, not large enterprise settlements.

In short, keep your operational backbone in fiat-backed coins and your experimentation layer in crypto-native assets.

2. Dual-Rail Routing (On-Chain + Off-Chain)

When it comes to global settlements, redundancy is a safety feature. Businesses often route payouts through two lanes simultaneously:

- Primary lane: On-chain stablecoin settlement for speed and programmability.

- Fallback lane: Traditional banking or fintech APIs (e.g., SEPA, Faster Payments) for redundancy.

If the blockchain network experiences congestion or downtime, funds can still reach recipients through the secondary channel.

3. Diversify Issuers and Assets

No single stablecoin issuer is immune to disruption. A regulatory freeze, banking exposure, or peg deviation can halt payouts system-wide.

Hybrid setups mitigate this by splitting exposure across multiple issuers — for example:

- 60% USDC (Circle)

- 30% USDT (Tether)

- 10% PYUSD (PayPal)

This portfolio-style approach ensures that even if one issuer faces stress, payout operations can continue smoothly.

4. Use Multiple Oracles

Price and FX feeds are the heartbeat of any payout logic. Smart contracts use oracles to determine exchange rates, gas fees, and collateral thresholds.

But if an oracle fails or is manipulated, the system can malfunction. So, hybrid designs pull data from multiple independent oracles (e.g., Chainlink, Pyth, RedStone) and implement circuit-breaker logic that automatically pauses payouts if data discrepancies cross a set threshold.

This “fail-safe mode” gives teams time to investigate anomalies before funds are misrouted.

How to Pick the Right Stablecoin for the Job

Five things:

- Redemption certainty

- Composability

- Cost considerations

- Compliance

- Spendability

Start with redemption certainty. If you need predictable fiat exits, use fully reserved, fiat-backed coins like USDC, USDT, or PYUSD. You get clean cash in and cash out, minimal basis risk, and clear issuer processes when the peg wobbles.

When your stack leans on DeFi, shift to composability. Over-collateralised choices such as DAI or LUSD plug into lending, DEXs, and vaults. Keep sizes capped to tame reflexivity in stressed markets.

Costs come next. For the lowest end-user fees, pair a high-throughput chain like Solana or Base with pre-negotiated on- and off-ramps. That pairing keeps micro-payouts viable.

Then clear compliance gates. Favor issuers with monthly reserve disclosures, independent audits, and blacklist controls. Reviews move faster, and circuit breaker playbooks stay enforceable.

Finally, optimise spendability. Prefer coins supported by card programs and major PSPs so recipients can hold, swipe, or off-ramp with minimal friction.

Stablecoin Payout Risks: What Can Go Wrong (and How to Brace)

The thing that trips teams up is not one big failure but several small ones stacking together, so you map risks, wire in controls, and rehearse the unwind.

- Issuer risk: Opaque disclosures or weak reserves erode confidence; you spread exposure across multiple issuers, set hard caps per coin, and require continuous attestations with alerting.

- Market risk: Pegs can wobble in stress; you maintain a standing redemption line, keep fiat buffers for payroll, and monitor premium or discount levels in real time.

- Tech risk: Bridges and contracts introduce exploit paths; you prefer native mints, audited routers, multisig controls, and a circuit breaker that pauses nonessential flows on anomaly.

- Compliance risk: Sanctions or KYC gaps create legal exposure; you embed provider checks, geofence restricted regions, and log every decision with oracle evidence.

- Liquidity risk: Off-ramps clog at the worst moments; you pre-contract multiple local partners per market, tier limits by corridor, and test failovers quarterly.

Treat these risk elements as a living system. They update after each incident, and can evolve as your payout scale grows.

How Transak Powers Stablecoin Payouts

Building a stablecoin payout system from scratch means juggling compliance, liquidity, and multi-chain settlements. Transak simplifies all of it through a single infrastructure layer.

With global coverage, Transak enables instant on- and off-ramping between fiat and stablecoins like USDC, USDT, and PYUSD, across Ethereum, Solana, Base, Arbitrum, Polygon, TON, and more ecosystems.

With MSB registration under FinCEN, FCA registration in the U.K., and ISO 27001/SOC 2 compliance, Transak give enterprises the regulatory assurance to move funds globally without risk.

By combining Visa Direct integration, local payment rails, and multi-chain routing via Transak One, businesses can send or receive stablecoin payouts with near-instant settlement and built-in KYC/AML safeguards, all through a unified API.

In short, Transak provides the compliance, liquidity, and infrastructure backbone for businesses to make stablecoin payouts work at scale.

Conclusion

Regimes like MiCA and US federal rules shrink ambiguity; banks, PSPs, and issuers align on supervision, disclosure cadence, and reserve quality.

Some analysts see rising Treasury demand from reserves; others warn about redemption-driven volatility in stress—both can be true depending on flows and turnover.

Meanwhile, cross-border retail and SMB payments are migrating to on-chain rails, where the unit economics actually work; wholesale remains cautious until interoperability and fungibility are established.

The principle still stands “design for failure; then design for scale”. And that should be the primary ethos behind stablecoin payments.