Takeaways

The clearest signal in crypto this year is also the most boring on purpose. Dollar-pegged tokens are turning into payment plumbing, and venture investors are racing to fund the pipes.

Since Tether's stablecoin hit $100 billion in circulation in March, VCs worldwide started scrambling for the leftovers (except these leftovers are actually worth trillions).

Here's what happens when Silicon Valley's smartest investors realize that boring old dollars can become attractive when they're digital – a complete rewiring of venture capital's crypto strategy.

A Regulatory Green Light That Rewires Incentives

The United States now has a federal stablecoin regime. The GENIUS Act, signed on July 18, created a licensing pathway, Bank Secrecy Act obligations, and clarity on who can issue and redeem payment stablecoins.

For venture investors, policy certainty reduces headline risk and brings large enterprises off the sidelines. Law firms briefed clients the day it passed, and the White House published a fact sheet that reads like an operating manual for compliance teams.

Europe is already live. MiCA’s first phase for e-money tokens and asset-referenced tokens has been applied since June 30, 2024. Issuers must hold liquid reserves, publish audited disclosures, and meet capital and conduct rules. The framework also introduces guardrails for “significant” tokens and retail-use caps to manage systemic risk. That combination, strict but clear, is exactly what growth investors want to see.

The policy race matters. After the U.S. move, European officials publicly accelerated digital euro work, citing competitiveness and the dollar’s lead in crypto-dollar rails.

The Trillion-Dollar Pivot Nobody Saw Coming

Remember when crypto VCs threw billions at "Ethereum killers" and Layer-1 blockchains? That is replaced by a clear realization that stablecoins are crypto’s biggest killer application.

Source: The Block

The numbers tell a compelling story of vindication:

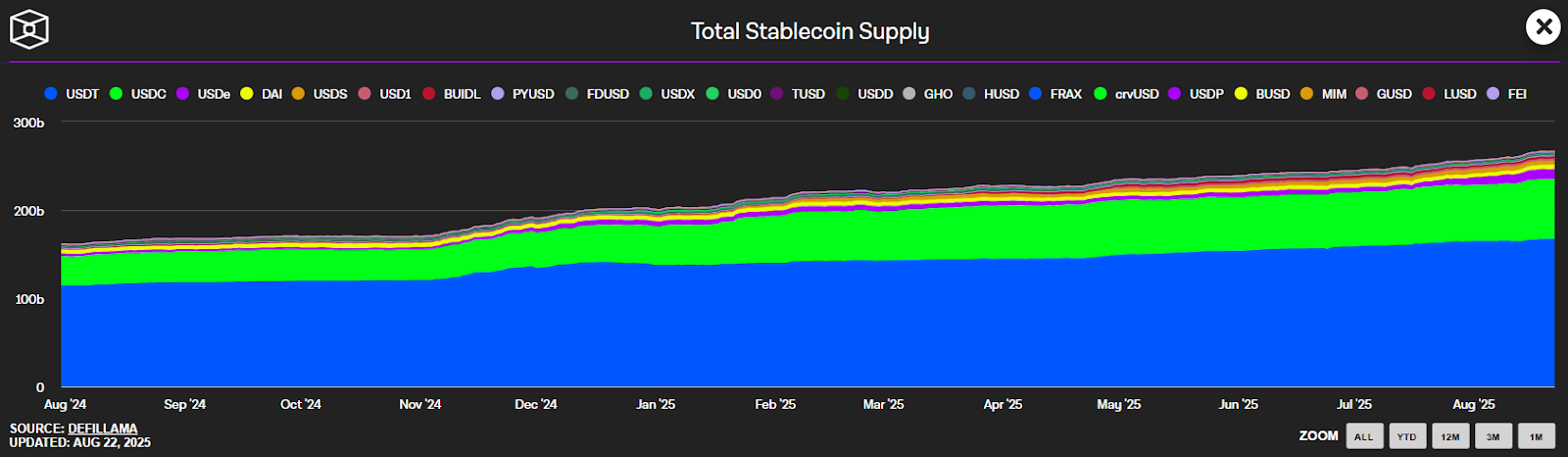

- Stablecoin supply exploded from $125 billion to $230 billion in 2024 alone (84% growth)

- Monthly cross-border payments hit $50 billion – up from almost nothing fifteen months ago

- Transaction volume crossed $30 trillion annually

Rob Hadick at Dragonfly captures the shift perfectly: "There is not a single financial services or fintech company in the world that doesn't have a stablecoin strategy today."

Also Read: Why FinTechs Are Turning To Stablecoins

When Stripe Wrote A $1.1 Billion Love Letter To Crypto

October 2024 marked the moment traditional fintech and crypto stopped pretending they weren't attracted to each other.

The largest crypto M&A deal ever, Stripe's acquisition of Bridge for $1.1 billion, was Silicon Valley's bat signal that stablecoins had graduated from experiment to infrastructure.

Juan Lopez from VanEck Ventures (formerly Circle Ventures) did the calculations that made every VC's spreadsheet sing: If Stripe shifts its $1 trillion payment volume to stablecoins at 4% treasury yields, that's a potential $40 billion annual net interest margin.

Suddenly, every fintech presentation deck featured the word "stablecoin".

The VC feeding frenzy that followed:

- Sequoia and Ribbit Capital backed Privy (crypto wallet infrastructure) before Stripe acquired it

- Coinbase Ventures shifted focus from protocols to payment rails

- Bain Capital Crypto raised Series A $35 million for M^0, declaring stablecoins "inherently a very profitable business" (Stefan Cohen's understatement of the decade)

- CoinFund predicts a fivefold increase in stablecoin supply post-regulation

The Great Infrastructure Gold Rush of 2025

You’d think the way for VCs to make bank from the stablecoin narrative is to bet on stablecoin issuers. That’s one part, because in reality, they're funding the entire stack. Think of it as the picks-and-shovels strategy, rather than putting money on stablecoins (or their issuers), they’re owning the entire rails that make stablecoins work.

For VCs, every layer (wallets, stablecoin cards, compliance rails, and APIs) is a monetizable node in the value chain. Issuers may capture the float, but the infrastructure providers capture the flow.

David Pakman from CoinFund expects transfer volumes to explode "in a short amount of time" once regulation lands. It simply means that VCs are pre-positioning for a regulatory green light that could unleash institutional adoption overnight.

The Yale Effect: When Even Dinosaurs Learn To Dance

Yale University (yes, the institution that pioneered the endowment model) is selling $6 billion of its private equity portfolio. Harvard's doing the same with $1 billion. When the veterans of illiquid investing start chasing liquidity, you know the game has changed.

This liquidity crunch is pushing VCs toward sectors with faster monetization potential. Enter stablecoins. They bring real revenue, actual users, and business models that don't require a PhD in cryptography to understand.

Transak and The Distribution Layer

Stablecoins may be the product, but access is the business. That’s where Transak comes in. Over the years, Transak has become one of the most important distribution layers for fiat-to-stablecoin conversions. With integrations across hundreds of apps, wallets, and exchanges, and with a combined user base of over 10 million (at the time of writing), Transak is often the first touchpoint for retail users, developers, and even corporates looking to move into stablecoins.

Earlier this year, Transak raised a $16 million strategic round led by Tether and IDG Capital. The thesis is straightforward for VCs, i.e., issuers may mint the dollars, but without compliant gateways like Transak, distribution stalls.

Transak’s stack covers on-ramps, off-ramps, NFT checkout, and global payments coverage in multiple countries (with localized methods). These rails are what enable stablecoins to scale.

Also Read: How Transak Abstracts the Messy Middle of Stablecoin Payments

Conclusion: Follow Smart Money

Recently, Coinbase Institutional just released a new forecast using Monte Carlo‑style simulations. They ran 20,000 separate growth scenarios, based on recent monthly adoption data and an autoregressive (AR‑1) model. As per the findings, the most probable outcome is a $1.2 trillion stablecoin market by 2028.

For VCs, that projection is less about headline numbers and more about validation. The growth curve is now data-driven, policy-aligned, and institution-ready.