Takeaways

- New stablecoins, like RLUSD, PYUSD, and USDG, are built for payments, not trading.

- Newer stablecoins focus on transparency, compliance, and being backed by real reserves.

- Regulatory clarity from the GENIUS Act, MiCA, and Hong Kong’s stablecoin rules is unlocking institutional confidence.

- Their design supports on-chain yield, interoperability, and multi-chain use, making them more practical for real-world finance.

- These coins are the foundation for programmable, compliant global money, bridging fintech, DeFi, and traditional banking.

For years, stablecoins like USDT and USDC have powered most of the crypto economy. Now, a new generation of regulated stablecoins is entering the market.

Tokens such as RLUSD and USDG are compliant, transparent, and purpose-built for real-world payments. Backed by clear regulatory frameworks like the U.S. GENIUS Act and Europe’s MiCA, they mark a turning point where stablecoins start functioning less like speculative instruments and more like financial infrastructure.

Also Read: Transak Powers Access to USDG, the First MiCA-Compliant Stablecoin from Paxos

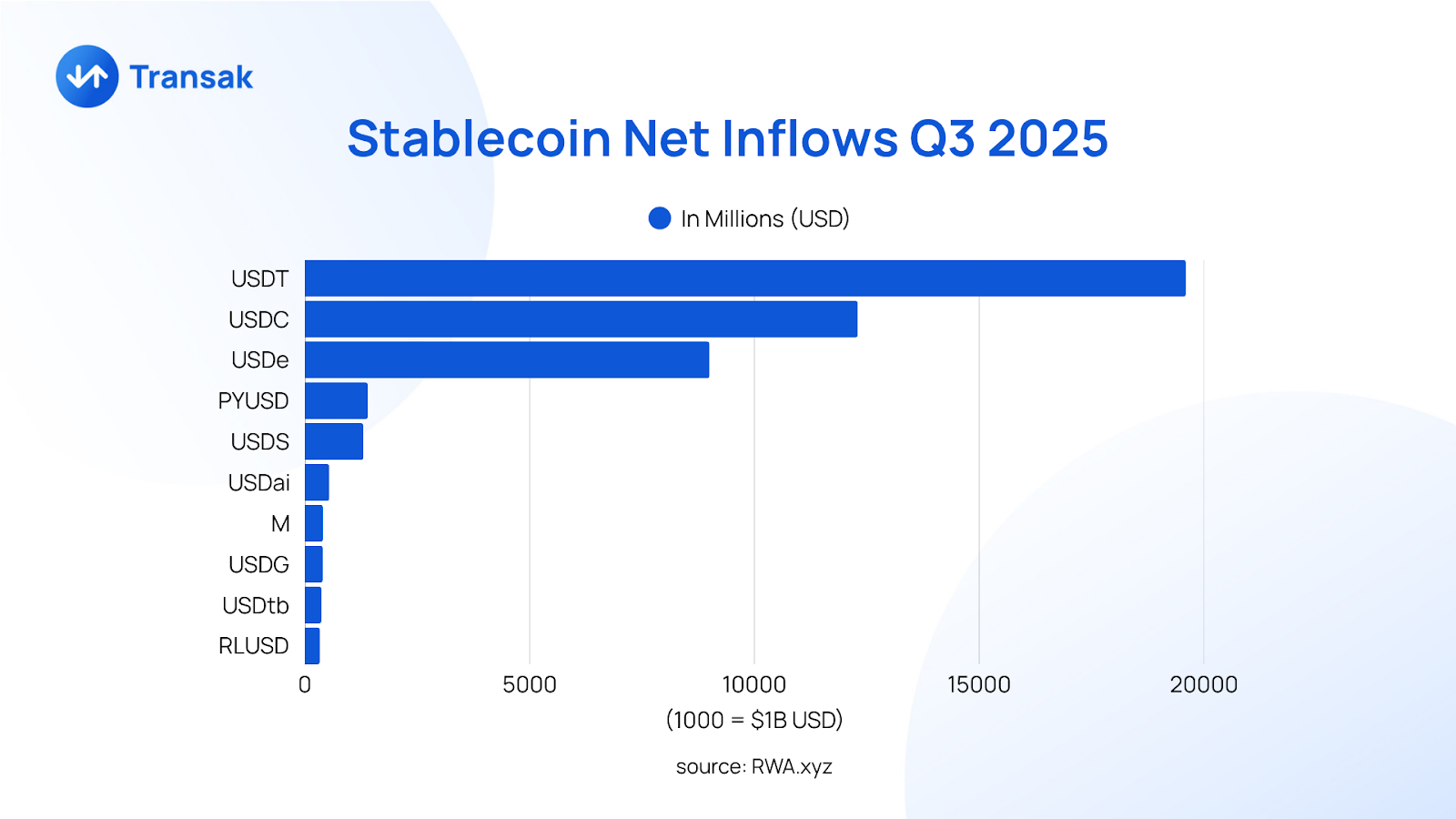

This regulatory clarity is already changing user behavior. In Q3 of 2025 alone, more than $46 billion in new stablecoin inflows came from institutional and retail users seeking compliant on-chain dollars. That’s why on-ramping (the ability to buy these stablecoins directly with local fiat currencies) matters more than ever. It’s the difference between viewing stablecoins as an investment and using them as money.

The Rise of Regulated Stablecoins

2025 is the year when digital dollars finally get a legal home address.

The GENIUS Act gives licensed issuers a clear path to operate under federal oversight, requires full 1:1 reserves, and forces real-time audits. The biggest players are already adapting:

- Tether is rolling out a U.S.-compliant version called USAT, issued through Anchorage Digital Bank

- Circle is expanding its compliance playbook globally

Europe’s MiCA framework has also kicked in, forcing issuers to plant a legal entity on EU soil and submit to continuous supervision. BBVA, one of Spain’s largest banks, is already preparing to launch a euro-backed stablecoin in 2026 under these new rules.

Hong Kong’s Stablecoin Ordinance (effective August 2025) now mandates local licensing for any fiat-backed stablecoin.

But what’s truly striking is how banks themselves are entering the race. In October, a consortium including Citi, Deutsche Bank, and UBS announced plans to develop multi-currency stablecoins pegged to G7 currencies.

These are signs that traditional finance finally sees programmable money as infrastructure.

Also Read: Why VCs Are Betting on Stablecoin Infrastructure in 2025

Why On-Ramping Matters

Despite the incredible innovation in stablecoins, ‘access’ remains a fundamental challenge.

Most users still acquire stablecoins indirectly, either by swapping from other crypto assets or through centralized exchanges that require intermediate steps. True mainstream adoption begins when stablecoins can be purchased directly with local currencies through compliant on-ramps.

1. The Fiat-to-Stablecoin Bridge

On-ramping is the process that converts fiat money into digital assets, in this case, regulated stablecoins like RLUSD or USDG. It connects traditional banking systems to the blockchain economy, allowing users to buy stablecoins using payment methods they already trust: credit cards, bank transfers, or local payment networks.

Without seamless on-ramping, stablecoins risk becoming isolated within the crypto ecosystem. With it, they can serve as everyday digital money, powering cross-border payments, savings, and decentralized applications without friction.

2. Unlocking Global Accessibility

Regulatory barriers often prevent users in emerging markets (Southeast Asia, Africa, and Latin America) from accessing compliant stablecoins directly.

By enabling localized on-ramping (where users can purchase RLUSD or USDG with their native fiat currencies) exchanges, wallets, and payment gateways can dramatically expand stablecoin adoption. It creates a universal entry point for users, regardless of geography or financial infrastructure.

3. Building Trust Through Compliance

On-ramping is also a trust mechanism. When users purchase a regulated stablecoin through a verified on-ramp partner, they interact with entities that comply with KYC, AML, and consumer protection standards. This transparency builds confidence among users, regulators, and financial institutions.

For institutional participants, on-ramping compliant stablecoins through licensed providers, like Transak, can simplify accounting, treasury management, and settlement.

How Are RLUSD And USDG Different from Yesterday’s Stablecoins?

The main difference between RLUSD, USDG, and the original stablecoins is their design for native yield generation and real-world asset backing.

These new coins integrate mechanisms for earning yield without leaving the chain, while older stablecoins like USDT or USDC are passive and rely on centralised reserves.

Likewise, such coins are positioned as regulated, multi-chain cash equivalents that slot into existing financial stacks.

The Practical Unlocks for Payments, Payouts, and Tokenized Assets

On-ramps turn compliance into usage. A card or bank transfer becomes RLUSD or USDG within minutes, directly inside the app. The same interface can redeem back to fiat, collapsing the hop from funding to spend.

As Visa expands settlement with USDG and PYUSD across additional chains, acquirers and processors can move value faster, while merchants continue receiving familiar payout files. Treasury teams gain speed and efficiency without needing to overhaul their accounting systems.

At the same time, tokenised assets finally have a native cash leg. The Securitize off-ramp allows 24/7 conversion from tokenized Treasuries to RLUSD, enabling investors to pay suppliers, rebalance portfolios, or transfer funds to bank accounts via a single path.

This closes a critical gap that previously relied on exchange wiring hours and fragmented infrastructure.

The global context highlights the scale of this change. As per the ECB’s last year's estimates, the total cross-border payments reached nearly one quadrillion dollars. Even a small portion of this moving to stablecoin settlement would result in significant time and cost savings.

By the next five years, forecasts project trillions in stablecoin transaction volume. On-ramps are the starting point for this transformation.

How On-Ramps Turn Stablecoins Into Everyday Money

On-ramps are the hidden engines behind crypto’s real-world adoption. They turn compliance (all the KYC, payment checks, and approvals) into everyday usage. In simple terms, they let you use your regular card or bank account to buy stablecoins like RLUSD or USDG, which show up inside your app within minutes. The same interface can even convert them back to fiat when you need to cash out, making the entire loop from “fund to spend” seamless.

Visa is now testing stablecoin settlements with USDG and PYUSD across more blockchains. This means acquirers, processors, and merchants can move money faster, while still receiving the same payout files they’re used to. Treasury teams in large companies benefit with instant settlement speed and automation without having to rebuild their accounting systems.

At the same time, tokenized assets, like on-chain U.S. Treasuries now have a direct cash counterpart. Securitize’s off-ramp allows investors to convert those tokenized Treasuries into RLUSD (24x7), and from there to fiat if needed. That means funds can be rebalanced, suppliers paid, or transfers made instantly, without waiting for bank hours or juggling multiple platforms.

This closes a gap that traditional infrastructure couldn’t fill. Estimates suggest that global cross-border payments reached almost one quadrillion dollars in 2024. If even a tiny fraction of that starts moving through stablecoins, the time and cost savings would be enormous.

Transak: Making Stablecoins Actually Usable

Transak handles the hard part of turning regular money into stablecoins like RLUSD and USDG. With support in multiple countries, people can buy these regulated tokens using familiar payment methods like cards or bank transfers, straight inside their favorite apps.

It’s compliant where it counts (FinCEN, ISO, SOC II) and fast where it matters. For wallets and dApps, plugging in Transak just means users can move between fiat and stablecoins without thinking twice.

For fintechs, Transak takes the headache out of going on-chain. Instead of building complex compliance rails or crypto integrations from scratch, they can plug into Transak’s API and instantly offer customers access to regulated stablecoins like RLUSD and USDG.

Conclusion

For decades, financial infrastructure has been bound by intermediaries, settlement windows, and compliance silos. On-ramps are dissolving those walls.

When someone can move from local currency to a compliant digital dollar within minutes, the line between traditional finance and crypto effectively disappears. This is how stablecoins graduate from “assets” to “rails.”

In the coming years, the success of this transition won’t be measured by how many people “own” stablecoins, but by how invisibly they use them (for payroll, trade, remittances, and investment flows).

On-ramps are where that invisible future begins.