A Strategic & Technical Deep Dive into the Most Advanced Stablecoin Onramp

Introduction

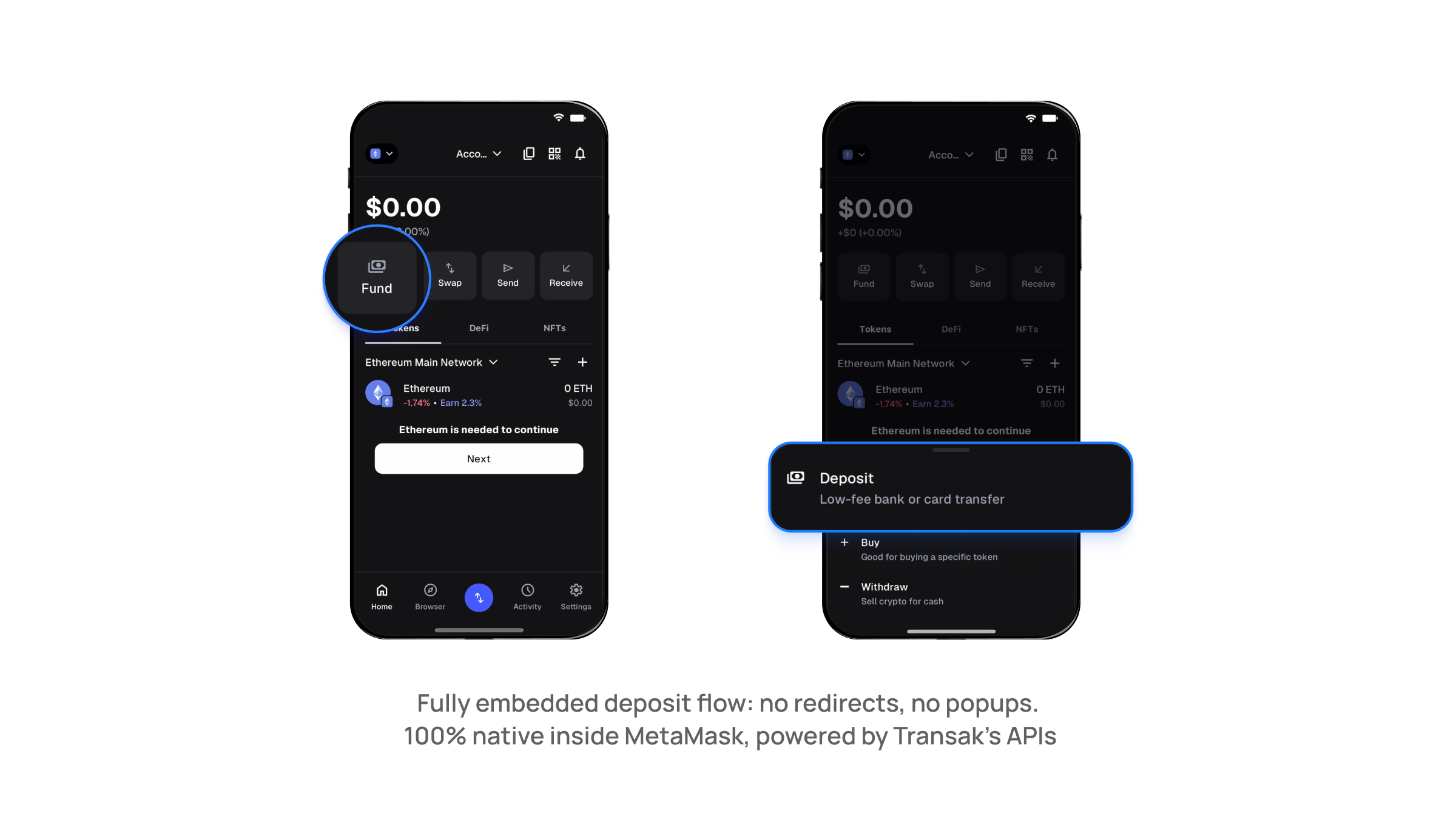

After 6+ months of collaboration, Transak and MetaMask have launched one of the most advanced fiat-to-stablecoin onboarding systems in Web3: a fully native, in-app deposit experience for MetaMask users in the US and EU.

At the core of this launch is Transak’s new whitelabel API stack, built from the ground up to offer seamless fiat deposits within MetaMask, without redirections, without handling PII, and without compromising on compliance or user experience.

This case study outlines what we built, how we built it, and why it sets a new benchmark for onramps, for wallets, developers, and users.

The Challenge: Outdated Onramp UX in a New Stablecoin World

Legacy Problems

Traditional onramps introduced too much friction:

- Popups and third-party redirects

- Lack of customization

- Hidden fees and poor transparency

- Low conversion rates

These flows were designed for traders, not users who treat stablecoins as real money.

What Users Expect Now

In 2025, stablecoins’ power:

- Payments and remittances

- Savings and daily spending

- Cross-border commerce

Stablecoins are now money. For users to treat them as such, they need Centralized exchange-level UX, fintech-style reliability, and self-custody, all at once. That was the challenge MetaMask brought to Transak.

The Vision: Onramping, Reinvented

Transak and MetaMask set out to build a new kind of flow:

✔️ Fully embedded inside the wallet

✔️ Near 1:1 stablecoin pricing

✔️ Native KYC and compliance

✔️ Support for both cards and bank transfers

✔️ A PII-free, developer-first API stack

The Solution: Native, White-Labeled On-Ramping powered by Transak

These are the features we built for Metamask to deliver a state-of-the-art Deposit flow:

1. Native UI

- Fully embedded “Deposit” button inside MetaMask Mobile, with no popups or redirects, all powered by Transak’s APIs.

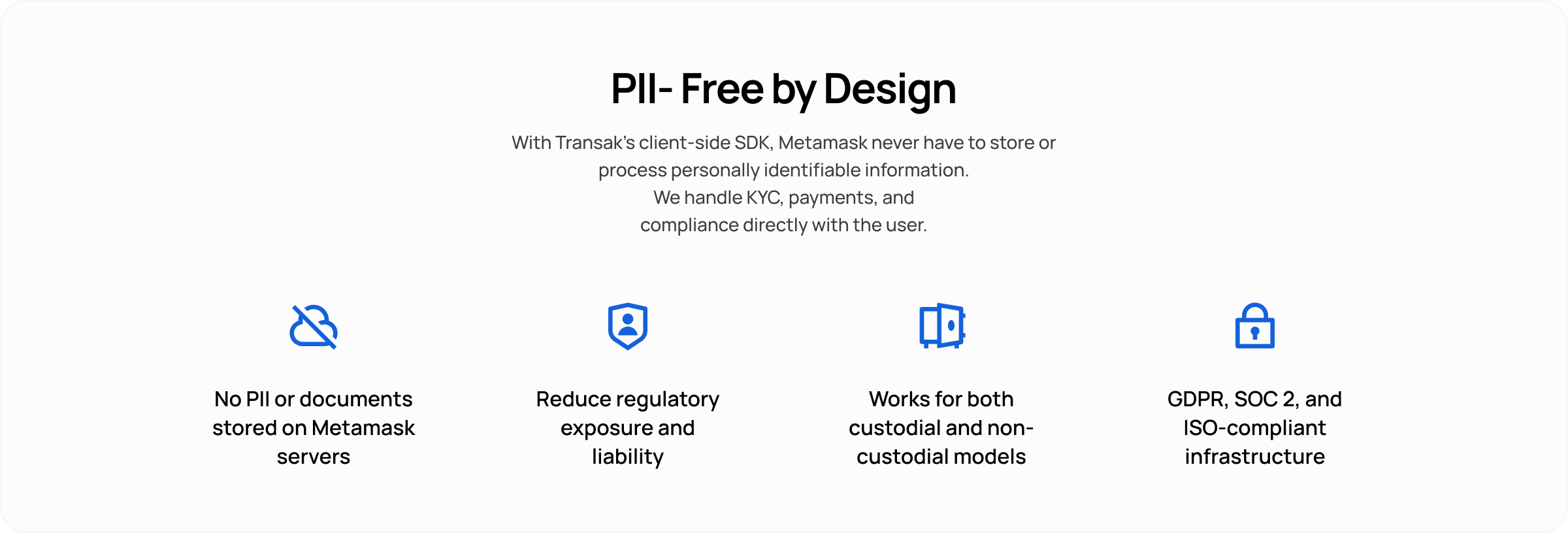

2. PII-Free Design

- MetaMask never handles user PII or touches the flow of funds.

- All authentication, KYC, and payment calls are made client-side via Transak APIs.

- This architecture keeps MetaMask outside the compliance scope and eliminates backend dependency.

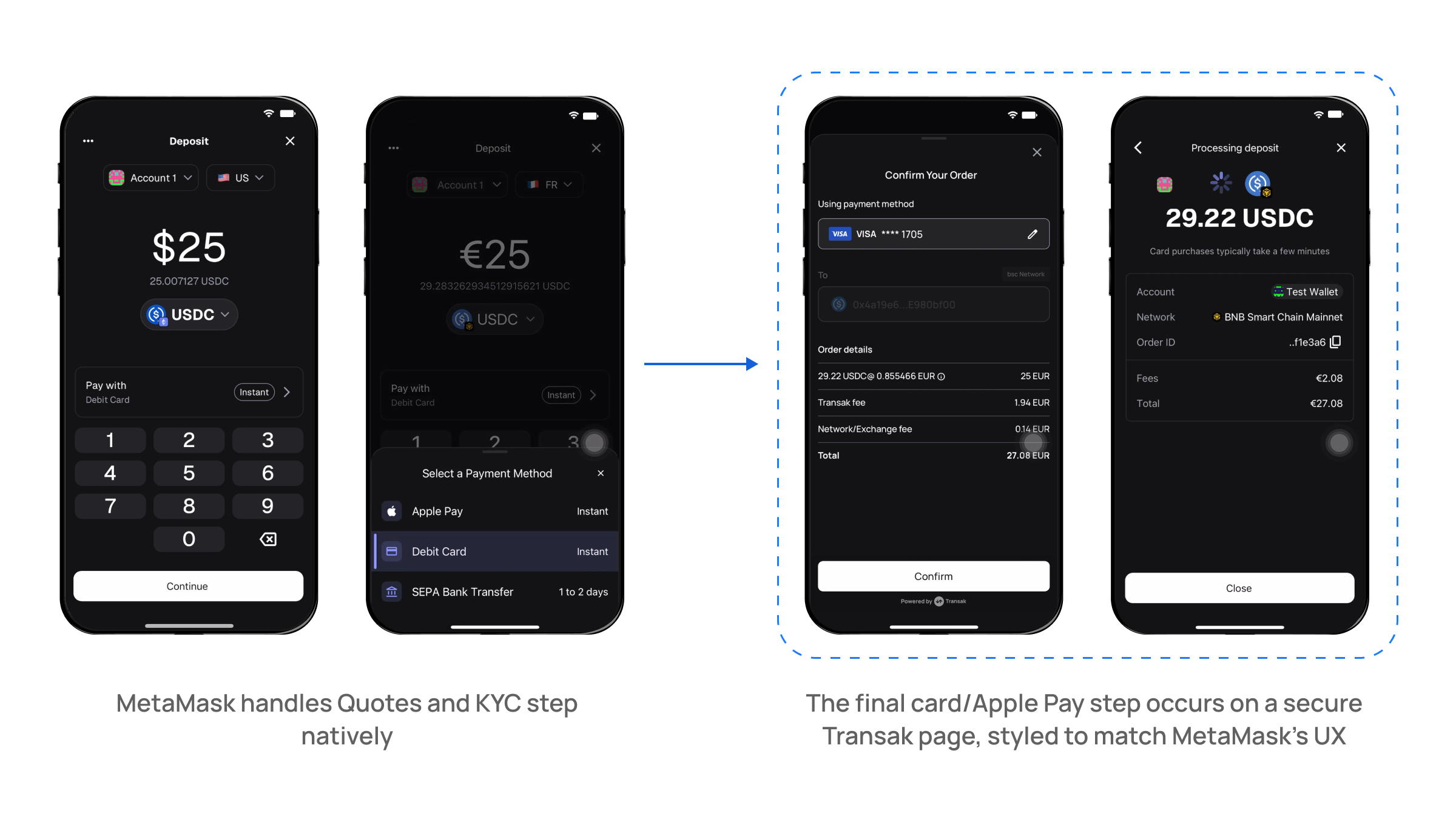

3. Semi-Widget Flow for Card & Apple Pay

- Developed a novel flow combining:

- Auth Sharing

- One-Time Tokens (OTT) - MetaMask handles all steps natively (quotes, KYC), and only the final card/Apple Pay step happens on a secure, Transak-hosted page.

- The user is handed off only once, without needing to log in again, creating a near-native experience.

- Fully PCI-compliant, yet UX-consistent with the MetaMask app.

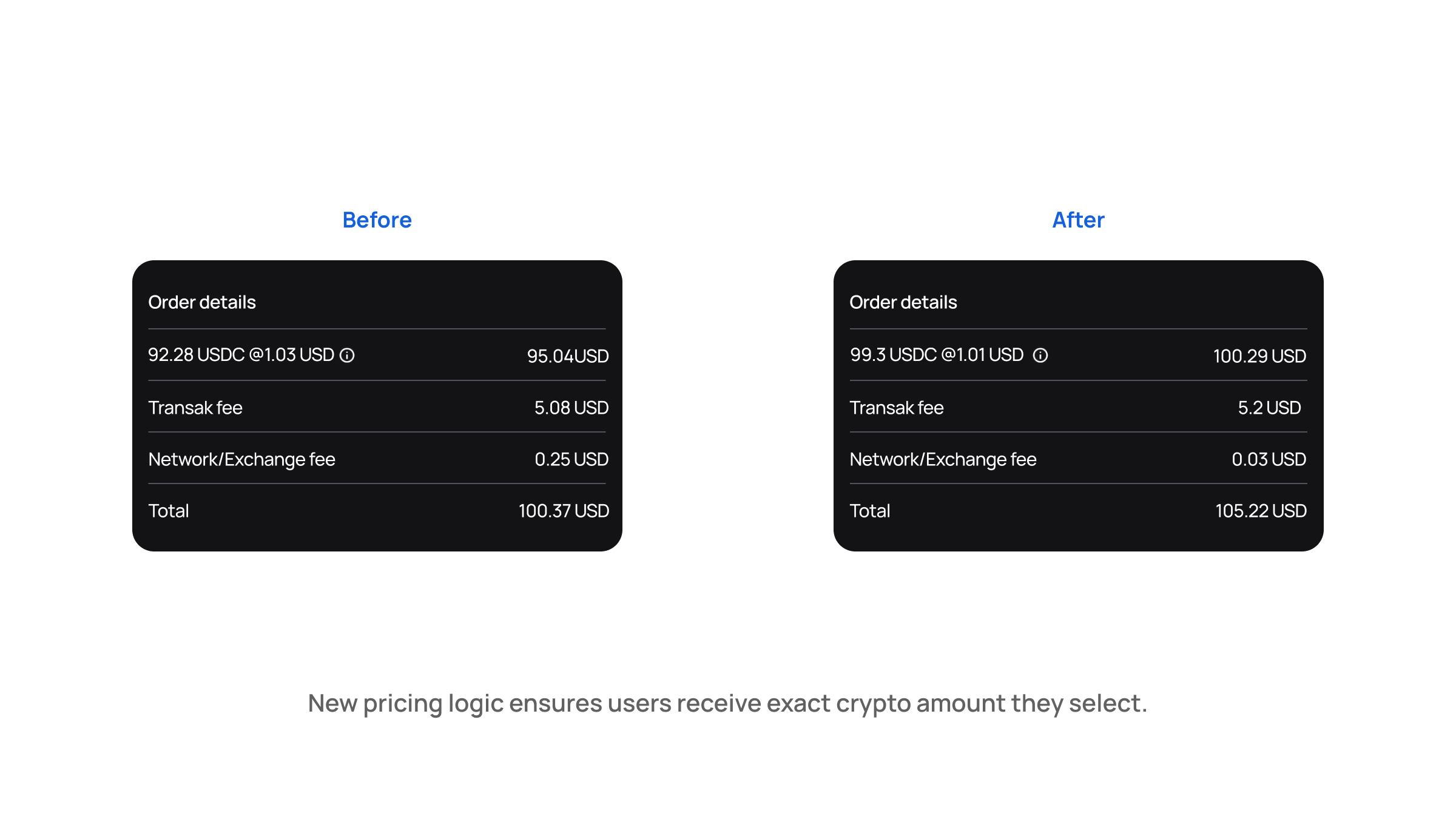

4. Pricing API Enhancements

- Introduced the `

FeeExcludedFromFiat`parameter so MetaMask can show exact crypto received (e.g. 100 USDC) with fees added transparently on top. - Added support for minimum amount checks and consistent response formatting.

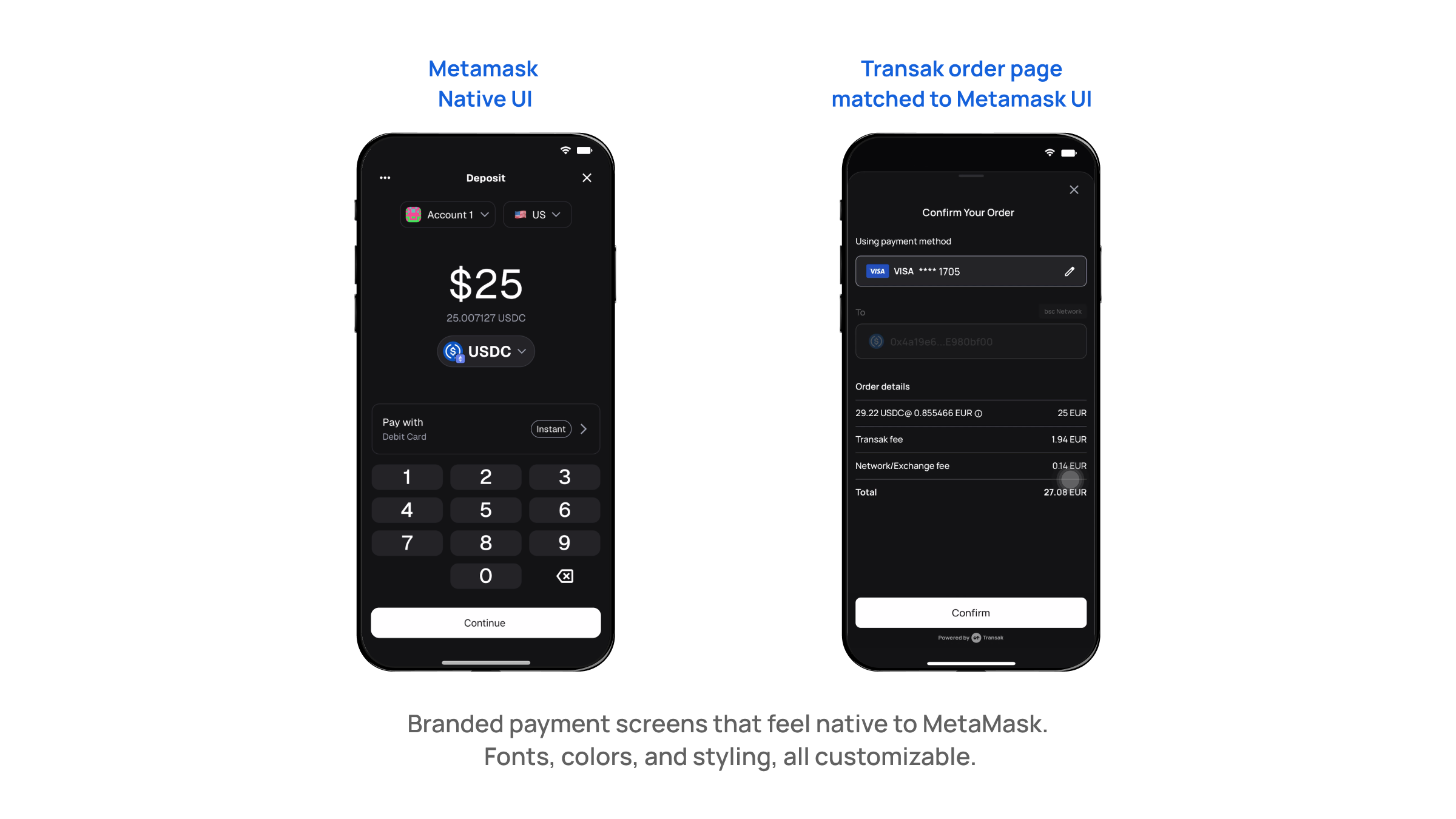

5. Custom UI & Branding for Payment Screens

- Added customizable CTA button colors, dark mode support, and color query parameters.

- Ensured full visual alignment with MetaMask across splash, confirmation, and payment screens.

- For flows where Transak widget is natively used, a user would never know it is a redirect as the UI completely matches Metamask.

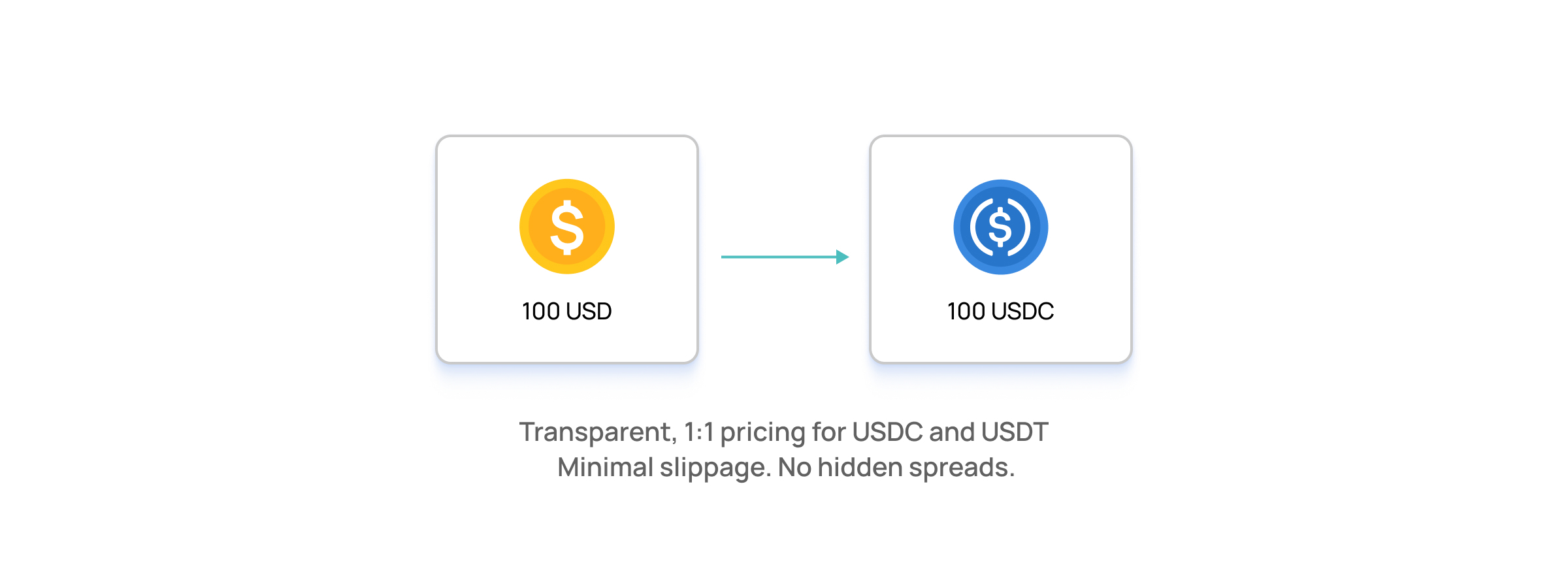

6. 1:1 Stablecoin Pricing

- Delivered near 1:1 pricing for stablecoins like USDC and USDT with minimal spreads and transparent fee breakdowns.

7. Multiple Payment Methods

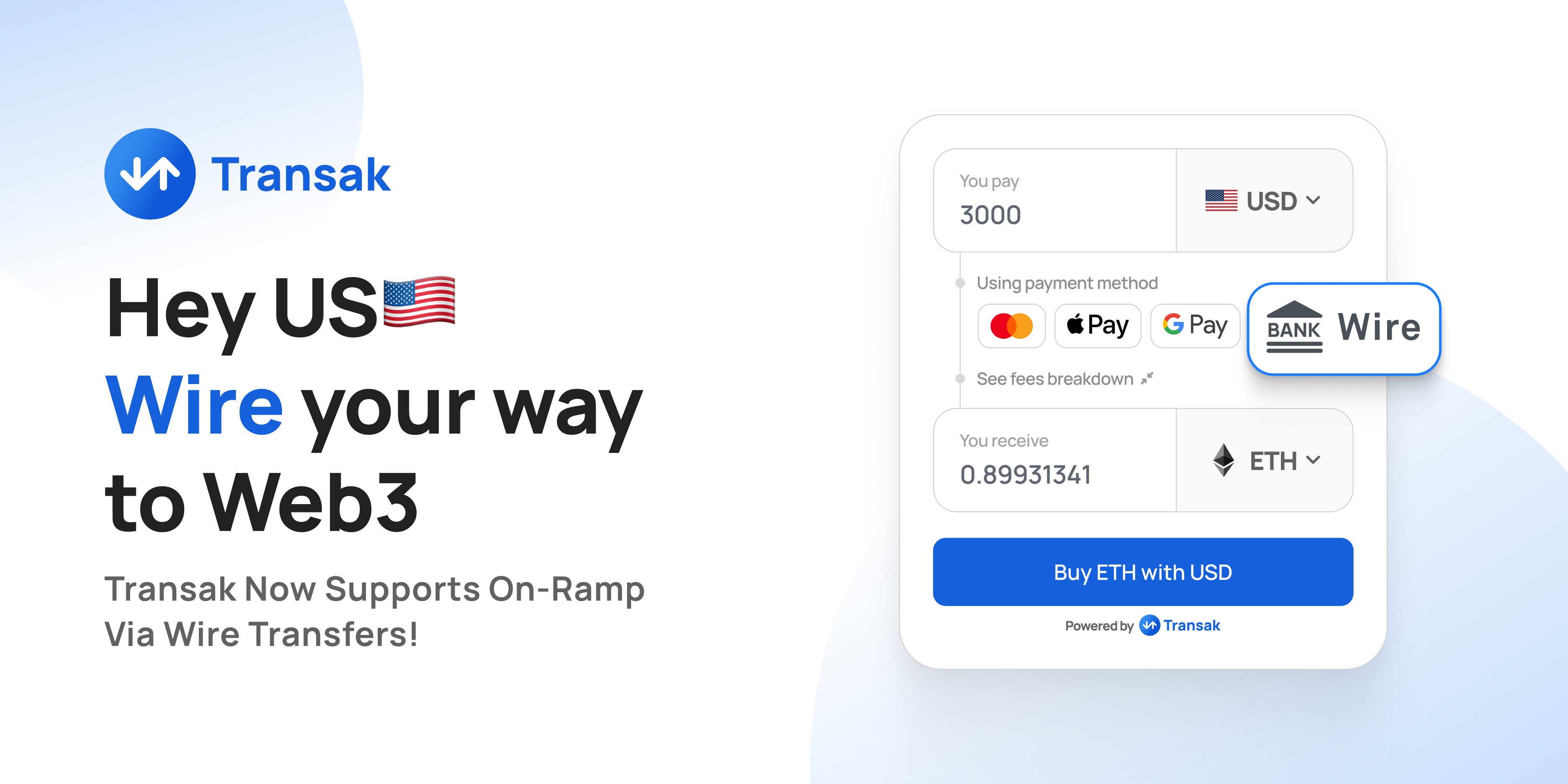

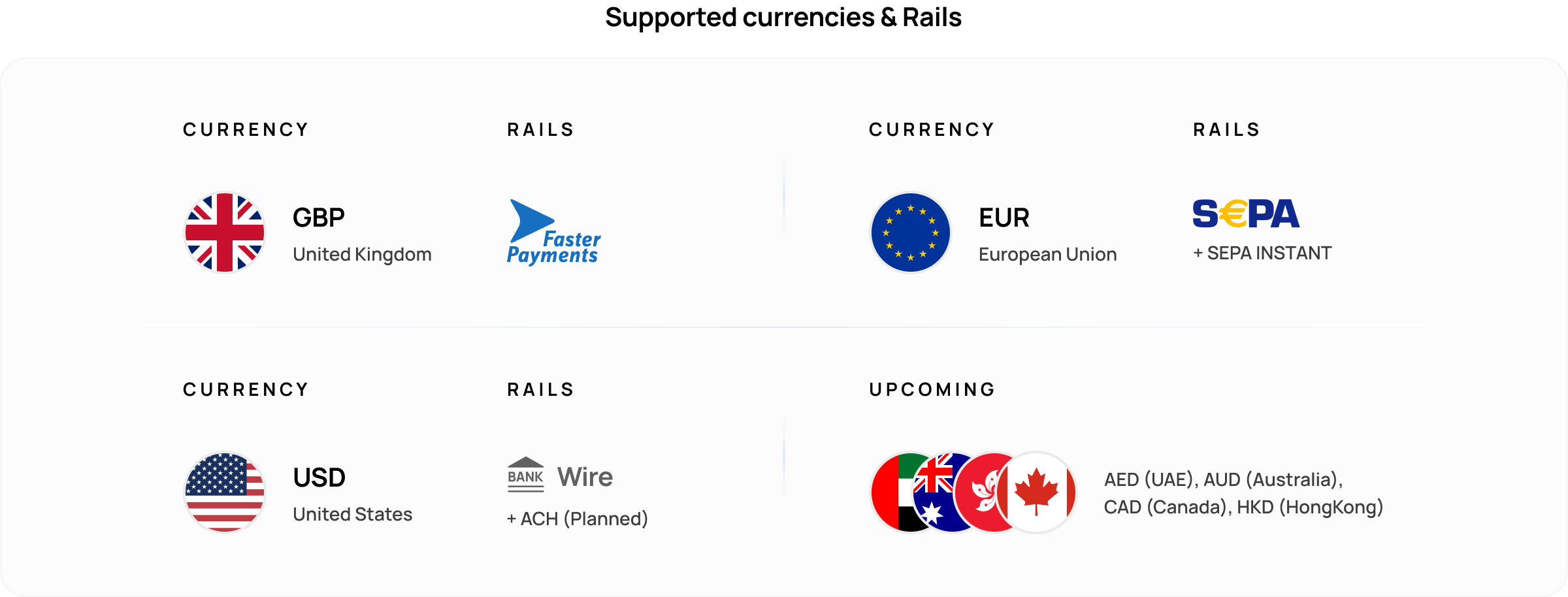

- Supported payment types include ACH, SEPA, Wire Transfers, and cards (Visa, Mastercard, Apple Pay, Google Pay).

- MetaMask uses public APIs to create orders and show details

- Transak handles:

- Backend reconciliation

- Automated fund sweeping and fulfilment

- Fully embedded in-app, no redirect

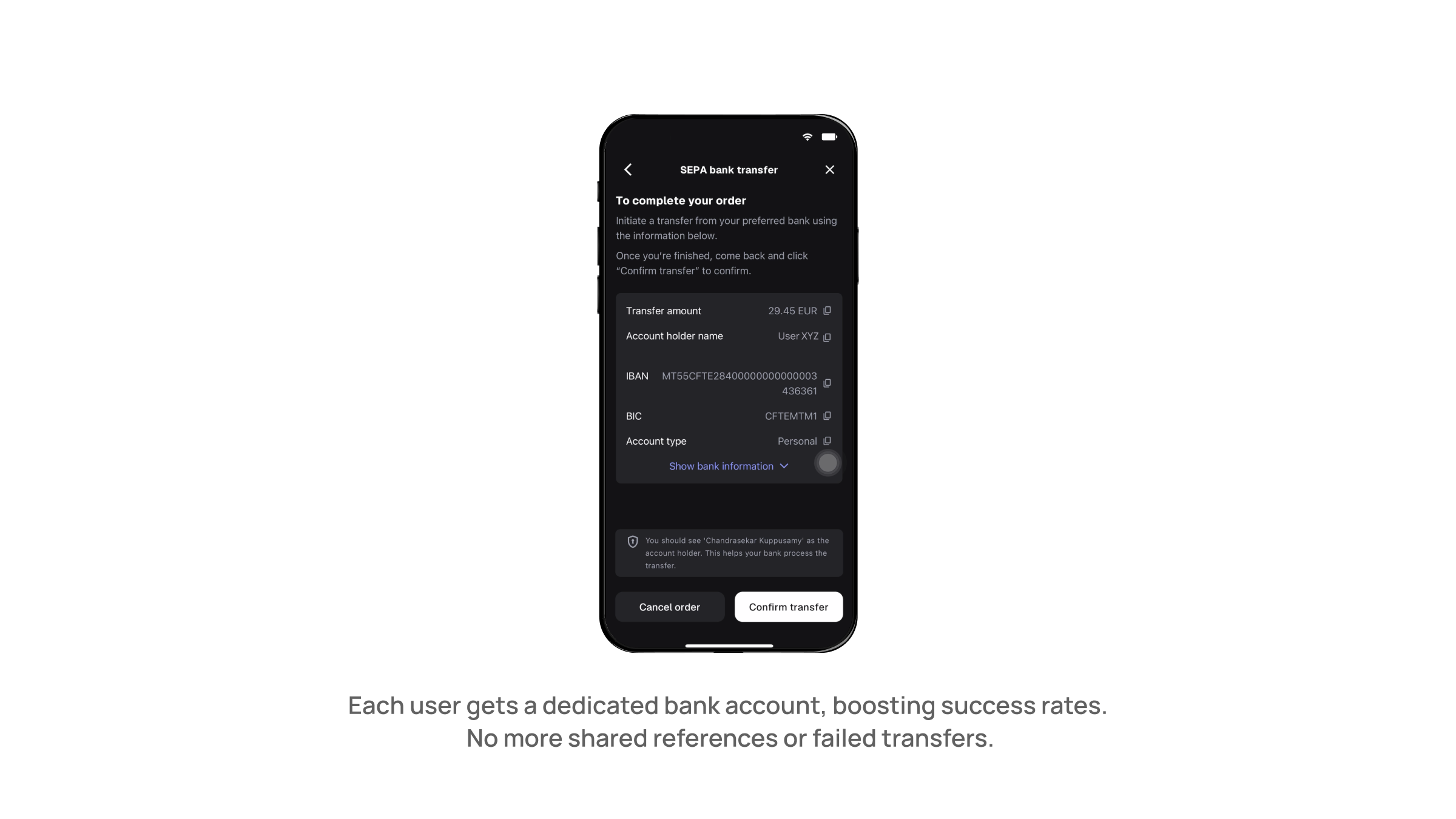

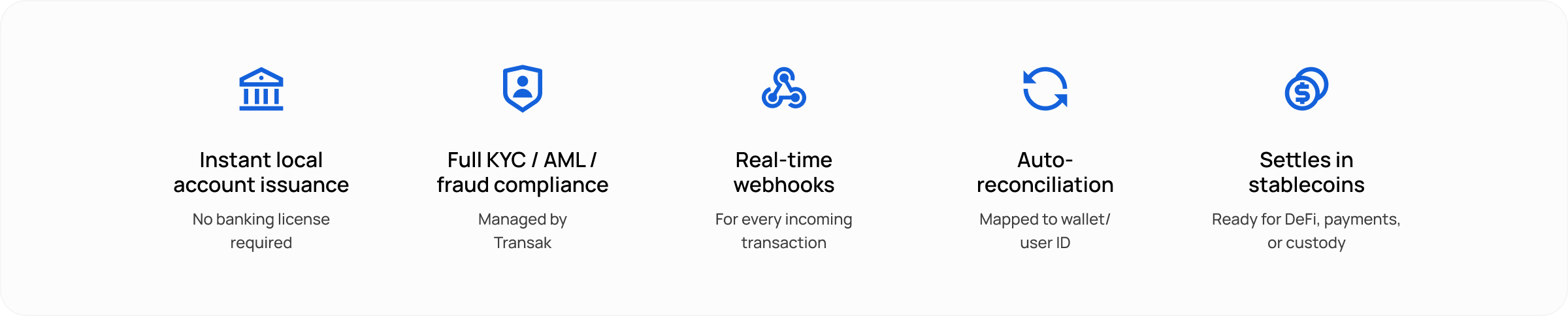

8. Named Bank Accounts

- Every user receives a dedicated IBAN or ACH account, removing the need for payment memos and improving reconciliation success.

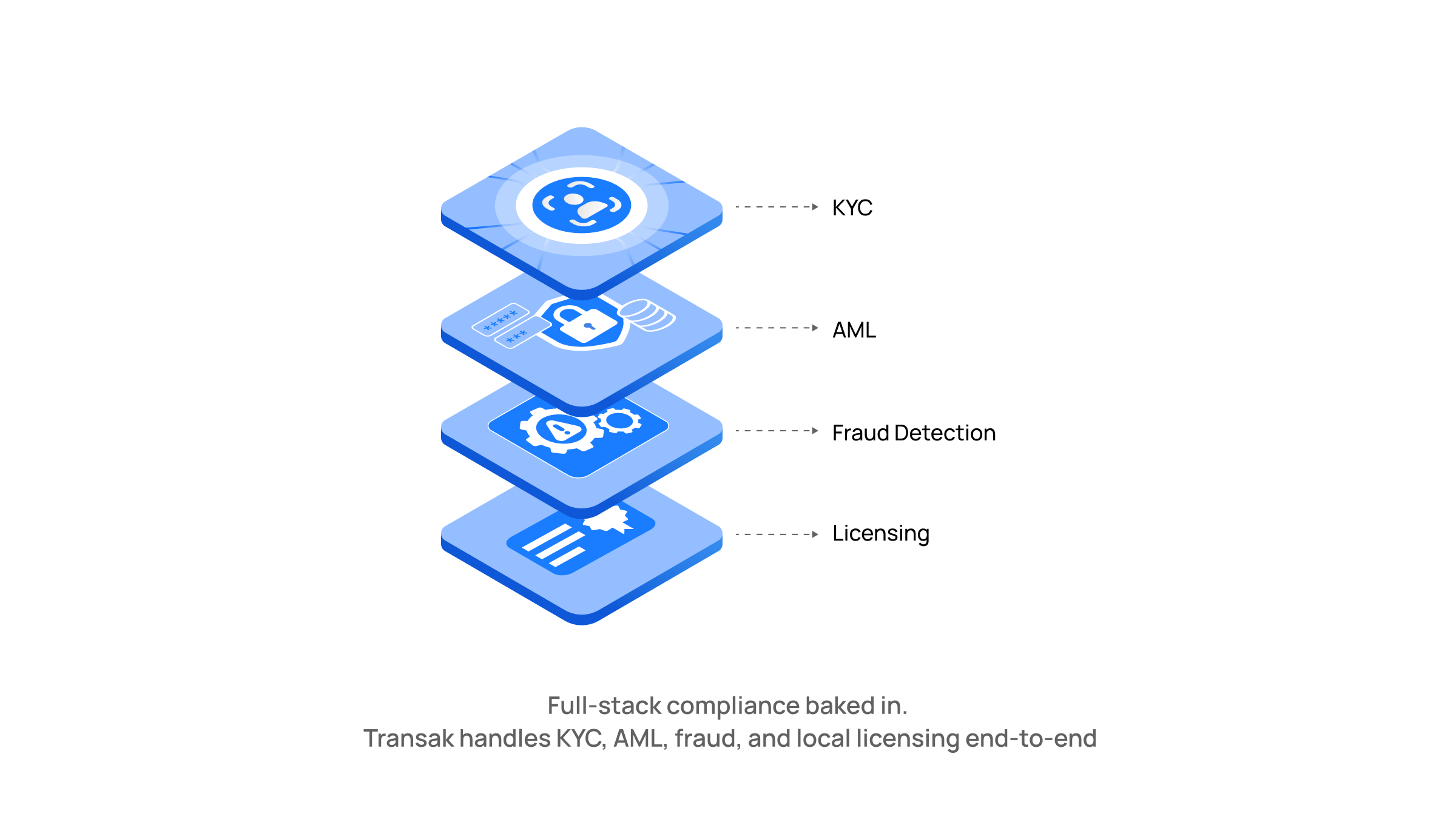

9. Compliance Ready

- Transak handles the entire compliance stack, including KYC, AML, fraud prevention, and local payment licensing in supported regions.

Why Transak?

1. Infrastructure-First, Not Just UI

Transak rebuilt its platform to support stablecoin-first liquidity, direct banking relationships, and low-fee routing, not just white-labeled wrappers on top of card processors.

2. Compliant Global Reach

With licenses, bank partnerships, and compliance controls across 60+ countries, Transak could offer deep regional coverage and a single API integration for MetaMask’s expanding user base.

Strategic Impact: Wallets Are Becoming Money Apps

This isn’t just an integration. It’s a blueprint for the next generation of Web3 onboarding:

- Wallets behaving like fintech apps

- Stablecoins treated like money, not tokens

- Users onboarded without needing exchanges

- Infrastructure that’s compliant, customizable, and invisible

🏁 Final Word

MetaMask Ramps, powered by Transak, is the most advanced example yet of what’s possible with embedded stablecoin infrastructure.

From custom auth to semi-widget flows, virtual accounts to fee-transparent pricing, everything was rethought from the ground up.

We didn’t just plug in an API.

We built a system. A product. A new standard.

Ready to build your Stablecoin Infrastructure, powered by Transak?