Galxe, the leading web3 growth platform, has transformed how decentralized applications attract, retain, and engage users. But when it came to converting quest participants into active dApp users, especially those needing crypto on-ramps, friction in identity verification and payment access stood in the way.

Transak’s KYC Reliance changed that. By integrating Transak’s KYC Reliance infrastructure with Galxe Passport V3, users can now transition from completing a quest to buying crypto instantly, without having to repeat identity verification. Verified users are issued a non-transferable NFT Passport, powered by Sumsub, which acts as a trustworthy, on-chain proof of KYC. This credential unlocks seamless access to Transak, making crypto onboarding frictionless and compliant.

The result: smoother user experiences, higher conversion rates, and a powerful new activation funnel for dApps.

The Challenge: From Engagement to Activation

For years, Web3 user acquisition followed a broken pattern, airdrops and NFTs—to drive user growth. This attracted bots, Sybil attackers, and mercenary users, with few sticking around.

Galxe’s questing solution was a leap forward, rewarding users for actions like voting in DAOs or completing token swaps. But the post-quest drop-off remained:

- Users hit friction when trying to buy tokens or stake assets

- KYC flows across exchanges were repetitive and slow

- dApps lost valuable user momentum at the final step

This led to high drop-offs, reduced user activation, and frustration for both users and dApps.

The Solution: KYC Reliance with Transak

By partnering with Transak, Galxe now supports seamless crypto access across ecosystems using a reusable KYC layer.

KYC Reliance- How It Works

When users complete their identity verification on Galxe, this data can be leveraged by dApps and partners integrating Transak, without asking the user to verify again.

🔄 Step-by-Step Process

- User registers on Galxe

- Completes KYC once using Sumsub.

- NFT Passport is issued to their wallet as identity proof.

- User registers on a dApp using Transak

- The dApp calls Transak’s Identities Endpoint.

- Transak verifies the user instantly

- The dApp sends the Sumsub KYC token or verified KYC data.

- Transak matches this against the user profile and auto-verifies the user.

- A verified customer record is created instantly in Transak’s system.

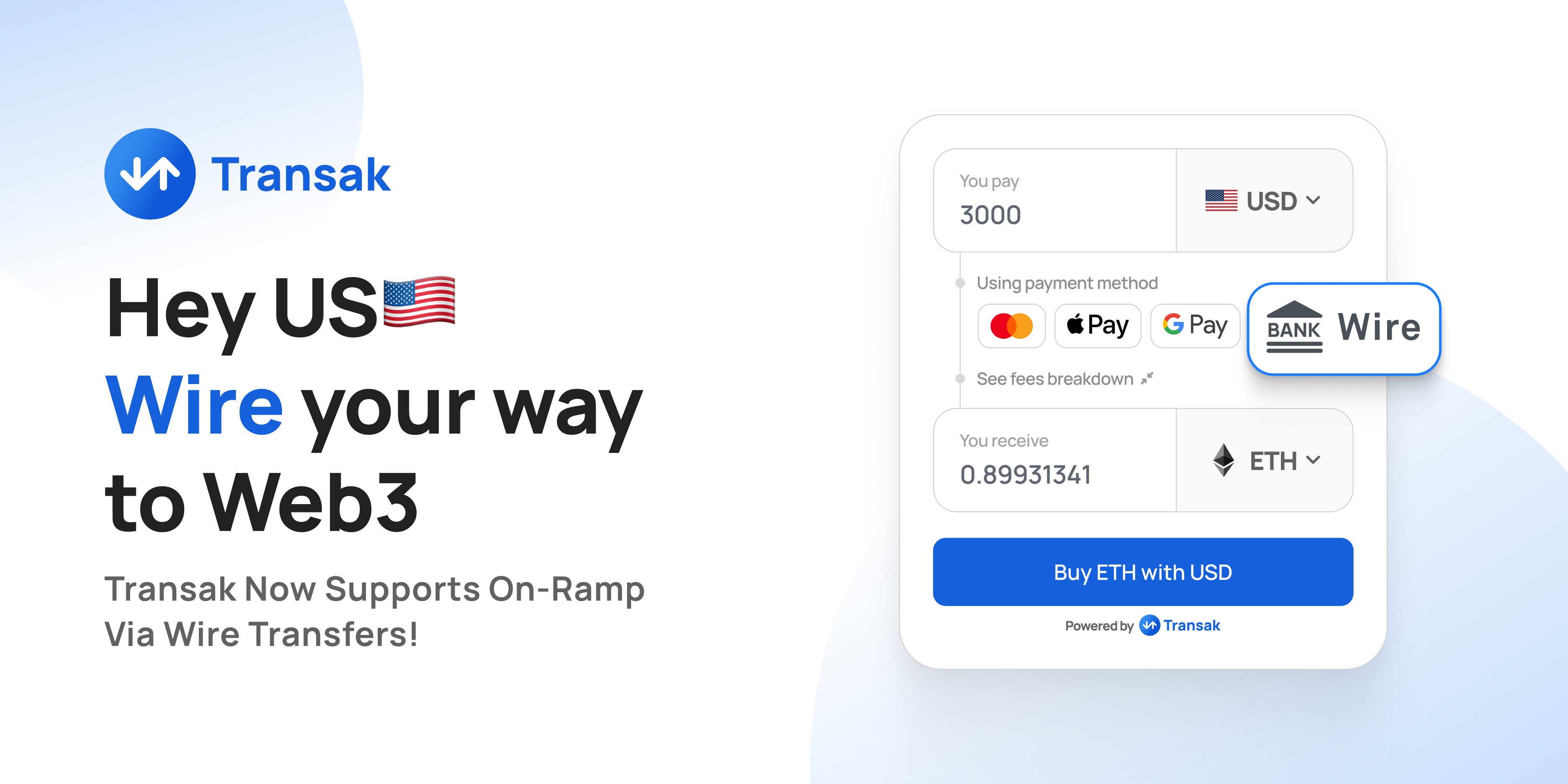

- User buys crypto instantly

- No friction, no repeat KYC.

- Orders up to $20000 are permitted under Standard KYC.

Why It Matters

Web3 platforms can now treat identity as infrastructure, turning KYC from a blocker into a growth accelerator.

For Galxe:

- NFT Passports replace fragmented verification

- Transak’s instant approval expands user capability

- Users never leave the Galxe/dApp environment

For Transak-integrated dApps:

- Onboard verified users with one API call

- Boost conversion rates with instant KYC approval

- Eliminate identity drop-off from your funnel

The Future: Ecosystem-Wide Identity Interoperability

With Galxe Passport V3, Sumsub KYC, and Transak KYC Reliance, Web3 apps can now create full-stack onboarding pipelines:

- Discover → Quest → Verify → Buy → Stake

- All without leaving the app

- All without repeating KYC

Ready to build full-stack onboarding journeys?

👉 Integrate KYC Reliance via Transak API