Takeaways

Executive Summary

Australia is entering a new stablecoin era, driven by high crypto adoption, remittance demand, and rising B2B use cases. While fintech funding has slowed and legacy payment rails remain costly, stablecoins offer faster, cheaper, and programmable alternatives for payments and commerce. Regulatory clarity is improving, with banks and institutions actively trialling AUD-backed tokens. Yet trust and access barriers persist.

This report examines Australia’s stablecoin landscape, covering user behaviour, regulation, real-world adoption in remittances and B2B payments, fintech infrastructure gaps, and how platforms like Transak are enabling compliant, bank-grade fiat-to-stablecoin connectivity across the region.

Australia’s Financial Landscape and the Unique Challenges It Faces

Australia’s fintech landscape has not seen meaningful year-on-year growth. As of 2025, there were 801 independent Australian-owned fintech companies, marking a 2% decline from 2024.

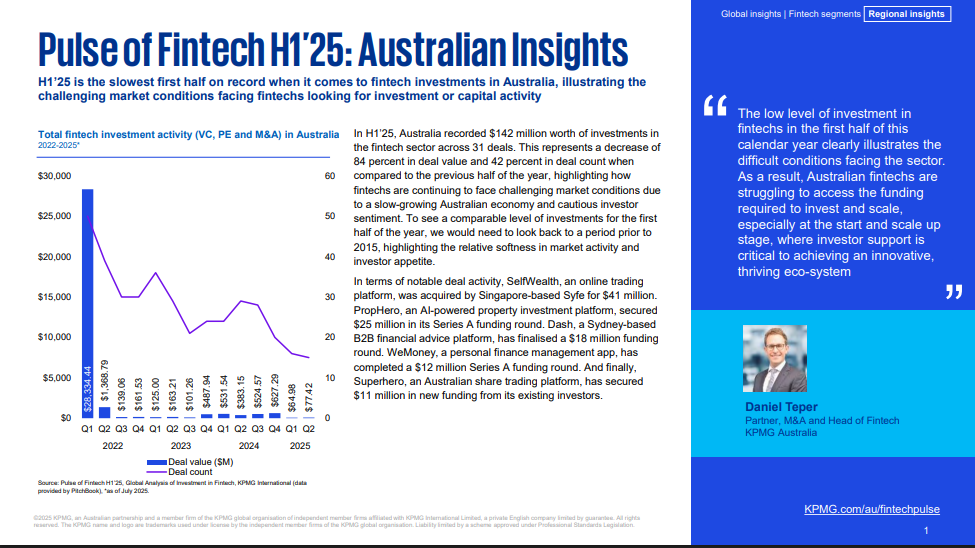

On the funding front, Australian fintechs received a total of $142 million in investments across 31 deals in the first half of 2025. Compared with the previous half, this represented an 84% decline in deal value and a 42% decline in the number of deals.

Online trading platform SelfWealth (through its acquisition by Singapore-based Syfe for $41 million), property investment platform PropHero, finance management app WeMoney, and Sydney-based B2B financial advice platform Dash secured the largest deals during this period.

The Australian fintech sector continues to face challenges and stagnation, driven by unclear regulations, economic uncertainty, tightening capital markets, and talent shortages. Many startups struggle to secure funding and have shifted their focus toward profitability, largely due to the following factors:

- Loss-making banking infrastructure: The Reserve Bank of Australia (RBA) notes that while Australia’s banking infrastructure is resilient, it has been under pressure from high interest rates, elevated inflation, and geopolitical uncertainty. Moreover, open banking remains in its nascent stage, as Australians continue to have trust issues stemming from a lack of regulatory clarity and the rise of financial fraud.

- Currency volatility: Australia’s largest trading partner is China. Fluctuations in China’s economic health have directly impacted the Australian Dollar’s stability. While 2022–2024 were the lowest and most volatile years for the Australian dollar, in 2025, it recovered to approximately 71 US cents.

- High remittance costs: While remittance costs remain relatively low in the APAC region compared to other regions, they still average 5.8% for a $200 transfer. Australia faces double-digit fees (15–18%) when sending to smaller Pacific Island nations such as Papua New Guinea.

KPMG’s Pulse of Fintech report highlights that stablecoins, embedded finance, and modernised payments remain the most prominent trends, attracting interest from central and commercial banks, payment service providers, and multinational corporations.

Stablecoin Market Size and Growth

Australia has one of the most crypto-engaged populations in the world. According to the 2025 Independent Reserve Cryptocurrency Index (IRCI), crypto adoption rose from 28% in 2024 to a record 31% in 2025 (with 32.5% of Australians having ever owned crypto), outpacing the US adoption rate. Bitcoin remains the most popular choice, held by 70% of Australian crypto investors.

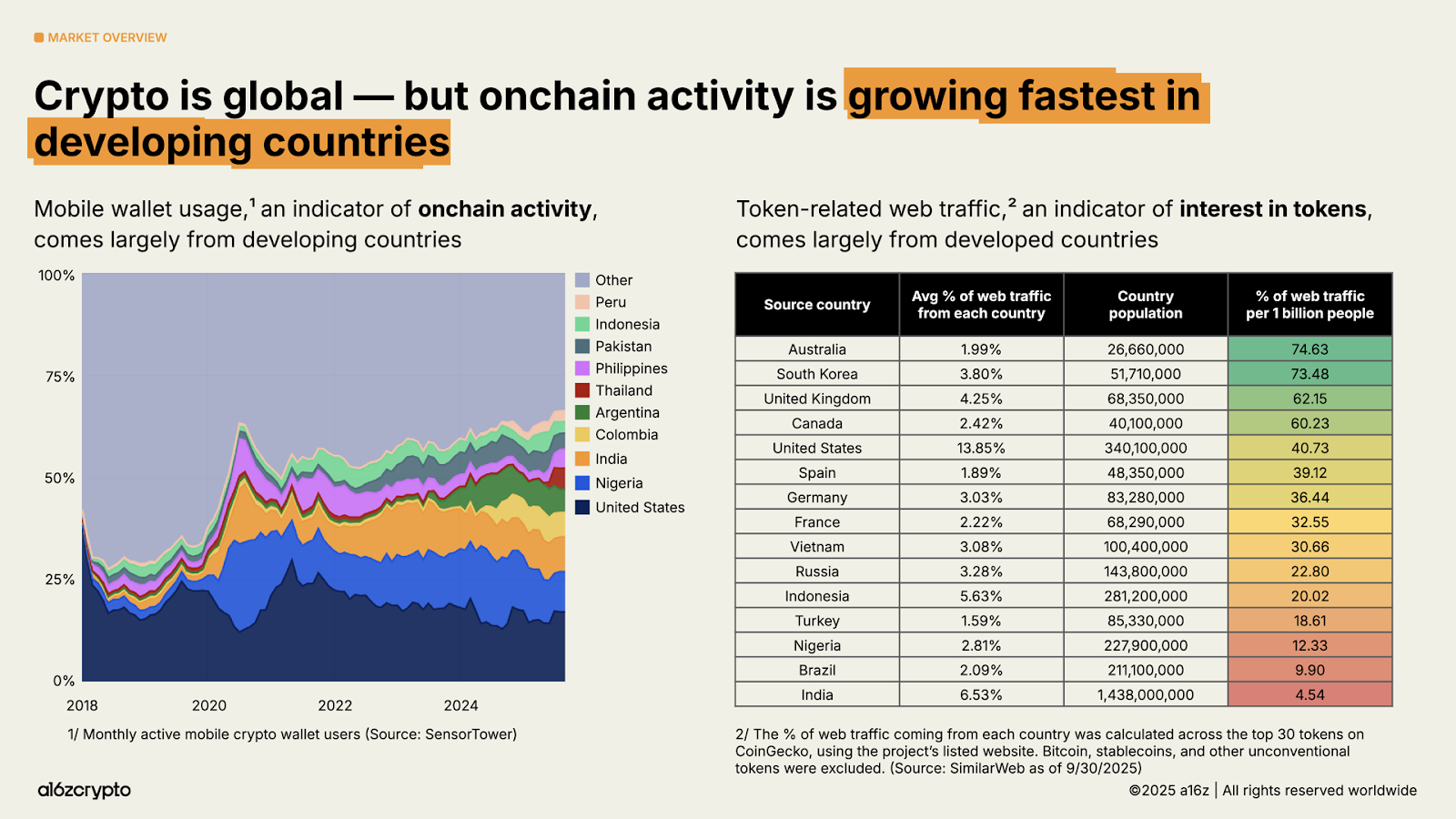

However, a16z’s State of Crypto 2025 report finds that most activity remains focused on token-related trading and speculation. That said, Australia is approaching an inflection point, with more comprehensive stablecoin regulations underway and growing institutional interest in real-world use cases.

Adoption and On-Chain Activity

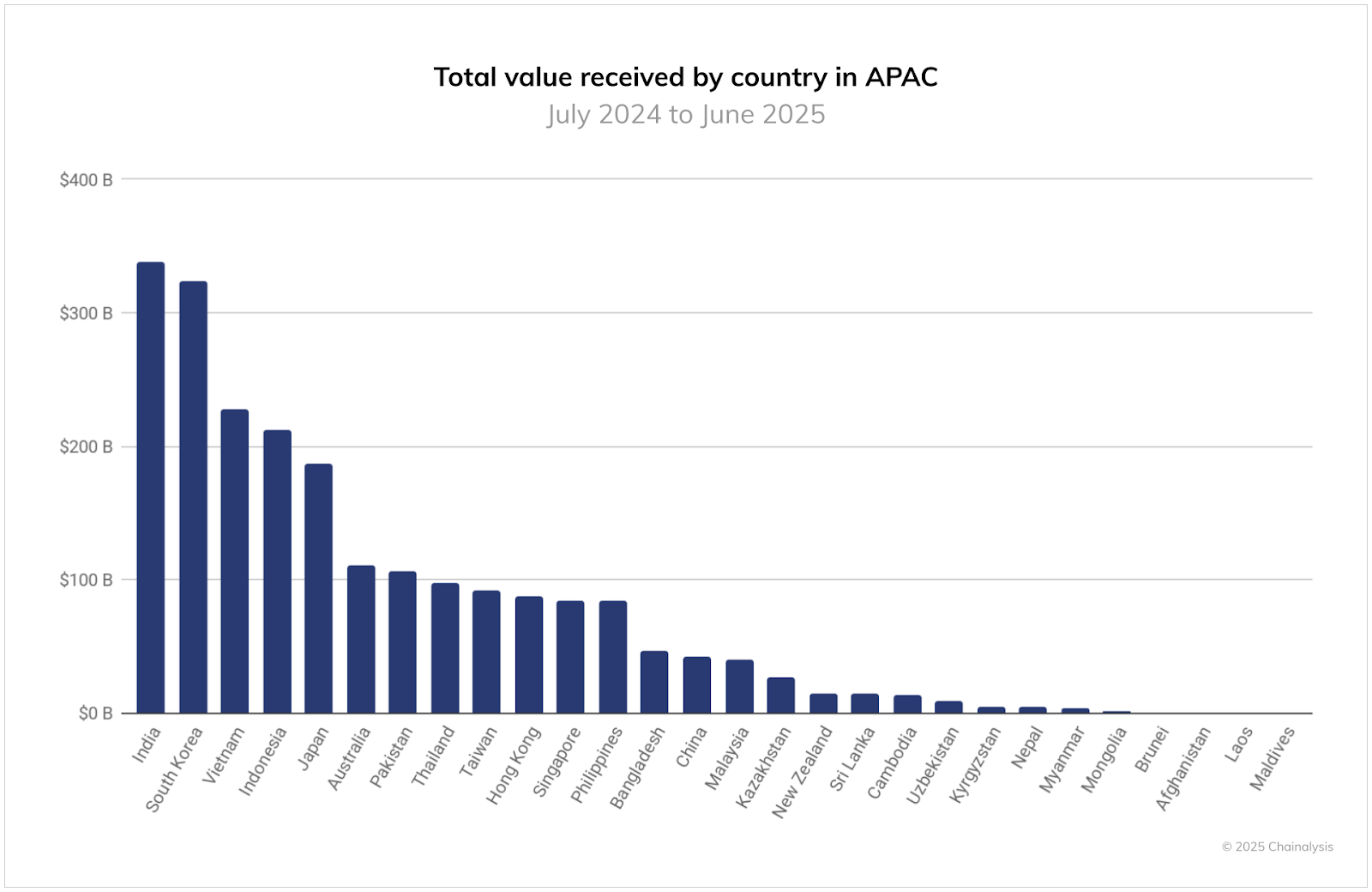

Nearly 33% of adults Australian adults today use or own crypto. Between July 2022 and December 2024, on-chain activity in the APAC region grew threefold. Between 2023 and 2024, it crossed the $100 billion mark for the first time.

Chainalysis data shows that Australia’s on-chain volumes are growing in line with broader APAC trends. Australia was the sixth-largest receiver of on-chain value between July 2024 and June 2025.

While most stablecoin holdings remain small, the average Australian crypto user is shifting from speculation toward practical applications, including DeFi, payments, and remittances.

Currently, 75% of trading on Australian crypto exchanges involves stablecoin pairs. USDT and USDC account for the majority of these transactions. However, homegrown stablecoins such as AUDD (issued by AUDC Pty Ltd) have also processed more than $1 billion in organic transactions on the Stellar blockchain, demonstrating strong domestic demand for AUD-backed digital currency.

Primary Use Cases

1. Remittances

Owing to its large and growing immigrant population (31.5% of the total population, or 8.6 million people), Australia is a major centre of remittance flows in the Asia-Pacific region. Outbound remittances from Australia reached approximately $38.2 billion (AUD $56.6 billion) in 2024, with India as the single largest recipient ($7.3 billion), followed by China ($5.35 billion). Other major corridors include Vietnam, the Philippines, and Pakistan.

Australia is also a vital funding source for Pacific Island nations such as Tonga, Samoa, and Fiji, where remittance fees remain high due to small market sizes. Stablecoin-powered remittances offer a lower-cost, faster alternative, enabling cross-border transfers and improving access to financial services for the unbanked and underbanked.

The IMF has noted that properly regulated stablecoins can support growth and financial inclusion in the Pacific by reducing reliance on correspondent banking networks and enabling 24/7, near-instant settlement at a fraction of traditional costs.

The Australia–Philippines corridor has gained the most traction so far, while others remain early-stage. Australian SaaS and Web3 firms such as Felix and Airwallex already use stablecoins for offshore payroll and contractor payments, and stablecoins are increasingly used in energy and commodity trade settlements across Asia.

Also Read: Payouts in Stables: What Should You Know

Notably, Australian banks have been scaling back correspondent banking services in the Pacific due to high compliance costs in low-margin markets, further accelerating interest in stablecoin-based cross-border payments. In response to growing demand, the Australian Council of Financial Regulators (CFR) is considering rules to treat widely used payment stablecoins as stored-value facilities.

Also Read: Decoding The Correspondent Banking System

2. E-Commerce and Retail Payments

Traditional cross-border payment methods can become expensive and time-consuming, particularly for gig workers and small businesses. For these users, stablecoins can reduce foreign exchange fees by 3–5%, save 2–3 days of settlement time, and hedge AUD volatility, all while enabling instant, borderless transactions.

Retail payments account for more than half of total payment volume in Australia. Visa, Mastercard, and American Express are the major card networks. Visa facilitates certain cross-border transactions using stablecoins such as USDC, and both Visa and Mastercard control 95% of the crypto card market. PayPal and Stripe also facilitate crypto-denominated transfers.

A growing number of e-commerce merchants have begun accepting cryptocurrency payments through integrations with global platforms. For instance, Shopify’s collaboration with Coinbase Commerce allows merchants to accept USDC on-chain and convert immediately to AUD, reducing reliance on traditional payment intermediaries.

Also Read: What is PayFi (Payment Finance)?

3. B2B Payments

B2B vendors and customers can transact directly using stablecoins without each party needing a local bank account. Platforms like FastStables already allow businesses to invoice globally in USDC or USDT and settle in AUD within minutes at approximately 0.25% in fees (far lower than the 3–5% typically charged by traditional banks for international wire transfers).

Also Read: Accept payments in Crypto: Starter’s Guide for Businesses

Many Australian startups now integrate stablecoin APIs—such as those from Transak or Circle’s partners—to automate settlement and accounting. This makes stablecoins a practical back-end infrastructure for payroll, supplier payments, and e-commerce settlement.

4. DeFi

Stablecoins make up 75% of transactions on Australian crypto exchanges, providing the settlement infrastructure for 24/7 trading by exchanges, over-the-counter (OTC) trading desks, and tokenization platforms. Beyond trading, payment platforms, wallet providers, tokenised yield management services, and treasury and liquidity providers all rely on stablecoins as foundational infrastructure.

According to the Zodia Custody ‘Pegged for Growth’ report (December 2025), tokenised yield management using stablecoins is becoming particularly prevalent among family offices and high-net-worth individuals in Australia, who use stablecoins to access DeFi yields while maintaining exposure to AUD-denominated assets.

Institutional and Banking Interest

Beyond retail adoption, Australian banks and institutions are actively exploring stablecoins for wholesale applications. These institutions see stablecoins as a way to accelerate settlement from T+2 batch processing toward instant payments (T+0) and to open up new settlement markets such as carbon credits and cross-border transfers.

The RBA’s Project Acacia (conducted with the Digital Finance Cooperative Research Centre, or DFCRC) is trialing a wholesale CBDC alongside a USD stablecoin to improve liquidity in tokenised asset trading. Several Australian stablecoin issuers, including AUDC (issuer of AUDD) and Forte Securities (issuer of AUDF), have participated in these trials.

There is growing discussion around using stablecoins for bonds, carbon credits, and syndicated loans. The active involvement of major banks—particularly ANZ and NAB—suggests that corporate payments, supply-chain financing, and interbank settlement could eventually run on interoperable stablecoin rails instead of legacy RTGS systems.

Key Institutional Milestones

- ANZ Bank minted its A$DC stablecoin in March 2022, settling a $30 million transaction on Ethereum between Victor Smorgon Group and digital asset fund manager Zerocap. This marked the first time a major Australian bank issued a dollar-backed stablecoin on a public, permissionless blockchain. A$DC was subsequently used in a landmark tokenised carbon credit purchase for Victor Smorgon Group via BetaCarbon.

- National Australia Bank (NAB) announced its AUDN token in 2023, fully backed by NAB’s own capital, designed to enable real-time blockchain settlements and atomic settlement of trade transactions.

- Catena Digital (Macropod) became the first issuer to receive ASIC’s stablecoin distribution class relief for its AUDM stablecoin in September 2025, effectively making it Australia’s first officially licensed stablecoin.

- Forte Securities followed with its AUDF stablecoin, with ASIC proposing to extend the same class relief to it shortly after.

Regulatory and Licensing Landscape

Australian regulators now treat stablecoins as a regulated payment medium, incorporating them within the existing financial services framework. The regulatory picture has evolved considerably through 2025, with three key developments shaping the landscape:

ASIC’s Stablecoin Distribution Class Relief

On 18 September 2025, the Australian Securities and Investments Commission (ASIC) granted first-of-its-kind class relief for intermediaries distributing stablecoins issued by licensed Australian Financial Services (AFS) providers. Under ASIC Corporations (Stablecoin Distribution Exemption) Instrument 2025/631, eligible intermediaries are exempt from holding separate market, clearing, and settlement licences until 1 June 2028. The relief is designed to bridge the gap until the government’s broader digital asset reforms are enacted.

Catena Digital Pty Ltd was the first issuer to benefit from this class relief through its AUDM stablecoin. ASIC subsequently proposed extending the relief to Forte Securities’ AUDF stablecoin.

Updated Digital Asset Guidance (INFO 225)

In October 2025, ASIC published its updated INFO 225 guidance, clarifying how existing financial services laws apply to digital assets. The guidance established that stablecoins, wrapped tokens, tokenised securities, and crypto wallets may constitute financial products under existing law, meaning providers require AFS licences. ASIC also introduced a class no-action position until 30 June 2026, giving digital asset businesses time to transition to licensing.

AML/CTF and Exchange Licensing

Australia’s regulatory framework for crypto exchanges and other platforms has been strengthened, with new AML/CTF frameworks and licensing rules in place. Exchanges are now required to secure an Australian Financial Services Licence from ASIC and register with AUSTRAC. Australia’s AML laws now cover all virtual asset transfers, including stablecoins.

Firms face penalties of up to A$16.5 million, three times the benefit gained, or 10% of annual turnover for misleading conduct and unfair contract terms. Transak secured AUSTRAC’s Digital Currency Exchange (DCE) registration in March 2025, confirming full compliance with Australia’s AML/CTF rules and positioning it as the one of the first globally compliant fiat-crypto payment infrastructure providers with Australian DCE registration.

Proposed Payments Licensing Reforms

In September 2025, Treasury released a draft legislation proposing a comprehensive regime for digital asset platforms and tokenised custody platforms. Separately, the government is consulting on payments licensing reforms that would capture stored-value facilities associated with payment stablecoins, bringing stablecoin issuers more formally within the prudential perimeter.

Risks and Uncertainties

Despite significant progress, several risks continue to shape the stablecoin landscape in Australia.

Users have yet to fully trust stablecoins as an everyday payment solution. The shift toward acceptance is occurring alongside greater regulatory clarity, widespread institutional interest globally, and stablecoin-focused regulations, like The GENIUS Act, which are setting precedents that may influence Australian authorities. However, the regulatory framework remains a work in progress, with final legislation still pending.

Reserve risk remains a core concern. Stablecoins require trust in the issuer’s reserves, and the collapse of algorithmic stablecoins cost Australian investors significant losses and left lasting scepticism. Although regulators now emphasise the need for adequate reserves and audits, comprehensive consumer protection frameworks are still being developed.

Crypto scams and volatility have made many Australians wary. High-profile collapses globally mean that banks and fintechs must carefully manage counterparty and legal risk. For merchants and B2B platforms, there is also the burden of AML compliance—any stablecoin on-ramp or integration must comply with AUSTRAC and KYC regulations.

Bank resistance also poses a barrier. According to the 2025 IRCI, nearly one in five Australian crypto investors (19.3%) reported that their bank had blocked or delayed crypto transactions, highlighting friction between the traditional banking sector and the growing digital asset ecosystem.

Transak’s Role in Australia’s Payments Future

Australia’s payments system is at an inflection point for modernization. What the ecosystem now requires is compliant infrastructure that bridges traditional finance and digital assets without adding operational or regulatory risk.

This is where Transak plays a critical role.

For fintech platforms, Transak reduces integration complexity by abstracting KYC, AML screening, and payment method orchestration into a single infrastructure layer. For enterprises, we enable stablecoin-based payroll, supplier settlement, and cross-border disbursements without requiring in-house licensing or custodial operations. For exchanges and wallets, it provides direct access to compliant AUD liquidity.

As Australia modernises its payments regime and stablecoins move further inside the regulatory perimeter, platforms that adopt the new tech will keep up with the times.