Takeaways

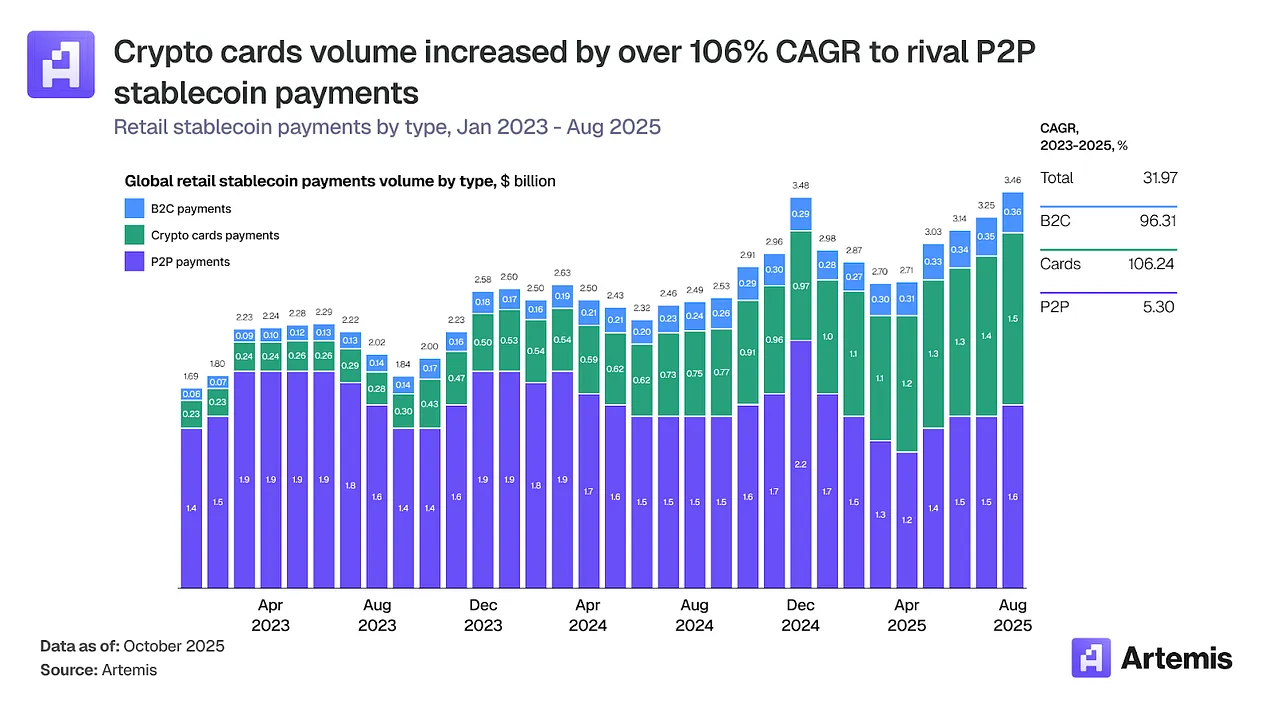

Crypto cards are getting big. At a CAGR of 106%, crypto cards surpassed P2P stablecoin transfers in 2025.

This growth did not happen overnight

Stablecoins took center stage in 2025 but at the consumer level, there wasn’t any good way to use these “digital dollars” like, well, dollars. Until crypto cards.

Not all crypto cards are the same. Crypto cards that route payments through traditional gateways, correspondent banks, and fiat rails merely offer a band-aid solution.

Crypto cards offer native settlement and help bypass legacy rails, save fees, and make payments instant. They are a win-win for users and merchants.

This article digs into what makes stablecoin rails the only efficient architecture for crypto cards.

The Two Types of Crypto Cards (And Why One Is Already Obsolete)

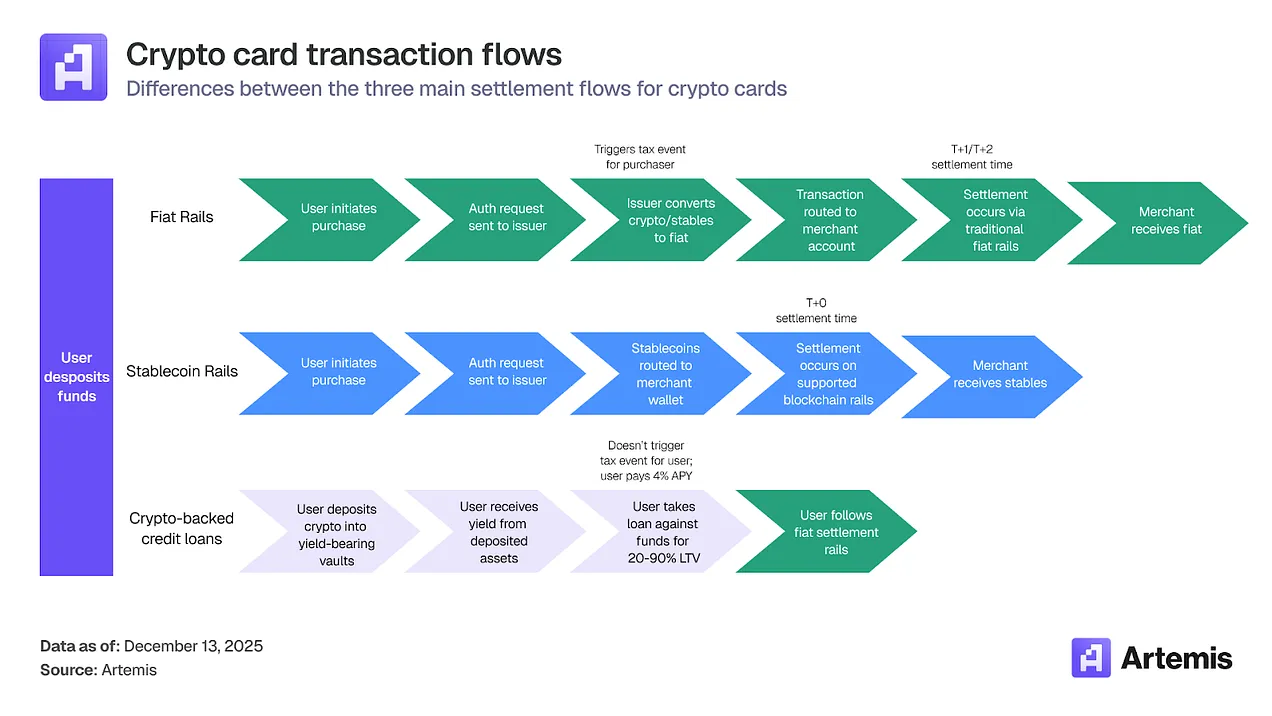

What happens when a user swipes a card at any merchant? For crypto debit cards, two distinct settlement flows happen.

- For the vast majority of crypto cards, the crypto-to-fiat conversion happens before any settlement at the payment network level. After that, the transaction happens in the same fashion as any other card transaction.

- The other settlement type, which is still nascent, happens via stablecoin rails. Issuance platforms handle settlement directly to the card networks like Visa, via a single integration.

In the first case, since legacy rails are involved, the benefits are minimal. Yes, the user gets to use their crypto in the easiest way possible, but merchants have to make do with the additional costs and hassle of integrating crypto cards, suffer slippage, and delays in settlement.

With stablecoin rails, settlement happens instantly, and since no routing through multiple gateways, banks, and networks is needed, charges are lower, and payments are faster and global. And with partners like Transak integration can be seamless via APIs.

Card networks are fast-catching on, and going in for stablecoin settlements. Visa’s stablecoin-linked card saw spending reach $3.5 billion in Q4 of 2025, at 460% YoY growth.

Five Reasons Stablecoin Rails Are the Only Viable Architecture for Crypto Cards

Stablecoin rails offer a fundamentally better infrastructure layer for crypto cards, and a great way to incentivize crypto card adoption for reasons such as:

1. Real-Time Settlement, 24/7/365

Traditional finance operates on banker's hours. The Hong Kong Stock Exchange opens at 6:30 AM local time. U.S. markets close in the evening. SWIFT payments don't process on weekends. If you initiate a cross-border payment on Friday afternoon, it might not settle until the following Tuesday.

Stablecoins present a better way to move money. These rails make crypto cards work 24/7. Settlements happen in real-time, in fiat, as always. The user pays in stablecoins. The issuer directly routes value to card networks to cut time and cost leakages.

2. Liberated Working Capital

When payments flow through traditional rails, capital gets trapped. Businesses must prefund correspondent bank accounts and wait days for settlements to clear. This working capital sits idle instead of funding growth, inventory, or operations.

Also Read: What Is Payment Finance (PayFi)?

In return, firms get instant, 24/7 liquidity, which they can use to meet capital needs across time zones. Businesses can reduce their working capital requirements and put the funds into expansion or growth.

3. Cost Savings & Customer Acquisition

The uncomfortable truth about traditional payments is that merchants lose 2-2.5% of every transaction to fees. These costs accumulate as payments route through aggregators, processors, and correspondent banks.

Stablecoin rails bypass these intermediaries entirely. Settlement costs can drop to 0.25% or less, saving businesses roughly 1.75% per transaction.

So, no, businesses can pass on the 2% fee savings to consumers by creating or improving reward programs. Suddenly, using a crypto card becomes a win-win situation.

The best technology disappears. Users don't want to understand blockchain protocols, gas fees, or cross-chain bridges. They want their payment to work, instantly, everywhere.

Crypto cards abstract away the technical complexity. Behind a familiar tap or swipe action, Transak handles routing, compliance checks, and more.

Also Read: The Evolution of Crypto Payments: From Wallets to Embedded Finance

5. Borderless Money for a Global Economy

Stablecoins are borderless by default. Integrating stablecoin-led card payments directly into your payment setup can open up access to a global user base, sans the cross-border fuss.

At the macro-level, crypto cards can be a way for fintechs and businesses to access digital dollars and skip the local inflationary pressures and weak banking infrastructure, especially in developing and third-world countries.

The Barriers to Adoption

Suppose you are a company or a fintech that wants to start getting into crypto, but you are met with challenges such as:

- Creating a new software for integrating stablecoin payments

- Setting up a wallet

- Finding a custody service

- Setting up an on-and-off-ramp service for crypto-fiat conversions

- Then the fragmentation problem, where you need to deal with so many blockchains, their gas fees, etc.

- Compliance and regulatory hurdles

These are a few of the many reasons businesses across the world refrain from integrating crypto cards, despite their benefits. Transak is solving this by turning complex integration into simple API calls.

Transak handles KYC, AML, routing, custody, and other backend processes, for the user to be able to buy with stablecoins without leaving your website’s interface. Our extraordinary liquidity routing engines let crypto-to-fiat conversions happen instantly.

Also Read: Transak Deepens Regulatory Footprint in the US, Now Licensed in 11 States

Instead of taking years to build compliance, liquidity, and infrastructure, companies can just use Transak to do it overnight. The customer just taps the card, while Transak almost instantly does all the grunt work in the background.

The next few years are going to the stablecoin supercycle period, and merchants can amplify their user experiences using stablecoin-led crypto cards with partners like Transak.

The Infrastructure Is Ready. The Question Is Who Moves First.

The technology works and the economics are compelling. The question is which businesses will recognize the opportunity and integrate stablecoin-backed card capabilities before their competitors?

If you’re ready to jump on the stablecoin bandwagon, we’re here for you. Partnering with Transak means you can skip the 18-24 month build cycle and go live in weeks instead of years.

We've already done the heavy lifting, like regulatory licenses across 11 U.S. states, direct integrations with major card networks, and liquidity routing engines that handle instant crypto-to-fiat conversion across multiple blockchains.

Your developers integrate once through our API. We handle KYC/AML compliance, custody, multi-chain routing, and real-time settlement in the background. Your customers just tap their card and experience seamless payments, while you capture the cost savings and competitive advantage.