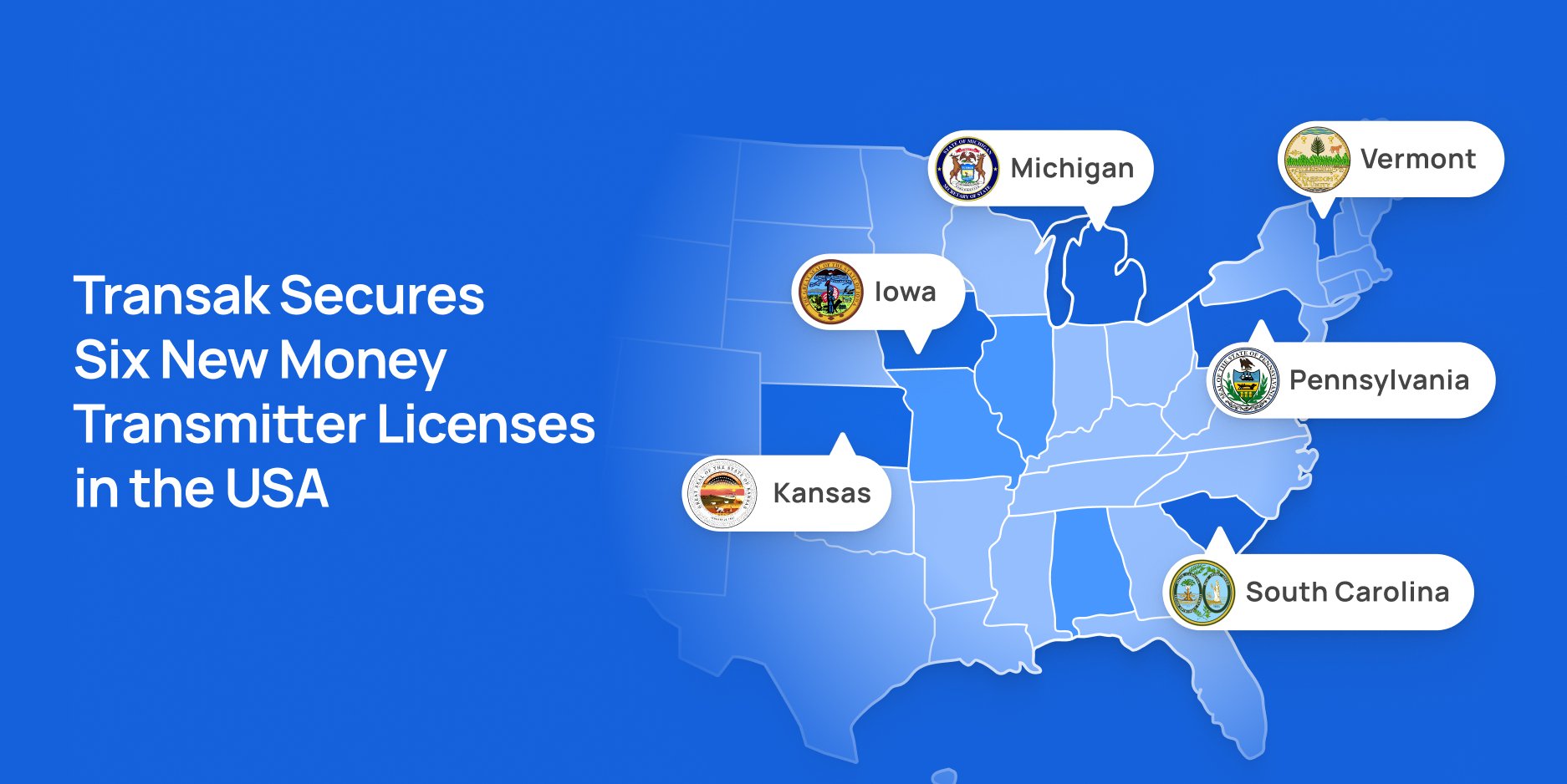

Transak USA LLC strengthens its U.S. compliance footprint with new MTL approvals in Michigan, South Carolina, Iowa, Kansas, Pennsylvania, and Vermont.

Transak, the payments infrastructure for stablecoins and crypto, has secured six new U.S. Money Transmitter Licenses (MTLs) in Iowa, Kansas, Michigan, South Carolina, Pennsylvania, and Vermont, marking a major leap in its U.S. expansion.

With this milestone, Transak is now licensed in ten U.S. states, reinforcing its position as one of the most regulated and compliance-driven stablecoin payment infrastructures in the country. The current roster includes Alabama, Arkansas, Delaware, Illinois, Iowa, Kansas, Missouri, Michigan, South Carolina, and Vermont.

Building the Foundation for Regulated Stablecoin Payments

Each state license enables Transak to operate directly within that jurisdiction, offering faster and more secure fiat-crypto transactions without relying on intermediaries. This allows for higher success rates, improved economics, and a smoother user experience across Transak’s ecosystem of over 450 integrated partners.

These licenses also advance Transak’s ability to:

- Deliver regulated stablecoin and crypto payment services across more U.S. states.

- Support fintechs, wallets, and enterprises seeking compliant on/off-ramp infrastructure.

- Enable lawful and efficient transitions between fiat and digital assets for U.S. users.

“Every new license we secure brings us closer to a future where users can move between fiat and digital assets seamlessly and lawfully,” said Bryan Keane, Compliance Officer (Americas). “Our new licenses are a testament to our team’s relentless focus on compliance, operational excellence, and building trust with regulators worldwide.”

2025: A Breakout Year for Transak in the U.S.

Transak has rapidly evolved into one of the most enterprise-ready infrastructures powering stablecoin payments in the U.S.

This year, the company:

- Became the first on-ramp provider to enable wire transfers for direct USD deposits into crypto purchases.

- Is preparing to launch ACH payments to make bank transfers faster and more accessible for American users.

- Partnered with MetaMask to power native white-label stablecoin deposits, enabling regulated 1:1 movement between bank accounts and digital wallets.

- Expanded stablecoin support (USDC, RLUSD, USDG) and released Virtual Account APIs and developer tools to help partners embed stablecoin payment flows natively.

Together, these advancements mark Transak’s transformation into a regulated, scalable, and programmable infrastructure for the stablecoin economy.

Why It Matters

The U.S. remains one of the most complex regulatory environments for digital asset services, with each state requiring separate licensing to transmit value. Transak’s growing portfolio of MTLs positions it among the most licensed stablecoin and crypto payment providers in the country that bridges the gap between traditional finance and decentralized ecosystems.

The procurement of these licenses is part of Transak’s mission to make stablecoin payments usable at scale. With additional MTL applications in progress, Transak is laying the foundation for nationwide stablecoin access so businesses and users can move value with the same ease as sending an email.

As regulated stablecoins, like USDC, RLUSD, and USDG, power the next wave of cross-border payments and on-chain finance, Transak’s compliance momentum ensures developers, businesses, and users can participate confidently within a transparent, lawful framework.

About Transak

Transak is the payments infrastructure for stablecoins and crypto. With its Virtual Account APIs and compliance-ready rails, Transak enables apps to onboard users, facilitate cross-border payments, and support multi-party payment flows—natively within their platforms.

Integrated by 450+ apps and used by 10 million+ users globally, Transak powers fiat-to-crypto and crypto-to-fiat transactions through bank transfers, cards, local payment methods, and stablecoins.

Transak operates globally with offices in Miami, London, Bengaluru, Dubai, and Hong Kong.

Learn more at transak.com or follow Transak on X and LinkedIn.