From Brazil to Thailand, the whole world wants to know how to buy crypto.

Truthfully, it’s not always as straightforward as going to the ATM — though developers are working around the clock to change that (and, on that note, stay tuned for some exciting announcements from us).

But while the crypto industry works on innovating the necessary tools to make buying crypto easier, there are still a number of ways to transfer your fiat (government) money to crypto.

In a process known as crypto on-ramp, consumers exchange their government-issued currency, such as USD or EURO, for cryptocurrency. There are presently over 20,000 types of cryptos, and the number continually grows as developers make new protocols and issue new types of coins to go with them.

Here’s what you need to know about why crypto on-ramps are important.

Centralized on-ramps have great UX — but still carry traditional risk factors

Crypto on-ramp can happen in a number of ways. Perhaps most common is through centralized exchanges, or CEXs. These include large, somewhat regulated exchanges. Over the last few years, CEXs earned a reputation for being more stable than decentralized exchanges (DEXs), since they are now big enough to warrant some federal oversight and presumably have enough customers that they must look out for consumer protections.

However, the recent news cycle has burst the CEX bubble dramatically. In mid July 2022, U.S.-based crypto lender Celsius filed for bankruptcy, which came on the heels of the failure of two other large crypto institutions, Three Arrows Capital and Voyager Digital.

Centralized crypto institutions are facing major roadblocks, namely regulatory uncertainty surrounding consumer fund protections and how digital assets will be (or already are) classified in their respective localities. It will take a number of lawsuits to establish norms around how the government, and therefore large crypto banks, will treat cryptocurrency in the event of institutional bankruptcies, theft, taxes, etc.

But due to the seamless user experience (UX) and easy-to-use interfaces of centralized platforms, the big players have mainstream appeal. Most don't expect this to change any time soon, and leading CEXs seem prepared to weather the volatility, seeing it as a natural step in any emerging industry.

On-ramping directly in DEXs and dApps

Welcome to the decentralized side of finance. Though unfamiliar to most mainstream consumers, decentralized finance (DeFi) activity still accounts for billions in crypto transactions. The analytics firm DeFi Llama reports $74.65 billion in DeFi TVL as of July 2022. While this isn't close to the action seen by the traditional financial industry, DeFi is growing despite (or perhaps because of) its unregulated status.

Traditionally, most DeFi traders and investors buy their crypto first on a centralized exchange before transferring it to a self-custody DeFi wallet. Centralized exchanges list hundreds or thousands of coins that consumers all over the world can purchase for a small processing fee.

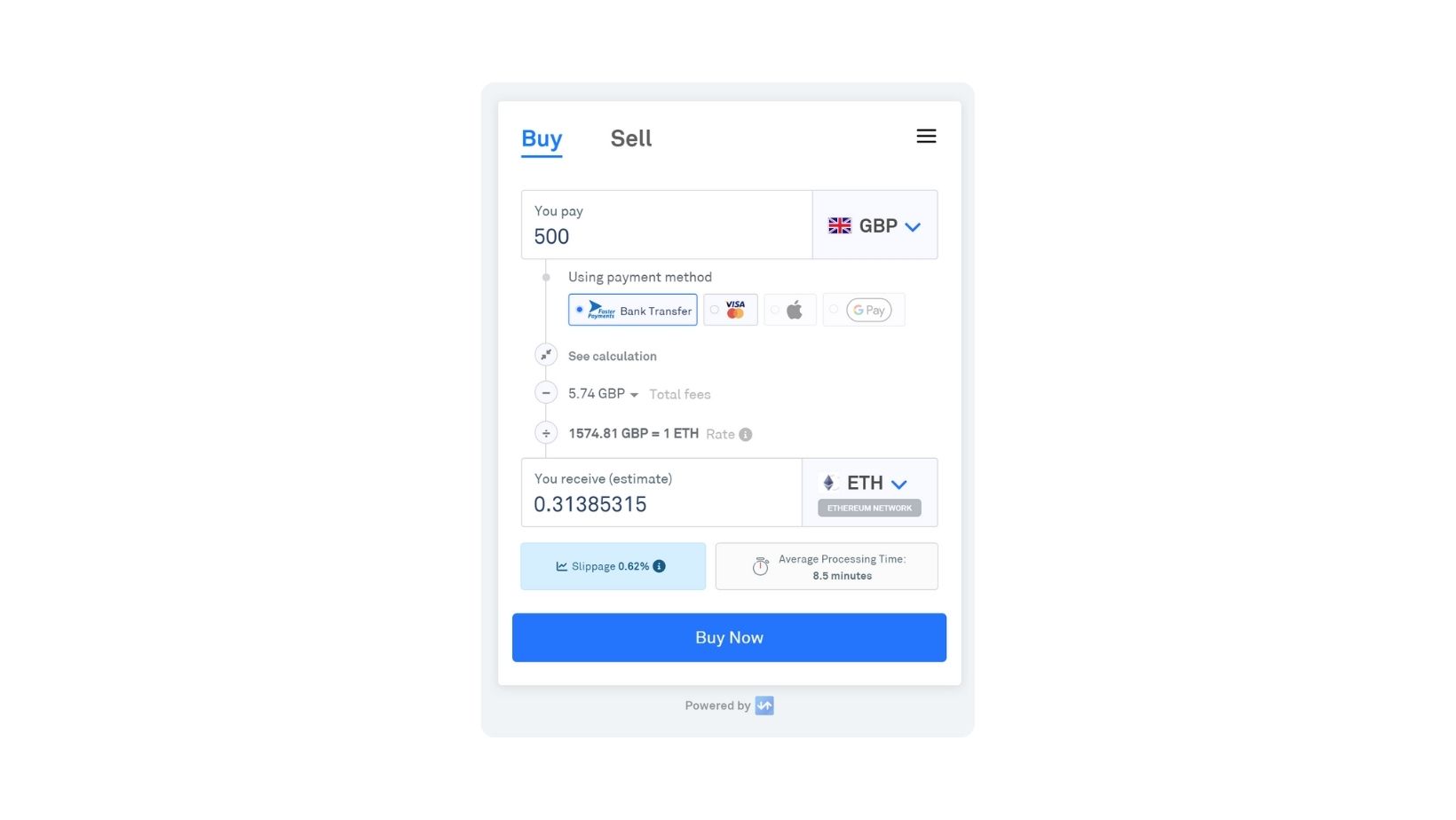

However, with such uncertainty surrounding centralized institutions, the option to on-ramp within dApps and DEXs may become more appealing as people grow more familiar and comfortable with DeFi. Crypto on-ramps like Transak offer a convenient way for users to skip the exchange and buy crypto directly within DeFi protocols, decentralized exchanges (DEXs), and decentralized apps (dApps).

Regulatory reasons aside, Transak and comparable on-ramps tend to be more streamlined and convenient. However, Transak is also fully authorized with the UK Financial Conduct Authority as a Registered Crypto-Asset Firm, which helps shoulder some of the regulatory burden. Transak’s regulatory status helps builders focus on what they do best — creating web3 and DeFi-friendly tools — by handling all anti-money laundering (AML) compliance and licensing requirements.

That's not to say, however, that on-ramping through a dApp or DEX doesn't carry risk for individual consumers. Those who buy or trade crypto on decentralized platforms should be aware of crypto's volatility and what protections they have (if any) in the event an anonymous user hacks their wallet or the platform they are using fails. It's important to treat decentralized financial transactions with the same caution you would bring to any important money decision. It also helps to read the roadmaps and join the online communities of any platform you use, whether for gaming or DeFi investing.

Examples of crypto on-ramp integrations

In just a few years since Transak graduated from the Consensys Tachyon accelerator program and released its product at ETH Denver, we’ve partnered with some of the top DeFi protocols and dApps.

Here’s a look at how crypto on-ramps provide an important step in each use case:

Crypto on-ramp for DeFi protocols

Transak has over 100+ partnerships, many of which are DeFi protocols. Whether the goal is yield farming, crypto mining, or simply 'HODLing" (aka long-term buy-and-hold investing), users once had to complete two to three separate steps just to fill their wallets. First, they had to buy coins and tokens from a CEX, then swap them for a compatible currency for whatever protocol they wanted to use (if applicable), then move them to a compatible self-custody wallet. This made the time and fees wasted rack up.

Meanwhile, Transak offers a seamless fiat-to-crypto on-ramp integration which lets users receive yield-earning tokens in their wallet with fewer steps and fees.

Learn more about two Transak partner examples — Aave and Beefy — that demonstrate why crypto on-ramp matters for DeFi.

Crypto on-ramp and games

When deep in gaming mode, the last thing players want to do is go through a laborious process to buy more crypto. With Transak’s API, players can top off their crypto wallets without interrupting their focus.

Read more about Transak’s partnership with Splinterlands to see an example.

Crypto on-ramp and NFT marketplaces

In May 2022, Transak partnered with Quixotic, Optimism’s first and largest NFT marketplace. Buyers can quickly add funds to their Quixotic account via debit/credit cards, Apple Pay or SEPA/Bank transfer. This is particularly significant given Optimism is a Layer 2 chain with its own token, a sticking point for many new users who are onboarding to crypto for the first time. Easy on-ramps help eliminate the friction that might otherwise dissuade someone from NFT ownership on a new or unfamiliar platform.

Check out another major NFT marketplace partnership between Transak and Paras.id, a digital collectible marketplace that supports and develops crypto-native IPs.

Are you building in web3 and in need of a way to accept payments? Learn how to integrate Transak today.