Takeaways

- With $33 trillion in total volume and $9 trillion in real economic transactions, stablecoins now operate at the scale of global payment networks.

- The GENIUS Act in the U.S. and MiCA in the EU turned stablecoins into legally usable financial instruments.

- Cross-border B2B payments, remittances, treasury operations, payroll, and backend settlement saw real traction.

- Most users spent stablecoins without knowing it, through cards, payouts, and apps.

- Stablecoins are now a strategic choice. Enterprises must decide where to integrate them, whether to issue or partner, and how to build compliance-first infrastructure before tokenized deposits and incumbents reshape the landscape.

For most of their existence, stablecoins lived in an awkward in-between state. Too large to ignore, too under-regulated to trust, and too crypto-native to be taken seriously by enterprises.

2025 ended that phase. Stablecoins crossed three irreversible thresholds at the same time:

- Scale: Transaction volumes reached payment-network magnitude

- Legitimacy: Regulators stopped debating whether and started defining how

- Utility: Real businesses began routing real money through them in production

Once all three are true simultaneously, the asset stops being optional infrastructure. That is the correct frame to understand stablecoins entering 2026.

The Scale No One Saw Coming

Stablecoins processed $33 trillion in transaction volume in 2025, up 72% year-over-year. Strip out automated trading and wash activity, and you're still left with $9 trillion in genuine economic transactions, which is 5x PayPal's entire payment volume and over half of Visa's throughput. The number is expected to hit $50 trillion by 2030.

Circle's USDC alone facilitated $18.3 trillion in annual transactions. Tether's USDT processed $13.3 trillion. Monthly volumes exceeded $700 billion by late 2025, with September hitting $1.25 trillion.

Interestingly, this growth decoupled from crypto trading cycles.

When Bitcoin pumps, trading volume spikes. But stablecoin volumes climbed steadily regardless of market sentiment, indicating product-market fit outside speculation. Businesses were solving real problems around settlement delays, FX costs, capital trapped in transit.

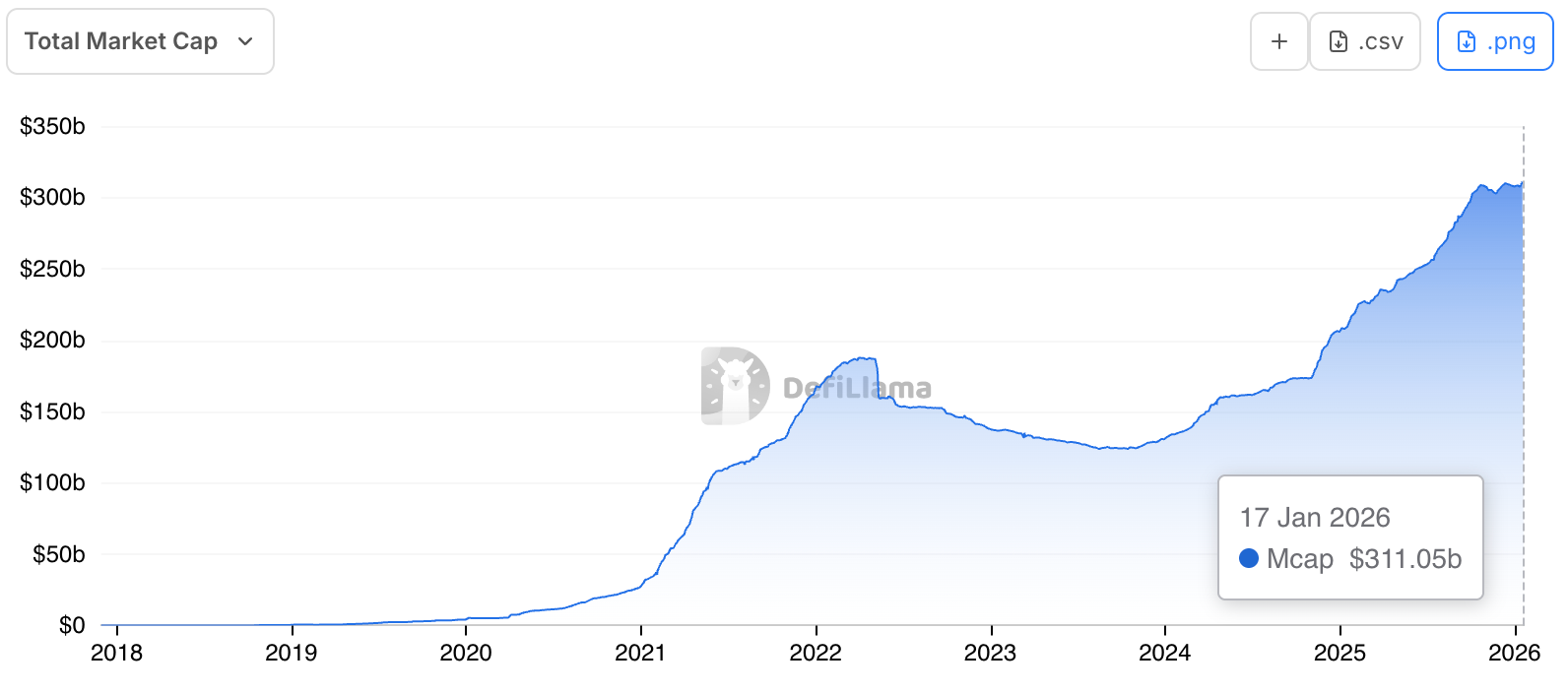

The stablecoin market cap grew from $205 billion in January to over $306 billion by year's end and over 1% of all U.S. dollar money supply now exists as tokenized dollars on public blockchains.

Source: DefiLlama

Regulation Became Enabling

The biggest unlock of 2025 was not technical. It was legal.

In the United States, the passage of the GENIUS Act created the first comprehensive federal framework for payment stablecoins. It clarified who can issue them, how reserves must be managed, and what compliance obligations apply. Stablecoins became regulated financial instruments, not regulatory gray zones.

Also Read: How The GENIUS Act Is Opening New Grounds For Stablecoin Adoption in The US

In Europe, MiCA moved from theory to enforcement. Exchanges delisted non-compliant stablecoins. Tether discontinued EURT. Several issuers exited European markets entirely. Circle achieved full MiCA compliance for both USDC and EURC, gaining exclusive advantages in a 450-million-person market.

Also Read: How MiCA Is Opening New Grounds For Stablecoin Adoption in The EU

Enterprises do not adopt systems that may be outlawed retroactively. Once rules existed, CFOs, compliance teams, and boards could finally approve stablecoin usage in production environments.

Where Stablecoins Actually Got Used

Cross-Border B2B Payments

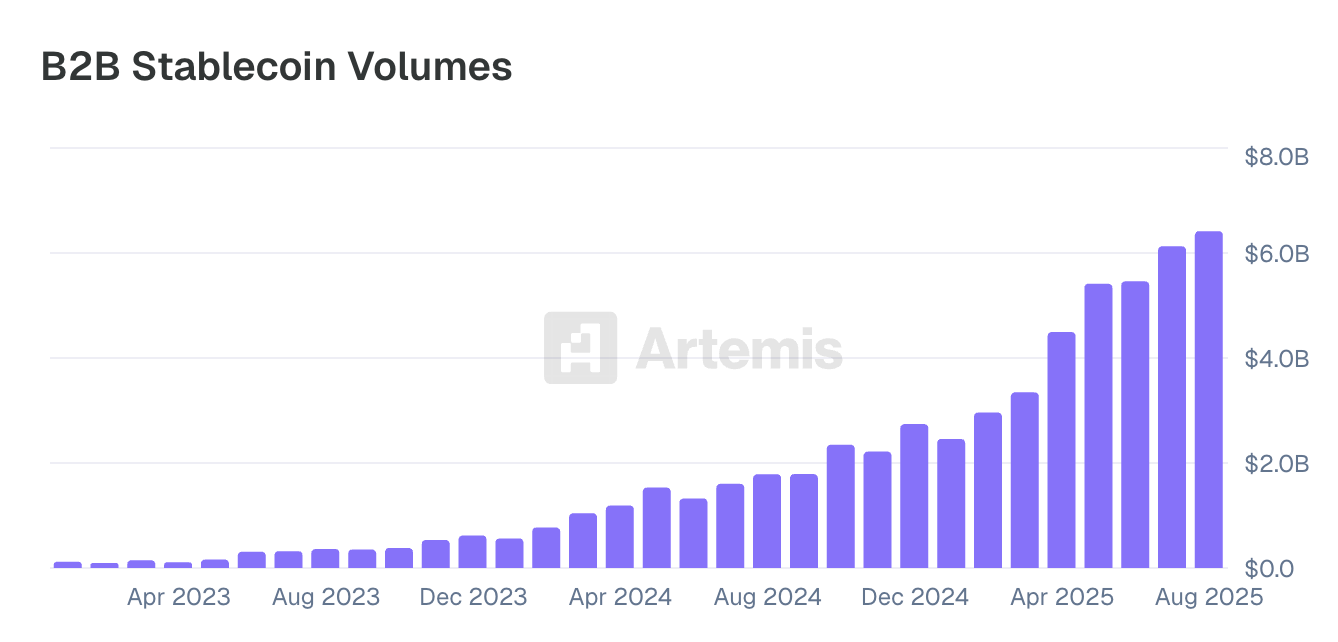

Business-to-business transfers became the largest stablecoin use case by 2025 with over $76 billion in direct B2B flows out of $122 billion in real-economy stablecoin payments.

Source: Artemis

- SpaceX's Starlink used stablecoins to collect payments from customers in countries with underdeveloped financial systems.

- Scale AI offered overseas contractors stablecoin payment options.

- JPMorgan and Siemens used JPM Coin for programmable treasury transfers.

- Citi and Maersk automated bank guarantee payments via smart contracts.

The busiest stablecoin corridor was Singapore-China. Among the top eight routes, the U.S. appeared on one side of seven and USD-backed stablecoins had become the bridge linking American finance with Asia, Latin America, and beyond.

Also Read: What Are Cross-Border Payments & Why Use Blockchain For It?

Remittances

MoneyGram launched a USDC-based service in Colombia in September 2025, letting users receive funds instantly into dollar stablecoin balances and cash out via 500,000+ retail agents.

Western Union announced their USD Payment Token (USDPT) for 2026 launch on Solana, partnering with federally chartered Anchorage Digital Bank. Both explicitly cited the GENIUS Act as enabling their moves.

In emerging markets facing inflation, like Turkey, Argentina, and Nigeria, dollar stablecoins became vital stores of value. USDT on Tron accounted for ~85% of stablecoin payment volume in Africa and Latin America due to low fees and wide acceptance.

Corporate Treasury

Stablecoins enabled 24/7/365 liquidity management. Treasury managers could rebalance globally on weekends. Cross-border intercompany transfers that took 3-5 business days and cost thousands in wire fees could settle in under an hour for a few dollars.

With Treasury rates around 5% in 2025, yield opportunities emerged. Circle worked with BlackRock to let institutional USDC holders invest in Treasury reserve funds. MakerDAO offered a DAI Savings Rate above 3%. "Treasury as a service" models emerged where platforms custody stablecoins and programmatically sweep them into yield strategies.

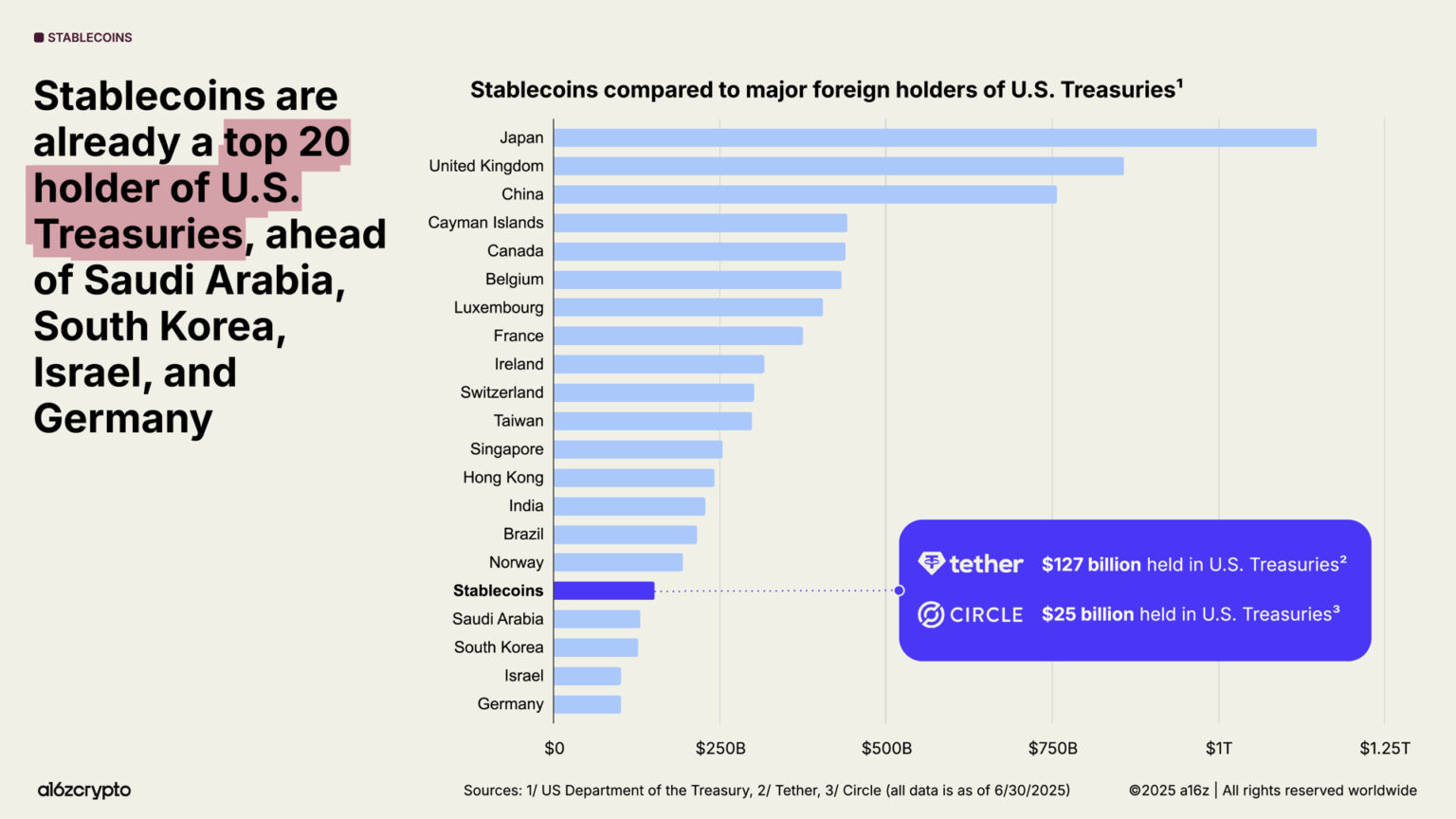

And by the end of 2025, stablecoin issuers collectively held over $150 billion in the U.S. Treasuries as reserves, making them the 17th largest holder of U.S. government debt worldwide.

Source: a16zcrypto

Payment Network Integration

Mastercard unveiled end-to-end stablecoin transaction capabilities, supporting USDC, PayPal's PYUSD, and others. Their Transfer Solutions embedded stablecoins into Mastercard Move for remittances and B2B disbursements across Europe, Middle East, and Africa.

Visa announced U.S. banks could settle daily card transactions in USDC on Solana rather than via wire transfers. When users made Visa card purchases, funds between issuers and acquirers could be exchanged in near-real-time using stablecoins—24/7 operation versus next-day ACH.

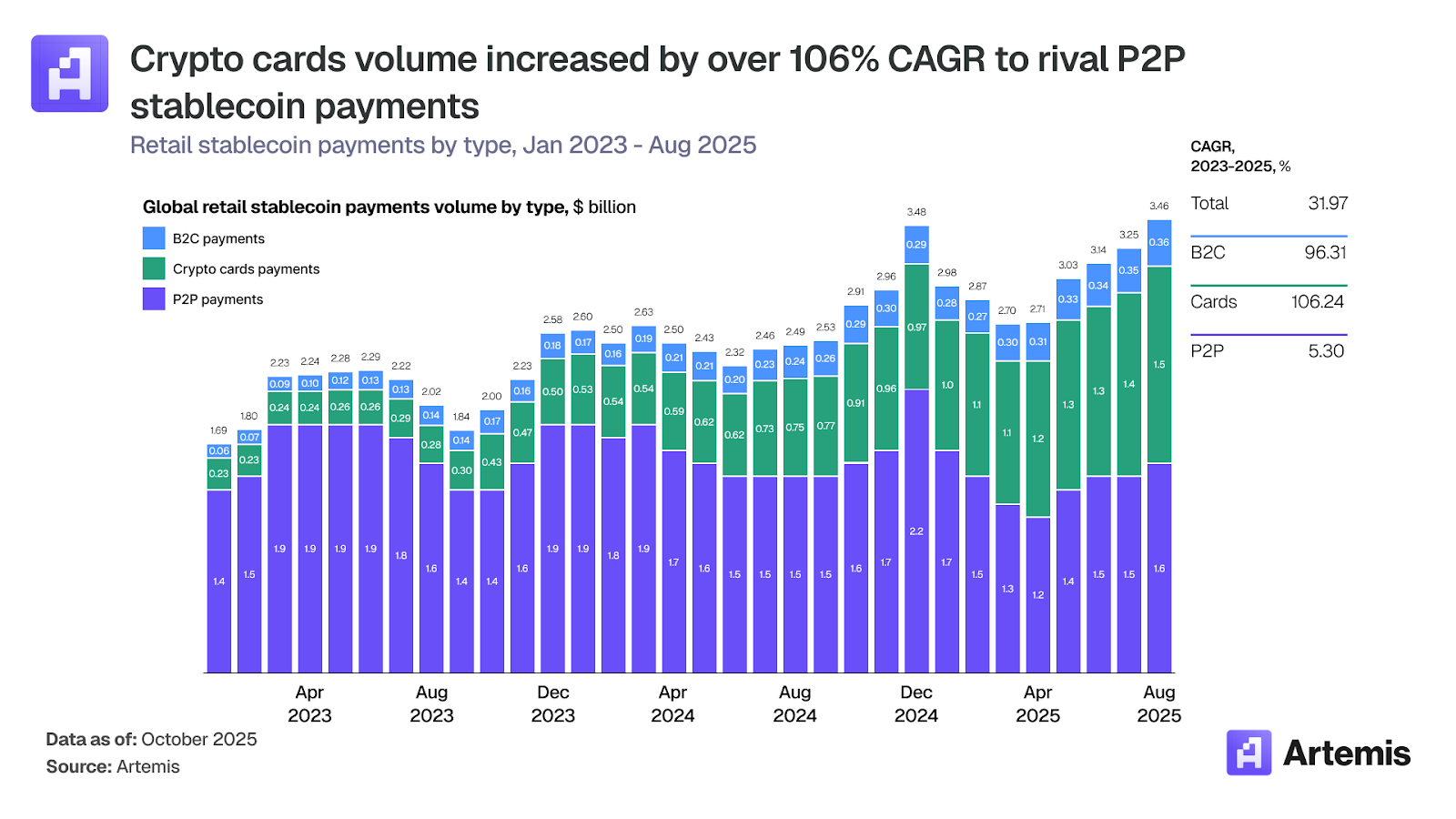

Card-linked payments funded by stablecoins grew from $250 million monthly in early 2023 to over $1.5 billion monthly by mid-2024, continuing through 2025. Consumers spent stablecoin balances on groceries and e-commerce, with merchants receiving fiat settlement.

Source: Artemis

Also Read: Stablecoin & Crypto Cards Explained

YouTube enabled U.S. creators to receive ad revenue in stablecoin through PayPal's Hyperwallet. Creators got funds in minutes rather than waiting for monthly bank deposits.

Payroll

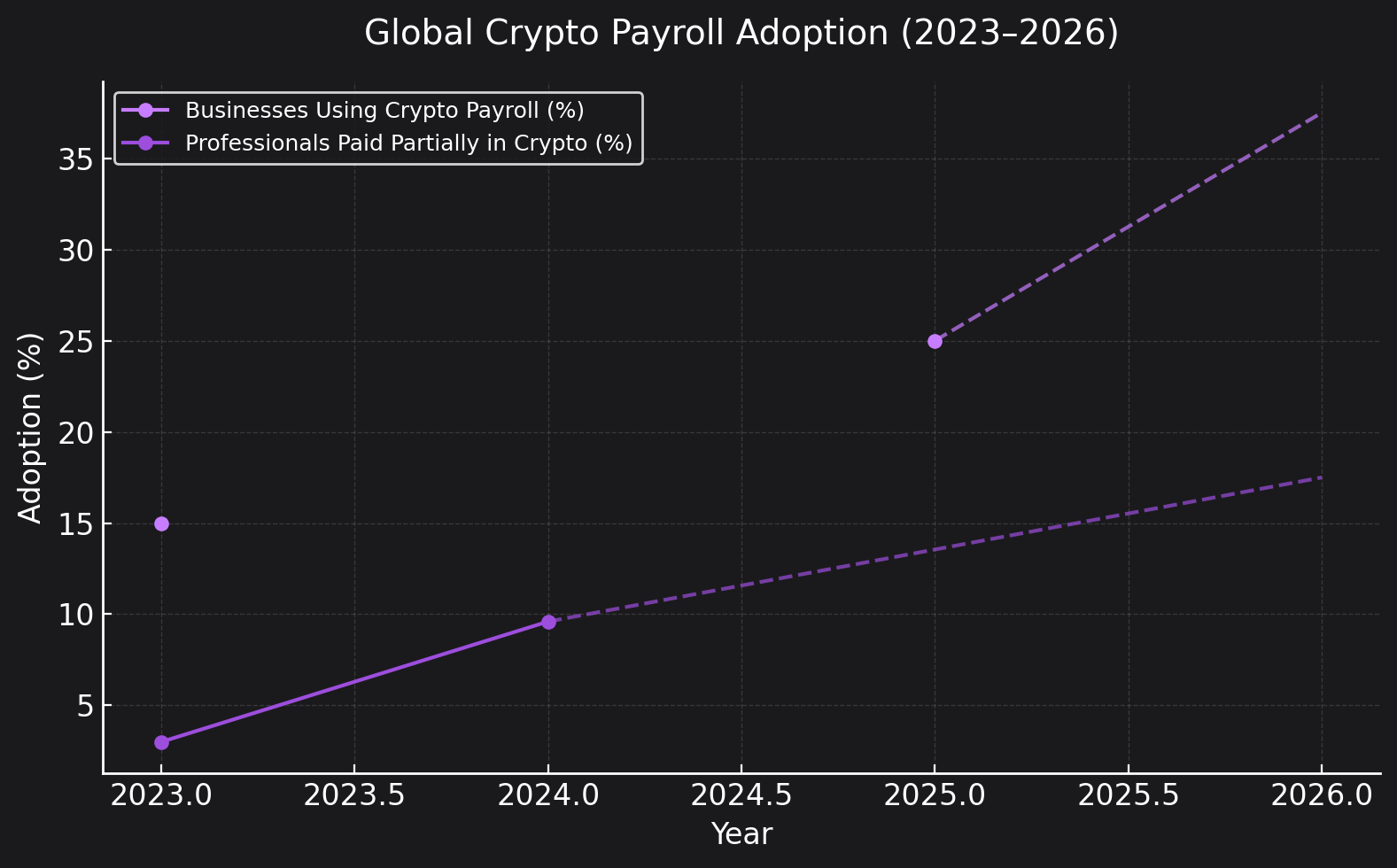

The share of professionals receiving part of their salary in cryptocurrency nearly tripled from 3% in 2023 to 9.6% in 2024, as per a report by Pentera Capital. By late 2025, one in four companies globally had arrangements to pay contractors or employees in crypto.

Source: Rise

Platforms like Deel and Remote introduced stablecoin wage options for workers in countries with weaker banking systems.

Outlook for 2026

The most important takeaway from 2025 is simple: Stablecoins are a strategic choice. In 2026, fintech and enterprise leaders must decide:

- Where stablecoins outperform legacy rails

- Whether to issue, integrate, or partner

- How to build compliance-first infrastructure

- How to prepare for competition from tokenized bank deposits

Transak provides the rails for any enterprise to practically use stablecoins within days.

For cross-border payouts, treasury movements, payroll, or stablecoin powered payments, we are the connective tissue between traditional finance and onchain money. Our tech stack lets you tap into the speed and efficiency of stablecoins while remaining compliant, auditable, and operationally sane.