The world’s two biggest economies are taking opposite bets on the future of money.

In the United States, regulators are warming up to privately issued stablecoins as the next rails for digital payments. Across the Atlantic, the European Union is pouring resources into a centralized alternative, the digital euro.

One side trusts market innovation while the other sides state control. And this ideological split could decide who sets the standard for programmable money in the coming decade.

In this article, we’ll unpack why the US is leaning toward stablecoins while the EU champions central bank digital currencies (CBDCs).

Quick Primer: CBDCs vs. Stablecoins

Both Central Bank Digital Currencies (CBDCs) and stablecoins represent digital versions of money, but the way they’re issued, controlled, and governed are very different.

|

Feature |

CBDCs |

Stablecoins |

|

Issuer |

Central Bank |

Private Entity (e.g., Circle, Tether) |

|

Governance |

Fully centralized |

Market-driven, regulated or unregulated |

|

Backing |

Government guarantee |

Reserves (fiat, treasuries, etc.) |

|

Purpose |

Monetary sovereignty, control |

Financial innovation, borderless payments |

|

Trust Model |

Public trust in state |

Market trust in issuer transparency |

|

Privacy |

Limited (state supervision) |

Varies by issuer and regulation |

|

Innovation Speed |

Slow, policy-driven |

Fast, competitive, ecosystem-led |

CBDCs: State-Controlled Digital Money

CBDCs are digital currencies issued directly by a country’s central bank. They’re the digital form of cash backed by the government and operated through centralized infrastructure.

- Issuer: Central bank

- Control: Fully centralized

- Trust model: Based on state authority

- Goal: Maintain monetary sovereignty and reduce dependence on private payment systems

- Example: China’s e-CNY, the ECB’s Digital Euro pilot

CBDCs aim to give citizens a digital payment option that’s as safe as holding physical cash, but with programmability and traceability baked in.

Stablecoins: Private-Sector Digital Fiat Currencies

Stablecoins, on the other hand, are issued by private entities and pegged to traditional currencies like the USD or EUR. Their stability comes from reserves (think cash, short-term treasuries, or similar assets) held by the issuer.

- Issuer: Private company or DAO

- Control: Decentralized or semi-centralized

- Trust model: Based on transparency, audits, and regulation

- Goal: Enable instant, borderless, blockchain-native payments

- Example: Circle’s USDC, PayPal’s PYUSD, Tether’s USDT, Circle’s EURC

Stablecoins bridge the gap between traditional finance and crypto ecosystems, letting users move funds 24/7 with minimal friction.

Europe’s Digital Euro: Building Public Digital Cash

The European Central Bank (ECB) is deep into the preparatory phase of the Digital Euro, a state-backed payment instrument described as “a digital form of cash, issued by the central bank and available to everyone in the euro area.”

Here’s the timeline so far:

- 2023: ECB begins technical research and prototype testing.

- 2024–2025: The ECB selects providers for fraud detection, offline payments, and privacy-preserving infrastructure.

- Late 2025: The Governing Council will decide whether to proceed to full development.

- Possible launch: Around 2029.

The motivation is strategic. Europe’s payment ecosystem heavily depends on non-European infrastructure like Visa, Mastercard, and PayPal. Policymakers fear that dollar-linked stablecoins could gradually displace euro-denominated payments, undermining monetary sovereignty.

So, the Digital Euro serves as a “public option,” a safe, sovereign anchor for the payment system that ensures Europeans always have access to risk-free central bank money, even in digital form.

However, this doesn’t mean Europe is anti-stablecoin. Under MiCA (Markets in Crypto-Assets Regulation), stablecoins are legal but strictly regulated.

The US: Private Rails, Public Oversight

In the United States, lawmakers have chosen a different path.

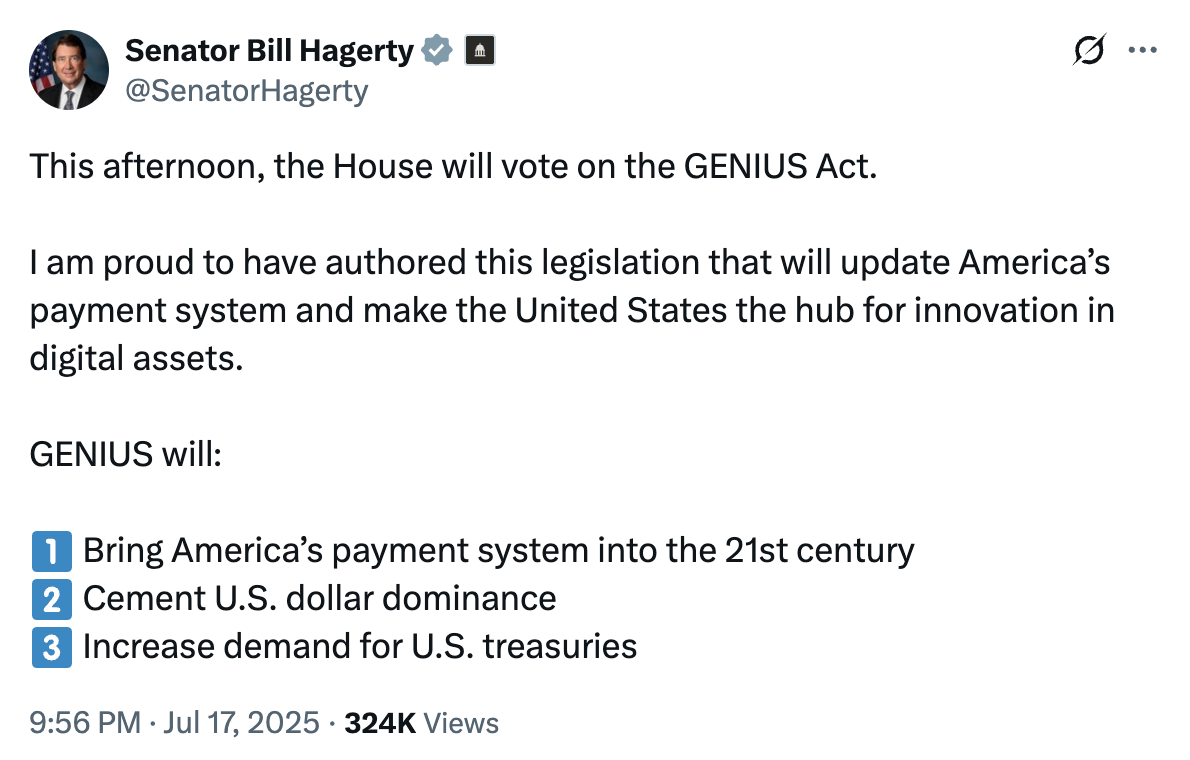

The GENIUS Act made payment stablecoins a legally recognised instrument and set standards for reserves disclosure and oversight. The law makes clear these tokens are payment tools, not securities.

At the same time, other legislation, the Anti-CBDC Surveillance State Act, has limited the Federal Reserve from issuing a retail CBDC without explicit congressional approval.

That means a government-run consumer wallet is politically off the table for now.

Source: Bill Hagerty on X

The U S has a strong private payments ecosystem, and its dollar is a global reserve currency. By legitimising dollar-pegged stablecoins, the US can extend the dollar into new digital rails and into platforms around the world.

Also Read: How The GENIUS Act Is Opening New Grounds For Stablecoin Adoption in the US

Stablecoins help keep global transactions tied to the dollar and help preserve its reach. The government aims to combine regulation with market speed so innovation can scale while meeting standards for consumer protection and anti-money laundering.

Stablecoins like USDC, PYUSD, and USDT are now powering 24/7 settlement, cross-border payments, and DeFi integrations, helping the dollar remain the de facto global reserve in digital form.

Do These Approaches Conflict?

The stablecoin vs. CBDC split is less a confrontation and more a reflection of geography and history across the Atlantic.

Europe is managing a shared currency across many states and wants a public safety net. The US is a single sovereign economy and gains value when the dollar moves freely on private rails.

Neither side rejects the other model. Europe permits stablecoins under regulation. The US is studying CBDC designs, especially for wholesale and cross-border settlements.

Both want the same core outcomes, like faster payments, financial inclusion, and resilience. They differ on who should be the primary custodian of the trust. The public sector in Europe or private firms in the US.

Theme |

European Union |

United States |

Common Ground |

|

Primary Model |

Digital Euro (Public CBDC) |

Regulated Stablecoins (Private sector) |

Both building programmable, trusted digital money |

|

Motivation |

Preserve euro sovereignty |

Extend dollar dominance |

Strengthen currency relevance |

|

Regulation |

MiCA governs stablecoins |

GENIUS Act regulates issuance |

Regulation > prohibition |

|

CBDC Stance |

Actively developing retail CBDC |

Studying wholesale CBDC |

Both exploring cross-border pilots |

|

Innovation Approach |

Public-led, slower rollout |

Market-led, faster adoption |

Focused on safety and transparency |

Implications for Fintechs and Payment Builders

Fintechs need flexibility, compliance, and product design that hides rail differences from users.

Payments

In Europe, a Digital Euro would give users direct access to central bank money, which changes settlement assumptions and risk profiles for wallets and points of sale.

In the US, stablecoins already enable near instant settlement and 24/7 rails. The product goal is to make payments feel instant, cheap, and reliable.

The implementation has to handle both CBDC rails and stablecoin rails without exposing complexity to customers.

Innovation

Fintechs must expect different cadences. Europe will be steadier and more predictable. The US will move faster and offer more experimental primitives.

Firms must build modular systems and composable APIs so they can swap the underlying rails as rules change. They must also design smart contracts and API primitives that can plug into a CBDC wallet or a private stablecoin pool.

Compliance and Trust

Regulation is now a product requirement. MiCA and the GENIUS framework make reserve rules, transparency, and AML checks essential.

From a product perspective, that means investing in real-time auditability, strong KYC flows, and transparent user disclosures. The firms that can show provable reserves and fast dispute processes will win trust and market share.

Liquidity and Treasury

CBDCs centralize issuance, stablecoins fragment it. Fintechs will need dynamic liquidity routing that shifts between CBDC and stablecoin pools while keeping UX seamless.

The Global Ripple Effect

The US and the EU may dominate the narrative, but their choices influence how other nations design, regulate, and distribute their own forms of digital money.

Some countries are leaning toward the European model, seeing CBDCs as a tool for national control and financial inclusion. China’s digital yuan (e-CNY) has already processed billions in transactions, and nations like India, Brazil, and South Africa are running their own pilots.

Others, meanwhile, are following the American template, betting on regulated stablecoins to power fintech innovation and cross-border efficiency. Hong Kong and Singapore are crafting frameworks for stablecoin issuers, Japan has legalized fiat-backed tokens under its Payment Services Act, and the UK is merging both ideas.

Where Transak Fits In

Transak operates as a compliance-first payments infrastructure provider, connecting banks, wallets, and DeFi protocols to stablecoin rails.

- It integrates directly with regulated stablecoin issuers like Circle and Paxos.

- It supports on-ramps and off-ramps for multiple countries and local payment methods.

- It’s fully aligned with MiCA, Travel Rule, and US money-transmitter regulations.

For builders, that means you can plug into fiat, stablecoin, and Web3 ecosystems without handling the regulatory complexity yourself.