Takeaways

If your product moves serious money, speed is only half the story.

For small, routine transactions, like coffee purchases and subscription renewals, speed is the determiner and we have the Faster Payment System for it.

But what happens when your client or customer has to move £2 million for a property acquisition immediately? Or when a wealth management client wants to transfer £500,000 between accounts with absolute certainty it'll arrive today? In these cases, you risk reversals and chargebacks. Here, finality, certainty, and timing matter more.

This is where CHAPS comes in.

What Is CHAPS?

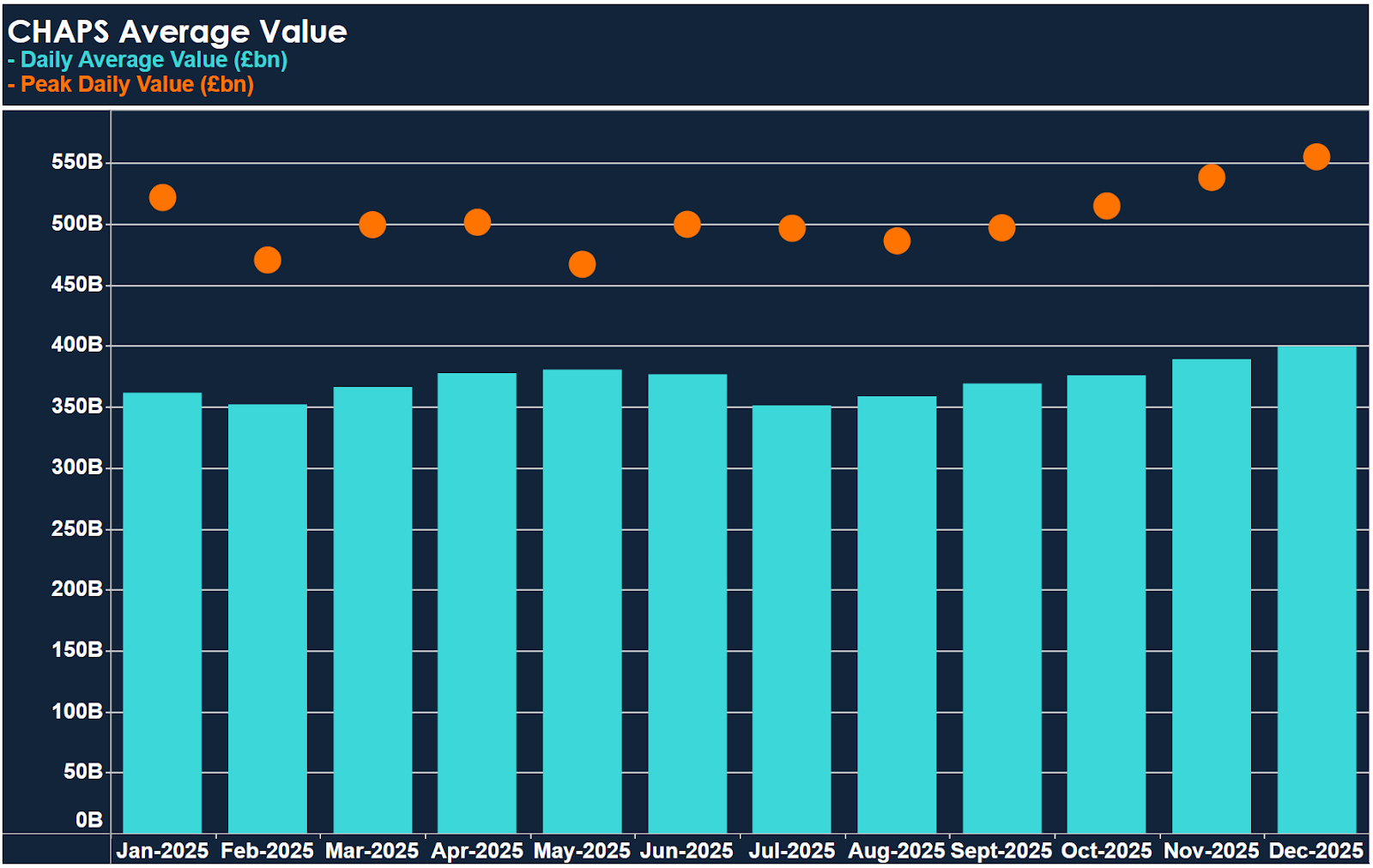

CHAPS (Clearing House Automated Payment System) is the UK's heavyweight payment champion. While it represents just 0.4% of UK payment volumes, it handles 91% of total sterling payment values. In 2025, CHAPS processed an average of £400 billion daily across 210,482 transactions (each payment averaging £1.7 million).

Source: Bank of England

Unlike newer payment rails that focus on instant consumer transfers, CHAPS focuses on high-value, time-critical GBP payments. When a payment absolutely must settle today, without reversal risk, CHAPS is the system enterprises fall back on.

In one line, CHAPS is the UK’s same-day, high-value payment system used for large and time-sensitive GBP transfers.

Four attributes of CHAPS make it the go-to payment method for B2B transactions:

- Same-day settled

- Irrevocable once processed

- Designed for high-value transactions

- Settled directly between banks

Common use cases of CHAPS include property completions, corporate treasury movements, tax payments, interbank settlements, and money market transactions.

How CHAPS Works Behind the Scenes

At a high level, a CHAPS payment moves directly from the sender’s bank to the recipient’s bank on the same business day. The mechanics matter if you are designing payment flows or exposing this option in a platform.

Here is the simplified flow of a CHAPS transaction:

- The sending bank submits a CHAPS payment instruction.

- The message is transmitted using SWIFT for secure and standardized financial messaging.

- Funds are settled in central bank money via the Bank of England.

- The receiving bank credits the beneficiary’s account.

There is no batching and no netting across days. Settlement happens individually and with finality.

CHAPS operates Monday to Friday, typically between 6:00 AM and 6:00 PM UK time, excluding UK bank holidays through the Bank of England's RTGS system. Each bank sets its own internal cut-off times, usually between mid-afternoon and early evening. If you miss the cut-off, the payment moves to the next business day.

Direct vs. Indirect Access

Not every institution connects to CHAPS in the same way and when you’re building or evaluating a CHAPS integration, understanding your access model is crucial.

Direct Participants

Direct CHAPS participants hold settlement accounts at the Bank of England and connect to the system directly. Currently, over 35 organizations hold direct access, including traditional banks and several challenger banks that have made the investment.

Direct access brings control and speed, but it also comes with heavy operational, compliance, and liquidity requirements.

As for the timeline, you can expect twelve to eighteen months from initial application to go-live.

Indirect Access

Indirect access means partnering with a direct participant who processes CHAPS payments on your behalf.

Here, you build the user experience and business logic while the partner handles the plumbing. Indirect participants typically pay £2 to £3 per transaction, with a maximum of £30, and end-users pay between £25 and £30.

For most businesses, indirect access is the pragmatic starting point. You can launch CHAPS capabilities in months rather than years, test market demand, and scale up to direct participation once volumes justify the infrastructure investment.

Benefits of CHAPS for Enterprise B2B Transactions

In addition to same-day settlements, ISO 20022 compliance, and other benefits, CHAPS offers more to enterprises that makes it a favorite for B2B transactions in the UK.

1. Insolvency Protection

CHAPS is designated under the Financial Markets and Insolvency (Settlement Finality) Regulations 1999. This means payments are legally protected even if the sending bank becomes insolvent after initiating the payment. The payment will settle even if the sender goes bankrupt.

2. Central Bank Money Settlement

CHAPS settles in central bank money on the Bank of England's books, which eliminates counterparty risk entirely. So, you're not trusting a commercial bank's solvency.

3. Legal Certainty Across Jurisdictions

CHAPS operates under well-defined UK law and settlement finality regulations, so there's clear legal precedent for how these payments are treated in cross-border situations and insolvency scenarios. For platforms dealing with international clients or complex corporate structures, this legal clarity is valuable because you know exactly where you stand.

4. Collateral Enforceability

Under the Settlement Finality Regulations, collateral security provided in connection with CHAPS is enforceable immediately, even if a participant becomes insolvent. The Bank of England takes full title transfer of collateral, meaning it can enforce without waiting for lengthy insolvency proceedings. This matters for platforms offering liquidity services or credit.

5. Intraday Liquidity Support

The Bank of England provides collateralized intraday liquidity to CHAPS participants. This means you can make payments throughout the day without needing to prefund your entire settlement account.

Drawbacks of CHAPS

CHAPS is meant for high-value transactions that prioritize timing and finality. When used for purpose it is not meant for, the drawbacks become noticeable.

1. Relatively Expensive

CHAPS isn't cheap, and that's by design.

Banks charge £20-35 per CHAPS payment, making it expensive compared to Faster Payments (often free for consumers) or BACS (a few pence). For platforms processing high volumes, these fees add up quickly.

2. Restrictive Operating Hours

CHAPS only operates 6am-6pm, Monday-Friday, excluding bank holidays. This creates problems for:

- International clients operating across time zones

- Urgent Friday afternoon payments that can't wait until Monday

- Time-critical transactions during holiday periods

3. UK Sterling Only

CHAPS is exclusively for GBP payments within the UK banking system. You cannot use it for international transfers or multi-currency payments, limiting its utility for global platforms.

Top CHAPS Use Cases

Understanding where CHAPS fits helps clarify your product roadmap:

- Property transactions remain the most visible use case. When someone buys a house in the UK, the completion payment, which is often in the hundreds of thousands of pounds, moves via CHAPS. Fintechs serving conveyancers, estate agents, or property investors need this capability.

- Corporate treasury operations use CHAPS for inter-company transfers, M&A transactions, and large supplier payments where same-day certainty matters. Treasury management systems that integrate CHAPS give finance teams the confidence to optimize working capital without payment timing risk.

- Financial institutions settle their own obligations through CHAPS. If you're building infrastructure for wealth managers, broker-dealers, or institutional investors, CHAPS is table stakes.

- Tax payments to HMRC for large corporations often move through CHAPS, particularly when deadlines are tight. Platforms serving accountants or finance departments need to support these time-critical government payments.

CHAPS vs Faster Payments vs BACS: Choosing the Right Rail

Here’s how CHAPS fits alongside other UK rails:

- Faster Payments: Best for low to medium value, real-time consumer and SME payments. Not ideal when transaction size or settlement certainty is critical.

- BACS: Optimized for bulk, scheduled payments like payroll and direct debits. Slow by design.

- CHAPS: Built for high-value, time-critical payments where failure or delay has real financial consequences.

Many enterprise platforms support all three and route transactions dynamically based on value, urgency, and risk profile.

CHAPS Meets Stablecoin Infrastructure

CHAPS and stablecoin infrastructure are complementary layers in a modern payment stack.

Also Read: How Transak Abstracts the Messy Middle of Stablecoin Payments

Use CHAPS when you need settlement finality under UK law, central bank money with zero counterparty risk, and integration with established financial market infrastructure. Use stablecoins via Transak when you need 24/7 availability, instant cross-border transfers at minimal cost, or programmable money with smart contract capabilities.

Smart platforms are built for both. A wealth management fintech might route a £5 million property deposit through CHAPS while offering USDC transfers for international remittances. A corporate treasury platform could use CHAPS for domestic UK settlements but switch to stablecoin rails for after-hours transactions or cross-border payments where correspondent banking is prohibitively expensive.

Want to upgrade your payments infrastructure?