RWA tokenization allows investors to buy digital tokens and attain fractional ownership of their underlying real-world assets.

For example, suppose 1 kilogram of gold is tokenized into 1000 tokens. In this case, you can buy one token and own one gram of that gold bar; if the value of gold appreciates, your token price will also increase.

Major advantages of RWA tokenization include:

- Faster settlement compared to the buying and selling of traditional assets.

- High liquidity as investors can own a small part of the expensive real-world asset.

- Availability of 24/7 platforms to buy, sell, or trade your assets, unlike traditional institutions that only allow transactions during working hours.

- The transparency that comes with blockchain technology powers the whole tokenization process.

- Elimination of intermediaries responsible for charging high brokerage fees for providing their services.

In this report, we'll uncover RWA tokenization, including its total addressable market size, the importance of blockchain oracle, core economic segments, early evidence, key challenges, and more.

What Are Real World Assets (RWA) Tokenization?

Real World Asset (RWA) tokenization is an innovation to transform the future of traditional RWA assets like real estate, commodities, art, and more. With the help of blockchain technology, RWAs are converted into digital tokens for investors worldwide.

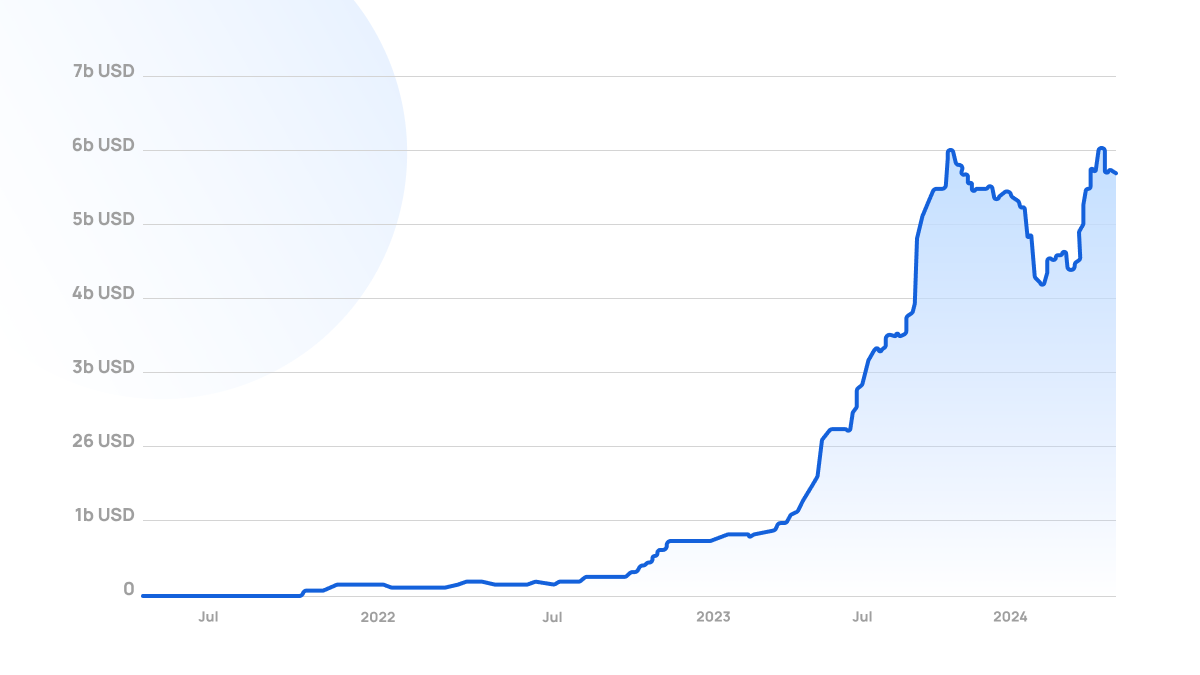

According to DeFiLlama, the RWA TVL is worth over $6 billion. Here, the Ethereum-based RWA single-handedly constitutes over $5 billion, and other blockchains like Tron, BSC, and Solana are also witnessing projects to tokenize RWA assets.

Leading asset managers, like BlackRock, are betting big on tokenization with $10 trillion on its tokenization vision. In his letter to investors, Larry Fink, the chairman, CEO, and co-founder of BlackRock, emphasized the importance of tokenizing asset classes.

Fink contends that the digital asset space has exciting applications based on the potential of its underlying technology. For this reason, BlackRock embraces blockchain technology to implement tokenization, starting with prominent asset classes like bonds and stocks.

“I believe the next generation for markets, the next generation for securities, will be tokenization of securities."

— Larry Fink | CEO, BlackRock

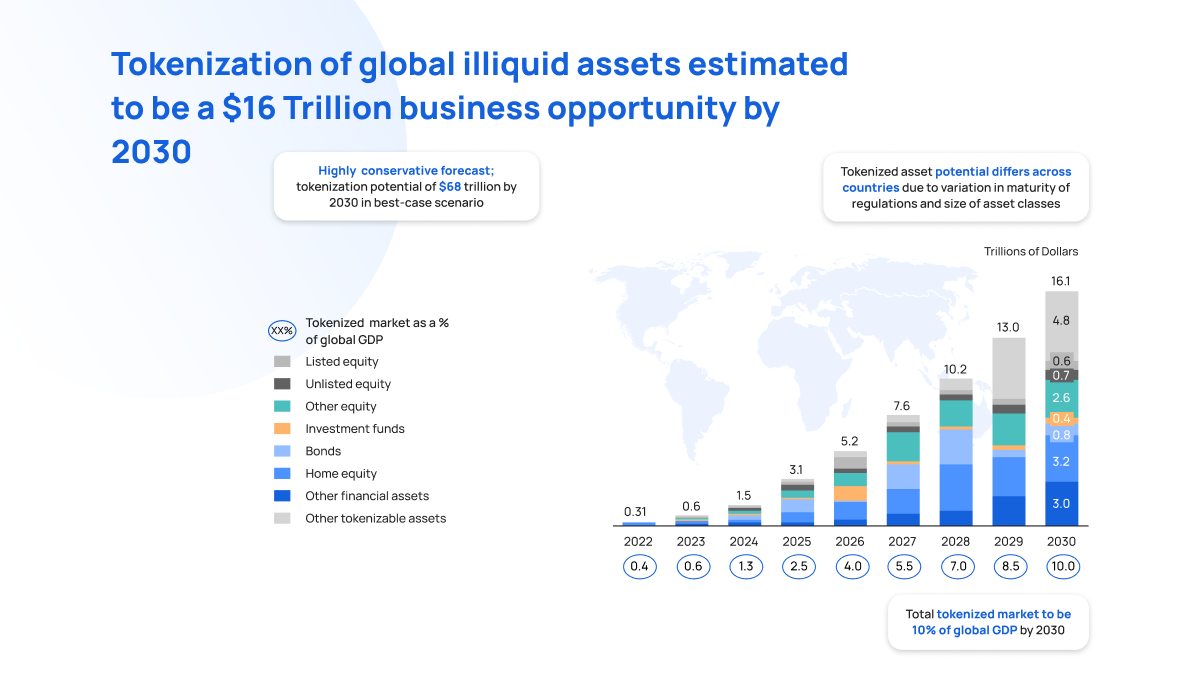

According to a collaborative report by the Boston Consulting Group and ADDX, the tokenization of illiquid assets is expected to create a business worth $16 trillion. Moreover, this report emphasizes that by 2030, the tokenized market will contribute 10% of the global GDP.

Total Addressable Market (TAM) Size of Tokenized RWAs

The tokenization of assets can be considered in its early stages; however, based on the market size of traditional assets, the number of those that can be converted into digital tokens is huge.

With the entry of major asset management companies, this transition process of traditional assets will cover valuation worth trillions of U.S. Dollars.

Citi has created a comprehensive report by consulting with domain experts to estimate the tokenization TAM for 2030. Based on their report:

- The real estate funds will reach a $20 trillion valuation with tokenized assets valued at $1.5 trillion by 2030.

- Private equity and venture capital are anticipated to have a $7 trillion valuation by 2030, with its digital assets constituting a 10% value of $0.7 trillion.

- The NFC & Quasi-Sovereign debt is expected to reach a $187 trillion valuation by 2030, with its tokenized assets reaching $1.9 trillion.

- The Repo, Securities Lending, and Margin collateral will reach a $42 trillion valuation with its tokenized assets at $1 trillion by 2030.

As more untapped RWAs enter tokenization, we can expect a much more significant growth in TAM.

Importance of Blockchain Oracles in RWA Tokenization

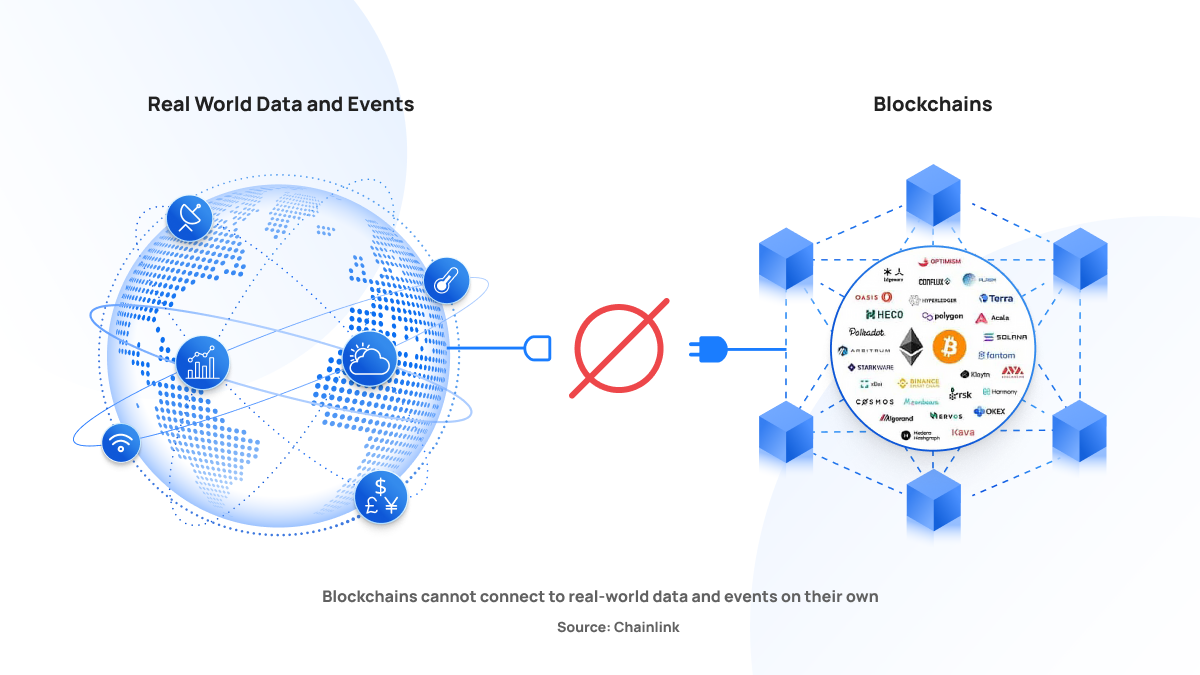

Blockchains cannot connect directly with the real world to make real-time data available for RWAs. For this reason, blockchain oracles play an important role in integrating the off-chain real-world data with the on-chain data.

Oracles create a hybrid smart contract to bridge the gap between the on-chain and off-chain data. This smart contract consists of a combination of off-chain oracle node and on-chain contract code.

Ethereum's co-founder Vitalik Buterin, on a podcast with Lex Fridman, points out that it is necessary for smart contracts to use off-chain data as stablecoins need price oracles to know the targeting price. Vitalik also mentioned that oracles are important for digital assets that mirror other financial assets.

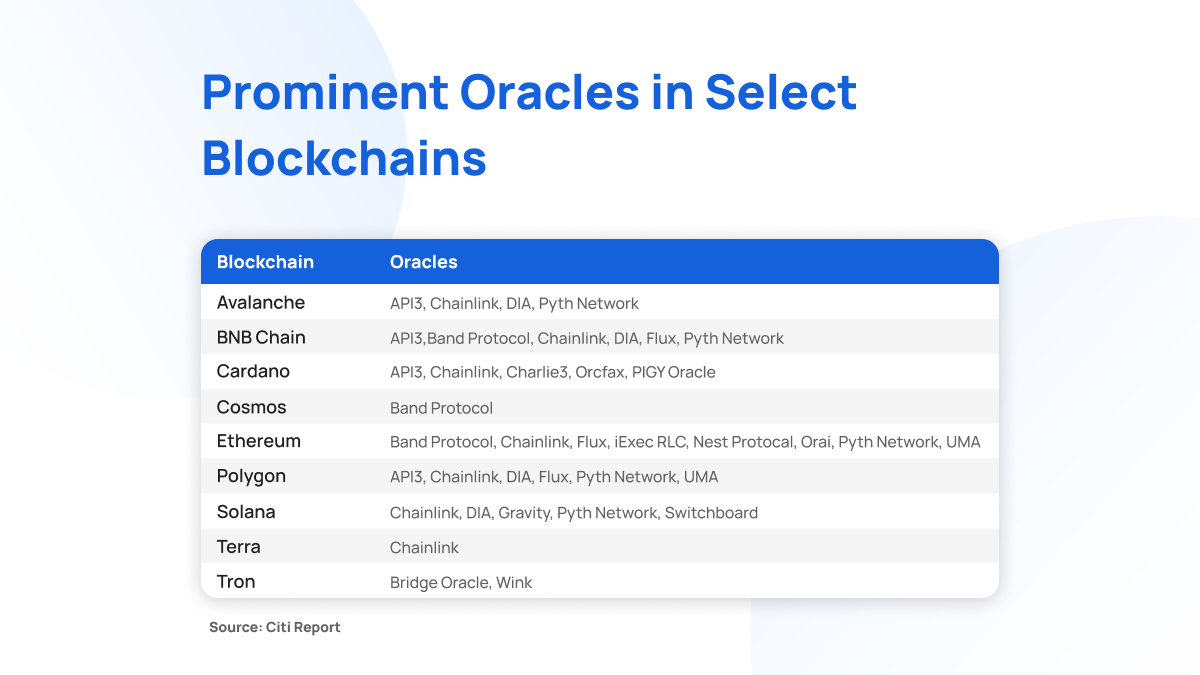

Oracles are available to power major blockchains like Ethereum, Polygon, Solana, and more. Chainlink is one of the best examples of oracles supporting numerous blockchains.

In a typical oracle-based transaction, the smart contract-based data requests from the on-chain contract code are first passed on to the off-chain oracle node. Then, the Oracle node verifies and sources external information using relevant APIs.

Finally, the required data is provided to the smart contract's storage with the help of an on-chain contract code.

Core Economic Segments and Tokenization

The tokenization of RWAs from the core economic segments is crucial in strengthening the base of the overall tokenized assets space.

Financial Services

Financial services can use tokenization to offer products and services with more liquidity to investors. Moreover, tokenized assets increase economic efficiency by reducing the time and cost associated with traditional financial services.

Investors can also benefit from the 24/7 marketplace where they can buy or sell assets anytime, regardless of weekends or holidays. As a result, the overall trading volume and market participation increases to a higher level.

Industrial Sector

Industrial asset tokenization converts physical assets like heavy machinery, devices, and production units into digital tokens. The availability of tokens in small value allows retail investors to own a part of the industrial asset.

In addition, the tokenization of supply chain-based assets enables real-time tracking, improving the system's overall efficiency. For example, Walmart partnered with the food traceability platform VeChain and achieved 200 million blockchain transactions.

Energy Sector

The world is moving toward renewable energy sources, and we can witness changes in our daily lives, including electric vehicles and solar home systems. Tokenization can transform this sector by distributing digital tokens that represent units of clean energy units.

The energy sector also has a huge potential in carbon credit tokenization, where each carbon credit represents the reduction of one ton of carbon emission. These carbon credit tokens can be brought, sold, and traded on supported marketplaces.

Real Estate

Real estate-based tokens are a major part of the ongoing RWA tokenization process. This sector, which was earlier accessible to wealthy investors, is now attracting retail investors as each token allows them to own a small portion of a plot, apartment, or commercial property.

For example, RealT is a platform that allows you to invest in fractional ownership of rental properties in the U.S. You can use this platform to buy a token for as low as $50 with rental income based on the rent of that particular property.

Early Evidence of RWA Tokenization

The world of RWA tokenization is already showing signs of how impactful it can be in the coming years. Some of the evidence to validate this impact include the following.

Introduction of More New Assets

The story around the tokenization of popular RWAs like real estate, gold, bonds, and stocks is not that new in the tokenization space. Inspired by these, non-conventional assets also started to get tokenized into digital tokens like Agrotoken, a platform that tokenizes agricultural products.

The Criptosoja token is the first token of the Agrotoken project that uses Ethereum's ERC-20 token standard. This token is equivalent to one ton of soy and in 1:1 parity.

High Surge in RWA Lending

The total RWA lending value was around $95 million during February 2021, and in February 2024, this lending value was reported to be over $10.7 billion, a whopping 11163% surge within three years.

Of this RWA lending value, almost 90%, or over $9.5 billion, is lent out by Maker, Truefi, and Maple Finance. With more competitors entering this tokenized lending space, exponential growth can be created.

Increased Activity around Ethereum RWA Tokens

The total number of RWA token holders on the Ethereum blockchain is over 97,000, with more than 205,000 total unique addresses. Moreover, these tokens have added around 38,000 holders in the last year.

The overall DEX volume of the RWA tokens also witnessed a massive surge since the beginning of 2024. This DEX volume of around $2.3 billion in December 2023 shot up to over $3.6 billion in April 2024.

Key Challenges of RWA Tokenization

The main challenges that RWA tokenization faces include:

- Market Accessibility: The tokenization represents various asset classes, even those with a physical presence in different countries, such as real estate. Considering this factor, developing and maintaining a marketplace that helps smooth token trading regardless of the user's physical location is important. This limitation in market accessibility can be challenging as regulations and taxation vary based on states and countries.

- Detailed Ownership Data: Owning a token represents the ownership of the underlying asset. As a result, it is important to establish clear and detailed rights that come with being an asset owner. Here, the projects that issue tokens must mention all conditions the token holder gains after buying the digital token for a fair ownership benefit.

- Lack of Awareness: The lack of awareness related to tokenized assets restricts traditional investors from buying digital tokens. Most investors from developing countries withhold these tokenized assets due to a lack of confidence in a newly emerged market. As a result, a much larger adoption is being slowed down.

- Lack of Standardization: Real-world assets from different jurisdictions have various rules and regulations based on their government policies. The major difference in these regulations restricts the creation of a universal framework for the tokenized RWAs. This complexity in establishing a standardized framework also restricts users from highly regulated countries from buying certain tokenized products.

Future of RWA Tokenization

The future looks exciting for RWA Tokenization with big financial players entering this game. Prominent names in the financial industry, such as JPMorgan Chase, HSBC, BlackRock, and Goldman Sachs, are betting on tokenizing RWAs.

The market value of tokenized U.S. Treasuries on public blockchains surpassing $1 billion is a great sign of where we are heading regarding tokenized RWAs. Franklin Templeton, Securitize, and Ondo Finance constitute almost 74% of the total market landscape of tokenized Government Securities.

Source: Dune.com

Despite the challenges faced by the tokenization space, including the regulatory hurdles, lack of awareness, and limits for standardization, RWA tokenization is expected to grow exponentially in the coming years.

Finally, with time, more traditional asset classes will enter into tokenization, providing investors with a wide range of investment opportunities to diversify their assets. As a result, we can witness more retail investor participation in high-valued RWAs like real estate, art, and precious metals.