Traditional prediction platforms are often biased, opaque, and controlled by intermediaries, leaving users with limited trust and fairness.

What if you could predict outcomes and earn rewards in a fully transparent, decentralized system without relying on middlemen?

Crypto prediction markets in DeFi offer a trustless way to forecast events using blockchain and smart contracts. Users can participate by placing predictions on ongoing betting events and be rewarded if their bets are spot on.

Following the 2024 U.S. elections, prediction markets attracted many eyeballs, with people betting on the candidates (Donald Trump and Kamala Harris). Taking this trend further, billionaire Elon Musk even posted on X favoring prediction markets on election results, highlighting the involvement of users’ real money.

https://x.com/elonmusk/status/1843132050242777187

According to Google Trends data, user search interest in the popular market Polymarket also surged during the U.S. election, reflecting heightened public curiosity and engagement in forecasting the outcomes through decentralized platforms.

Based on the CoinGecko research report, the crypto prediction market grew over 565% in the third quarter (Q3) of 2024. Here, the top three prediction markets also witnessed a combined betting volume of $3.1 billion compared to the $466.3 million in the previous quarter.

In this article, we'll explore crypto prediction markets, how they work, their differences from centralized ones, major components, a case study using Polymarket, use cases, advantages, notable names from this field, and more.

What Is A Prediction Market?

A prediction market is a public platform where people speculate on future events and place bets on specific outcomes. The participants place their bets, where they either win or lose all their money based on the final result.

These markets have a long history, dating back to the 16th Century when gamblers placeed bets on the results of church official selections. The election betting volume surged at the beginning of the 20th Century with almost $64 million based on a 2002 dollar valuation.

Prediction markets typically provide bettings in three main categories:

- Categorical Markets: In this category, participants have multiple options to choose from. For example, which brand will sell the most mobile phones this year: Apple, Samsung, Xiaomi, or OPPO?

- Binary Markets: Offer only two options for the participants. Example: Will Christiano Ronaldo score a hat trick today? YES or NO?

- Scalar Markets: Instead of fixed choices, the participants speculate based on a range of values or outputs. Example: What will the price of ETH be at the end of 2024, within a range of $2,000 to $5,000? Bettors who are more accurate in predicting the final price receive the highest payout.

Understanding Decentralized Prediction Markets

Decentralized prediction markets allow users to speculate on the outcome of future events by placing bets or stakes. Built on blockchain technology, these platforms eliminate the need for intermediaries using smart contracts to facilitate and manage transactions, outcomes, and rewards.

Augur is an example of one of the earliest forms of decentralized prediction market, launched in July 2018. As of October 2024, the market cap of the top prediction market coins is over $540 million.

The major limitations of centralized prediction markets were the restrictions imposed upon participants based on jurisdiction, bet size limits, and lack of anonymity. Decentralized prediction markets aim to provide equal opportunities for a global audience without the involvement of intermediaries.

Vitalik Buterin highlighted in one of his blog posts that prediction markets have long been regarded as the "holy grail" of epistemic technology. He sees potential for a breakthrough with the rise of A.I., which could flood prediction markets with vast knowledge and lower participation costs, potentially addressing the shortcomings that held back previous iterations.

How Do Decentralized Prediction Markets Work?

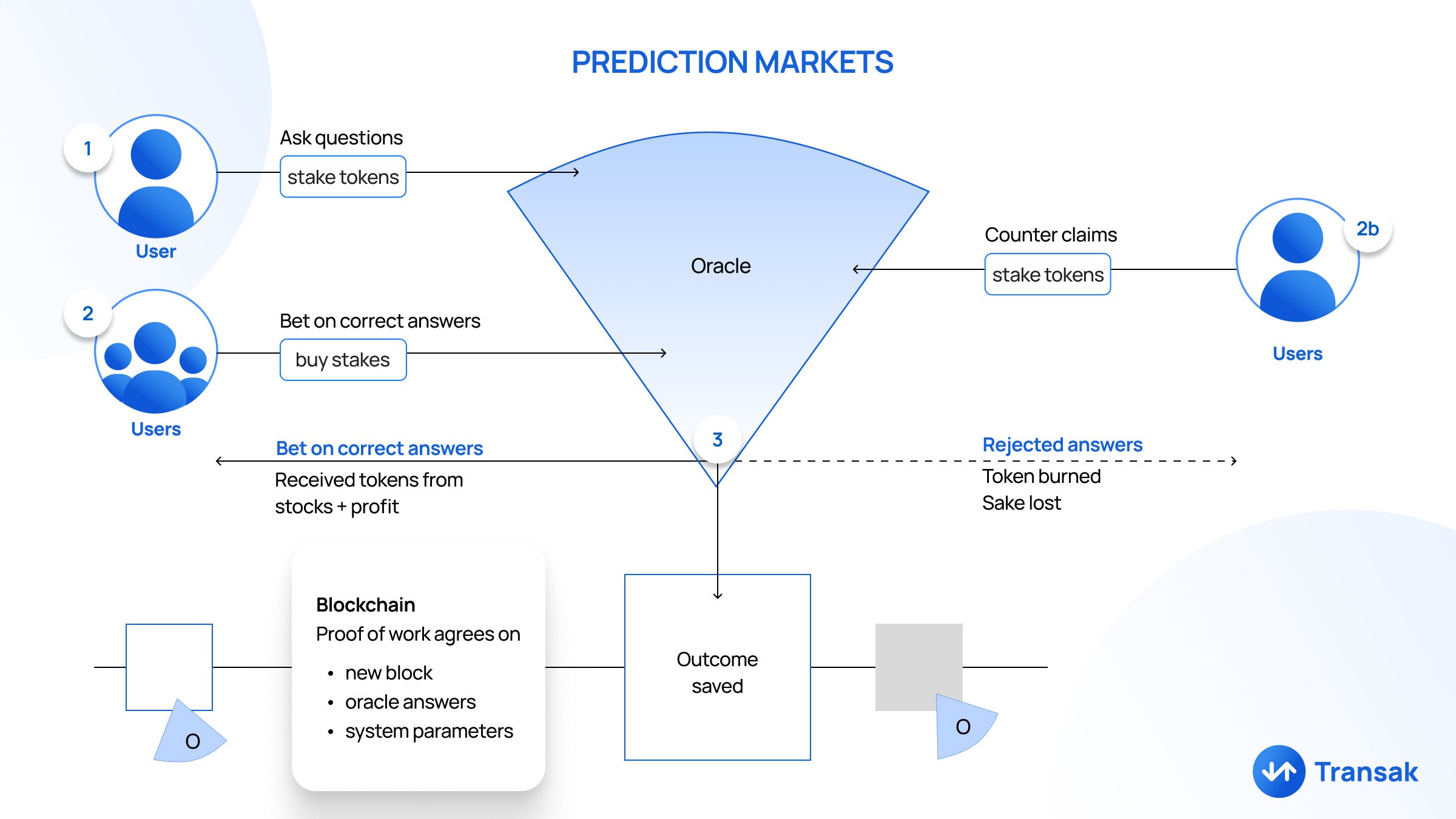

Decentralized prediction markets use data oracles and smart contracts to automate the market's operations, following the result. Typically, there are four main steps involved:

- Market creation

- Betting on outcomes

- Outcome resolution

- Dispute mechanism

- Blockchain integration

- User rewards and token dynamics

1. Market Creation

A user initiates a market by asking a question (e.g., "Will Bitcoin's price exceed $50,000 by December 31?").

The user stakes tokens to create the market and define the parameters, such as possible outcomes (e.g., Yes/No) and the closing date.

2. Betting on Outcomes

Other users participate by buying stakes in one of the possible outcomes. The price of these stakes adjusts dynamically based on market activity, reflecting the collective sentiment on the likelihood of each outcome.

For example, If many users bet "Yes," the price of "Yes" tokens increases, while the "No" tokens become cheaper. This dynamic pricing mechanism ensures a market-driven probability estimate for each outcome.

3. Outcome Resolution

Once the event concludes, the oracle comes into play. The oracle fetches off-chain data (e.g., Bitcoin's price at the specified time).

This data is relayed to the blockchain, where the prediction market smart contract verifies and saves the outcome.

Outcome Handling

- If the oracle confirms the correct answer (e.g., "Yes"), users holding "Yes" tokens receive a proportionate share of the total stake (stakes + profit).

- Tokens associated with the incorrect outcome (e.g., "No") lose their value.

4. Dispute Mechanism

If a user disagrees with the oracle's resolution, they can submit a counter-claim by staking additional tokens to challenge the result.

The system may escalate the dispute to a decentralized governance mechanism for resolution (e.g., voting or arbitration).

Rejected Outcomes

- If the counter-claim fails, the challenger loses their staked tokens, which are burned.

- This ensures economic disincentives for malicious or frivolous challenges.

5. Blockchain Integration

The blockchain (e.g., Ethereum, Arbitrum) ensures:

- Immutable storage of the market's data (e.g., stakes, rules, and outcomes).

- Execution of smart contracts to handle payouts and enforce market rules.

- Consensus on new blocks, oracle answers, and system parameters through decentralized mechanisms like proof-of-work (PoW) or proof-of-stake (PoS).

6. User Rewards And Token Dynamics

Users who bet on the correct outcome receive payouts in the form of:

- Their original stake.

- Additional profits from the stakes of incorrect outcomes.

Liquidity providers (those who stake assets to support the market) earn transaction fees proportional to market activity.

Decentralized vs. Centralized Markets

Features |

Decentralized Prediction Markets |

Centralized Prediction Markets |

|

Restriction |

Users are not restricted based on their location or local regulations. |

Restrictions are imposed on individuals based on citizenship and other jurisdictional regulations. |

|

Control |

It operates using deployed smart contracts without a central controlling authority. |

A central authority issues rules and controls registration and betting activities. |

|

Trust |

It is trustless, as the operations are automated using smart contracts. |

It entirely depends on the central authority behind the platform. |

|

Fees |

Lower fees are incurred due to the absence of intermediaries. |

Typically, higher fees are charged to participants. |

Major Components Of Decentralized Prediction Markets

The key components of a successful decentralized prediction market include:

- User Experience (UX): Without a smooth user experience, decentralized platforms find it difficult to onboard and sustain users. Participants must be able to create events, place bids, monitor live status, and receive winning funds seamlessly.

- Smart Contracts: These self-executing sets of instructions are deployed on the blockchain based on the operationality of the prediction market. These smart contracts take care of the bidding process till the fund distribution without any need for manual interference.

- Crypto Assets: Participants can place their bets for events with cryptos that the platform supports. It's better to choose stablecoins, as most platforms support them, to avoid price volatility based on the value change between the bet and the result.

- Oracles: The off-chain data from the real world, like a tennis match's result or stats, are delivered to the blockchain with the help of oracle services. This final output is an important factor in deciding the winning and losing bids.

Rise in Decentralized Prediction Markets: A Polymarket Case Study

Founded in March 2020, Polymarket is one of the pioneers of the decentralized prediction market built on Polygon. This market doesn't charge any trading, deposit, or withdrawal fees, and participants can use USDC on Polygon or Ethereum to deposit their funds on Polymarket.

Polymarket witnessed staggering monthly account growth, increasing from around 8,500 in January 2024 to over 158,000 in October 2024. This 18x surge is due to the growing demand for U.S. election 2024-based events in this decentralized market.

Along with the user expansion, the monthly volume also experienced exponential growth, rising from approximately $54 million to nearly $1.15 billion, representing a massive 2030% increase between January and October 2024.

This decentralized market succeeded in gaining user growth by offering a wide range of events across the world with high bet value. For example, users can choose events based on sports, crypto, politics, science, business, or pop culture according to their preference.

A single 'Presidential Election Winner 2024' prediction event on Polymarket crossed a trading volume of over $2 billion at the beginning of October 2024 and went upto over $3.6 billion before betting closed. Here, the participants can monitor the real-time stats of their candidates with a chance in percentage and a potential reward if their bet wins.

When it comes to bet size, around 85% of the users on Polymarket place their bids ranging between $0 to $500. The bet size reduces drastically with the increase in stake, with only around 1.5% of users betting above $5,000.

How To Participate In Decentralized Prediction Markets?

Typically, the majority of decentralized prediction markets follow simple procedures to ease user onboarding and increase participation. Users can follow these simple steps to place their bets on such platforms:

- Account Set Up: Users can create a new account on high-liquid markets to start their participation. For example, Polymarket provides a Polygon wallet to users after they create their account.

- Deposit Crypto Asset: Then users need to send supported cryptocurrencies to their wallets and connect them to the platforms. Most platforms also provide options to buy tokens from crypto marketplaces using cards and other payment methods.

- Browse and Choose Markets: Next, the user has to search for and select the required event based on their preferred interest. It's best to choose events with a high bidding volume that allows the user to buy or sell at any time.

- Place Bids: Buy shares on the platform using the deposited cryptocurrency at market price or set a limit order at the desired price. Here, users can analyze the potential return based on the current betting scenario to make informed decisions.

- Monitor Bids: After placing the bid, users can monitor their positions in real-time and add or remove their bet size accordingly if necessary. This dashboard provides a quick overview of live position value, volume traded, profit and loss, and more.

- Event Result Announcement: Each event comes with a fixed deadline at which the final results will be announced. For example, prediction events for the Super Bowl game end following the final score declaration.

- Avail Winning Fund: After an event's final result, the winning tokens are transferred to users who placed winning bets. This activity can be tracked from the platform's dashboard.

- Withdraw or Reassign Funds: Users can withdraw their funds from winning bets and transfer them to other supported wallet addresses. If they find more interesting events, they can use this fund to place more new bets.

Real-World Applications of Decentralized Prediction Markets

- Political Predictions: Due to their global relevance and impact, predictions on major global political events are a hot topic in prediction markets. For example, Gnosis has conducted various prediction markets on political events, including those of the U.S. presidential elections or Brexit, the U.K.'s departure from the European Union.

- Financial Market Forecasts: Participants can use decentralized prediction markets to forecast outcomes such as stock or crypto market prices, interest rates, economic indicators, and many more. An example of this is Augur's crypto price prediction events, where users can bet on whether the price of ETH/USD will exceed 10,000 within a provided period.

- Business Predictions: Users can make predictions related to business, such as product launches, company mergers, CEO changes, IPOs, and more. For example, Polymarket has an event named "Will Circle IPO in 2024?" with a betting volume of over $62,000 as of October 2024.

How Decentralized Prediction Markets Can Help

Crowd Wisdom

Crowd wisdom is the idea that large groups of people, when diverse and independent, can collectively make better decisions or predictions than individuals. Decentralized prediction markets harness this power by meeting key conditions for crowd wisdom, such as fostering diversity, offering incentives for participation, and ensuring that decisions are made independently without outside influence.

Real-Time Update

Decentralized prediction markets provide their participants with up-to-date data through Oracle services, unlike centralized polls, which take much longer to update. This real-time data allows users to make quick decisions based on the latest information, helping to maximize gains or minimize significant losses.

Transparency

Trust is an essential factor in prediction markets, as centralized platforms can manipulate the outcome of bids to their benefit. The transparent nature of decentralized prediction markets ensures that all transactions and data are openly recorded on the blockchain, preventing manipulation and fostering greater trust among participants.

Flexibility

Major platforms offer a wide range of events from various categories, with options to pick those with recent result announcements. This flexible nature of decentralized prediction markets helps users diversify their funds across multiple events and outcomes to minimize risk and maximize potential returns.

Notable Decentralized Prediction Markets

Hedgehog Markets

Hedgehog Markets, launched in 2021, is a decentralized prediction market built on Solana, offering faster transactions with low fees for its participants. The platform, which raised $3.5 million in funding in July 2021, provides a simple user interface that allows users to participate in events with just a few clicks after connecting their wallet and adding sufficient funds.

Politics is the major category offered by this market, along with other categories such as crypto, finance, and boxing.

Polkamarkets

Polkamarkets operates on Ethereum, Moonriver, Moonbeam, and Polygon to provide participants with an Automated Market Maker (AMM) algorithm similar to that of major decentralized exchanges (DEXs). This market has undergone security audits by popular firms like Hacken and has attracted over 59,000 users, generated more than 795K predictions, and recorded a total trading volume of over $3 million.

POLK is Polkamarkets' utility token, allowing its holders to create, curate, and resolve prediction markets.

Overtime Markets

Overtime Markets is a sports-focused decentralized prediction market built by Thales Protocol that functions using data feeds from Chainlink. Since its launch in May 2022, this market has conducted over 333 K transactions, with a total notional volume crossing $59.5 million.

Soccer constitutes the majority of the Overtime Markets, covering major leagues such as the Champions League, La Liga, Ligue 2, EFL Championship, and others.

Conclusion

Decentralized prediction markets are evolving rapidly, with increased user participation in recent years. The user-friendly platform interface, transparency, low fees, real-time tracking, and other factors help this emerging market onboard a new user base.

These markets are among the potential decentralized platforms where users can deploy their crypto assets to generate returns from winning bets. However, it's important to understand the underlying risks, as placing all funds on one event and losing them can result in the total loss of the deployed assets.

FAQ

1. Are prediction markets legal?

The legality of prediction markets varies by jurisdiction. Some countries regulate them as financial instruments, while others classify them under gambling laws or restrict them entirely.

2. Are prediction markets gambling?

Prediction markets are not strictly gambling; they are speculative tools. While they involve risk and reward, they are often used for data-driven forecasting rather than games of chance.

3. Are prediction markets accurate?

Prediction markets can be highly accurate (relatively speaking) as they aggregate collective intelligence and financial incentives, often outperforming traditional polling or expert predictions in forecasting outcomes.