Takeaways

Money was supposed to move faster. But the traditional system was lacking so much that today, money no longer moves, it gets ‘managed’.

How?

Because behind every digital transaction, there’s a jerry-rigged network of banks and payment processors that follow their own rules and take their own time to settle funds. Every transfer feels like a mini negotiation between systems that don’t speak the same language.

Circle came up with a brilliant solution to fix this fragmented money movement network. They call it Circle Payment Network, or CPN for short.

Also Read: Why Stablecoin Fragmentation Is a Problem (and What Can Fix It)

What is Circle Payments Network, CPN?

The Circle Payments Network (CPN) is a closed, permissioned settlement network built by Circle, the issuer of USDC, to enable instant, compliant, and programmable money movement between regulated financial institutions using digital dollars.

In simpler terms, it’s a private payments infrastructure for USDC where verified members such as banks, fintechs, and merchants can send and receive funds directly, across blockchains and borders, without relying on traditional intermediaries like SWIFT or card networks.

Essentially, CPN acts like the SWIFT network for stablecoins. Instead of just messaging payment instructions, it actually moves value instantly on-chain.

For participating institutions, that means they can:

- Move liquidity globally in real time.

- Settle merchant and B2B payments in stablecoins.

- Simplify treasury operations by bypassing multiple intermediaries.

- Access Circle’s fiat ramps for conversion when needed.

Also Read: What Are Stablecoins?

How Circle Payments Network Works

At its core, the Circle Payments Network functions as a global payment orchestration layer for USDC that connects banks, fintechs, and merchants into a unified settlement network where dollars can move instantly, compliantly, and across blockchains.

Source: CPN Whitepaper

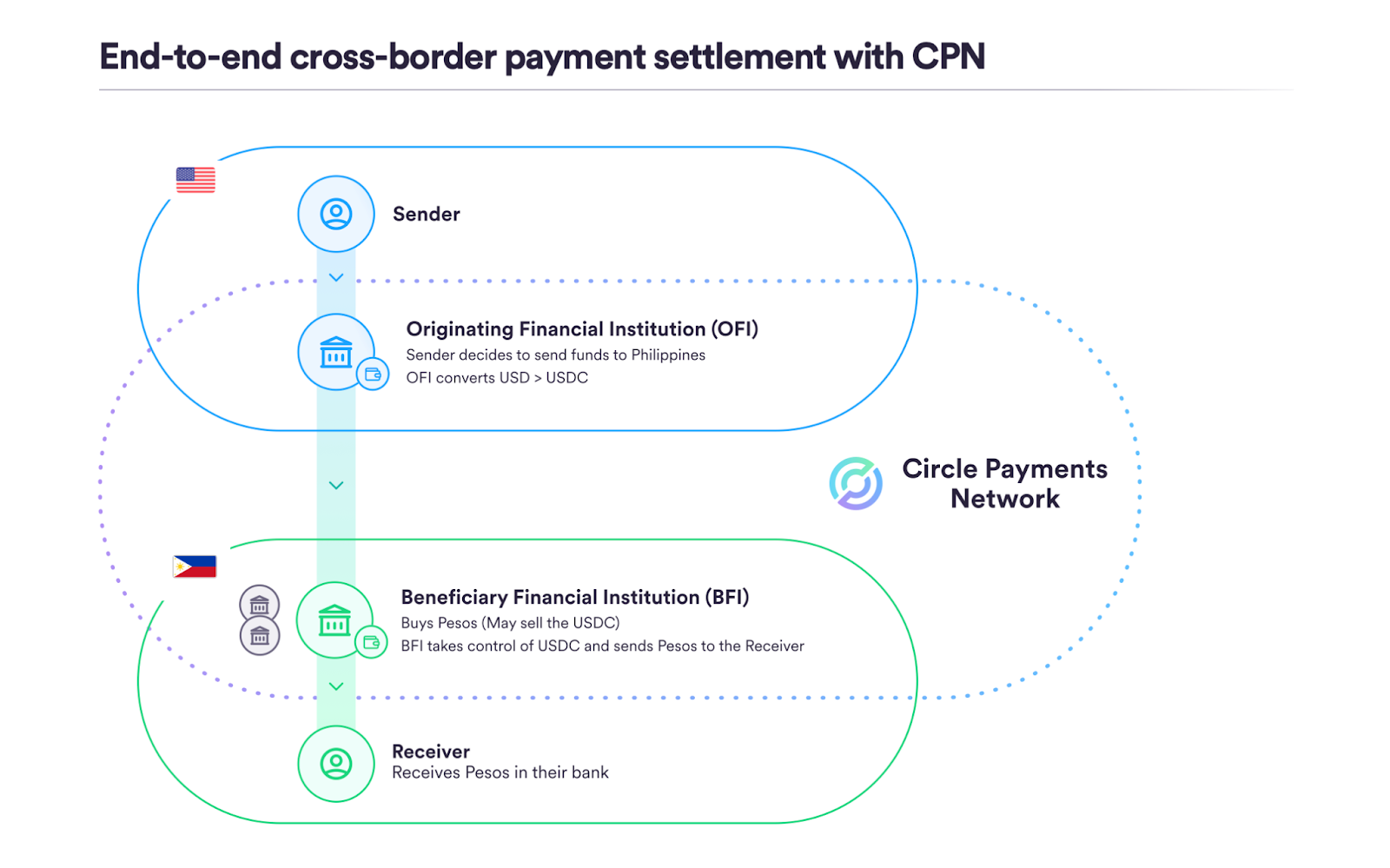

At a high level, every transaction on CPN flows through three essential components:

- The Originating Financial Institution (OFI)

- The Circle Payments Network (CPN)

- The Beneficiary Financial Institution (BFI)

1. Originating Financial Institution (OFI): The Sender’s Gateway

An OFI is the institution that initiates a transaction within the CPN. It could be a bank, fintech, payment processor, or merchant platform.

The OFI performs all compliance checks, including KYC, AML, and sanctions screening on its customers.

When a customer initiates a payment (for example, paying an invoice), the OFI converts the source currency (e.g., USD) into USDC, minting it directly through Circle’s infrastructure. Once minted, this digital dollar is now ready to move on-chain.

In short, the OFI’s role is to verify, mint, and originate the transaction.

2. Circle Payments Network: The Orchestration and Settlement Layer

This is where CPN’s magic happens.

When an OFI submits a payment request, CPN steps in to handle everything that typically slows down cross-border transfers, say, routing, quoting, and compliance synchronization.

First, the CPN queries liquidity providers or participating BFIs to fetch the best available quote (e.g., USD to BRL). The quote includes conversion rates, fees, and settlement times.

Once the quotation is approved, CPN encrypts and transmits payment data (including Travel Rule and beneficiary info) between both sides securely.

It then validates, signs, and executes the payment on-chain across the best-performing blockchain (e.g., Ethereum, Solana, or Avalanche).

All of this happens within seconds, with real-time traceability and programmable audit trails.

3. Beneficiary Financial Institution (BFI): The Receiver’s Gateway

The BFI is the receiving institution within the network.

- It decrypts and verifies the payment data shared by the OFI.

- Once validated, it receives the USDC on-chain.

- The BFI can then off-ramp that USDC into local fiat currency (e.g., BRL, EUR, INR) via its own banking connections or payment partners.

- Funds reach the beneficiary’s account (sometimes through instant payment systems like PIX (Brazil) or SEPA Instant (EU)) in minutes.

The result is a fully settled, cross-border transaction with near-instant finality, full compliance, and no correspondent banks in between.

Why the Circle Payments Network (CPN) Matters

In the old world, a simple cross-border transaction touches multiple banks, clearing houses, and correspondent networks before it arrives. Each one adds time, cost, and uncertainty.

The Circle Payments Network (CPN) changes that by removing intermediaries and building a direct, programmable settlement layer for global institutions. It matters because it translates blockchain efficiency into regulated financial infrastructure. That is something no public stablecoin network or traditional payment rail has yet achieved.

Also Read: Global Money Movement Report 2025: How Stablecoins Are Powering Next-Gen Finance

1. For Fintechs: Plug-and-Play Global Reach

Fintechs spend months integrating local payment partners to reach new markets. With CPN, they can plug into a single global network and instantly gain access to multi-currency settlement powered by USDC.

- No need for local banking relationships in every region.

- Instant access to on/off-ramps, liquidity providers, and compliance checks.

- Programmable APIs for remittances, payroll, and merchant settlements.

Fintechs can go global without rebuilding their payments stack.

2. For Banks: Infrastructure, Not Competition

Traditional banks play it safe wherever blockchain is involved, often due to compliance and custody concerns. So, CPN brings in much-needed regulatory assurance and traceability into on-chain money movement.

- Every participant is verified under Circle’s KYC and AML standards.

- Travel Rule data and transaction metadata flow securely between institutions.

- Settlement happens in USDC, a fully reserved and regulated digital dollar.

Banks can now experiment with blockchain rails without giving up regulatory control.

3. For Businesses: Real-Time Cross-Border Settlement

Large corporations and SMEs often struggle with FX inefficiencies and settlement delays in global trade. With CPN, businesses can:

- Settle invoices in minutes instead of days.

- Receive transparent, guaranteed quotes (no hidden FX markups).

- Track every transaction on-chain with auditable finality.

Treasury teams get predictability, liquidity, and visibility in real time.

How CPN Compares to Existing Payment Systems

|

Feature |

Circle Payments Network (CPN) |

Public Stablecoin Transfers |

SWIFT |

Visa B2B Connect |

|

Primary Function |

Institutional stablecoin settlement network |

Peer-to-peer blockchain transfers |

Messaging system for banks |

Cross-border settlement network for enterprises |

|

Settlement Type |

Instant on-chain with built-in compliance |

Instant on-chain (but in regulatory gray zone) |

1–5 days via correspondent banks |

Near real-time (within participating banks) |

|

Participants |

Verified institutions (banks, fintechs, PSPs, corporates) |

Anyone with a wallet |

Banks only |

Banks & corporates |

|

Currency Support |

Fiat-backed stablecoins (e.g., USDC, EURC) |

Crypto & stablecoins |

150+ fiat currencies |

Major fiat pairs |

|

Compliance |

Network-enforced KYC, AML, and Travel Rule compliance |

Varies by user & jurisdiction |

Bank-regulated, country-specific |

Bank-regulated, enterprise-level |

|

Transparency |

High (transparent on-chain audit trails) |

High (public blockchain data) |

Low (limited visibility during settlement) |

Moderate (enterprise dashboards) |

|

Programmability |

High, with regulated programmability for institutions |

High, but unregulated |

None |

Limited APIs |

|

Availability |

24/7/365 |

24/7/365 |

Limited to banking hours |

Business hours per region |

|

Interoperability |

Unified cross-chain routing and fiat integration |

Fragmented across chains |

Poor with siloed systems |

Limited within Visa network |

|

Use Case Focus |

Institutional settlements, treasury, and global commerce |

Retail, DeFi, remittances |

Interbank messaging |

Enterprise FX and B2B payments |

|

Example Transaction |

USD → BRL via USDC on-chain + instant off-ramp via PIX |

USDC → USDT between wallets |

USD → BRL via 3 correspondent banks |

USD → EUR within Visa members |

How to Use the Circle Payments Network (CPN)

Unlike traditional payment networks that rely on intermediaries and manual processes, the Circle Payments Network is designed for direct participation by regulated institutions.

CPN isn’t a consumer product. It’s an infrastructure layer that banks, fintechs, and enterprise platforms can plug into through Circle’s APIs and compliance onboarding process.

So, using CPN as an individual is not possible (at least as of now). And for the curious still reading this, here’s what the process looks like end-to-end:

- Join the Network: Apply as an Originating Financial Institution (OFI) or Beneficiary Financial Institution (BFI). Circle conducts KYC, AML, and sanctions checks before granting access.

- Integrate with Circle APIs: Connect through Circle’s API suite to enable USDC minting/redemption, payment initiation, FX quoting, and Travel Rule data exchange.

- Initiate a Payment: The OFI requests a quote (e.g., USD→BRL), receives the best rate from network liquidity providers, mints USDC, and signs the transaction digitally.

- Settle On-Chain: CPN routes, validates, and executes the transaction securely across the optimal blockchain — ensuring instant, auditable settlement.

- Convert and Reconcile: The BFI receives USDC, off-ramps it to local fiat (e.g., via PIX or SEPA Instant), and credits the recipient’s bank account — all within minutes.

Why On/Off-Ramps Matter for Networks Like CPN

Even the most advanced payment networks are only as powerful as their access points. For the Circle Payments Network (CPN), that means connecting the on-chain world of stablecoin settlement with the off-chain world of local currencies and real users.

This bridge is made possible by on- and off-ramp providers like Transak, which enable individuals and businesses to move seamlessly between fiat and stablecoins. By supporting local payment methods globally, Transak makes it possible for users to fund wallets, pay merchants, and withdraw to bank accounts, all while staying within regulated channels.

Conclusion

If traditional payment orchestrators connect payment methods, the Circle Payments Network connects money itself by orchestrating how USDC flows between institutions in real time.

By connecting banks, fintechs, and enterprises through a unified network, Circle is redefining financial infrastructure. Transactions that once required days and multiple intermediaries can now settle in seconds, with data-rich compliance built directly into the flow of money.

As more participants join the network, the programmable foundation for the next generation of global payments that Circle is laying down will only get stronger.

FAQ

Is Circle Payments Network a blockchain?

No. The Circle Payments Network (CPN) is not a blockchain. It’s a permissioned payment settlement layer built atop of existing blockchains.

Instead of creating a new chain, CPN connects multiple blockchains where USDC operates (like Ethereum, Solana, and Avalanche) and enables regulated institutions to send, receive, and settle funds instantly using stablecoins.

Is Circle Payments Network Layer-1 or Layer-2?

The Circle Payments Network is neither Layer-1 nor Layer-2. It’s a network layer that sits above both, enabling cross-chain payments and institutional settlements using USDC.

While Layer-1s handle the actual on-chain transactions and Layer-2s improve scalability, CPN coordinates how those transactions move between verified financial institutions.

Who can use Circle Payments Network (CPN)?

The Circle Payments Network is designed for regulated entities, not individual consumers. Participants include:

- Banks and financial institutions

- Fintechs and payment processors

- Enterprises managing cross-border payments

- Liquidity and FX providers

Can I use Circle Payments Network (CPN)?

No, you can’t use CPN directly unless you’re a regulated institution such as a bank, fintech, or payment provider. It’s not open to individual users or retail customers.