Hawaii has recently adopted a more welcoming stance towards cryptocurrency. As the Aloha State ventures further into the world of cryptocurrencies and blockchain technology, Transak is thrilled to announce its official launch in Hawaii, providing a much-needed gateway to Web3 for individuals and businesses alike.

The establishment of the Digital Currency Innovation Lab (DCIL) in 2019 marked a pivotal moment for the cryptocurrency industry in Hawaii. By providing a regulated sandbox environment, the DCIL allowed qualified cryptocurrency businesses to operate while gathering operational data and observing the activities of participating companies. This observational study sought to determine the most appropriate regulatory environment for the industry to serve the state of Hawaii and its consumers.

After concluding the four-year study in June 2024, Hawaii's governing regulatory agencies announced in a joint press release that the business activities of digital currency companies should not be classified as money transmission under Hawaii law. As a result, starting July 1, 2024, cryptocurrency exchanges and businesses are no longer required to obtain a money transmitter license to operate in the state. This regulatory shift creates a more supportive environment for cryptocurrency businesses in Hawaii, promoting innovation and industry growth.

According to a report by Miq Intelligence, Hawaii expresses the greatest interest in cryptocurrency among all US States. Despite the growing interest in cryptocurrencies, the people of Hawaii faced significant hurdles in Web3 onboarding like cryptocurrency acquisition using fiat.

Transak offers a compliant solution for these needs. Transak Limited and Transak USA LLC are registered as Money Services Businesses (MSBs) under the Financial Crimes Enforcement Network (FinCEN). As part of this registration, Transak fully complies with the Bank Secrecy Act, ensuring that all transactions are secure and adhere to stringent anti-money laundering (AML) and know-your-customer (KYC) requirements. This regulatory compliance is crucial for maintaining transparency and trust in the evolving world of digital assets.

Transak's features are designed to cater to both newcomers and experienced users. The platform's intuitive interface guides users through setting up and managing their digital wallets, ensuring their assets are safe and secure. Hawaii residents can get started in just a few minutes, and use the app to access hundreds of cryptocurrencies in seconds.

“We believe that Transak has the potential to play a major role in driving the adoption of Web3 in Hawaii. Our platform makes it easy for individuals and businesses to access the benefits of this exciting new technology. This strategic expansion aligns with Hawaii’s progressive stance on cryptocurrency adoption and digital innovation, positioning Transak as a key player in the state’s evolving financial landscape,” said Sami Start, CEO of Transak.

As part of this launch, several of Transak’s key partners, including BitPay, MetaMask, Changelly, and Trust Wallet, are now live in Hawaii. Hawaii represents a high-potential, yet underexplored market for these platforms. Transak has consistently supported its partners with seamless user onboarding, and with this expansion, partners operating in the USA can now unlock access to Hawaii. This move enables users to tap into the broader Web3 ecosystem with a diverse range of global and localized payment options, enhancing their experience and expanding market reach.

This expansion not only enhances the ecosystem of digital finance but also empowers local users and the millions of tourists visiting the Aloha State each year to easily access and use cryptocurrencies. These integrations allow customers to effortlessly onboard using familiar wallets and services, enhancing the overall user experience.

Recently, Transak achieved ISO/IEC 27001 certification, a globally recognized standard for managing information security risks. This certification reflects Transak’s commitment to implementing rigorous security measures that protect user data and ensure operational integrity.

Soon after, Transak became the first crypto on/off-ramp provider to attain SOC II compliance, which confirms our systems meet the highest standards for data security, availability, and confidentiality. These certifications are vital for fostering trust with users and partners, especially in a financial landscape where security is paramount.

Transak’s expansion into Hawaii marks a significant step forward in bridging the gap between fiat and crypto, providing users with an easy, compliant, and secure way to purchase and sell digital assets. With a user-friendly platform and focus on simplicity, Transak aims to make the Web3 experience accessible to everyone. Hawaiians can now effortlessly purchase cryptocurrencies using their credit or debit cards, eliminating the need for complex exchanges and transfers. Transak also offers faster KYC processes, allowing users to get started quickly, and offers localized payment methods for added convenience.

Transak's features are designed to cater to both newcomers and experienced users, offering high purchase limits and multiple payment methods for flexibility. Additionally, with support in over 160 countries and 170+ cryptocurrencies, our products connect Hawaii to the global Web3 community. Transak also integrates with most of the popular wallets and is accessible via 350+ dApps, providing a seamless and comprehensive Web3 experience.

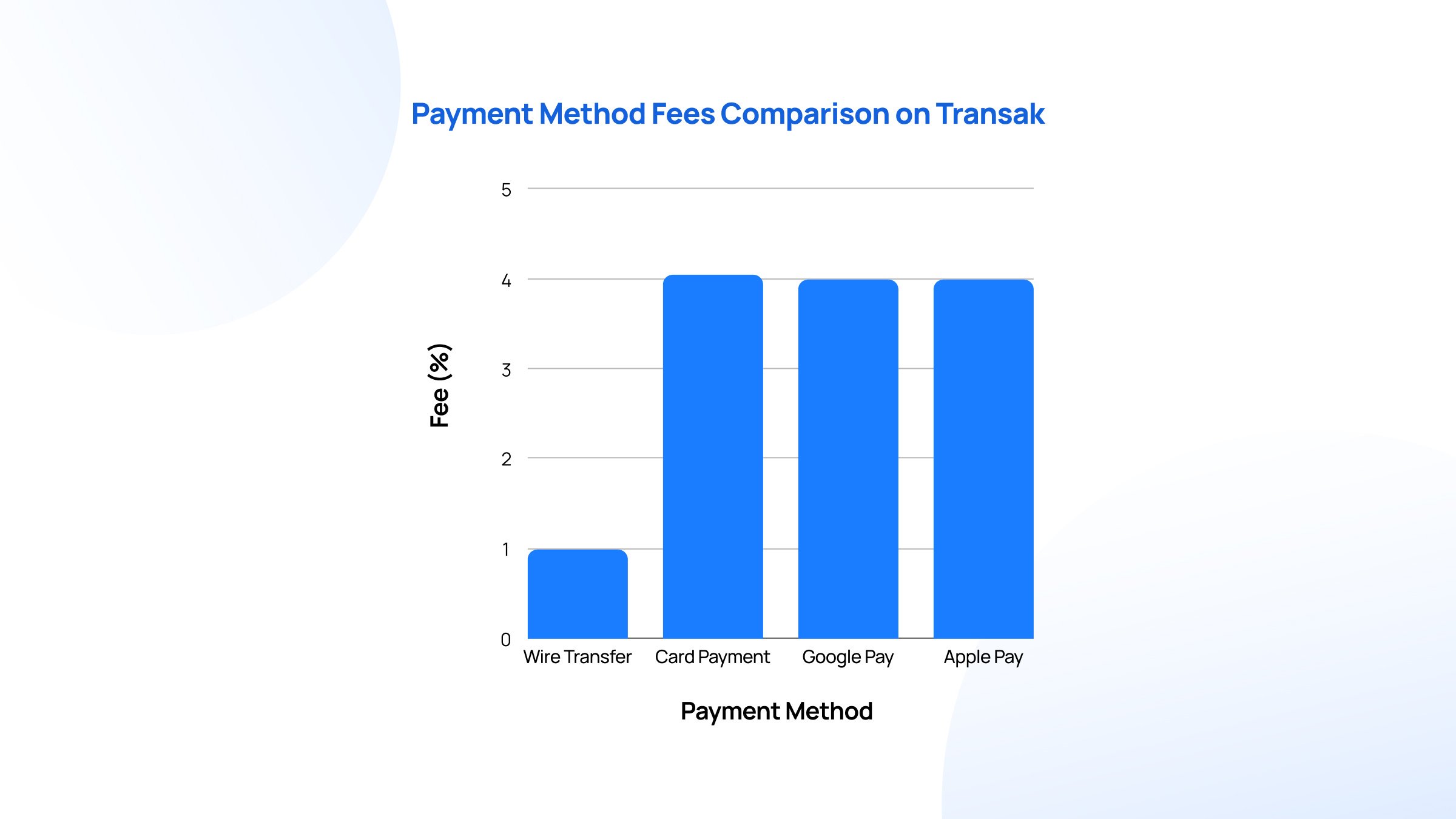

Further, to keep up with the rising demand for cryptocurrency in the region, Hawaiians can leverage wire transfers to purchase large sums (starting at $2,000) at relatively lower fees.

Prior to Transak, Hawaiians had no way of using the very familiar wire transfer payment method for cryptocurrency purchases. Conventional payment methods were too fee-heavy.

About Transak

Transak is the world's most compliant and largest Web3 payments infrastructure provider, serving over 5.7 million users across 160 countries. It powers 350+ platforms, facilitating the purchase and sale of digital assets with its API-driven fiat-crypto on/off-ramp, NFT checkout, and other solutions that simplify KYC, compliance, payment methods, and customer support.

Headquartered in Miami, US, and incorporated in Delaware, Transak has a tech hub in Bengaluru and offices in London, Milan, Dubai, and Hong Kong.

For more information, visit transak.com or follow us on x.com/transak and linkedin.com/company/transak.