You might have seen this new term popping up in online chats or noticed it in a piece by one of your favorite columnists.

Crypto Restaking.

Unlike flashy meme coins or the latest NFT drop, crypto restaking is a more foundational concept. It’s about potential that’s locked away inside assets you already hold, but perhaps... not working enough.

In traditional staking, you lock up your crypto (say ETH on the Ethereum) to help secure the network. Proof of Stake demands this. In return, you get rewards – honest work for honest yield. But that’s just your assets doing the basics. The bare minimum.

Crypto restaking asks a simple-yet-profound question: What if staked assets, already securing one network, could lend their strength and trust to secure other things simultaneously without being unstaked?

In this article, we’ll explore restaking in crypto, the role it plays in securing multiple networks, different restaking protocols, and more.

What is Restaking in Crypto?

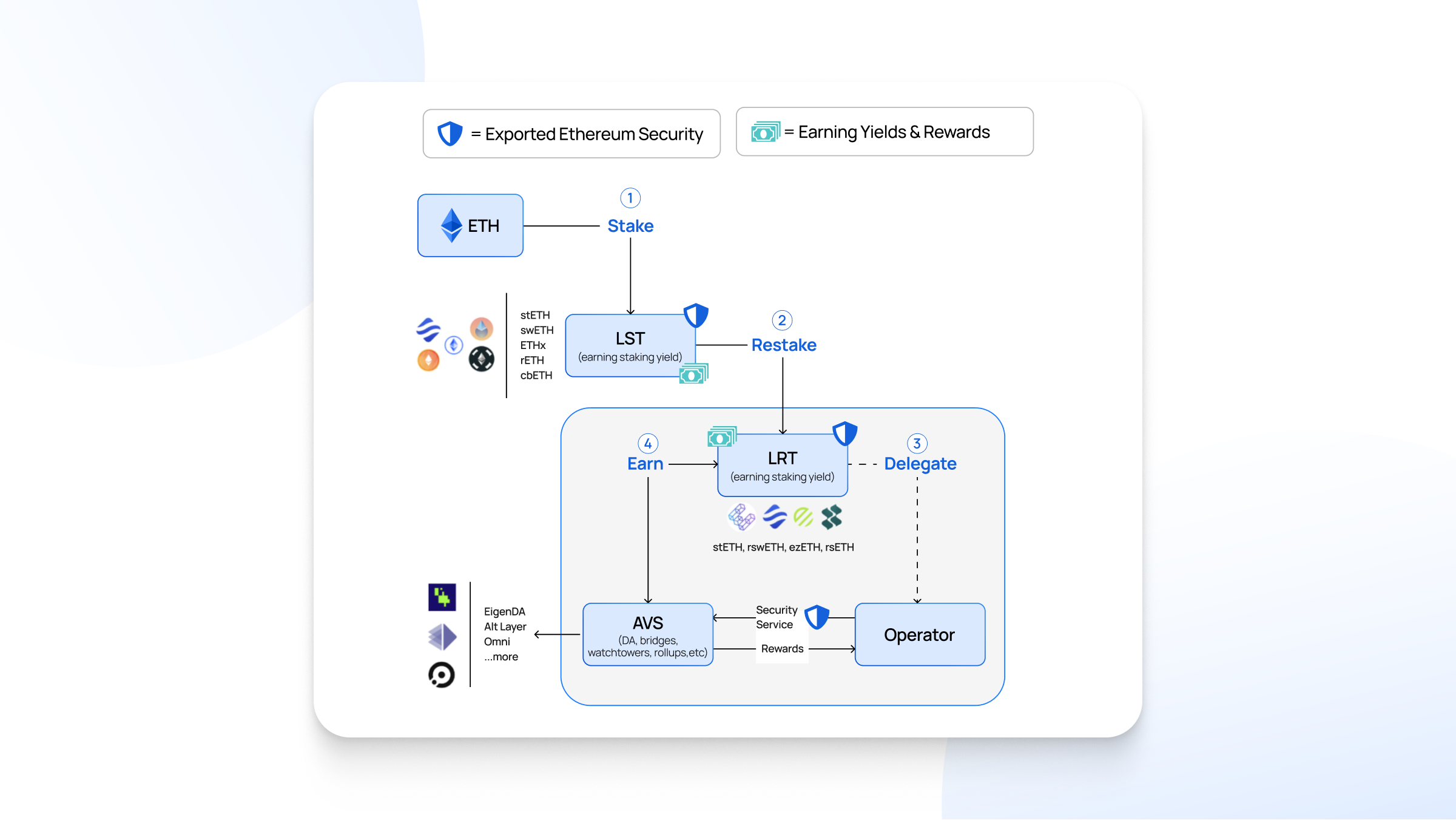

Restaking in crypto means using staked assets to secure more than one network or protocol at the same time, instead of locking them for just one chain or one use.

Think of your staked cryptocurrencies, like ETH, validating transactions on the blockchain. That's one of the primary duties of a PoS-blockchain’s native token.

Now, restaking allows you to take that same stake, that same locked capital, and extend its security umbrella over other protocols and systems being built within or alongside the Ethereum ecosystem.

It’s like using the foundation of a skyscraper not just for the main building, but also to anchor surrounding structures, making the whole complex stronger and more interconnected. Your same coins, already committed, are now doing double, triple, maybe even quadruple duty.

This is NOT liquid staking, though they are related. With liquid staking, you stake your ETH and receive Liquid Staking Tokens (LSTs) like stETH or rETH. These LSTs represent your staked position but remain liquid – you can trade them, use them in DeFi, etc., while still earning staking rewards from the underlying staked ETH. It frees up capital and gives it mobility.

Restaking takes this a step further.

It often uses LSTs (in liquid restaking) or the native staked asset itself (in native restaking) and opts them into securing additional systems. These systems are often called Actively Validated Services (AVSs).

What are AVSs?

Actively Validated Services (AVSs) are modular plugins that need to be secured. Data availability layers, sequencers, oracle networks, virtual machines, and bridges are a few examples.

Think of AVSs as new protocols eager to bootstrap their trust without building their own validator set from scratch.

These “protocols” act as the intermediary, the platform that allows your staked assets to provide this scalable security. EigenLayer is the pioneer here, the name you’ll hear most often, built initially on Ethereum's social consensus and security layer. But there are many others.

.png)

At its core, restaking works by extending the slashing conditions of the base layer (like Ethereum) to these additional services (AVSs). Slashing is the penalty validators face if they act maliciously or negligently—they lose a portion of their staked assets.

When you opt into restaking, you agree that your staked assets can also be slashed if the validators you're delegated to misbehave while securing these additional protocols. You're essentially saying, "My stake guarantees honesty not just on Ethereum, but also on these specific AVSs I choose to secure."

This requires validators to run additional node software for the AVSs they support. It’s more work for them, more responsibility. But it’s also the source of additional rewards.

There are two main paths:

- Native restakig

- Liquid staking

1. Native Restaking

.png)

If you're running your own validator on Ethereum, you can point your withdrawal credentials to the restaking protocol's smart contracts (like EigenLayer's EigenPod).

Your validator duties on Ethereum continue as normal, but you can now opt-in to validate AVSs using that same staked ETH. You earn staking rewards from Ethereum plus additional yield from the AVSs you help secure.

This path offers potentially higher rewards but involves more technical overhead and direct slashing risk tied to your validator's performance across all secured networks.

2. Liquid Restaking

.png)

This is the more accessible route for most potential participants. You hold LSTs (like stETH, rETH, cbETH). You deposit these LSTs into a restaking protocol. The protocol then "restakes" these LSTs, directing the underlying staked ETH's security potential towards chosen AVSs. You earn your base LST yield plus rewards from the restaking activities, often distributed as points or additional tokens.

It's simpler, doesn't require running a validator, but might involve intermediary smart contracts and slightly lower net rewards than native restaking due to fees.

Popular liquid restaking tokens (LRTs) bundle various LSTs and manage the restaking process, aiming for diversification and optimized yields.

Between late 2024 and early 2025, many new staking protocols emerged, each with a unique focus and features. These protocols cater to user preferences and blockchain ecosystems, primarily Ethereum and Bitcoin.

Below is a breakdown:

|

Protocol |

Primary Supported Asset(s) |

Type of Restaking |

Focus/Key Features |

Approximate TVL (Early 2025) |

Potential Yield |

Key Security Considerations |

|

ETH, LSTs |

Native & Liquid |

Shared security for Ethereum AVSs |

> $15 Billion |

Variable based on AVS participation |

Slashing, Centralization |

|

|

Any ERC-20 |

Native |

Permissionless shared security for any ERC-20 |

> $2 Billion |

Variable |

Immutability, Decentralization |

|

|

ETH |

Liquid |

Non-custodial liquid restaking |

> $2.8 Billion |

Staking + Restaking + Points |

Non-custodial |

|

|

BTC |

Native |

Bitcoin restaking for BVS |

~$310 Million |

Variable based on BVS participation (in other tokens) |

Programmable slashing |

|

|

ETH, stETH, ETHx |

Liquid |

Scalability & liquidity for ETH restaking |

> $1.5 Billion |

Up to 20% APR |

Audits, Bug bounty |

|

|

ETH |

Liquid |

Liquid restaking with EigenLayer integration |

> $150 Million |

Staking + Restaking + Pearls + EigenLayer Points |

Security collaborations |

|

|

ETH |

Liquid |

Maximizing returns & security for ETH, Native Liquid Restaking Protocol (nLRP) |

~$279 Million |

Variable |

Security focus |

|

|

ETH, LSTs |

Liquid |

LRT & strategy manager for EigenLayer & Symbiotic, Multi-chain support |

> $700 Million |

Variable |

Security partnerships, Audits |

|

|

BTC |

Native |

Trustless Bitcoin staking for PoS security |

> $4 Billion |

Variable based on BSN participation (in other tokens) |

Trustless design, Audits |

Simply put, protocols like EigenLayer are marketplaces or coordination layers. They connect the supply of staked capital (from native restakers and LST holders) with the demand for security (from AVSs).

These protocols manage the restaking process:

- Registering stakers (native or liquid).

- Registering AVSs seeking security.

- Allowing stakers (or LRT protocols acting on their behalf) to delegate their restaked assets to node operators securing specific AVSs.

- Handling the attestation and validation information from operators for these AVSs.

- Enforcing slashing conditions across multiple networks or services based on the agreed restaking terms.

- Distributing the additional rewards generated by the AVSs back to the restakers.

Regardless of the protocol, the underlying goal is always the same: network security scaling in a cost-effective approach and well-established blockchain networks supporting the growth of other protocols and networks.

Why Bother? The Allure of Capital Efficiency and Improved Rewards

Why are people talking about restaking opportunities? Why take on the added complexity, the added slashing risks?

1. Capital Efficiency

This is the big one. Your assets staked are no longer doing just one thing. They're multitasking. The same capital secures the main chain and potentially multiple AVSs.

It’s like making your money work harder, unlocking its latent potential without needing more capital. This enhances the overall value proposition of staking.

2. Additional Yield/Improved Rewards

Securing more systems means earning more rewards. AVSs pay fees for the security they borrow. These fees flow back to the restakers (native and liquid) and the operators validating the AVSs.

This promises extra rewards on top of standard staking yield, creating opportunities to earn staking rewards from various protocols simultaneously. It’s a way to compound your earnings potential on your blockchain assets.

3. Enhanced Security for New Protocols

For new protocols, bootstrapping security is incredibly expensive and time-consuming. They need to attract enough validators and staked capital to become robust.

Restaking offers a shortcut. They can eventually rent security from the massive pool of staked ETH (or other staked assets on other chains), leveraging Ethereum’s economic trust.

This lowers the barrier to entry for innovation in areas like data availability layers, bridges, and other crucial security infrastructure. It helps secure the broader blockchain ecosystem. It's a way to provide scalable security tailored to network demands.

The Other Side of the Coin: Understanding the Risks

Nothing comes for free, especially not in crypto. The promise of additional yield walks hand-in-hand with new risks. It's crucial to see both sides, to understand what you're opting into.

1. Increased Slashing Risks

This is the most direct risk of restaking.

Your staked assets are now on the line for validating potentially multiple systems. If the operator you delegate to misbehaves on any of the AVSs they are securing with your stake, your assets could be slashed.

While protocols try to mitigate this (e.g., attributing slashing for a specific AVS only), the fundamental risk surface area increases. Misbehavior on an AVS could impact your base layer stake. These are added slashing risks compared to traditional staking.

2. Smart Contract Vulnerabilities

Restaking introduces new layers of smart contracts – the module itself, contracts for LRTs, and contracts within the AVSs.

Each new contract is a potential point of failure, vulnerable to bugs or exploits. A vulnerability in any part of this chain could put your staked tokens at risk. The complexity increases the potential for unforeseen issues. These yield risks are tied directly to the technology's integrity.

3. Operator and AVS Risk

You are trusting not only the base layer validator (if natively restaking) or the LRT provider (if liquid restaking) but also the operators validating the AVSs and the design/security of the AVSs themselves.

An AVS might have flawed logic, or an operator might be incompetent or malicious specifically regarding their AVS duties. Vetting operators and understanding the AVSs you choose to secure becomes important, though often abstracted away in liquid restaking.

4. Centralization Concerns

While aiming to democratize security, there's a risk that restaking could centralize around a few large operators or LRT protocols, creating new potential points of control or failure.

The reliance on Ethereum's social consensus is powerful but also concentrates risk if the restaking layer itself faces issues.

5. Liquidity and Complexity

Especially with liquid restaking tokens (LRTs), you're dealing with another layer of abstraction.

Understanding the underlying LSTs, the chosen AVSs, the fee structures, and the specific risks of the LRT protocol itself adds complexity. Market liquidity for some LRTs might also be lower than for base LSTs.

How to Restake Crypto & Earn in 2025: A Cautious Approach

If you're considering exploring restaking opportunities in 2025, the key is caution and diligent own research. The scene's fresh and constantly changing.

Step 1: Understand Your Base

Are you comfortable with traditional staking or liquid staking first? Understand the risks and rewards of holding staked ETH or LSTs before adding the complexity of restaking.

Step 2: Choose Your Path

- Native Restaking: Only if you are technically proficient, running your own validator, and fully understand the slashing risks and operational requirements of validating AVSs.

- Liquid Restaking: The more common path. Research different restaking protocols (EigenLayer is primary; others may emerge) and available LRTs.

Step 3: Research LRTs

Don't just chase the highest advertised yield. Look into:

- Which LSTs does the LRT hold?

- Which AVSs is the LRT securing?

- Who are the operators validating these AVSs?

- What are the fees?

- What are the specific smart contract risks associated with this LRT provider? Read audits.

Check community reputation and discussion (social consensus).

Step 4: Select AVSs (if native or offered choice)

Understand what service you are securing. Is it a reputable project? What are the specific slashing conditions?

Start small, perhaps securing only one or two well-established AVSs initially.

Step 5: Use Reputed Platforms

Interact with established restaking services and DeFi platforms. Beware of phishing scams and imitation sites.

- EigenLayer

- Ether.fi

- Renzo Protocol

- Symbiotic

- Puffer Finance

Note: The above list is non-exhaustive and only for informational purposes. DYOR before interacting.

Step 6: Start Small and Stay Informed

Don't commit all your staked assets to restaking immediately. Test the waters with a smaller portion you can afford to lose.

Observe the process, the rewards, and any potential issues.

Protocols update, new AVSs launch, risks evolve. Keep learning and adjust your strategy based on the latest information and network demands.

Crypto staking is not just about squeezing out extra rewards. The concept is a game-changer for how we view blockchain security and capital efficiency. It's an attempt to prevent the immense economic security of major PoS networks like Ethereum from being siloed, allowing it to permeate and strengthen the entire blockchain tech domain.

Understandably, there are risks to crypto restaking. Increased slashing risks, smart contract vulnerabilities, and the possibility of unforeseen consequences in such a complex, layered system. However, the potential is undeniable. Improved rewards, greater capital efficiency, and a more secure and interconnected DeFi and blockchain ecosystem.