Takeaways

- Solayer enables restaking SOL to earn more while securing Solana-native apps.

- InfiniSVM uses hardware acceleration for >1M TPS and ultra-low latency performance.

- Restaking boosts security for on-chain apps without new validator sets or bridges.

- sSOL unlocks a blockspace marketplace, letting apps and users optimize performance.

- LAYER token governs the Solayer ecosystem and powers InfiniSVM infrastructure.

Solana’s high-performance blockchain has long been celebrated for its speed, throughput, and efficiency. But until recently, it lacked one of the most powerful mechanisms reshaping the security and utility layers of blockchain ecosystems: restaking.

With the rise of EigenLayer on Ethereum, the concept of restaking has gained traction as a way to extend validator security to new networks and applications without bootstrapping trust from scratch. For context, the TVL of EigenLayer (shown in the image below) crossed the $20 billion mark in under a year, highlighting the surging demand for restaking.

Now, Solana is entering the restaking arena with Solayer – a native restaking protocol – and its pioneering AVS (Actively Validated Service), InfiniSVM.

Restaking on Solana isn’t just about copying Ethereum’s playbook. It’s a tailored innovation riding on Solana’s unique architecture all while maximizing capital efficiency for SOL holders and validators.

According to Galaxy Research's July 2024 report, over $20 billion in assets are currently restaked, with ETH and its derivatives making up a massive 96%.

In this article, we’ll explore how Solayer works, what InfiniSVM brings to the table, and why this marks a significant leap for Solana’s decentralized security economy.

Why is Restaking Important?

Restaking is important because it unlocks more utility from staked tokens by allowing them to secure more than just one network.

Traditionally, when you stake tokens like SOL or ETH, they only help secure the base blockchain. But with restaking, those same tokens can also be used to secure new services and networks (think oracles, bridges, or zero-knowledge systems) without needing new validators or separate capital.

Basically, instead of each new project or network having to bootstrap its own validator set (which is costly and inefficient), they can borrow the security of an already trusted and well-capitalized validator network.

What Is Solayer?

Solayer is a restaking protocol on Solana that lets users boost their earnings by locking up their staked SOL. It also increases the reliability of network access while reducing associated costs by up to 50 times.

Solayer's restaking TVL jumped from over $261 million in November 2024 to nearly $490 million by January 2025, marking an impressive 88% surge. At the time of writing (March 2025), the TVL stands at just over $100 million.

While analyzing the token breakdown of Solayer's restaking, SOL makes up over 87%, followed by INF and JITOS at 4.42% and 2.87%, respectively.

With the growing adoption of Solayer's restaking model, users are earning more and contributing to a more secure and scalable Solana ecosystem. As total value locked continues to rise, Solayer is proving to be a game-changer in optimizing staking efficiency, reducing costs, and strengthening network resilience.

Here's why more users are choosing Solayer:

- Stronger Security: Restaking with Solayer reinforces Solana's security, with more participants working together to safeguard the network.

- Stack more Rewards: Earn additional rewards on top of staker's original staking by restaking tokens, maximizing their returns effortlessly.

- Fuel Solana's Growth: Solayer empowers new projects to scale securely by giving them access to the same robust security framework.

Solayer Restaking Step-by-Step Guide

Solayer restaking involves a simple process which is as follows:

Step 1

Go to the Solayer website and connect to any supported Solana wallet. There's a long list of wallets, including Phantom, Solflare, Ledger, WalletConnect, and more. Here, we're connecting to the Phantom wallet.

Step 2

Next, Join the official Discord channel and follow their X account.

Step 3

Enter your invite code if you have one. Otherwise, you can skip this for later and continue with the restaking setup.

Step 4

Visit the Solayer website's home page to explore possible deposit tokens. It's better to choose SOL tokens, as they typically provide higher APY rates than other tokens.

Step 5

Deposit the selected token.

Step 6

Select the "Delegate" section from the homepage.

Step 7

Select the AVS to delegate the SOL token. Here, we'll choose Sonic, enter the amount of the SOL token, click "Delegate," and confirm the transaction on the wallet.

Step 8

Check the status of the delegated SOL tokens as a final confirmation.

Once the token is delegated, the wallet holding the delegated tokens can be used to interact with crypto projects, unlocking restaking benefits and additional yield opportunities.

How Does Solayer Work?

EigenLayer shook Ethereum's security model with restaking, allowing off-chain services like oracles, rollups, and DA layers to tap into ETH's Proof of Stake (PoS) security. This approach, called Exogenous Actively Validated Services (AVS), extends Ethereum's security guarantees beyond its main network.

Now, Solayer is bringing that concept on-chain but with a Solana-native twist. Instead of securing off-chain systems, Solayer introduces Endogenous AVS, a mechanism that enhances security and performance for on-chain applications using Solana's Proof of Stake.

What does that mean in practice?

It means applications built directly on Solana, including exchanges, NFT marketplaces, and memecoins, can use Solayer's framework to optimize security, efficiency, and throughput. No bridges and no external dependencies, just pure on-chain power backed by SOL's PoS consensus mechanism.

Solayer's delegation system is built to manage assets efficiently. The pool manager oversees asset flow and converts them into Solayer-specific tokens like sSOL. The delegation manager distributes stakes across validators and Actively Validated Services (AVSs), while the stake pool handles validator selection and optimizes returns through MEV-boosting.

With Solayer, Solana is not just scaling transactions. It redefines how native applications secure themselves, making the ecosystem more robust, permissionless, and future-proof.

swQoS is a network resource allocation system that determines access to critical elements like blockspace and transaction processing capacity. Solayer is building on top of this system to create a new marketplace where stakers, validators, and application developers interact more efficiently.

Right now, swQoS operates as a protocol between RPC nodes and validators. That leaves applications with little influence, even though they're the ones that need the most control over security and performance to serve their users effectively.

Solayer's staking works like a cloud or blockspace marketplace, just like developers on AWS can pay for extra storage or RAM to enhance performance, in Solana, resources like block space and transaction throughput are distributed based on stake weight. Stakers act as the supply side, apps drive demand, and validators serve as the facilitators, ensuring efficient allocation within the ecosystem.

sSOL is the Liquid Restaking Token (LRT) that powers access to Solayer's cloud marketplace. It simplifies staking, letting users effortlessly contribute to stake-weighted QoS and unlock multiple revenue streams from restaking in just a few clicks.

Understanding Solayer InfiniSVM

Solayer infiniSVM takes inspiration from the cutting-edge techniques used by top high-frequency trading firms—the ones that execute trades in nanoseconds. These firms push the limits of speed by offloading programmability onto specialized hardware like FPGAs, microwave signals, and short radio waves.

Solayer is bringing that same level of optimization to the blockchain, redefining how transactions are processed at lightning speed. This high-performance aspect of Solayer InfiniSVM, which offers over 12% native SOL yield, successfully attracted SOL deposits worth over $133 million from more than 300k depositors as of March 2025.

Solayer takes efficiency to the next level by offloading key processes like scheduling, signature verification, and deduplication to specialized hardware, including programmable switches and SmartNICs.

Its "megaleader" architecture uses pre-execution clusters that feed into programmable switches for sequencing, then taps into an FPGA NIC via Infiniband for complex tasks like re-execution.

To address potential technical hurdles, the system advocates hardware-accelerated and multi-executor SVM networks. To improve usability, the introduction of features like seamless wallet support helps build a user-friendly chain capable of executing a TPS of over 1 million with 100Gbps+ bandwidth.

Unlike the EVM's sequential execution model, SVM runs non-conflicting transactions in parallel, leveraging all available CPU cores. Its memory model uses multi-version concurrency control (MVCC), keeping multiple data versions for seamless concurrent reads while ensuring that writes follow a strict serialization order dictated by the PoH sequence.

Regarding the consensus mechanism, a Proof-of-Authority and-Stake architecture is introduced where a trusted entity is responsible for properly functioning the shred mechanism. Once a shred gathers votes from 51% of the selected provers, the sequencer generates a proof and marks it as finalized if all previous shreds are finalized.

Notable Features of Solayer InfiniSVM

SVM-Compatible for Seamless Integration

Solayer is fully compatible with the Solana Virtual Machine (SVM), making it effortless for any Solana dApp to integrate. By tapping into one of the fastest and most efficient blockchain ecosystems, developers gain access to a robust infrastructure without needing additional modifications.

Effortless User Experience with Chain Abstraction

Solayer eliminates onboarding friction by abstracting away complex blockchain interactions. Users can engage with their favorite Solana applications without worrying about manual bridging or network switching, ensuring a smooth and intuitive experience from the start.

A Unified Layer, No More Fragmentation

Solayer prevents ecosystem fragmentation by settling all applications onto a shared global layer. This structure allows projects to scale independently while maintaining a cohesive and interoperable environment, fostering seamless growth across the network.

Infinitely Scalable to Match Demand

Designed for horizontal scalability, Solayer dynamically adjusts network throughput based on demand. Whether traffic spikes or drops, its elastic architecture ensures Solana remains performant, efficiently handling increased transaction loads without compromising speed or security.

AI Agents for the Next Billion Users

InfiniSVM empowers Solayer to support the massive influx of AI agents and users expected in the coming years. With unparalleled network capacity, it enables scalable automation, real-time data processing, and AI-driven applications that will redefine the future of blockchain interactions.

What Is LAYER Token?

LAYER is the native utility token for InfiniSVM and the governance token of the Solayer ecosystem. Its maximum supply is fixed at 1,000,000,000 LAYER tokens, starting with an initial circulating supply of 220,000,000.

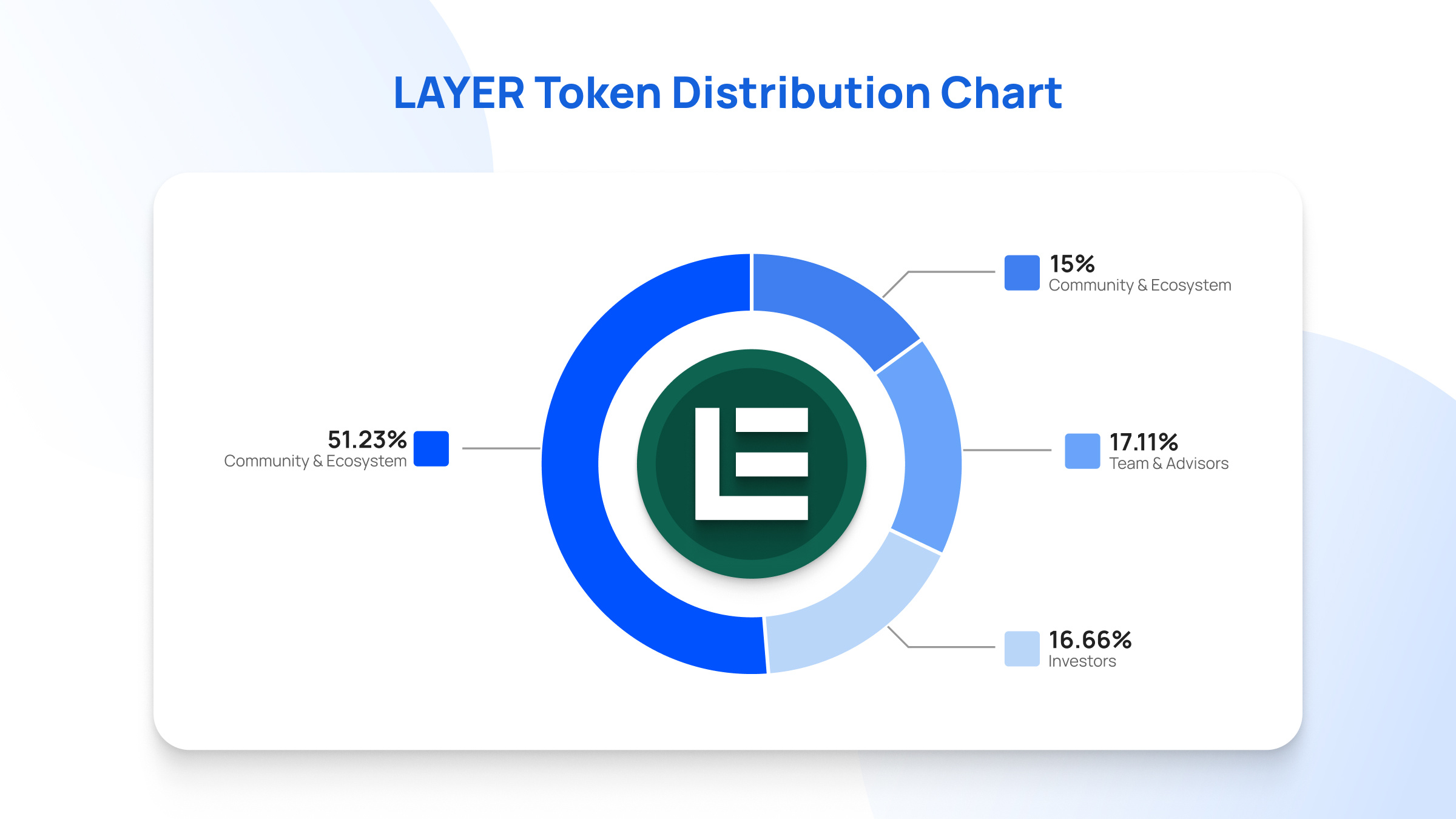

A generous 51.23% of the total token supply of LAYER is allocated for the Solayer community and ecosystem, of which 34.23% is dedicated to R&D, ecosystem growth, and other activities. The remaining 14% and 3% are distributed for community events/incentives and Emerald Card community sales, respectively.

Solayer Foundation receives 15% of the total token supply to fuel network development and vertical product expansion. 17.11% is allocated to advisors and core contributors, and 16.66% to investors.

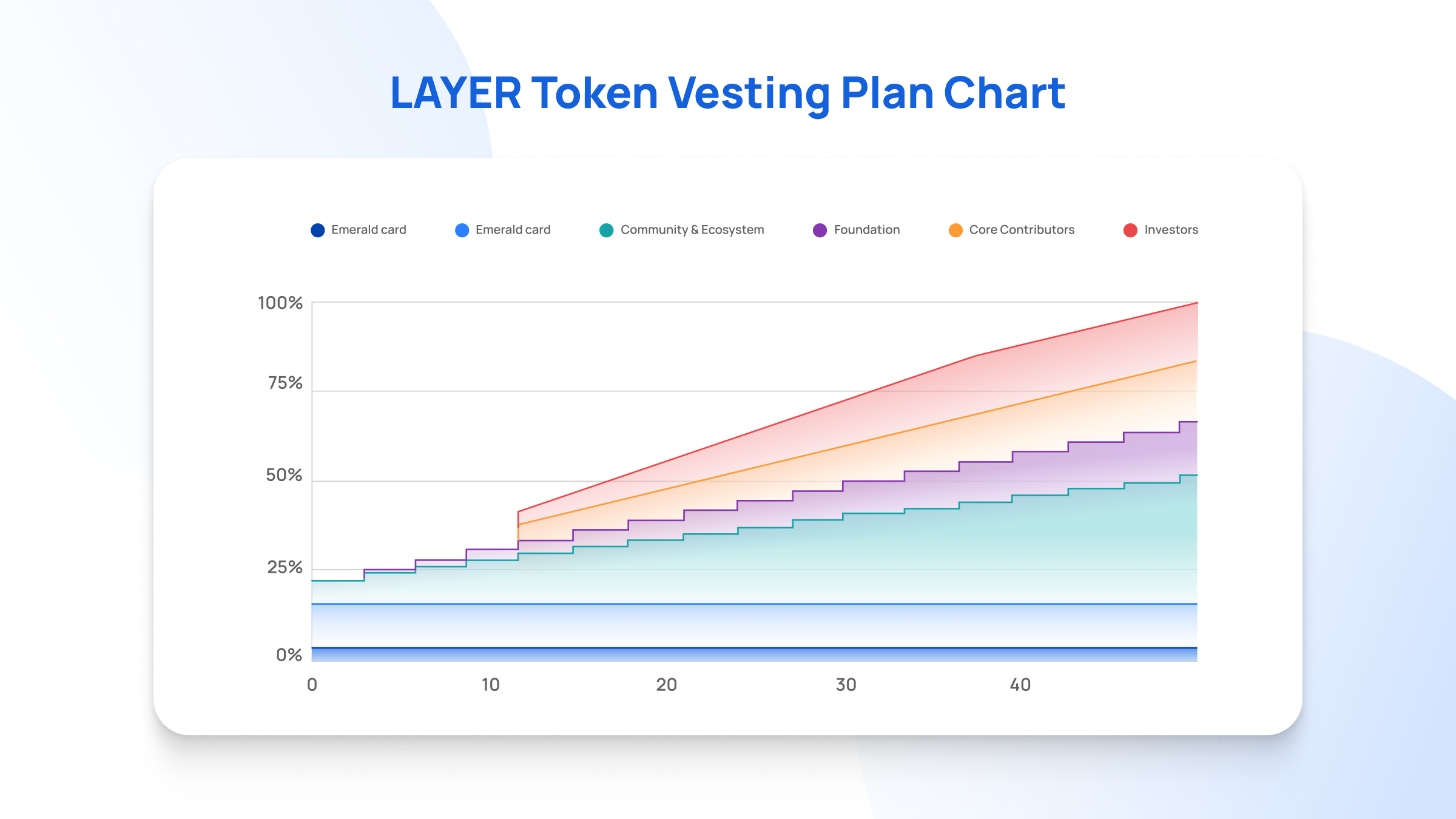

LAYER tokens will be gradually released based on a structured vesting schedule:

- Genesis Drop & Emerald Card Community Sale: Fully unlocked at launch.

- Community Incentives: Linearly vested over 6 months.

- Community & Ecosystem: Vested every 3 months over 4 years.

- Foundation: Vested every 3 months over 4 years.

- Team & Advisors: 1-year cliff, followed by 3 years of linear vesting.

- Investors: 1-year cliff, followed by 2 years of linear vesting.

This approach ensures a balanced token distribution while aligning long-term incentives across the ecosystem.

Conclusion

Solayer isn't just about securing Solana; it's about giving stakers more control over how their stake is utilized. By allocating stake across multiple systems, they're strengthening the network and optimizing security and performance for the applications they care about.

With the introduction of InfiniSVM, Solayer is taking blockchain infrastructure to the next level. It integrates high-frequency trading principles, hardware acceleration, and parallel execution to achieve unmatched speed and efficiency. This combination of innovative staking models and technical advancements positions Solayer as a critical pillar in Solana's evolving ecosystem.