Ethereum exchange-traded fund (ETF) allows you to trade and invest in Ether (ETH) while enjoying the combined benefits of both crypto and traditional finance.

The U.S. Securities and Exchange Commission (SEC) approved applications from NYSE, Nasdaq, and Cboe BZX to list Ethereum ETFs on 23 May 2024. This is the second-largest approval from the SEC on crypto ETFs after it approved the historic Bitcoin ETFs in January 2024.

In this article, we'll explore Ethereum ETFs, their different types, advantages, differences with Bitcoin ETFs, and more.

What is Ethereum ETF?

Ethereum exchange-traded fund (ETF) is a crypto ETF that tracks the price of ether, the second-largest cryptocurrency by market cap. These ETFs allow investors to gain exposure to crypto assets as easily as buying or selling a stock ETF.

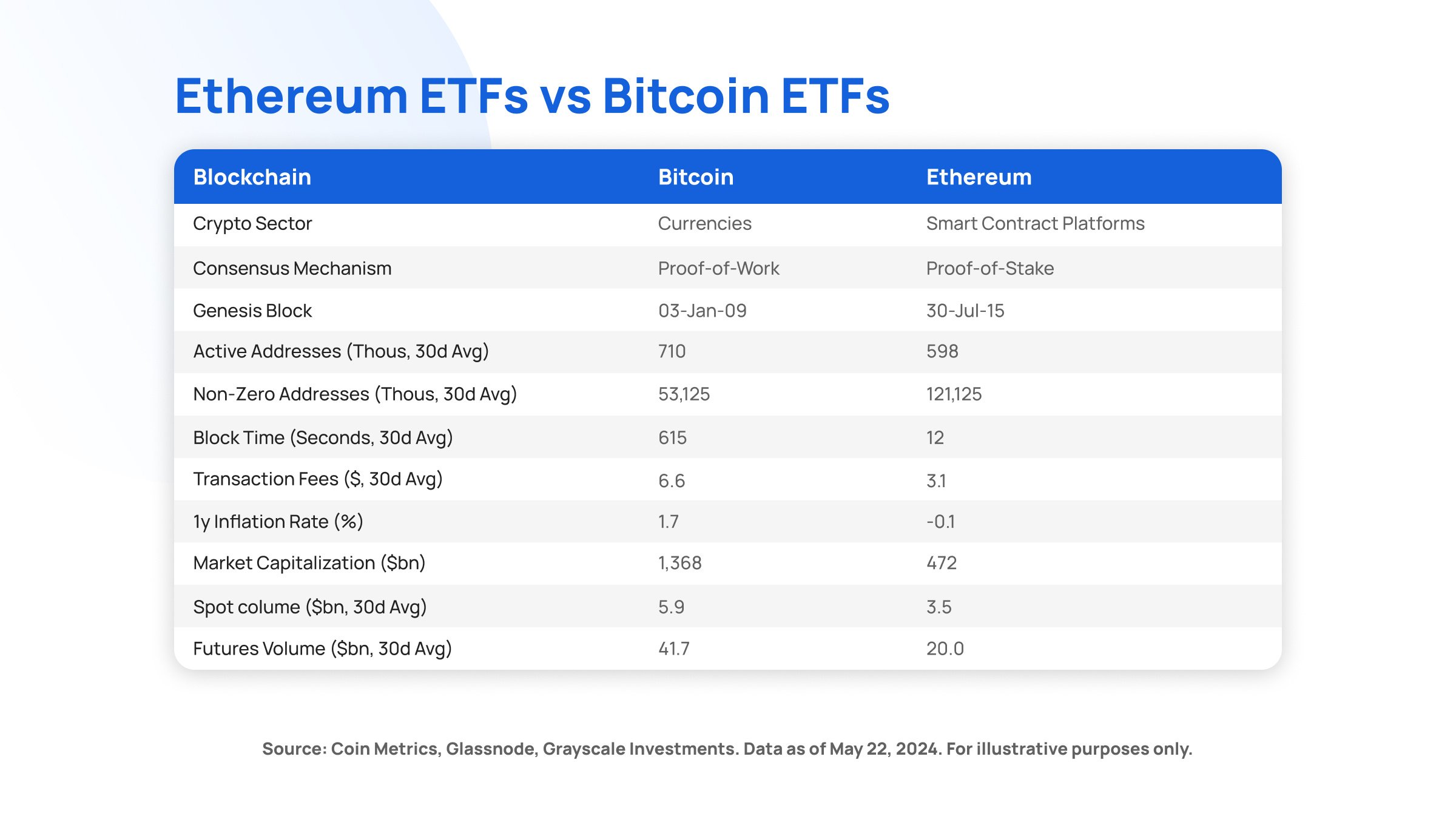

Investors or traders can visit the online platforms of supported exchanges to trade or invest in Ethereum ETFs. According to a report by Grayscale based on 22 May 2024 data, Ethereum's advantage over Bitcoin on higher non-zero addresses, lower transaction fees, lower inflation rate, etc., might potentially help to increase demand for Ethereum ETFs.

Ethereum ETF issuers charge a fee for managing the overall fund for investors. For example, Franklin Templeton has set a 0.19% annual fee for its ether ETF, which is awaiting launch.

Ethereum ETFs also encourage investors from traditional finance to gain a seamless exposure to crypto assets. For example, investors don't need to create a crypto wallet or worry about procedures like storing their private keys.

Types of Ethereum ETFs

Ethereum ETFs are mainly classified into two categories: spot Ethereum ETF and futures Ethereum ETF.

Spot Ethereum ETF

Ether (ETH) is the underlying asset of the spot Ethereum ETFs. These spot ETFs track the real-time market price of ether.

Spot Ethereum ETFs are ideal for investors or traders who prefer simple instruments to park their funds. Moreover, the live price of ether is directly correlated to the spot ETF's price, making it easier to track.

Futures Ethereum ETF

Futures Ethereum ETFs hold ether's future contract instead of ETH tokens. Here, investors or traders speculate on ether's future price movement.

The price of the future Ethereum ETF is not very similar to the price of ether. Additionally, the complex structure of the future market might not suit first-time investors.

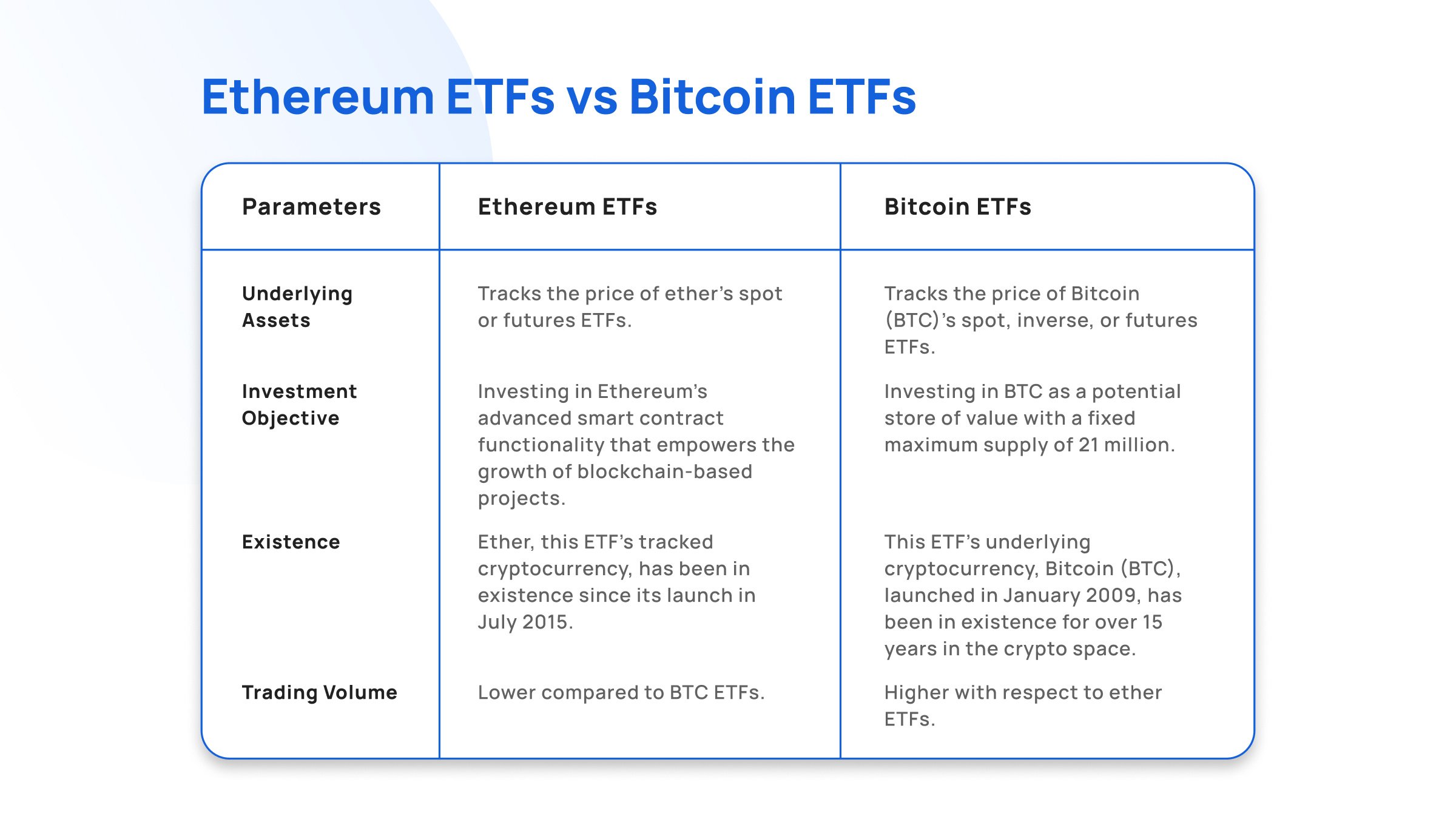

Ethereum ETFs vs Bitcoin ETFs

BlackRock's Ethereum ETFs — New Era for Digital Assets

BlackRock's interest in the crypto space is evident with its $10 trillion tokenization vision and its introduction of the crypto ETF iShares Bitcoin Trust (IBIT). At the end of May 2024, BlackRock's IBIT surpassed Grayscale to become the U.S.' largest spot Bitcoin (BTC) ETF with around $20 billion in assets.

Following the success of IBIT, BlackRock has filed for the SEC approval of Ethereum ETFs. According to a Bloomberg analyst, this launch is expected around the end of June 2024.

BlackRock's bullish approach to crypto strengthens the crypto industry, which has endured terrible times following massive collapses in recent years. This asset management giant's involvement will encourage more big players to come forward and launch Ethereum ETFs and other digital assets.

Advantages of Ethereum ETFs

- Asset Diversification: Investors can add Ethereum ETFs to diversify their investment portfolio along with other ETFs or stocks.

- Crypto Exposure: Traditional finance investors can explore Ethereum's products like spot and future ETFs without creating wallets.

- Proper Regulations: Ethereum ETFs are approved by regulatory authorities to ensure investor's safety.

- High Liquidity: The demand for Ethereum ETFs attracts a large number of investors and traders, enhancing liquidity.

- Reduced Risk: The ETF provider holds the ether assets that restrict the loss of cryptocurrency from the user's crypto wallet following any theft or hacks.

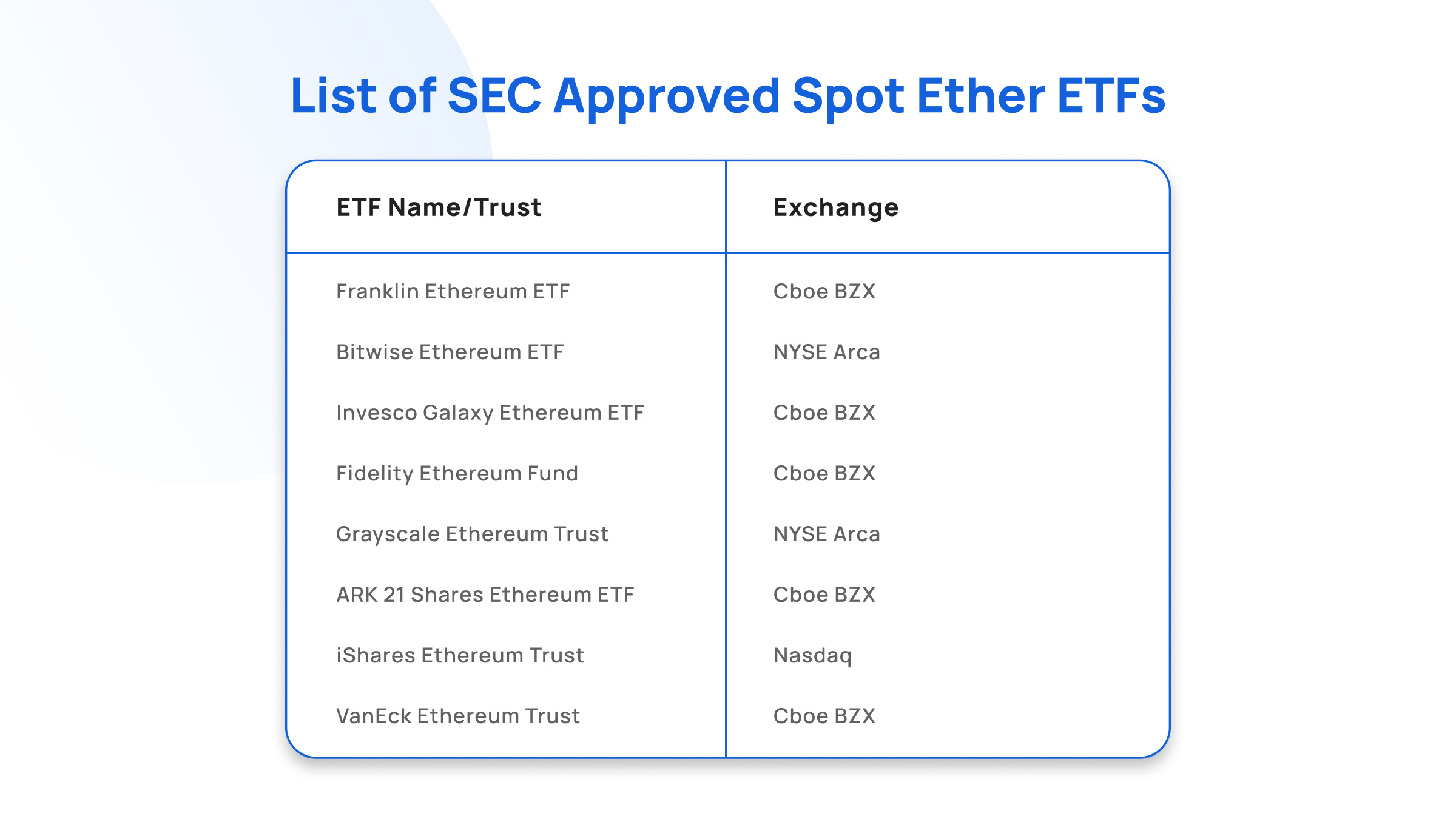

List of SEC Approved Spot Ether ETFs

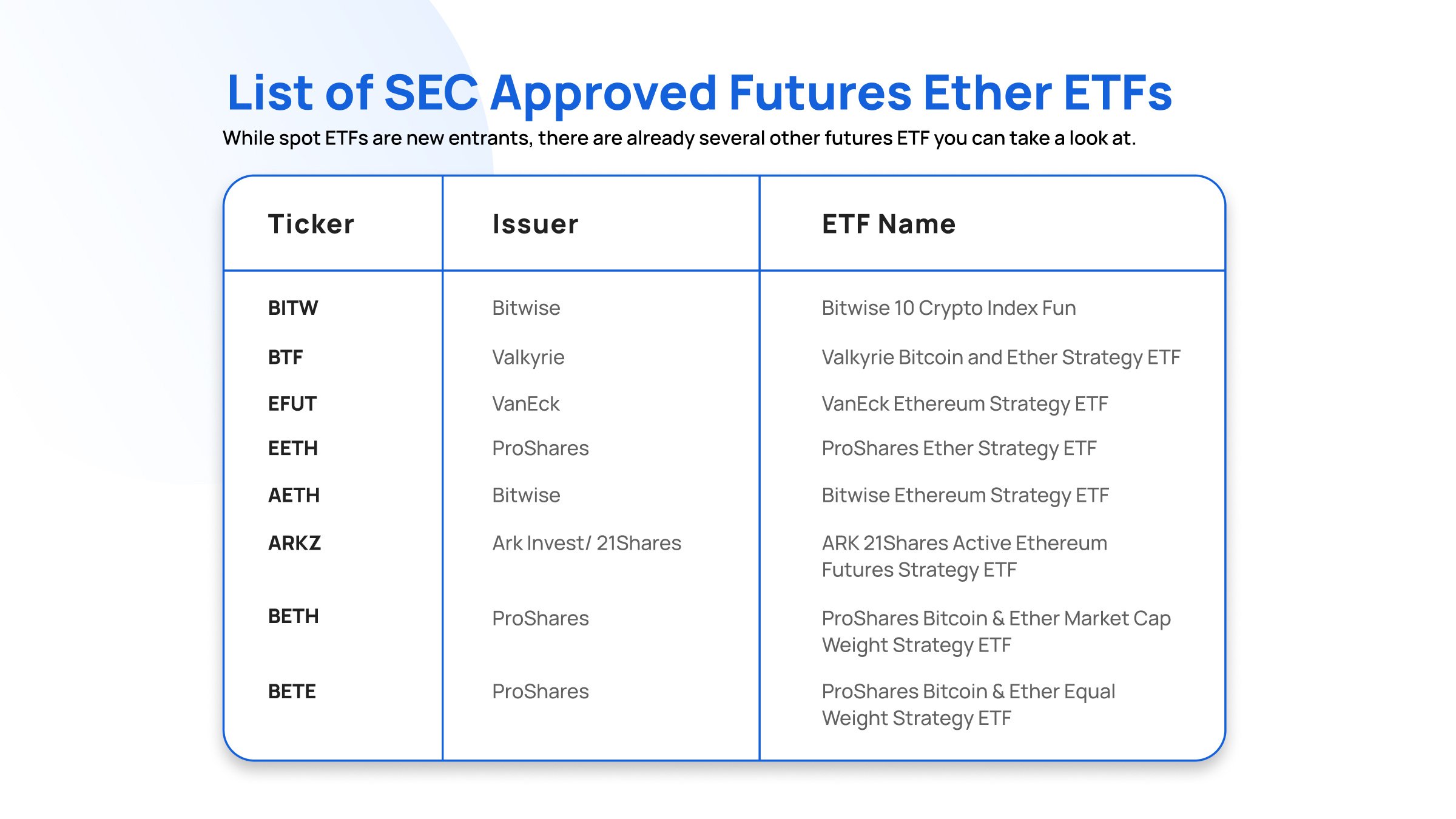

List of SEC Approved Futures Ether ETFs

While spot ETFs are new entrants, there are already several other futures ETF you can take a look at.

Alternative To Ethereum ETFs

While Ethereum ETFs offer a convenient avenue for investors to gain exposure to Ether (ETH) through traditional financial markets, some may prefer direct ownership and control over their digital assets. This approach, known as self-custody, allows individuals to hold and manage their Ethereum independently, without relying on third-party institutions.

Ethereum Self-Custody With Ledger Ethereum Wallet

Self-custody involves storing your Ethereum in a personal wallet, granting you full control over your private keys and, consequently, your assets.

Hardware wallets, such as the Ledger Ethereum wallet, are renowned for their robust security features. These devices store your private keys offline, safeguarding them from online threats and unauthorized access.

Using a Ledger wallet, you can securely manage your Ethereum holdings and interact with decentralized applications (dApps) on the Ethereum blockchain.

Purchasing Ethereum Directly Via Ledger Live And Transak

For those interested in holding ETH directly, the Ledger Live application, in partnership with Transak, offers a seamless solution.

Ledger Live is a comprehensive platform that enables users to manage their crypto assets securely. Through its integration with Transak, you can purchase Ethereum using various payment methods, including credit and debit cards, with the acquired ETH being delivered directly to your Ledger wallet. This process combines the convenience of online transactions with the security of self-custody, allowing you to buy, manage, and stake your Ethereum all within the Ledger ecosystem.

By opting for self-custody and direct purchase of Ethereum, you maintain full ownership and control over your digital assets, aligning with the decentralized ethos of cryptocurrencies.

Conclusion

The SEC approval for the issuance of Ethereum ETFs is indeed a milestone for the crypto ecosystem. The increased interest of asset management and financial giants in crypto ETFs will fasten the crypto adoption.

The proper involvement of regulatory bodies in Ethereum ETF approval will add trust among traditional investors and traders. However, as an investor or trader, one should always be aware of the potential risk before investing in these ETFs or other assets.