Token burning is a mechanism implemented by crypto projects or holders aimed to eliminate tokens from the supply forever.

Large numbers of circulating tokens are a common concern for investors who question the sustainability of a token's future value. As a solution to this concern, crypto projects execute coin burning at once or at regular intervals according to their burning goal.

For example, popular memecoin Shiba Inu (SHIB) has increased its token burn to over 863% in June 2024. According to Shibburn, the total SHIB burn tokens from its initial supply has crossed 410 trillion.

In this article, we'll understand token burning, its working process, its importance, advantages, disadvantages, impact on token price, and major examples from the crypto space.

What is Token Burning?

Token burning is a method that involves the permanent removal of tokens or coins from circulation by sending them to an irretrievable address, thereby reducing the total supply.

In most cases, the primary intention of burning crypto is to make it scarce and valuable, benefiting its investors and community.

In the process of burning, tokens are intentionally transferred to an eater or burn wallet address without any access. Once the tokens are sent to these inoperable wallets, it's impossible to recover them.

Say you want to burn ETH. All you’d have to do is send any amount of ETH you want to burn to the Ethereum burn address.

Ethereum burn address: 0x0000000000000000000000000000000000000000

The popularity of crypto burning started in 2017 following the token burn initiative of Binance Coin (BNB). In 2018, tokens like Stellar (XLM), Bitcoin Cash (BCH), and Tron (TRX) also embraced crypto burning.

How Does Coin Burning Work?

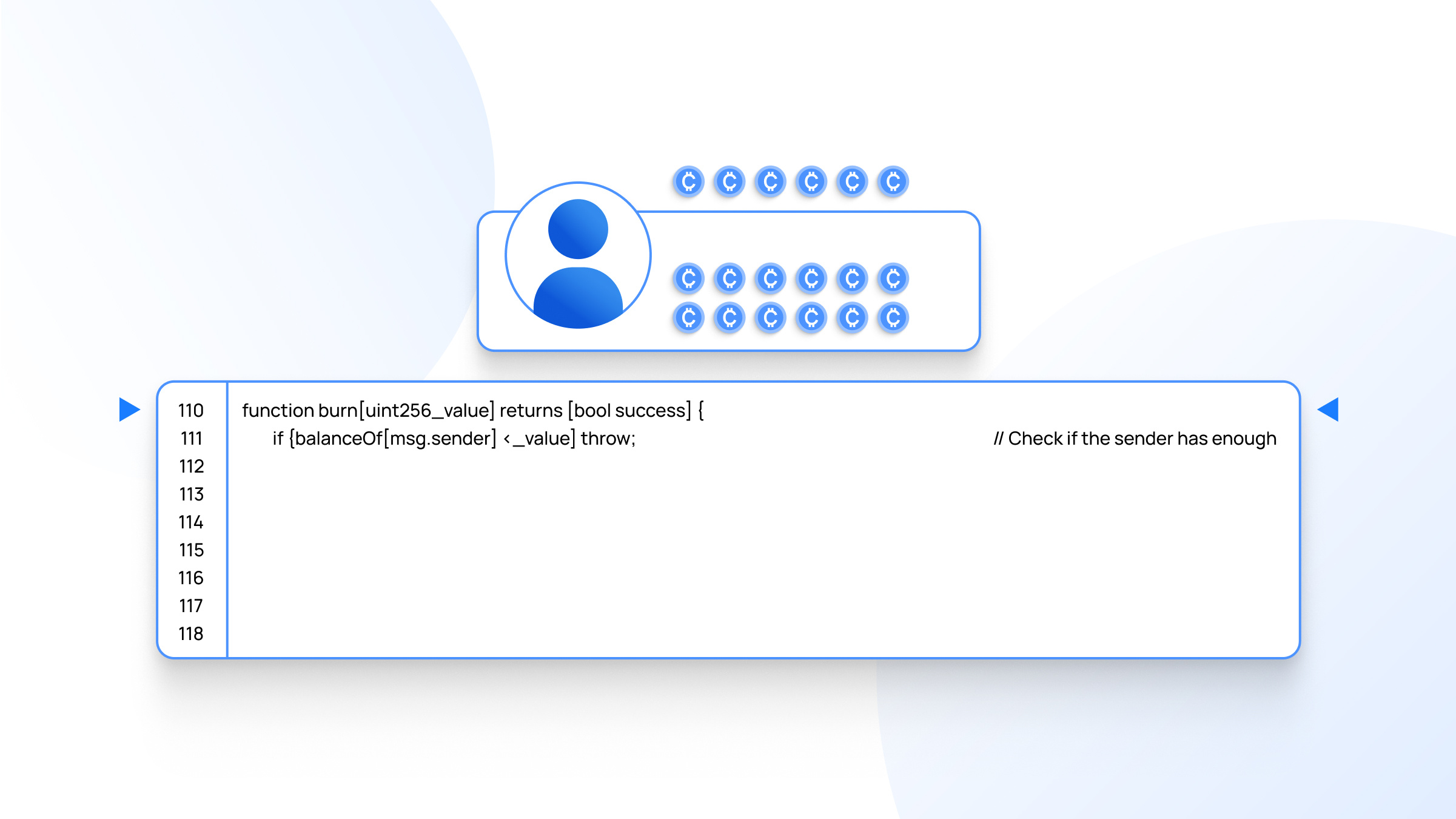

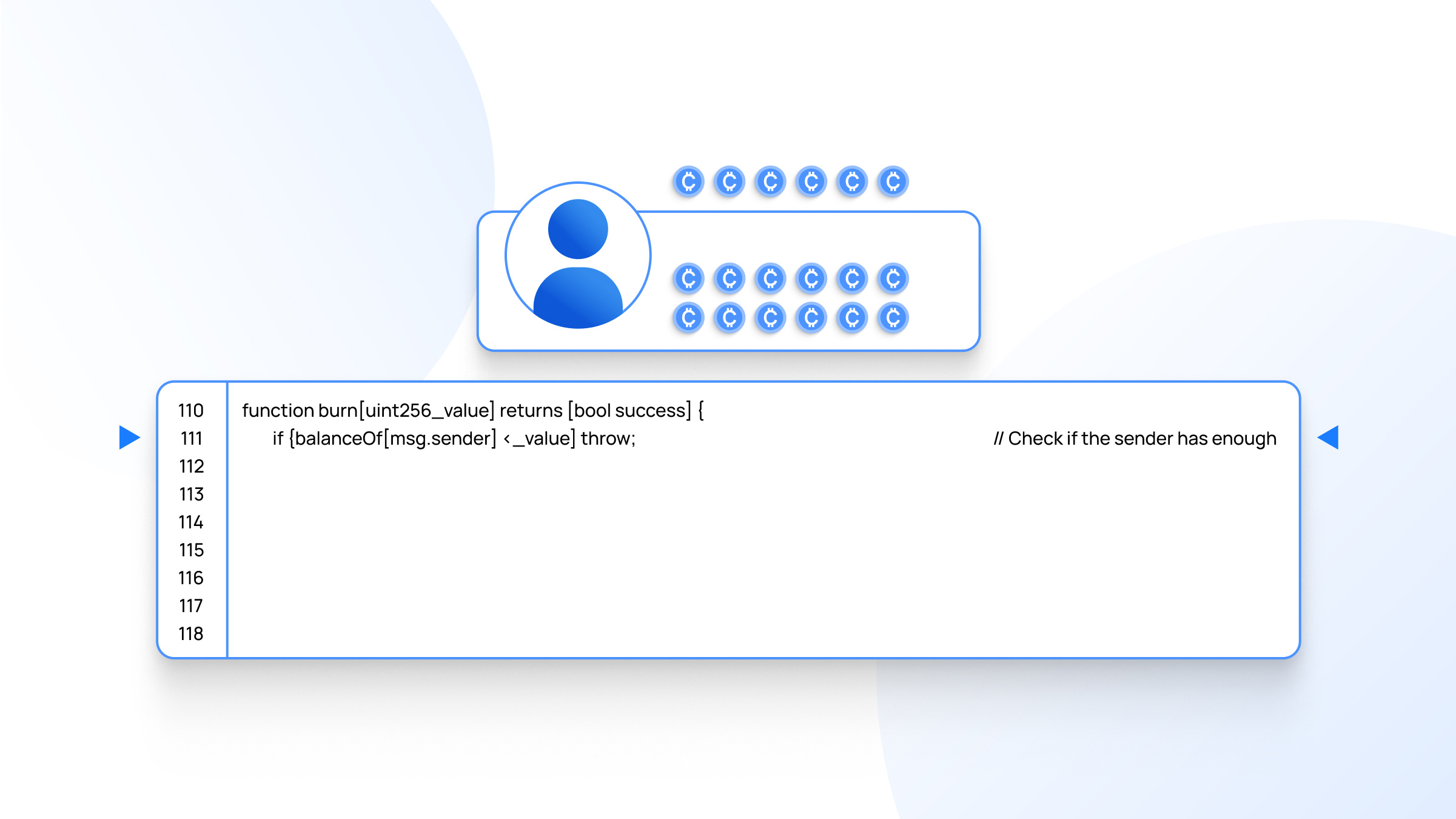

Step 1

A token holder who aims to participate in the burning process will initiate the process by calling the "burn function." Here, the holder also mentions the amount of coins intended to burn.

Step 2

The token's smart contract then verifies whether the person holds enough tokens on their provided wallet address. Here, the smart contract also ensures that the holder has been given a valid number of tokens.

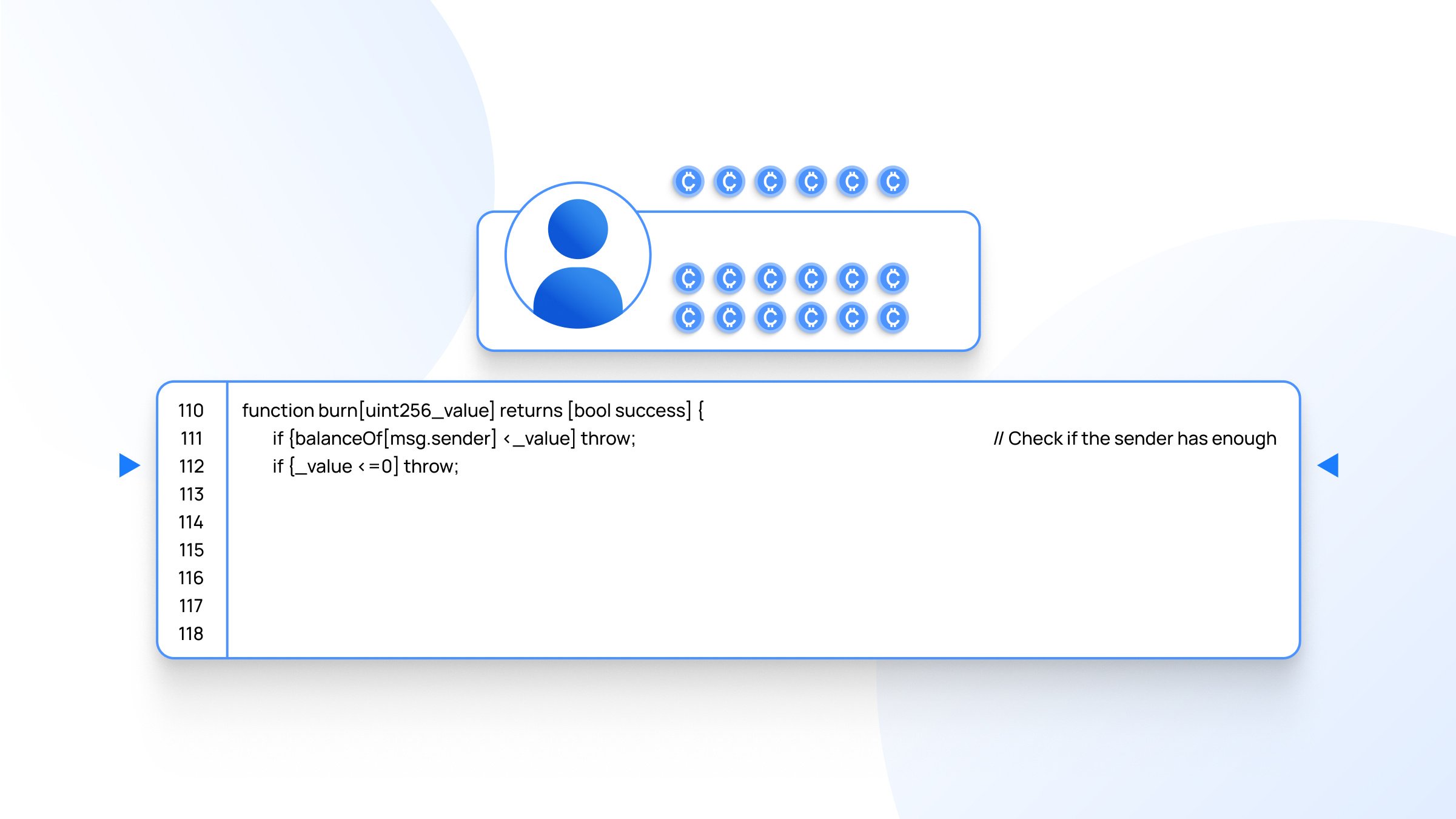

Step 3

If the token available on the wallet address is below the provided number or is a non-positive number, it's considered invalid, and the burn function will not be initiated. Values such as 0, -2. -0.5, etc., are considered invalid.

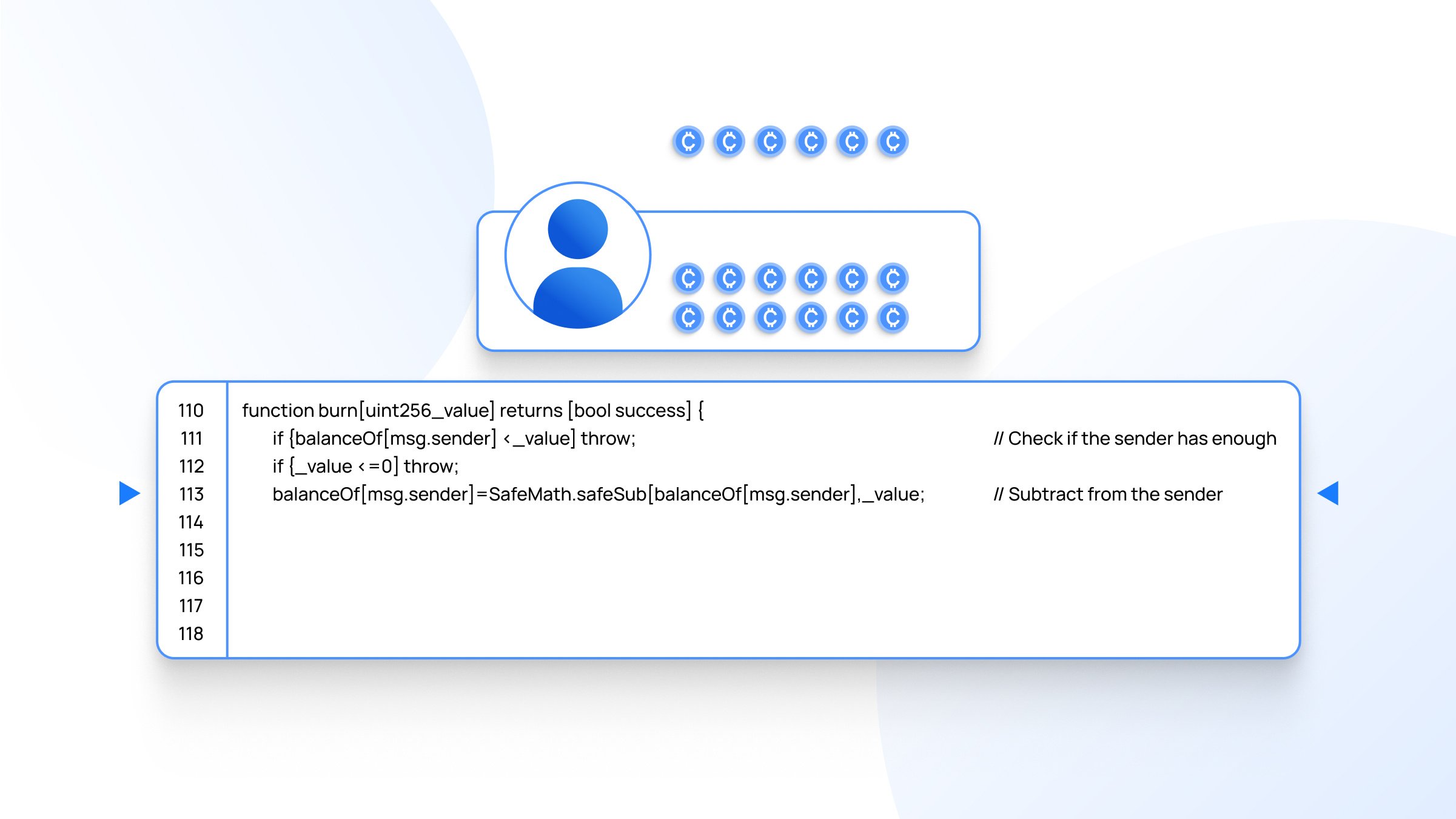

Step 4

If the holder has enough tokens and the provided number is valid, the burn function gets initiated. After the execution of this function, the provided number of tokens gets deducted from the token holder's wallet address.

Once this crypto burning is completed, the tokens are gone forever, leaving no possibility for recovery.

Why is Burning Tokens Important?

Although the goal of token burning is to reduce the number of coins, crypto projects execute this process for various purposes, such as:

To Maintain the Token's Steady Price

Stablecoins and wrapped tokens use the burning mechanism to provide an approximate price promised to their holders. Stablecoins aim to offer a price the same as its underlying asset, like the U.S. dollar, whereas wrapped tokens mirror the price of their backed cryptocurrency.

Both stablecoins and wrapped tokens mint and burn according to their reserve assets. Coin burning helps to maintain a consistent price for these tokens regardless of market volatility.

Spam Protection

Coin burning can help safeguard blockchain networks from Distributed Denial-of-Service (DDoS) attacks. These types of attacks are executed using bots to send a large number of requests to targets to overload their network.

For example, in 2021, Solana's network went offline for 17 hours following a DDoS attack. The coin burning mechanism makes DDoS attacks a less feasible option for executing an attack on the network.

Enhances Holder's Confidence

A regular token burning process helps to offer a deflationary status for the tokens. For this reason, there exists a potential for investors to accumulate such tokens for the long term.

The gradual decline of the token's circulating supply also develops positive market sentiments among the crypto community. For example, in 2019, Stellar Development Foundation (SDF) burned over 50 billion XLM tokens aimed at onboarding new users and investors.

Proof of Burn (PoB) Explained

Proof of Burn (PoB) is a consensus mechanism that encourages users to burn tokens for mining rights. PoB involves the involvement of less energy, addressing the high energy consumption of Proof-of-Work (PoW) mechanisms.

In PoB, miners don't need to spend money setting up high computational devices or electricity bills like PoW miners do. Here, the PoB mechanism leverages virtual mining systems to validate transactions.

The token holder then verifies the coin burn using blockchain explorers. For example, Etherscan checks the coin burning transaction on Ethereum.

The token holders who remove their coins from the token supply gain the opportunity to validate transactions based on the number of tokens burned using the PoB mechanism. Here, the validators can increase the value of potential rewards by burning a large number of tokens.

Advantages of Burning Crypto

- Transparency: Investors can check the coin burn transaction as it is recorded on the on-chain. This transparent mechanism helps to develop a long-term bond among project developers, investors, and community members.

- Environmental Friendliness: PoB consensus mechanism uses minimal energy consumption as compared to PoW mechanism. As a result, PoB can benefit from the growing demand for environmentally sustainable projects.

- Use Incentivization: Rewarding token holders for participating in a burning mechanism can encourage more individuals to burn coins. The availability of rewards also helps to attract more people to the project's community.

Disadvantages of Crypto Burn

- Irreversibility: After the completion of the token burning process, it'll be permanently eliminated from the provided wallet address. This irreversible nature of token burn can pave the way for individual holders to regret once the price of the burned token surges.

- Market Volatility: Token burning process and announcements are celebrated by the projects and their communities on major social media platforms. This rise in popularity might lead to short-term price volatility.

- Less Impact: Individual or small coin burning by projects doesn't have any positive impact on the crypto. For example, burning a few hundred a token for a project with over 100 billion circulating supply creates negligible impact.

How Token Buring Impacts the Crypto Price?

Token burning is considered a positive event in the crypto space, encouraging more projects to execute this burning mechanism. However, the positive sentiments towards token burning don't fully guarantee a positive impact on the token's price.

The price variation of tokens depends on numerous factors, such as overall crypto market sentiments, project development, and more. However, sustainable projects with token burning mechanisms surely have a positive impact on the token's tokenomics and price from a long-term perspective.

There are also instances where the token price surges when projects announce token-burning-related activities. For example, following the Injective (INJ) token burn event on June 12, 2024, the INJ token surged over 18%.

Source: FXEmpire

The sudden demand in the market can positively impact the price rise when projects burn or plans to burn their tokens. However, buying tokens at market peak impulsively based on FOMO can potentially lead to huge losses.

Notable Examples of Token Burning

BNB Token Burn

During the launch of BNB in 2017, Binance committed to removing 100 million coins from its total supply of 200 million BNB. Binance's whitepaper also clearly mentions using 20% of their quarterly profit to buy back BNB and burn them until their commitment towards destroying 100 million BNB tokens is fulfilled.

In the first quarter of 2024, Binance executed its 27th BNB burn, resulting in the removal of almost 2 million BNB from the supply worth ~$1.2 billion at that time. Following the 27th token burn, Binance succeeded in burning over 54 million BNB since its launch, lowering the circulating supply to around 147 million BNB.

Source: BNB Burn

BNB token burn details are available on platforms like BscScan so users can verify the coin burning transactions and wallet addresses. This real-time BNB burn data adds more trust to the community.

ETH Token Burn

Ethereum implemented the EIP-1559 in August 2021 as a part of its London Hard Fork. This Ethereum proposal forwarded the restructuring of the Ether fee model, which includes the burning of ETH with each token transaction.

The changed protocol ensures the burning of a part of the gas fee following every transaction on the Ethereum network. The token burns and issuance of ETH are around 413K and 922K per year, respectively, restricting its supply growth by almost 0.42%.

Source: Ultra Sound Money

Within 3 years after the implementation of London Hard Fork, over 4.4 million ETH tokens were removed from the circulating supply.

The live update of ETH token burns is available on websites like beaconcha, with the base fee charged, total tokens burned, burn rate, and more.

Vitalik Buterin’s SHIB Token Burn

The co-founder of Ethereum, Vitalik Buterin, shocked the crypto community in 2021 by burning over 410 trillion SHIB coins. The creators of the memecoin project, Shiba Inu, gifted trillions of tokens to Buterin as a gift, which is reported to be a marketing stunt.

However, Buterin declined to hold these gifted tokens and burned 90% of the total received SHIB coins to a dead wallet address. At that time, the total burned tokens were worth around $6.7 billion.

Buterin also mentioned that he plans to use the remaining 10% for charitable action in the future. He kept his word by donating all the remaining gifted SHIB coins worth $1.2 billion to the India Covid Relief Fund founded by co-founder of Polygon, Sandeep Nailwal.

Conclusion

Token burning is a helpful mechanism that incentivizes token holders through the PoB consensus mechanism. Burning crypto can also help projects control the inflation of token supply, helping to grow the token holders.

The transparency behind token burning and the real-time availability of its data strengthen the trust among the crypto project's community members. However, burning coins doesn't have a direct correlation to the burnt token's price.