In recent years, India has been tiptoeing on the precipice of a digital financial revolution.

The interest among investors, entrepreneurs, and the general populace towards cryptocurrencies is spreading faster than the government can keep up. The journey towards a more crypto-friendly stance in India has been anything but straightforward. While initially marked by regulatory ambiguities and policy flip-flops, the government seems to be settling the heated discussion with regulations that fit all parties involved.

Despite the hurdles, the crypto ecosystem in India is showing signs of robust growth. This seems to have acted as a catalyst for the Indian government to look into this technology.

The result?

A potentially fairer, regulated, and supporting landscape for both cryptocurrency investors and web3 businesses.

Albeit slow, the government's approach towards cryptocurrency regulation has evolved from outright skepticism to a more measured, cautious optimism. The change in tune is becoming more apparent through various policy proposals.

In this article, we will see how India is transitioning towards a more pro-crypto stance, analyzing the key drivers behind this shift.

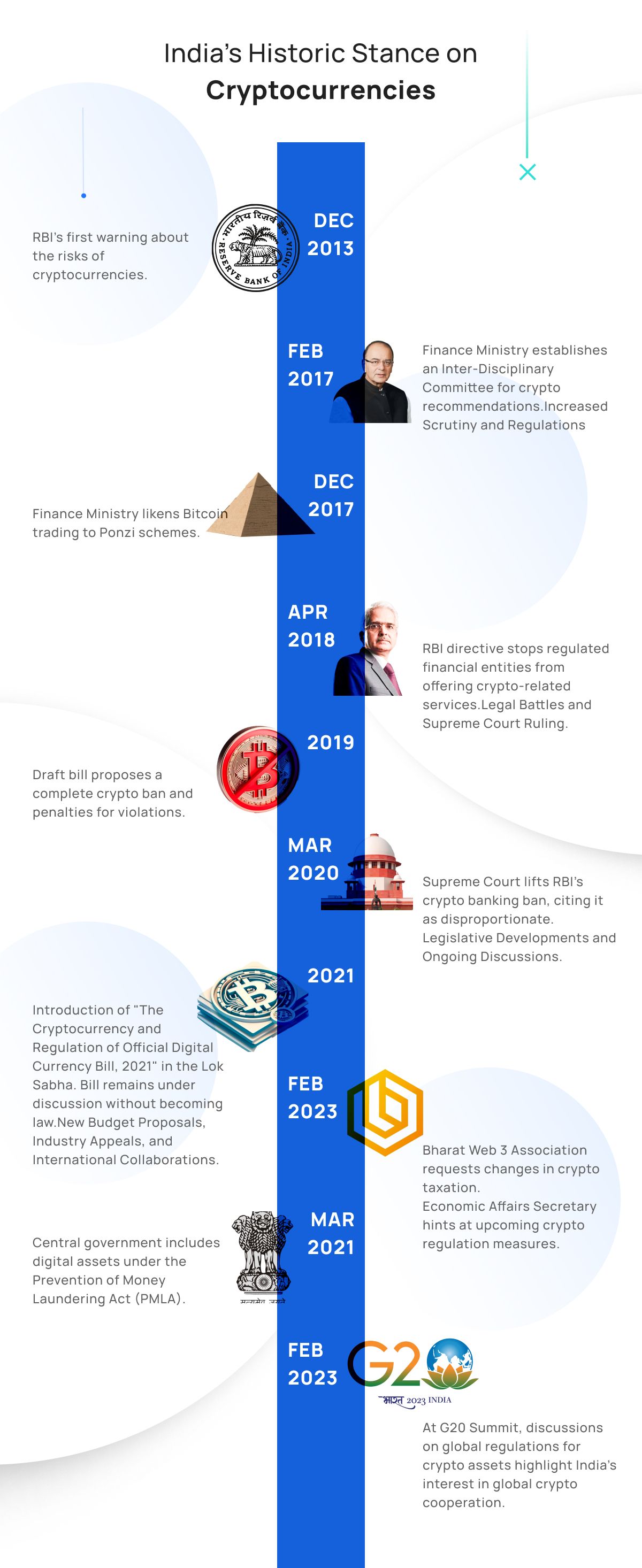

India’s Historic Stance on Cryptocurrencies

India's stance on cryptocurrencies has been marked by skepticism, regulatory concerns, and evolving policy responses.

Here's a brief overview of India's historic stand on cryptocurrencies.

Initial Interest and Concerns (2013-2016)

December 2013: The Reserve Bank of India (RBI), India's central bank, issued its first warning about cryptocurrencies. The RBI cautioned users, holders, and traders of virtual currencies about the potential risks they are exposing themselves to.

February 2017: The Finance Ministry set up an Inter-Disciplinary Committee to study the status of cryptocurrencies and suggest recommendations.

Increased Scrutiny and Regulations (2017-2018)

December 2017: As Bitcoin and other cryptocurrencies gained massive popularity worldwide, the Finance Ministry cautioned investors, comparing Bitcoin trading to Ponzi schemes.

April 2018: The RBI issued a directive to all regulated financial entities, instructing them to cease any crypto-related services. This effectively crippled the operations of cryptocurrency exchanges in India as they were unable to process fiat transactions.

Legal Battles and Supreme Court Ruling (2019-2020)

2019: A draft bill titled "Banning of Cryptocurrency & Regulation of Official Digital Currency" was circulated. This bill proposed a complete ban on cryptocurrencies in India and criminal penalties for violations.

March 2020: In a landmark judgment, the Supreme Court of India lifted the RBI's banking ban on cryptocurrency, stating that it was disproportionate and violated the right to conduct business. This was seen as a major win for the cryptocurrency community in India.

Legislative Developments and Ongoing Discussions (2021-2022)

2021: The Indian government introduced "The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021" in the Lok Sabha, aiming to create a favorable framework for the creation of digital currency. However, as the year progressed, the bill remained under discussion without being passed into law.

New Budget Proposals, Industry Appeals and International Collaborations (2023)

February 1, 2023: As part of the new budget, the Bharat Web 3 Association representing the Indian crypto industry called for changes in the taxation structure concerning cryptocurrencies.

February 4, 2023: In a post-budget press conference, Economic Affairs Secretary Ajay Seth announced plans to introduce measures around crypto regulation later in the year, although the specifics were not disclosed.

March 7, 2023: The central government issued a notification bringing digital assets and their related financial services under the ambit of the Prevention of Money Laundering Act (PMLA).

September 5, 2023: During the G20 Summit, Finance Minister Nirmala Sitharaman disclosed that significant deliberations were taking place regarding the establishment of global regulations for crypto assets, indicating India's interest in international cooperation on cryptocurrency regulation.

A Glimpse Into The Indian Regulatory Roadmap for Crypto Assets

March 2023 marked a pivotal point in India's crypto journey with the inclusion of cryptocurrencies under the country’s anti-money laundering act.

This change holds crypto exchanges, NFT marketplaces, and custody service wallet providers accountable for monitoring and reporting any suspicious financial activities, thereby instilling a sense of legality and structure in the once uncertain market.

Crypto intermediaries now fall under the Prevention of Money Laundering Act (PMLA), obligating them to record transactions and client data, akin to traditional financial institutions. This is a win for transparency and echoes the government's message of safe and declared investments in the crypto sphere.

Extending money laundering rules to the crypto trade blankets various transactions and services related to virtual digital assets. This extension gives authorities greater oversight on cross-border asset transfers, stepping up the vigil against potential illicit financial activities.

Where Does India Stand In Crypto Adoption?

India, along with Nigeria and Thailand, tops the 2023 Global Crypto Adoption Index by Chainalysis, showcasing significant adoption, especially among lower middle-income nations.

The country secured the top position in four out of five sub-indexes used in the same Chainalysis report, indicating strong crypto adoption. This includes centralized service value received, retail centralized service value received, DeFi value received, and retail DeFi value received.

Despite regulatory setbacks, India's crypto adoption saw a significant rebound from the previous year, where it had slipped to the fourth position in the 2022 index.

Further, India could potentially have over 150 million crypto users in 2023, a figure more than five times that of the US. Moreover, more than half of all crypto users globally in 2023 are projected to come from India.

Between July 2022 and June 2023, India led in transaction volume with an estimated $268.9 billion in crypto assets — that’s over 20% of the world’s crypto activity from just one country!

So, what is driving this adoption in India?

Factors Driving Adoption

A significant driver of crypto adoption in India is the rise of fintech, mobile technology adoption, and the increasing popularity of digital payments. According to Deloitte, the number of smartphone users could be as high as 1 billion by 2026.

The adoption patterns in India reflect a broader trend in the Central & Southern Asia and Oceania (CSAO) region, where different factors are driving adoption across various countries.

Various cryptocurrencies like Bitcoin, Dogecoin, and Ethereum are gaining traction, signaling a grassroots-level adoption in India.

A survey by Analytics Insight revealed that 60.5% of respondents have invested in cryptocurrencies as of 2022, showcasing a growing acceptance and understanding of digital currencies among the citizens.

The rising awareness and acceptance of cryptocurrencies among both the general public and the financial sector play a significant role. As people become more educated about the potential benefits of cryptocurrencies, they are increasingly viewing them as legitimate assets.

Importantly, the tech behind cryptocurrency is relatively new. As a result, the mature demographic (people aged 40 and above) are typically wary of it given the unfamiliarity. However, a substantial portion of crypto investors in India are between the ages of 18 and 35, which suggests that the younger demographic is driving cryptocurrency investments in the country.

Regulatory Landscape

The Reserve Bank of India (RBI) initially maintained a conservative approach by prohibiting banks from dealing with cryptocurrencies.

However, the narrative has been shifting slowly as more people get drawn towards crypto, and governments are exploring different regulatory approaches.

Today, regulated crypto on-ramps and exchanges can liberally accept INR deposits via payment methods like IMPS. Transak users could even make payment via UPI to get cryptocurrencies.

FIU Registration: A Significant Milestone for Crypto In India

The registration with the Financial Intelligence Unit (FIU) marks a significant milestone for the cryptocurrency industry in India as it brings crypto service providers under the ambit of the Prevention of Money Laundering Act (PMLA), 2002.

Here’s a detailed breakdown of the FIU registration and its implications based on various sources.

FIU Registration

Crypto businesses are required to register with the Financial Intelligence Unit (FIU) as part of compliance with anti-money laundering (AML) regulations. This registration process falls under the broader framework of the Prevention of Money Laundering Act (PMLA).

Significance

The registration signifies a notable step towards regulatory compliance in the crypto sector.

The FIU registration allows for better monitoring and reporting of suspicious transactions, thus aiding in the prevention of money laundering and other financial crimes through crypto channels.

Impact on Crypto Businesses

Crypto businesses are now obligated to perform verification processes such as Know Your Customer (KYC). Additionally, they are required to report suspicious activities to the FIU voluntarily and must designate a Money Laundering Reporting Officer (MLRO) to ensure compliance with the act.

This includes having a customer due diligence and record management program in place and maintaining transaction records related to crypto business.

Web3 Businesses and FIU Registration

Major web3 businesses, including Transak, have registered with the FIU, making them reporting entities under the new regulations.

This registration is mandatory for all crypto service providers and is likely to help facilitate information in a systematic manner concerning suspicious financial transactions.

Conclusion

The Indian government’s approach to cryptocurrency clearly transitioned from hostility to cautious optimism.

Despite the bumpy start, the outlook for cryptocurrencies and crypto investors in India looks promising — one that is regulated and aligned with the nation’s economic interests.

Reserve Bank of India’s CBDC pilot program and NPCI’s inclusion in the Hyperledger Foundation are strong signs of increasing awareness and acceptance surrounding blockchain-based digital assets.

It will be interesting to watch how the policymakers steer the ship from here.

Follow Transak’s blog to keep up with the latest developments.