If you’re curious about how to buy KDA (Kadena’s native token) with Transak, read on.

The Reddit threads don’t lie: Kadena is earning some buzz and a reputation for being one of the most undervalued blockchain projects currently in the space.

If you’re curious about how to buy KDA (Kadena’s native token) with Transak, read on.

Now, we know that Reddit isn’t exactly the most unbiased forum for tech and product reviews, but we do love the question that passionate Proof-of-Work diehards pose, the very question that makes Kadena so relevant: Can Proof of Work (PoW) be sustainable?

Kadena’s goal is to say yes, and then build it. The Kadena protocol is PoW, but the tech has evolved to solve the Layer 1 scalability issues that Ethereum is currently grappling with. The company also claims to have cracked the environmental issue, with a full wing devoted to sustainability (Kadena Eco). According to the company website, the Kadena blockchain actually increases in energy efficiency as the amount of transactions per second (TPS) is scaled higher and higher.

The native token of the Kadena ecosystem is KDA. How do you buy KDA with Transak? Let’s go over the steps.

What is KDA?

KDA is the native token of the Kadena blockchain ecosystem. According to CoinMarketCap.com, KDA has a maximum total supply of $1 billion KDA.

As a token, KDA can be used to pay for gas (service fees) and/or as a reward token when miners produce new blocks in the ecosystem.

At the time of writing, KDA has a market capitalization (market cap) of $538,235,908.

History of Kadena

The Kadena whitepaper came out in 2016. It describes a vision for a PoW blockchain that can be scaled to an enterprise-level use case without running into security or validation issues. The whitepaper argues that blockchain scaling is “critical for industrial adoption” and for “growing participation” globally in crypto.

Today, Kadena markets itself as a PoW blockchain that offers businesses and individuals the ability to utilize safe smart contracts and marginal-cost transactions. On a technical level, Kadena is sort of complex and interesting. Kadena’s company documents describe it as a hybrid blockchain made from Chainweb — a public protocol designed from a braided PoW consensus mechanism — and Kuro — a private chain protocol with the reported capacity to support as many as 8,000 TPS across 500 nodes.

How to buy crypto KDA using Transak

Consumers can buy KDA on crypto exchanges such as Binance, Bittrex, KuCoin, and others. Many people don’t know, however, that you can buy KDA directly through the Transak crypto onramp widget.

Here’s how it works:

Step one: Go to global.transak.com

There, you'll be met with our crypto onramp widget. (Say hello.)

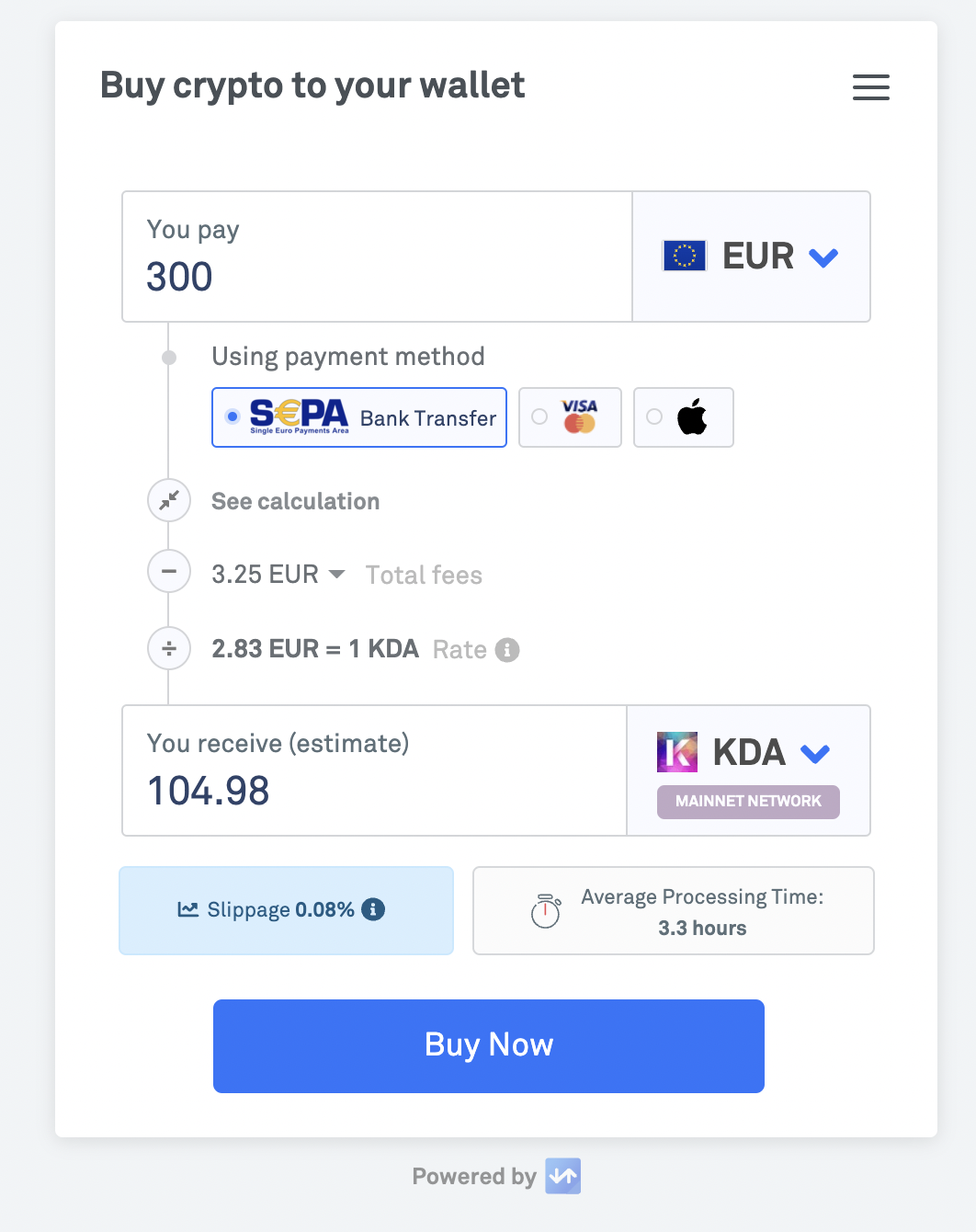

Step two: Select your currencies and payment methods

Choose between Transak’s available payment methods and currencies. Enter the total amount of fiat currency you want to spend on your crypto onramp.

Step three: Enter the amount you want to purchase

The minimum and maximum amounts of KDA you can purchase differs from country to country. It also depends on what fiat currency you are using to buy the crypto. Minimums and maximums will be noted at the time of your purchase.

Step four: Notice the exchange rate and fees

Click “See calculation” and review all fees before moving ahead with your transaction.

Step five: Click “Buy Now”

Note the processing time to get an expectation as to when you can receive your KDA.

Please also note the slippage rate. What is slippage? Slippage is simply the Transak price compared to the market rate. There will always be a slight discrepancy due to the volatile nature of crypto (values change within minutes and seconds). The slippage amount you see here will vary depending on market conditions and will be subject to change until the moment you click “buy.” The final slippage rate will depend on the exact time of your purchase. Our goal is to ensure that our crypto onramp process remains transparent. Whenever possible we aim to minimize slippage.

Is Transak available everywhere?

Transak is available in 125+ countries and for 100+ cryptocurrencies. As a company, Transak is a registered cryptoasset firm with the UK Financial Conduct Authority under the Money Laundering, Terrorist Financing and Transfer of Funds. That makes it easy for DeFi protocols and networks to trust Transak for the KYC process (aka “know your customer”). Transak also brings the efficiency of letting users pay by ApplePay, Debit/Credit cards, and Sepa/Bank transfers.

However, due to varying cryptocurrency regulations in different areas of the world, you may be limited to what cryptocurrencies you can buy. For instance, Transak is not yet available in New York due to the Bit License requirement. You may not be able to buy KDA with Transak in every single country or locality.

Read more about Transak’s fees.